#CelticFC 2020/21 accounts cover a “most difficult financial year”, badly impacted by COVID. Also disappointing on the pitch, as they finished runners-up in the league, were knocked out of both domestic cup competitions in early stages and eliminated after Europa League group.

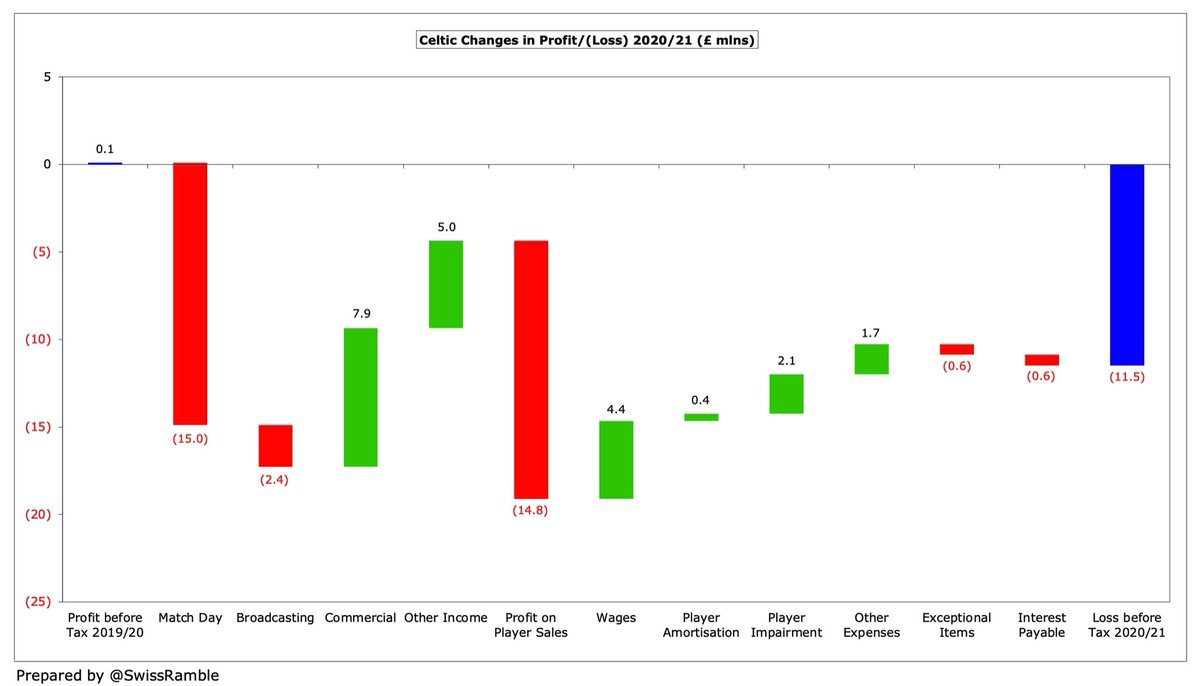

#CelticFC swung from £0.1m pre-tax profit to £11.5m loss (£12.6m after tax), as revenue fell £9m (13%) from £70m to £61m and profit on player sales fell £15m from £24m to £9m, partly offset by £5m other income (business interruption coverage) and £9m (9%) reduction in expenses.

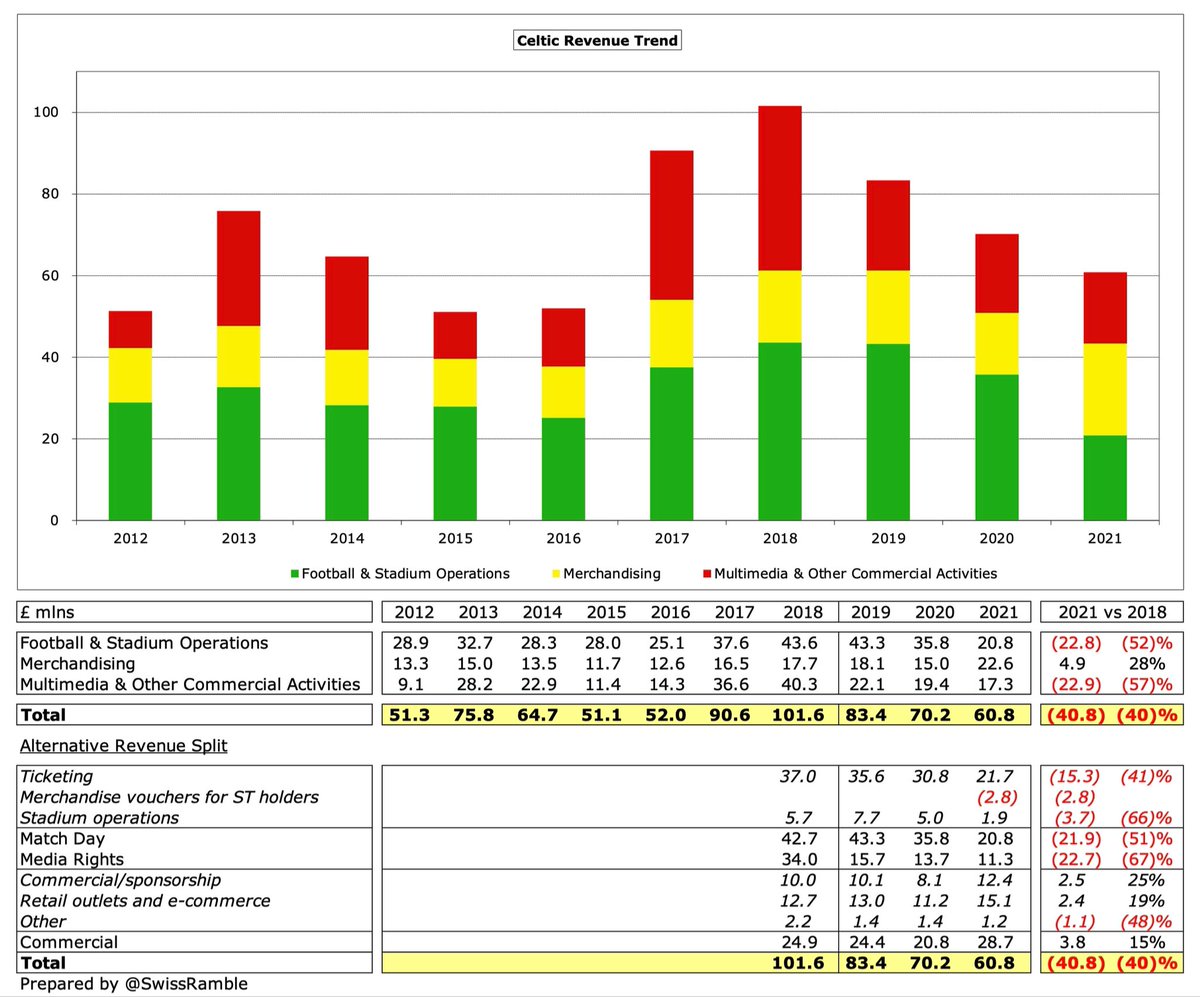

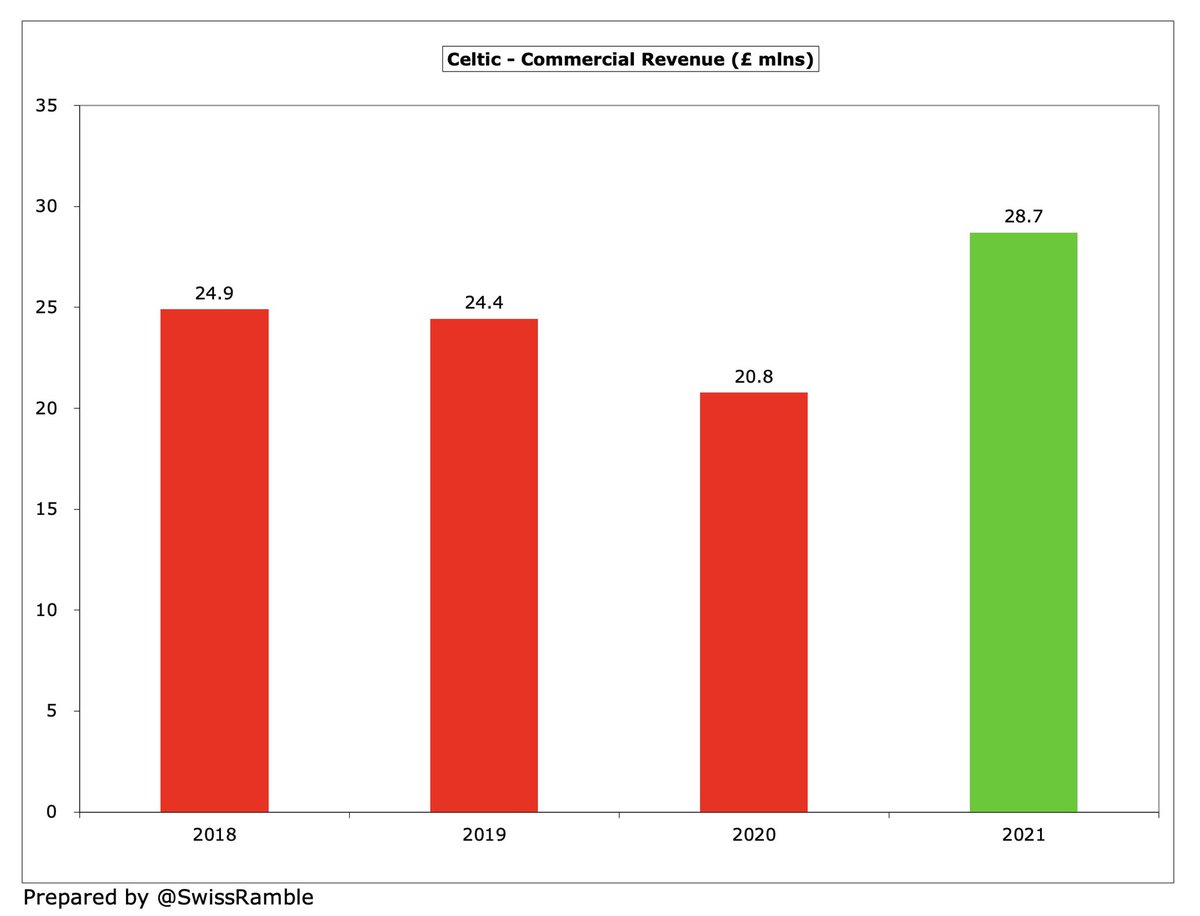

#CelticFC revenue “attrition” was driven by match day, which dropped £15.0m (42%) from £35.8m to £20.8m, and broadcasting, down £2.4m (18%) from £13.7m to £11.3m, though the net effect was eased by commercial, which rose ££7.9m (38%) from £20.8m to £28.7m.

