🇲🇨 Head of Discretionary Management and Research at LIOR | PhD | Bloomberg 🇺🇸 🇪🇺 🇨🇳 "Top Forecaster" for several years | RT ≠ endorsement

15 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/C_Barraud/status/1571944642891091969

https://twitter.com/C_Barraud/status/1503342468875665409

https://twitter.com/C_Barraud/status/15022098797375692802/ Sanctions/counter-sanctions linked to #Russia/#Belarus and the collapse of Ukrainian economy will have a significant impact on trade and supply chain. It's more than just natural gas.

https://twitter.com/C_Barraud/status/1502157367667953676

https://twitter.com/C_Barraud/status/1499697473828311040🇨🇳 #NPC Meeting Debrief (2) | The fact that officials opted for the upper range of expectations looks very encouraging.

🇨🇳 #NPC meeting (2) | Residential #housing market is crashing.

🇨🇳 #NPC meeting (2) | Residential #housing market is crashing.

https://twitter.com/C_Barraud/status/1489238772218798092

https://twitter.com/FerroTV/status/1487080503094218757🇺🇸 #Macro Update (2) | The problem is that #Biden advisors and economists didn’t see it coming, thinking that #inflation was transitory. As a result, Biden approval rating ⬇ sharply and is for the first time below #Trump's at this time in the presidency.

https://twitter.com/zerohedge/status/1487884059388923905

https://twitter.com/C_Barraud/status/1486417921203130369🇺🇸 #FOMC (2) | However, at press conference, #Fed Powell tried his best to send hawkish signals.

https://twitter.com/C_Barraud/status/1486431303209738249

https://twitter.com/C_Barraud/status/1484066753420345344🇪🇺 🇺🇸 There are at least four big divergences with the U.S.:

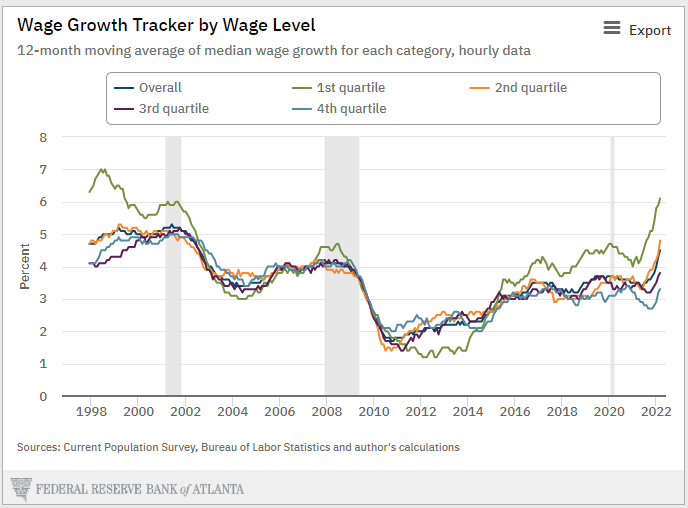

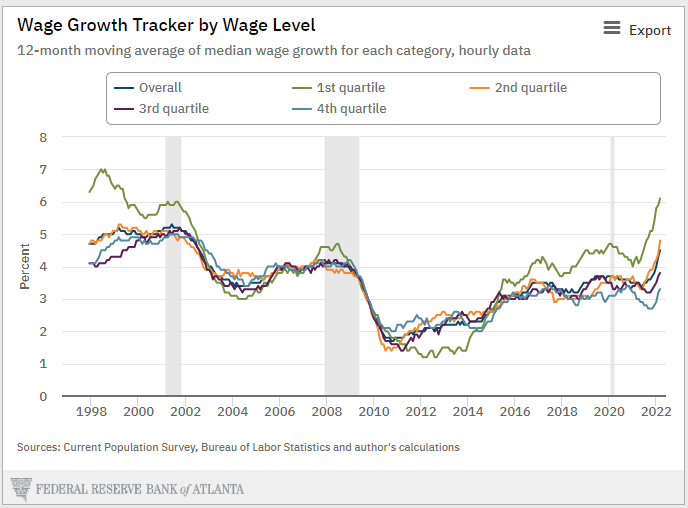

3/4 of consumers ranked #inflation, compared with unemployment, as the more serious problem facing the nation. Given that inflation's impact is regressive, the Sentiment Index ⬇ 9.4% among households with total incomes <$100K, but ⬆ 5.7% among households with incomes >$100K.

3/4 of consumers ranked #inflation, compared with unemployment, as the more serious problem facing the nation. Given that inflation's impact is regressive, the Sentiment Index ⬇ 9.4% among households with total incomes <$100K, but ⬆ 5.7% among households with incomes >$100K.