#CelticFC mitigated revenue losses by “tight cost control” with lower wages, down £4.5m (8%) from (restated) £56.2m to £51.7m; player amortisation, down £0.4m to £11.8m; player impairment, down £2.1m; and other expenses, down £1.7m (8%). Includes £0.6m for Neil Lennon departure.

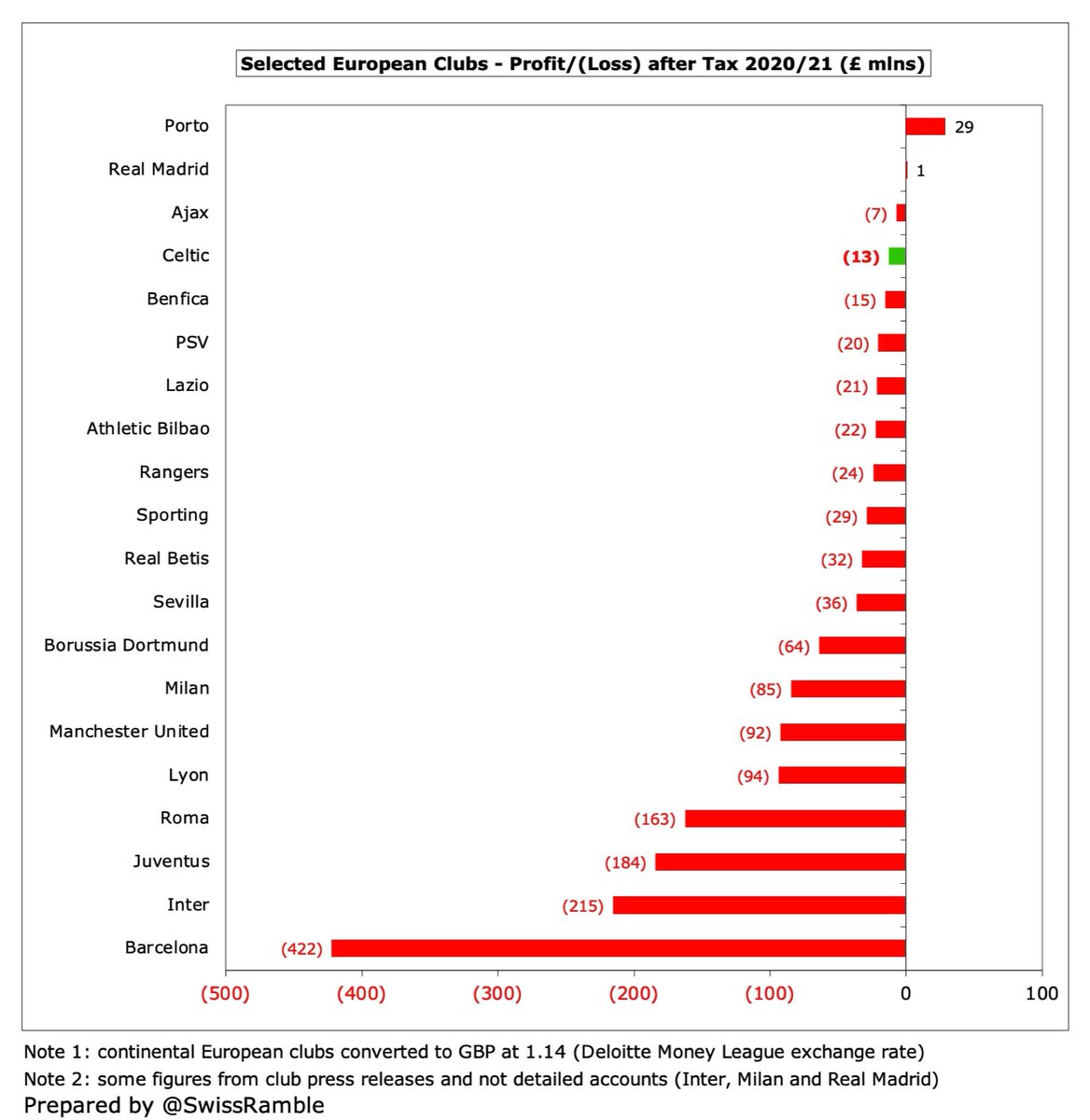

#CelticFC £12.6m loss after tax is obviously not great, but to put this into perspective it was only around half the £24.2m deficit reported by their rivals Rangers. The much smaller losses (and profits) at other Scottish clubs are from 2019/20, less impacted by COVID.

Clearly, the pandemic has had a major impact on the financials at all clubs with the cumulative revenue loss for #CelticFC over the past two years estimated as £24.7m (2019/20 £9.4m and 2020/21 £15.2m), mainly due to playing games behind closed doors.

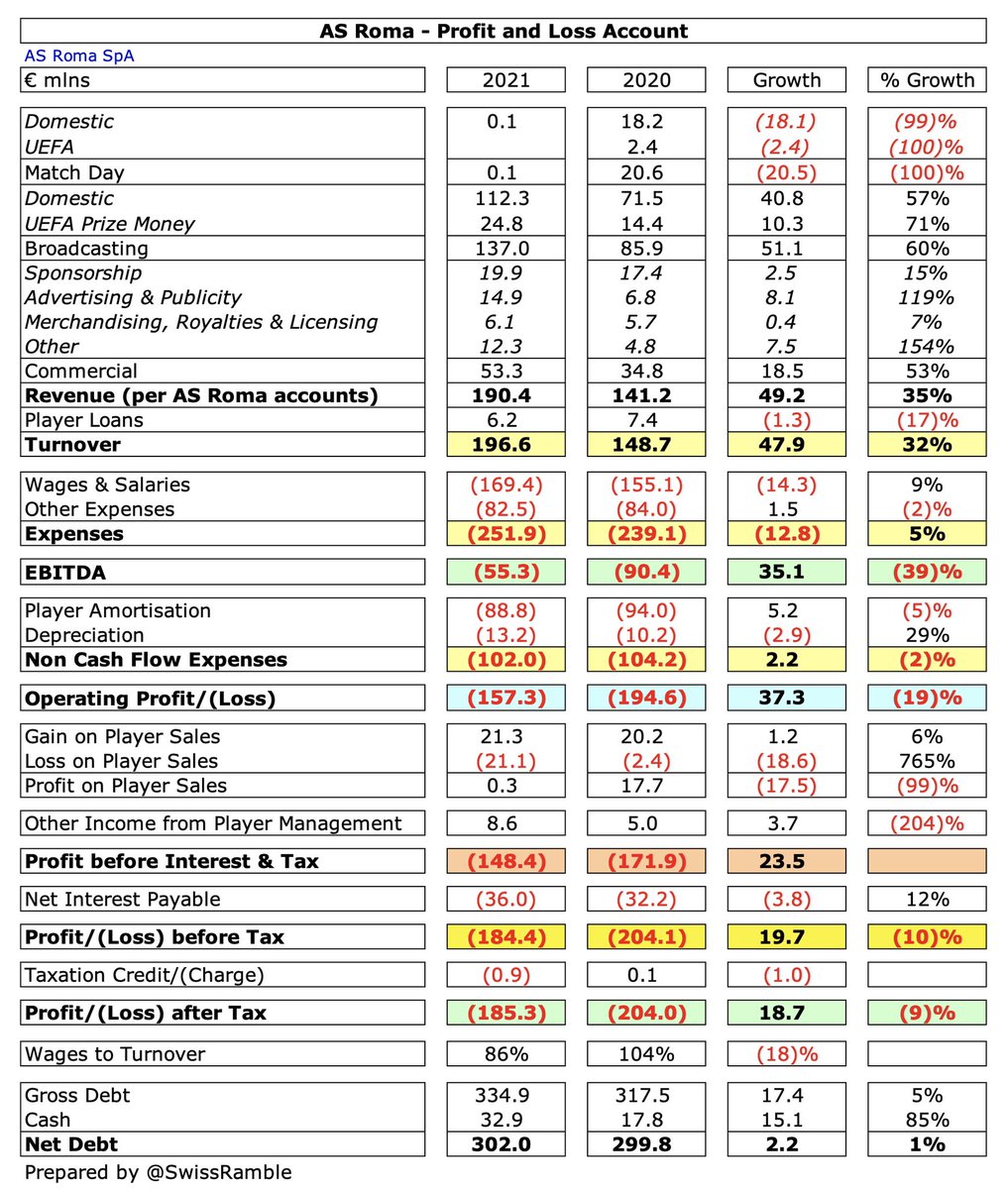

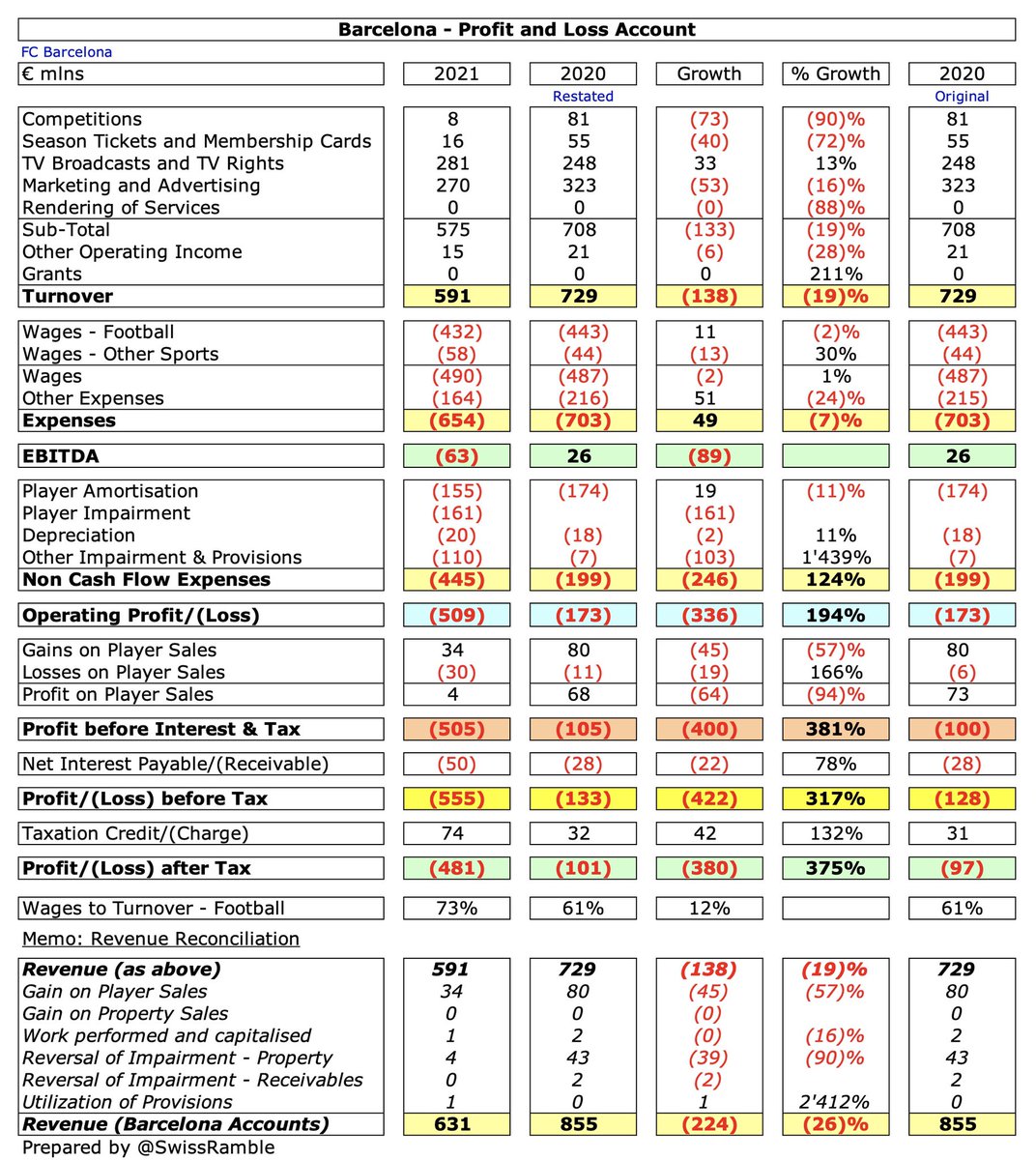

COVID had a major impact on football in 2020/21 with many leading clubs posting huge losses, e.g. Barcelona £422m, Inter £215m, Juventus £184m & Roma £163m. In contrast #CelticFC relatively small £13m loss “demonstrated the importance of maintaining a sustainable business model.”

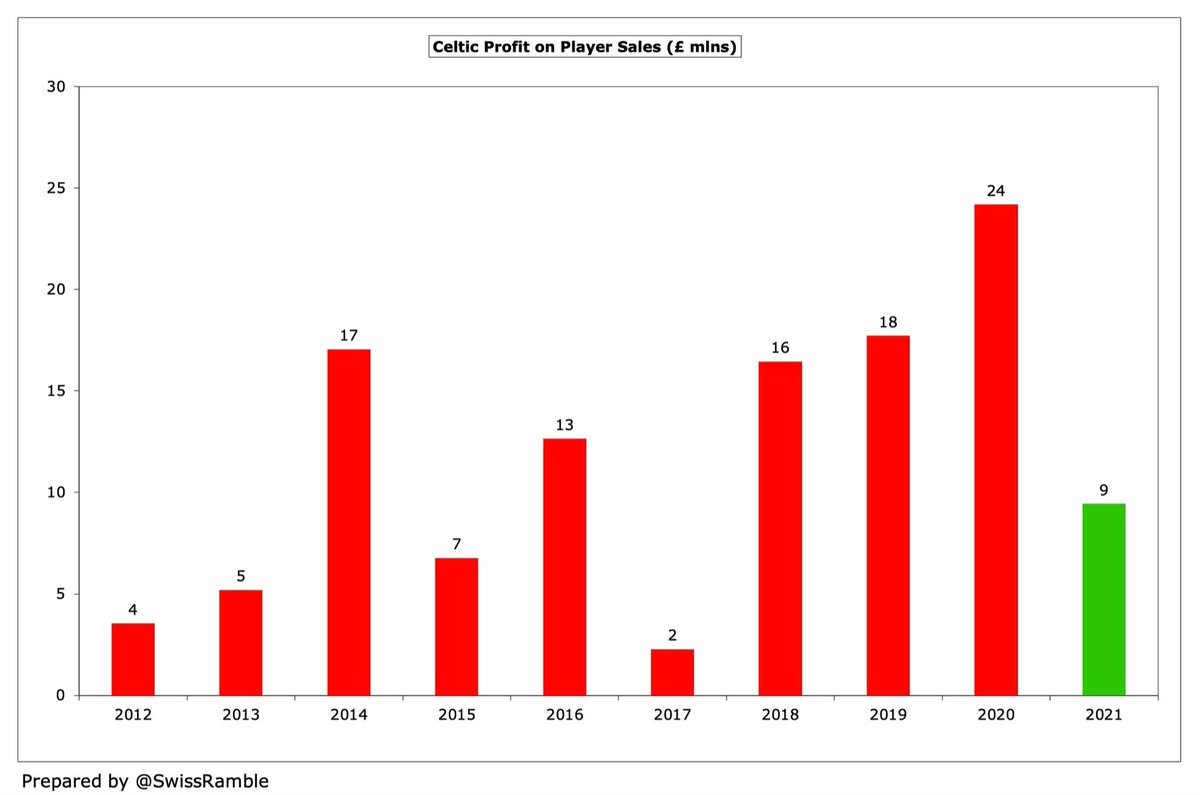

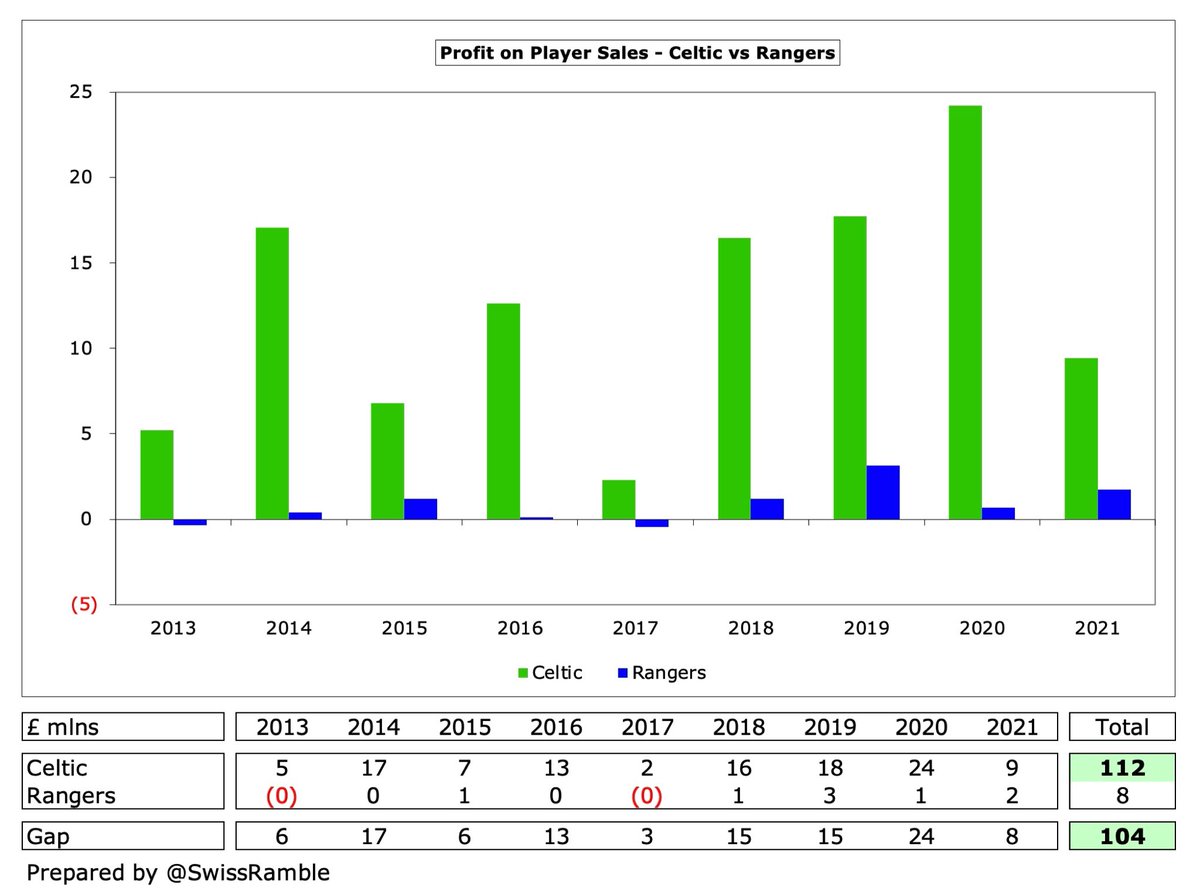

Furthermore, #CelticFC profit on player sales fell £14.8m from £24.2m to £9.4m, though still by far the highest in Scotland, e.g. Rangers only made £1.7m. Included Frimpong to Bayer Leverkusen, Klimala to NY Red Bulls & Hendry to KV Oostende, while prior year had Tierney to #AFC.

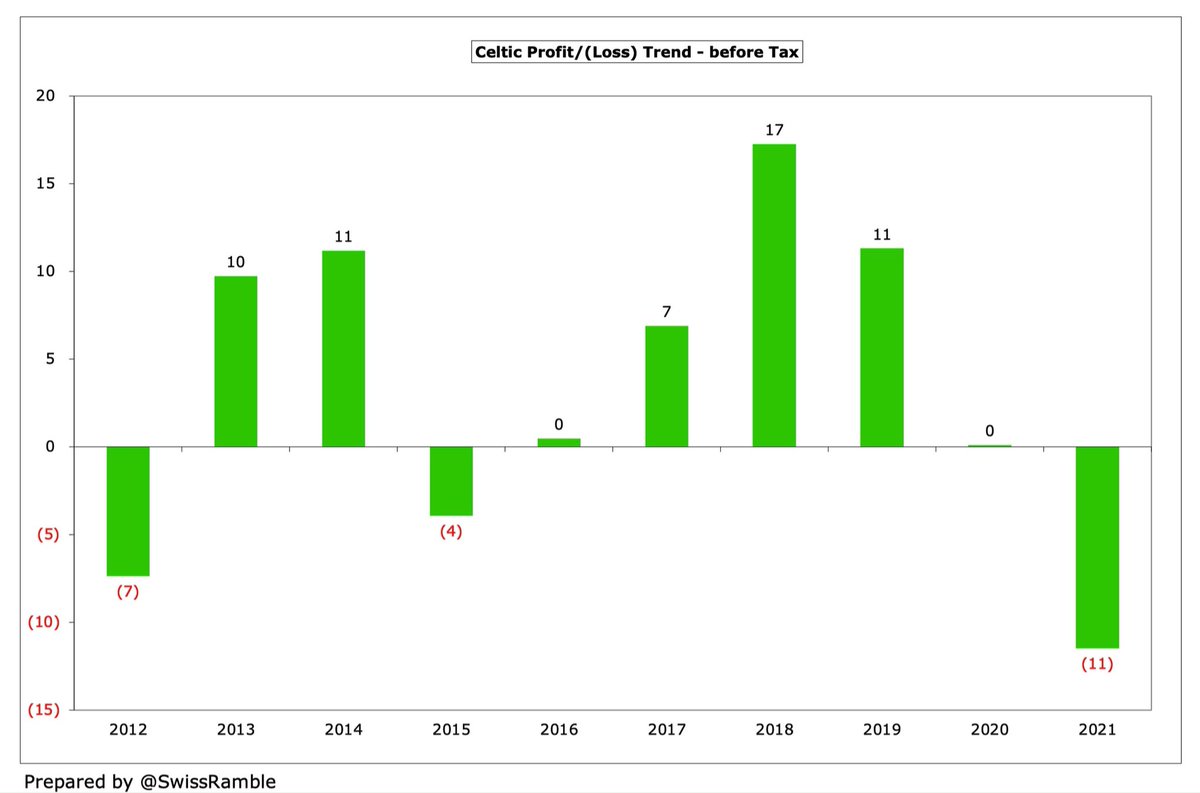

#CelticFC pre-tax loss in 2020/21 is the first since 2014/15, breaking a sequence of five profitable years in a row. In fact, they have generated profits in seven of the last nine seasons, amounting to a net £42m gain over that period, despite last year’s £11m deficit.

#CelticFC player trading is “fundamental” to their self-sustaining business model with an impressive £68m profits delivered in the last four years (excluding this summer’s sales). Money earned also includes sell-on fees from past sales, e.g. van Dijk from Southampton to #LFC.

#CelticFC 2020/21 accounts do not include the big money sales of Odsonne Edouard to #CPFC, Kristoffer Ajer to Brentford and Ryan Christie to Bournemouth, which are worth around £34m in sales proceeds, so will return the club to profit in 2021/22.

Profits from player sales have made a big difference to #CelticFC bottom line. As a result, in the last nine years they have generated £112m profit from player trading, compared to just £8m in the same period for Rangers.

#CelticFC operating loss (i.e. excluding player sales) improved from £24.5m to £20.7m in 2020/21, though this is still down from £5m profit 4 years ago. Although most clubs post operating losses, Celtic’s is second highest in Scotland, only surpassed by Rangers £23.5m deficit.

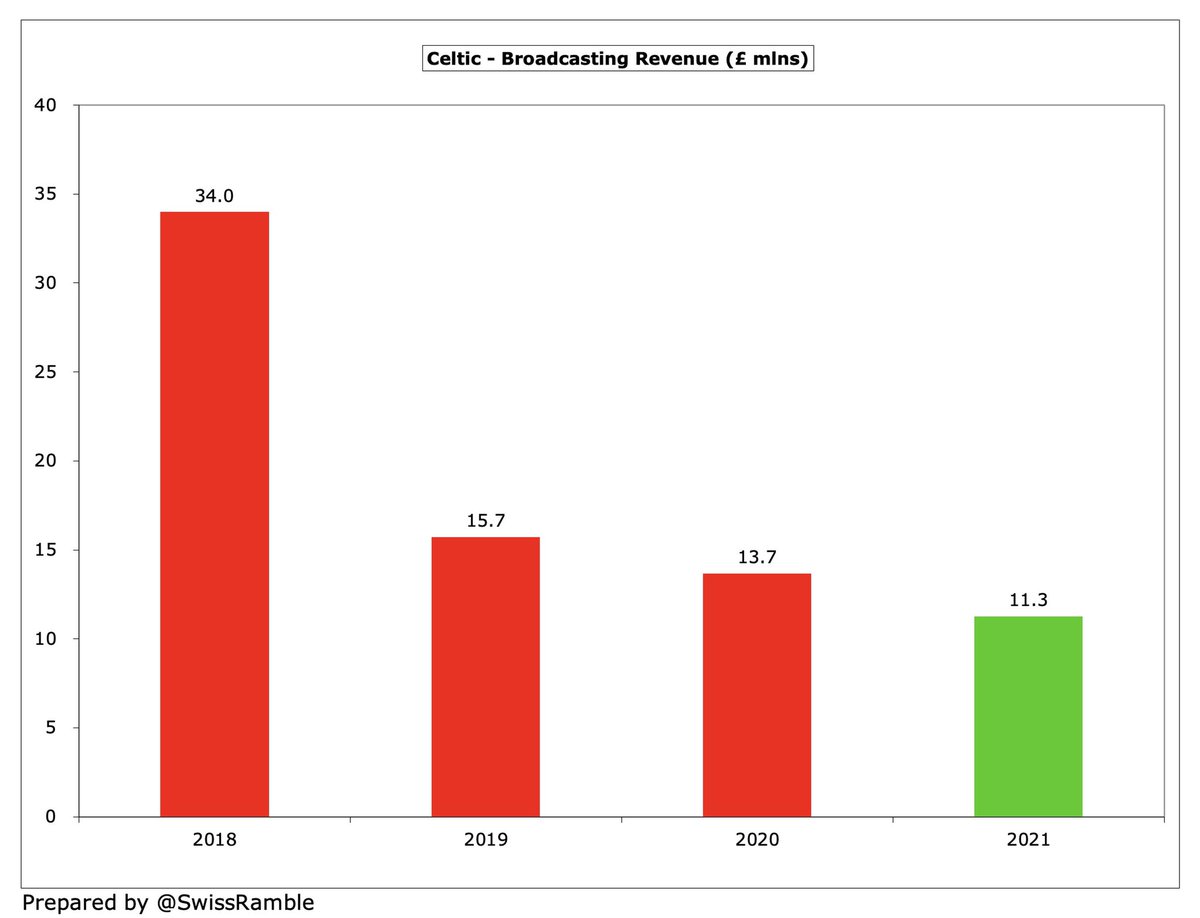

#CelticFC revenue has fallen £41m from £102m peak three years ago to £61m, which is the lowest since £52m in 2016. The decline is due to a combination of COVID and failure to qualify for Champions League, which has driven decreases in match day £22m and broadcasting £23m.

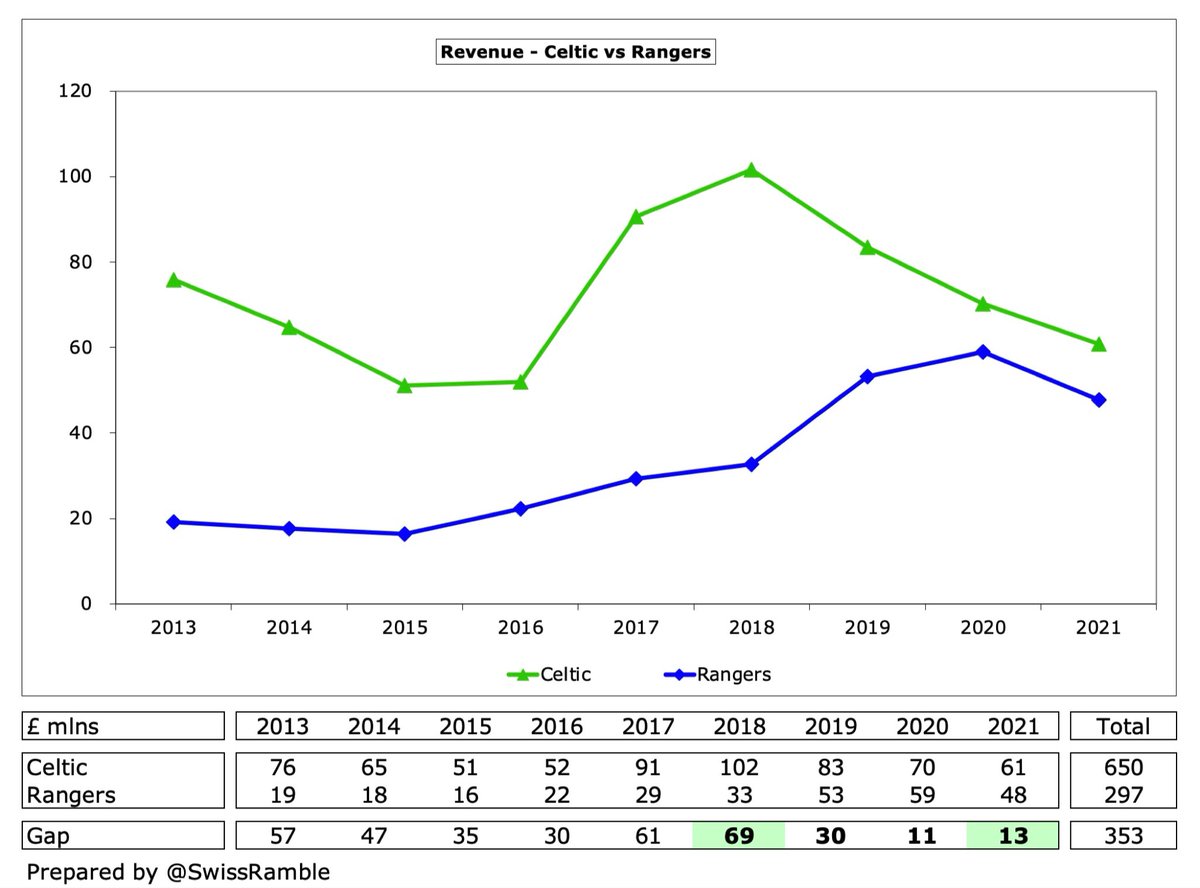

#CelticFC have enjoyed a substantial revenue advantage over their rivals Rangers in recent times, but the gap has narrowed over the last four years from £69m in 2018 to £13m in 2021 (Celtic £61m vs. Rangers £48m).

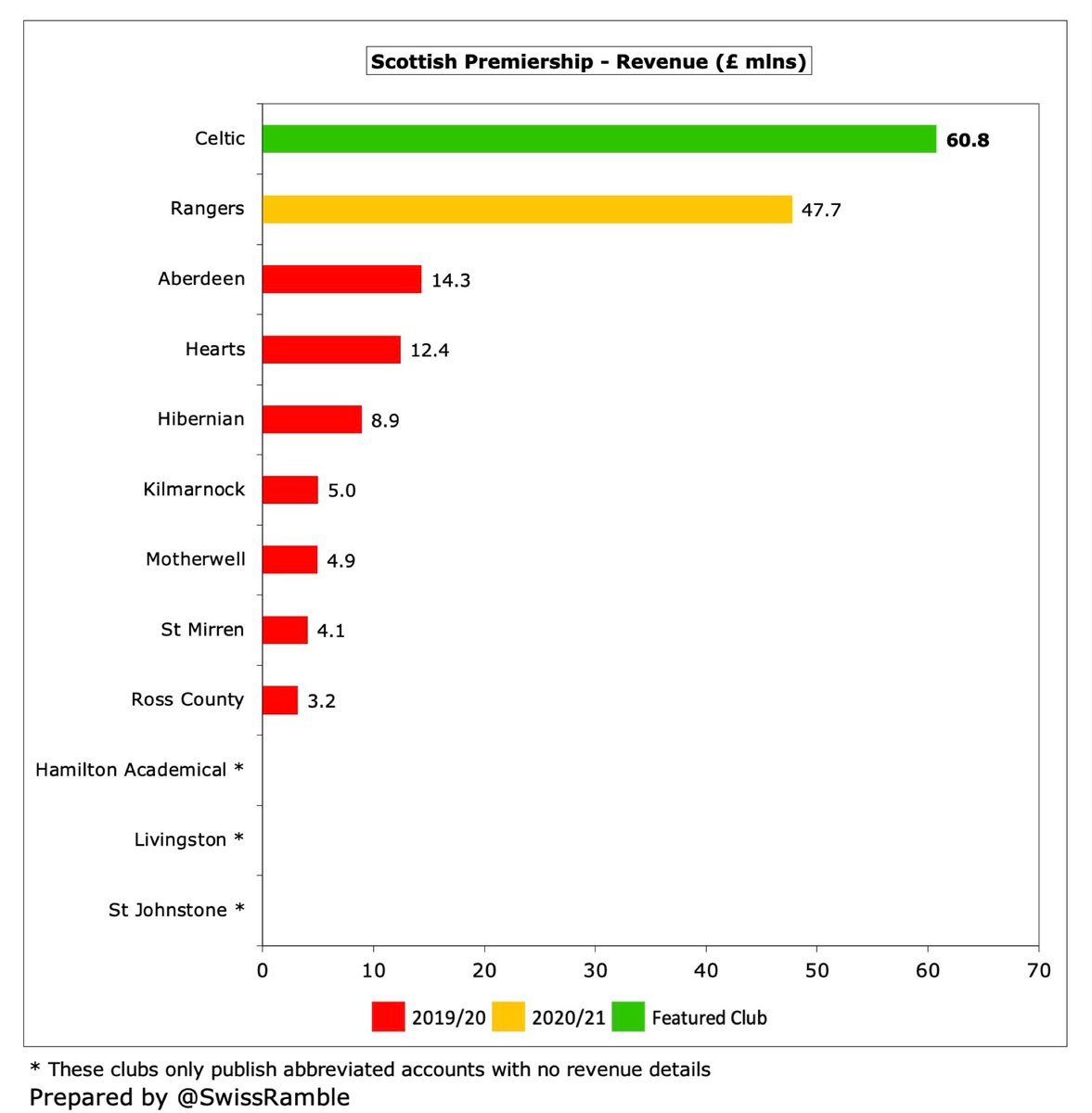

Of course, the big two Glasgow clubs generate significantly more revenue than the rest of the Scottish Premiership. Even after the impact of COVID, #CelticFC £61m is still more than four times as much as Aberdeen £14m, followed by Hearts £12m, Hibernian £9m and Kilmarnock £5m.

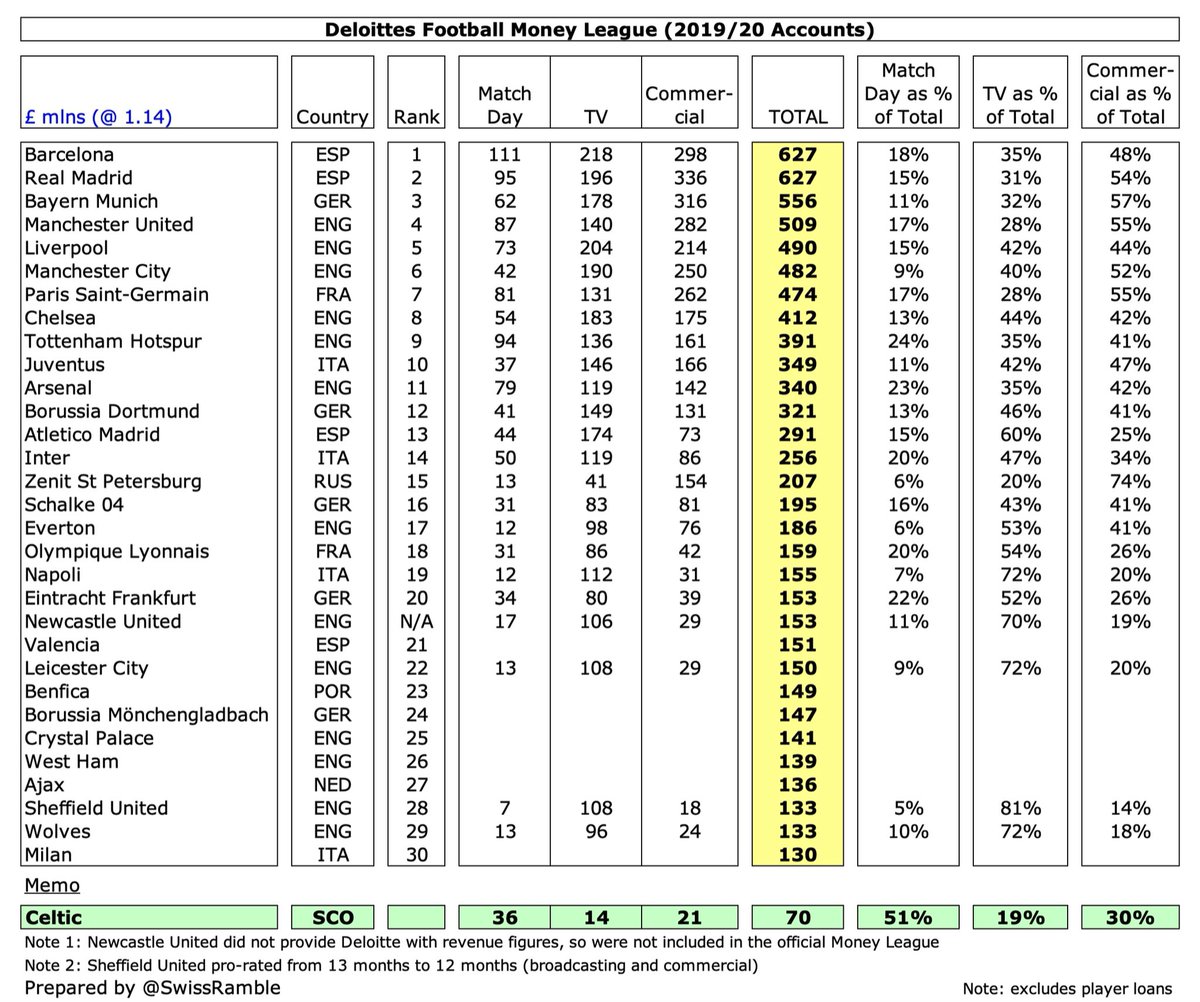

However, like others outside the Big Five leagues, #CelticFC are still faced by a major revenue challenge, e.g. their £70m revenue in 2019/20 was less than half the £130m required to be in the Top 30 European clubs, as shown by the Deloitte Money League global ranking.

This might seem like a spurious comparison, but the fact is that in 2004 #CelticFC were placed as high as 13th in the Money League. Since then, their revenue is essentially flat, while the club in 20th place has increased by £97m and the top club by £456m (higher pre-COVID).

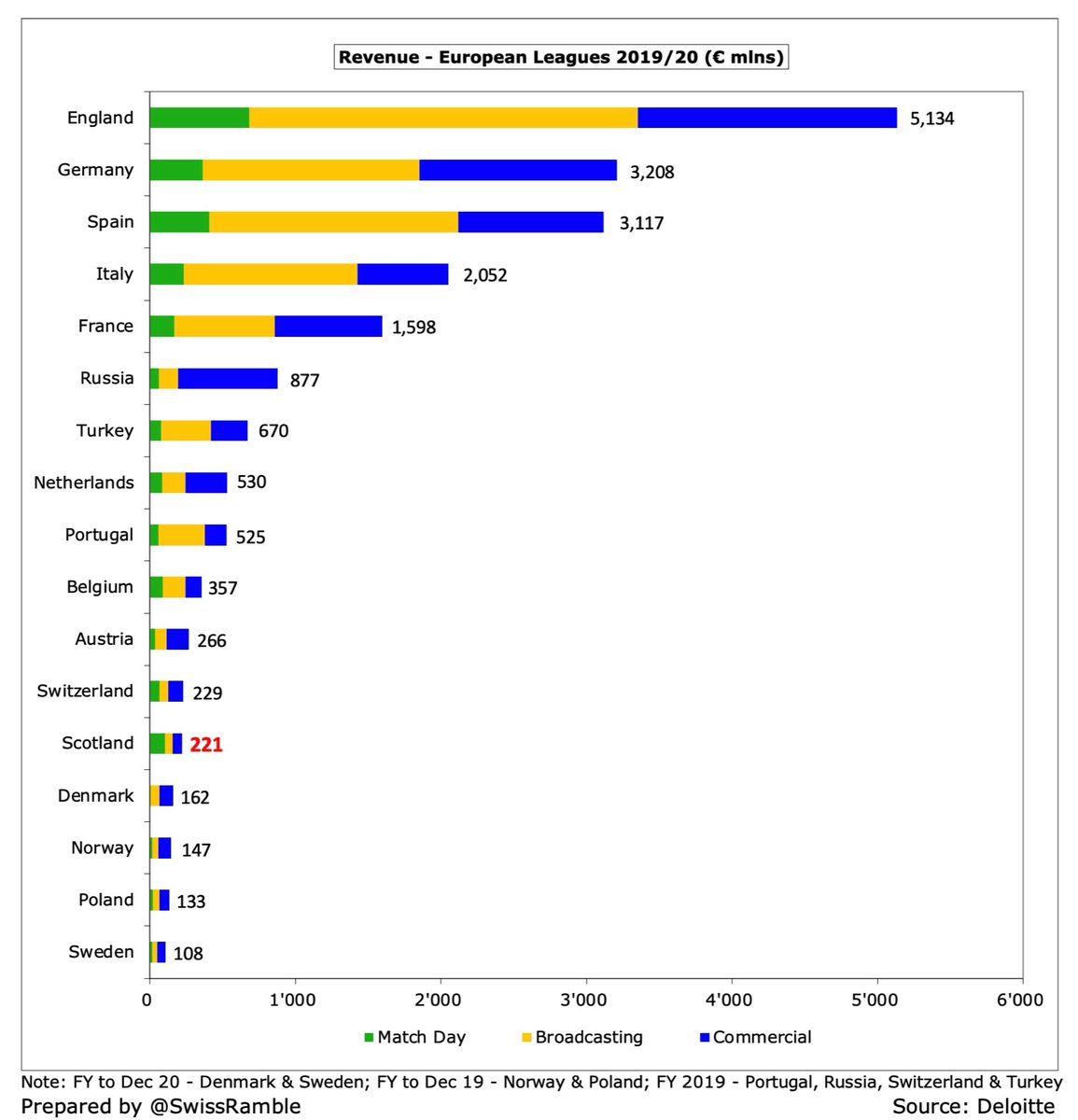

This is at the heart of #CelticFC issue, i.e. they are the proverbial big fish in a small pond. In 2019/20 the Scottish Premiership generated £221m revenue, miles behind England £5.1 bln and Germany £3.2 bln, but also below the likes of Austria £266m and Switzerland £229m.

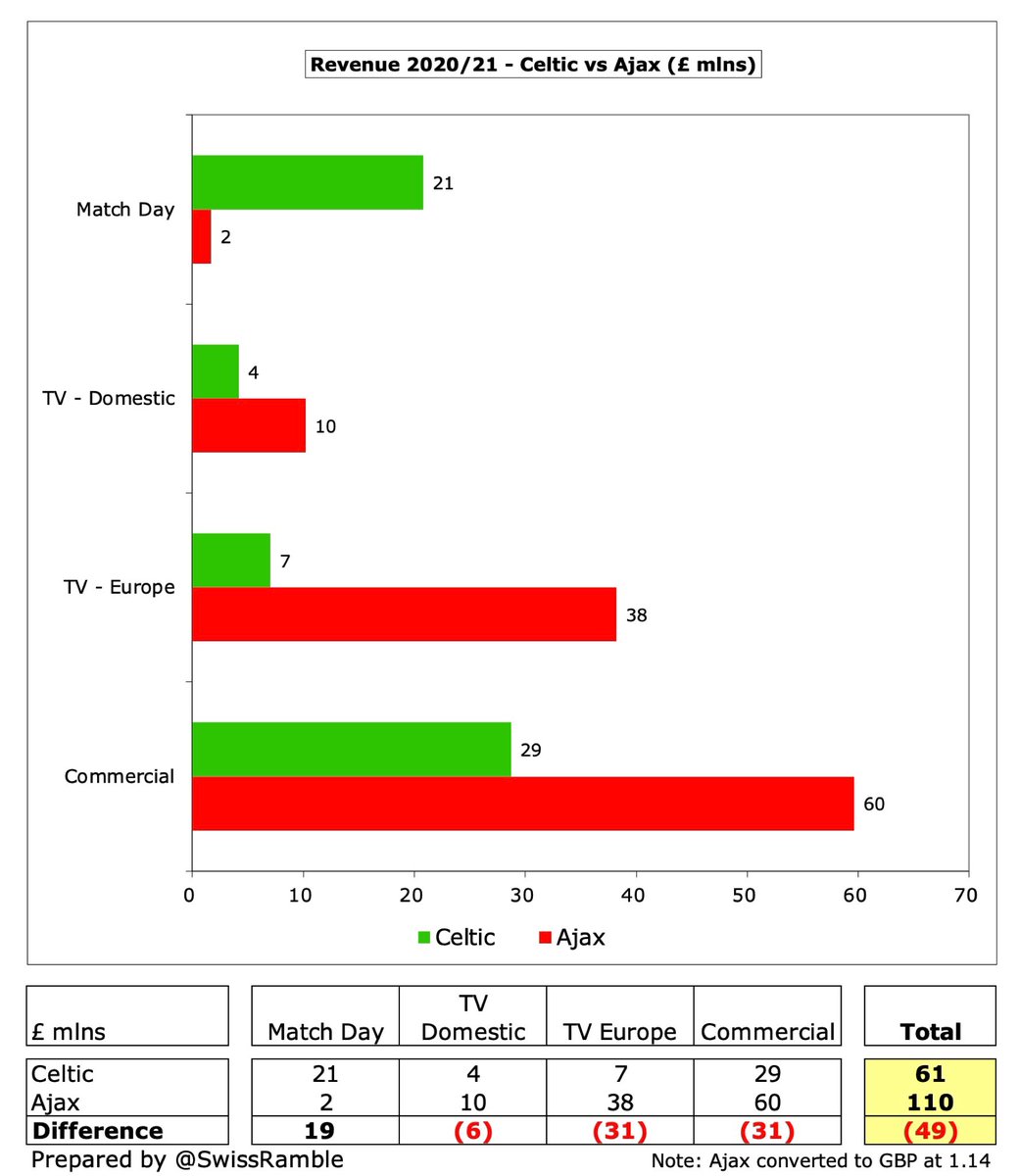

Of course, any comparison is a little misleading, as English clubs benefit from huge TV money, but if we compare #CelticFC £61m revenue with, say, Ajax £110m, there is still a £49m shortfall. Celtic’s match day is higher, but commercial and Europe TV money are much lower.

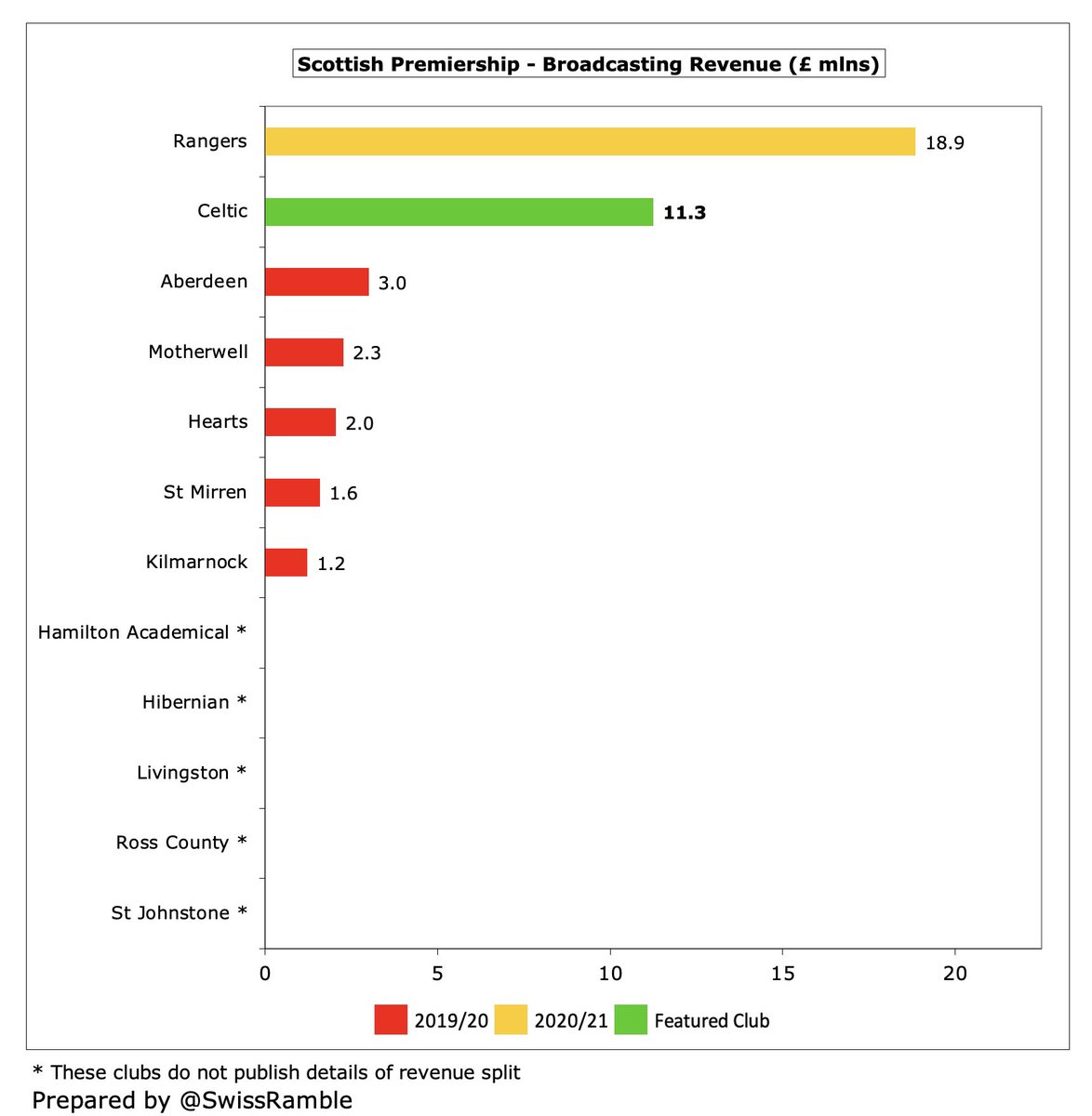

#CelticFC broadcasting revenue decreased £2.4m (18%) from £13.7m to £11.3m, due to dropping to second place in the Scottish Premiership and not progressing beyond the Europa League group stage. This revenue stream has now fallen three years in a row and is below Rangers £18.9m.

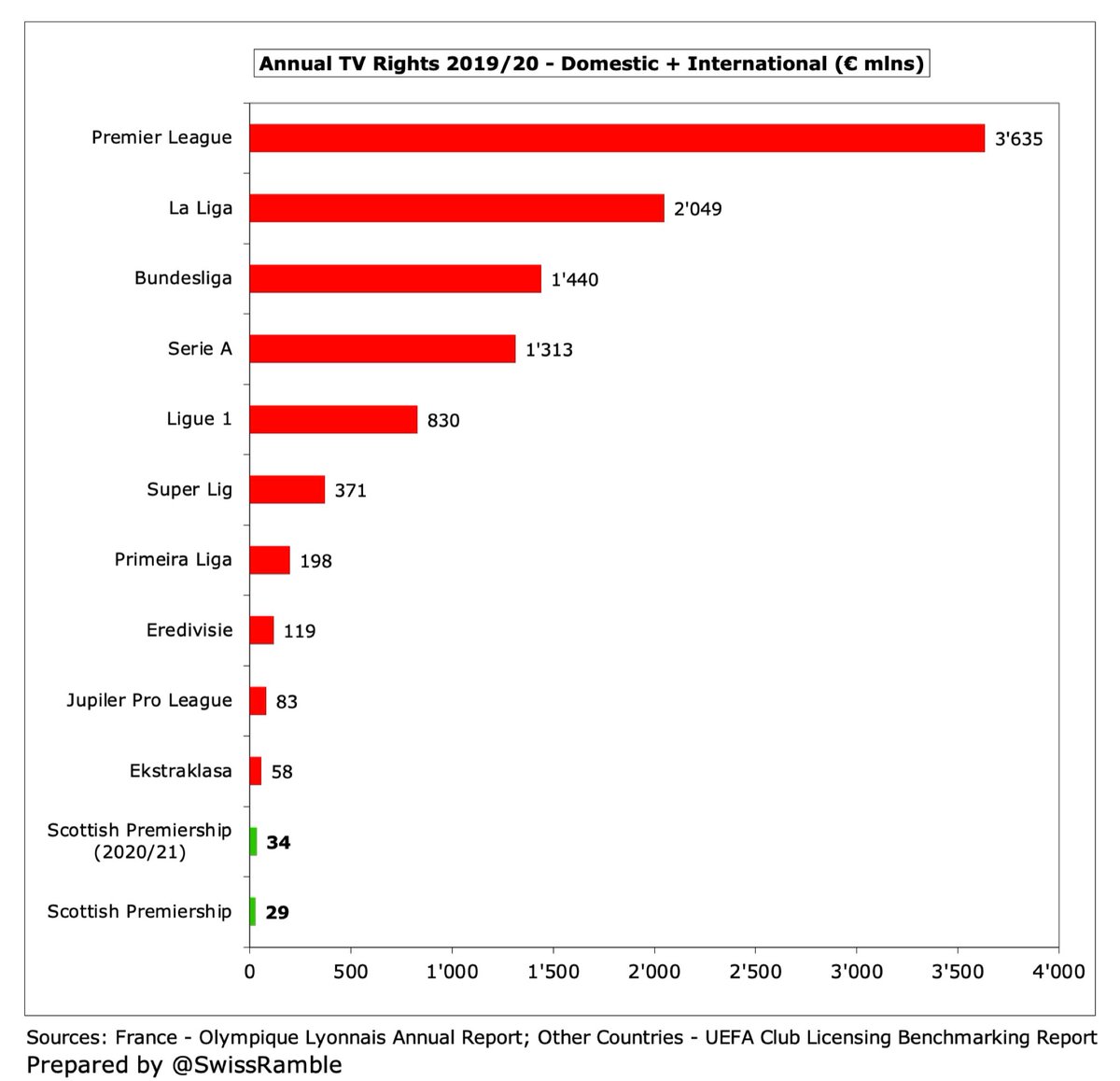

The SPFL has not yet published details of TV distributions for 2020/21, but #CelticFC only received £3.4m for winning the title the previous season, which pales into insignificance compared to many European leagues, e.g. last place in Premier League is worth around £100m.

There was a new 5-year Scottish TV deal with Sky Sports worth £30m (€34m) a year from 2020/21 (up from £25m), but this is not going to move the needle by much. It’s still much lower than Poland Ekstraklasa €58m & Belgium Jupiler League €83m, let alone Premier League €3.6 bln.

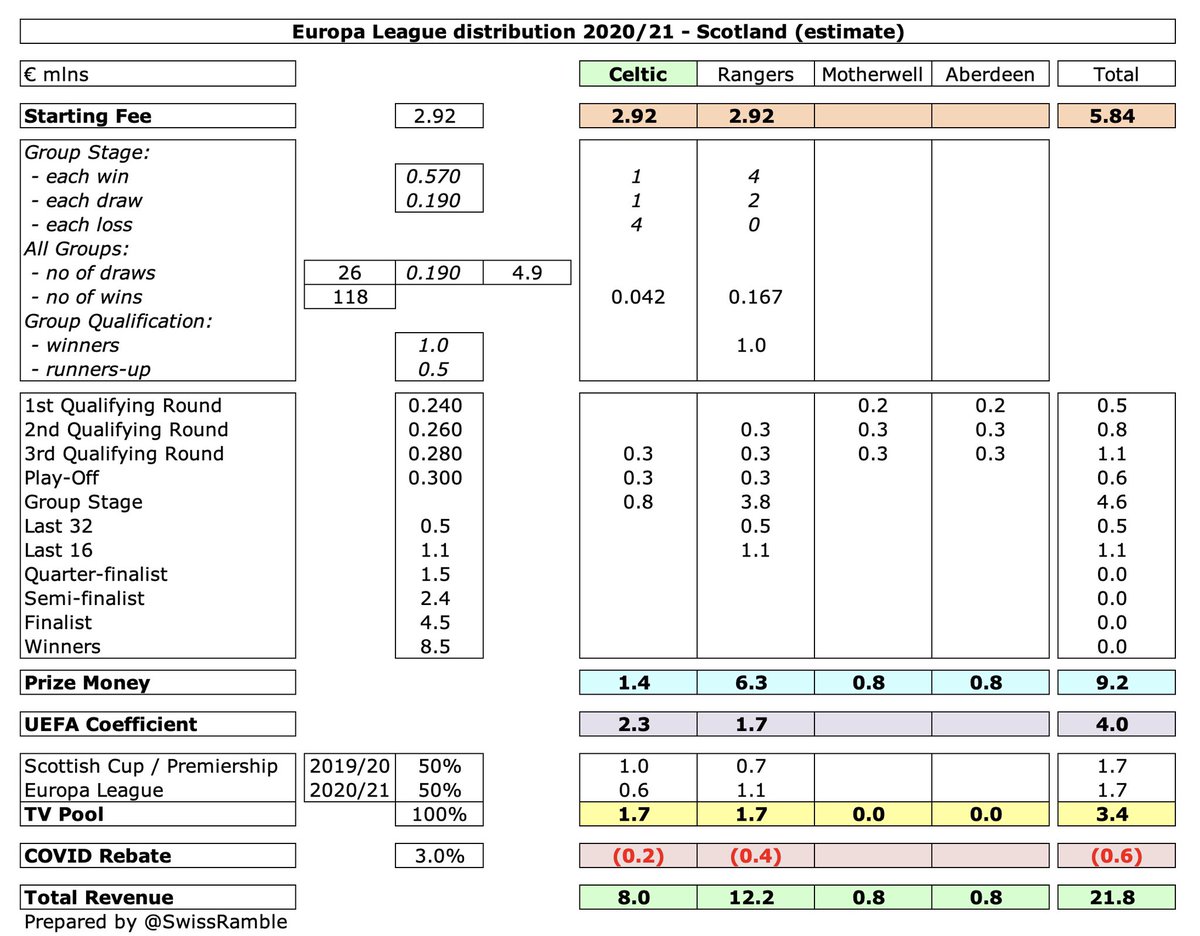

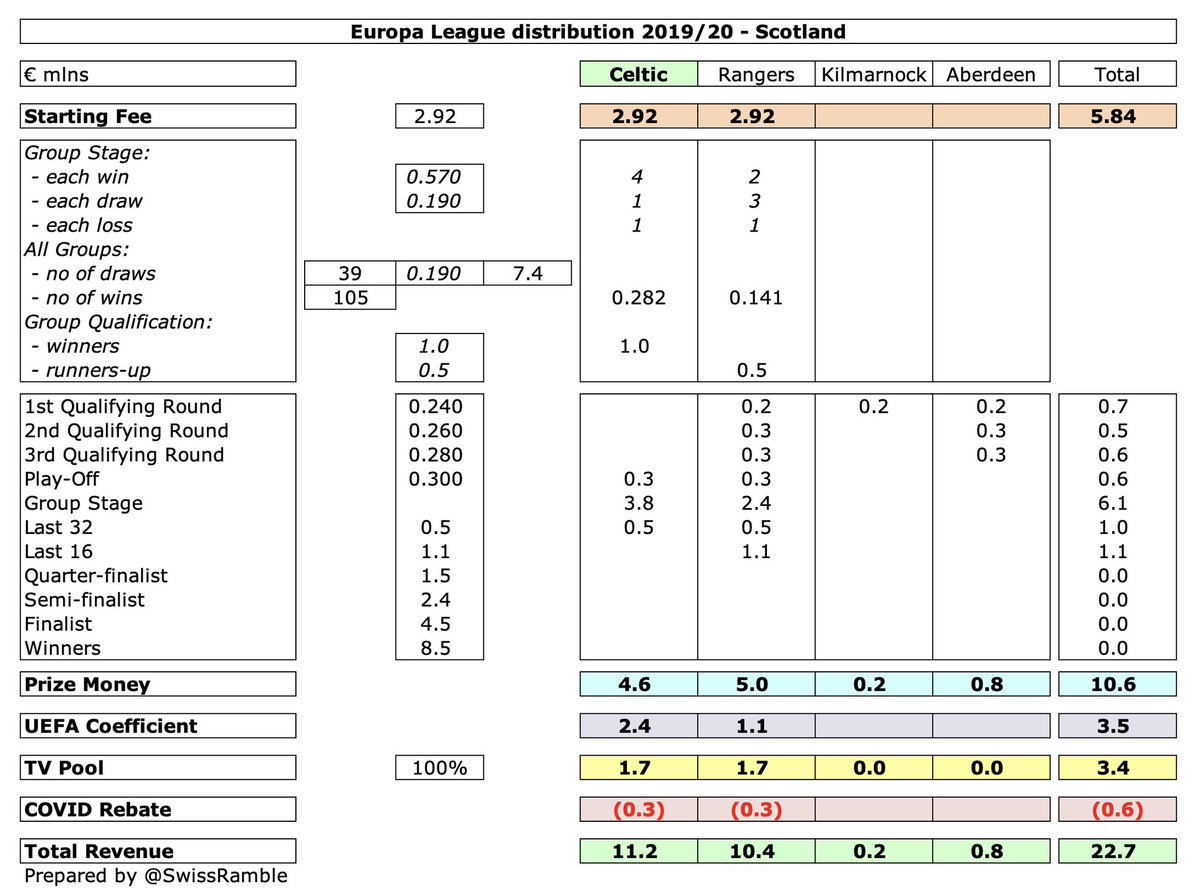

Based on my estimate, #CelticFC earned €8.7m from Europe in 2021: €8.0m from the Europa League group stage plus €0.7m for 2 Champions League qualifying rounds. This was €3.7m less than prior season €12.4m (Europa League last 32 €11.2m plus CL 3 qualifying rounds €1.1m).

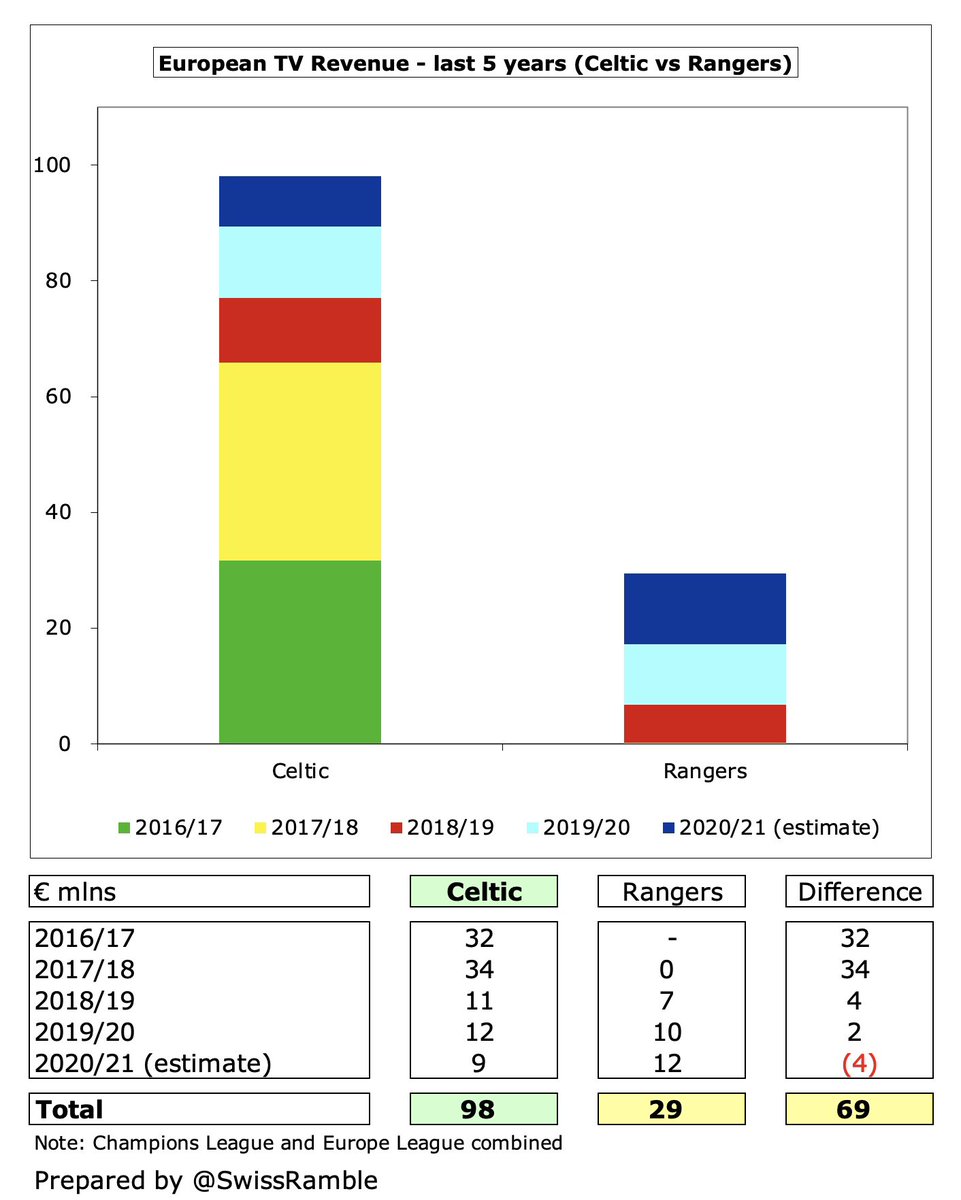

European qualification is extremely important for #CelticFC, who have earned €98m from Europe in last 5 years, €69m more than Rangers €29m. Champions League is the real differentiator with Celtic receiving over €30m in both 2017 and 2018, when they reached group stage.

It is therefore crucial that recent good performances in Europe by #CelticFC and Rangers have improved Scotland’s UEFA coefficient, so that the 2021/22 Scottish champions have a decent chance of automatically qualifying for the Champions League group stage.

#CelticFC match day income fell £15.0m (42%) from £35.8m to £20.8m, as all games played behind closed doors, though fans’ generosity limited the damage. Season ticket holders given streaming service and £50 retail voucher, but that could not fully compensate for live experience.

#CelticFC £20.8m match day income, net of £2.8m merchandising vouchers, was still higher than Rangers £18.2m, even though this has fallen from an impressive £43.3m two years ago before the pandemic struck. Next highest in Scotland were Hearts £5.1m (2019/20 figure).

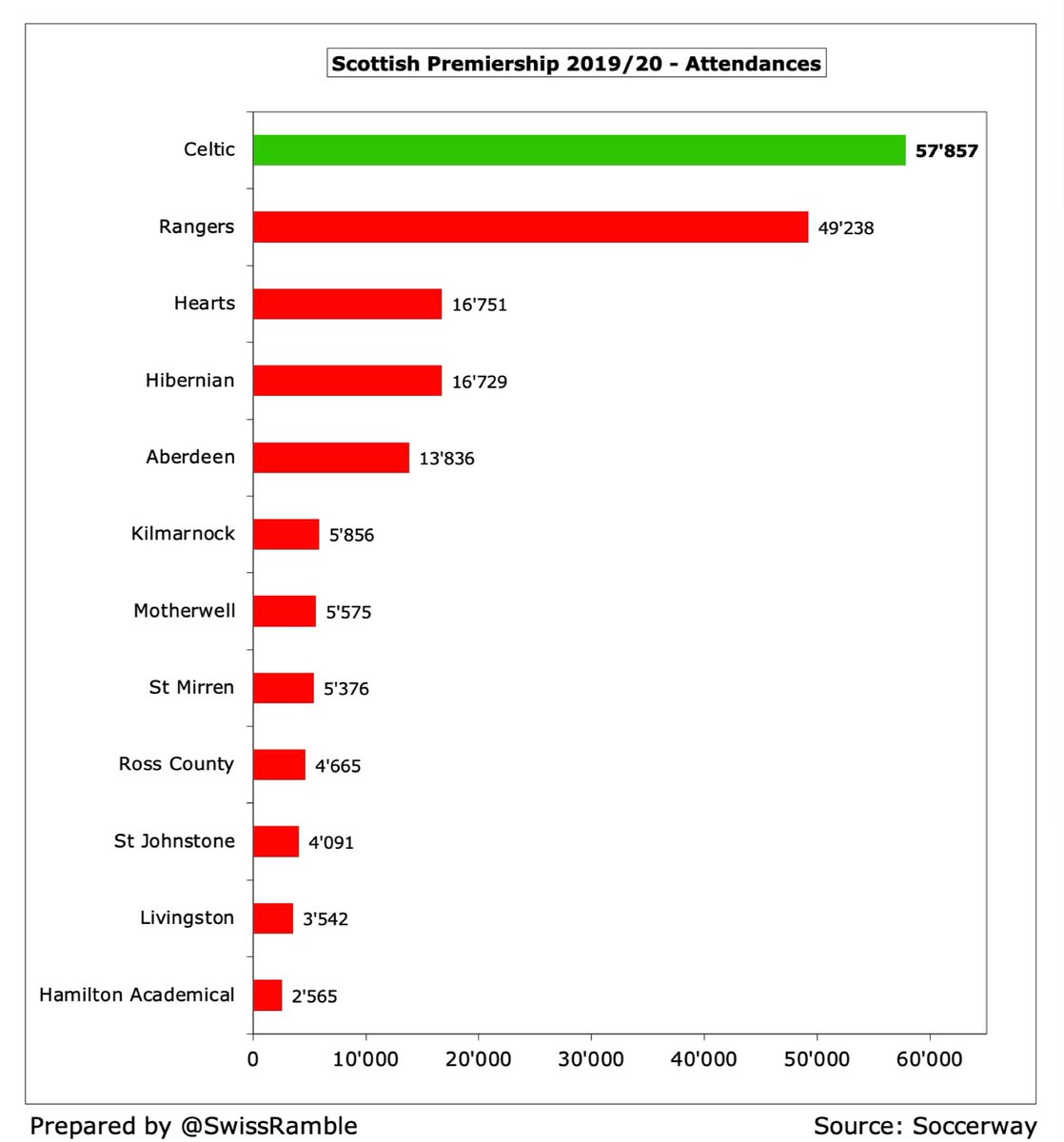

#CelticFC average attendance in 2019/20 was 57,857, nearly 9,000 more than Rangers 49,238, so they will be delighted with fans’ return to the stadium. The 55,000 season ticket holders in 2020/21, despite uncertainty around return to the stadium, “exceeded all expectations”.

Match day revenue is particularly important for Scottish clubs, given the low TV deal. According to Deloitte, this accounted for an incredible 48% of total revenue in Scotland in 2018/19 (pre-pandemic) with the next highest being significantly lower, i.e. Belgium 26%.

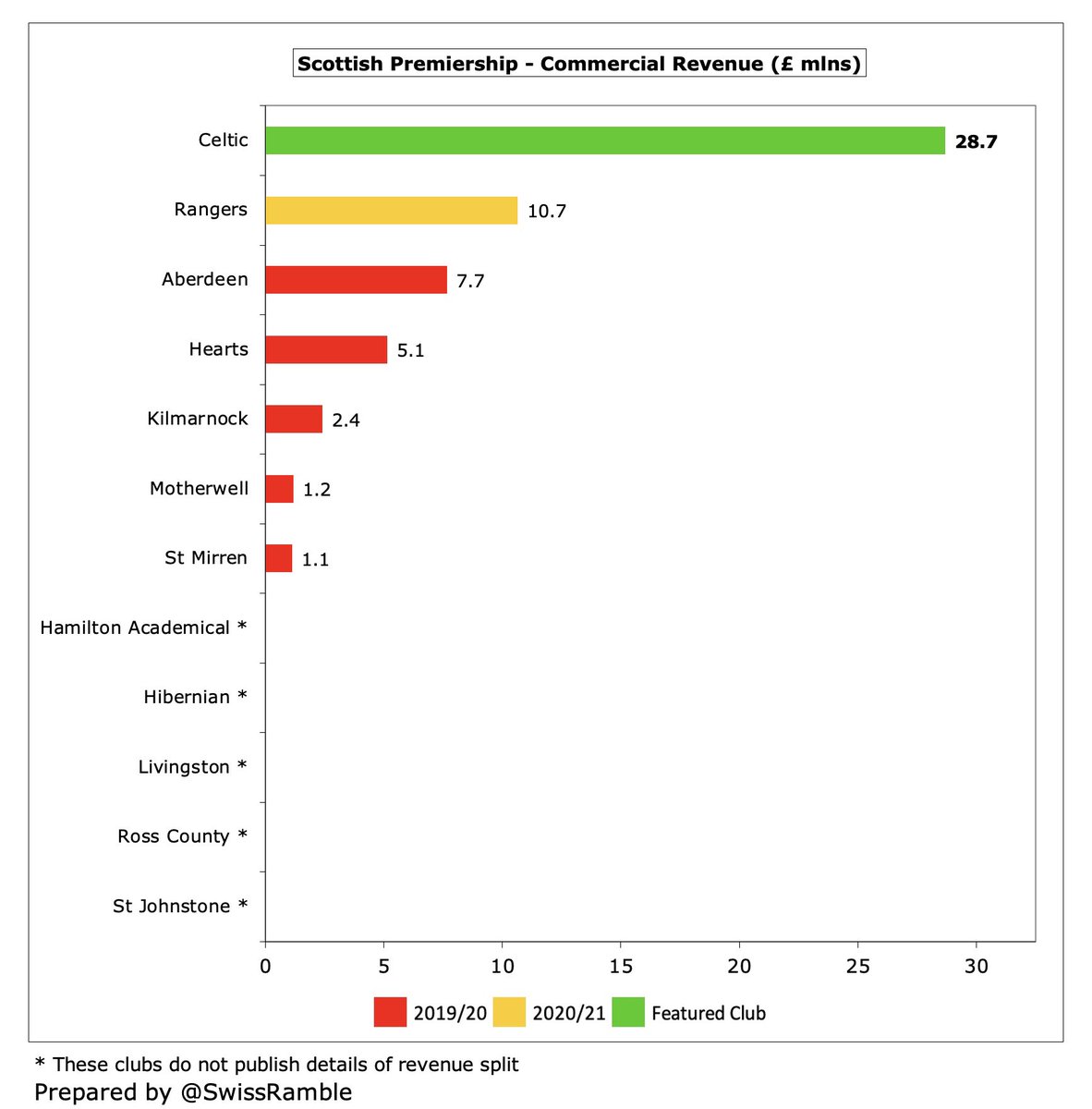

#CelticFC commercial revenue rose £7.9m (38%) from £20.8m to £28.7m, comprising retail £15.1m, sponsorship £12.4m and other income £1.2m, mainly due to “exceptional” merchandising (record online sales). By far the highest in Scotland, well ahead of Rangers £10.7m.

#CelticFC new 5-year kit deal with Adidas started in July 2020, reportedly worth £6m a year. The Dafabet shirt sponsorship, described as “the most lucrative sponsorship agreement in Scottish football history”, has been extended until June 2025.

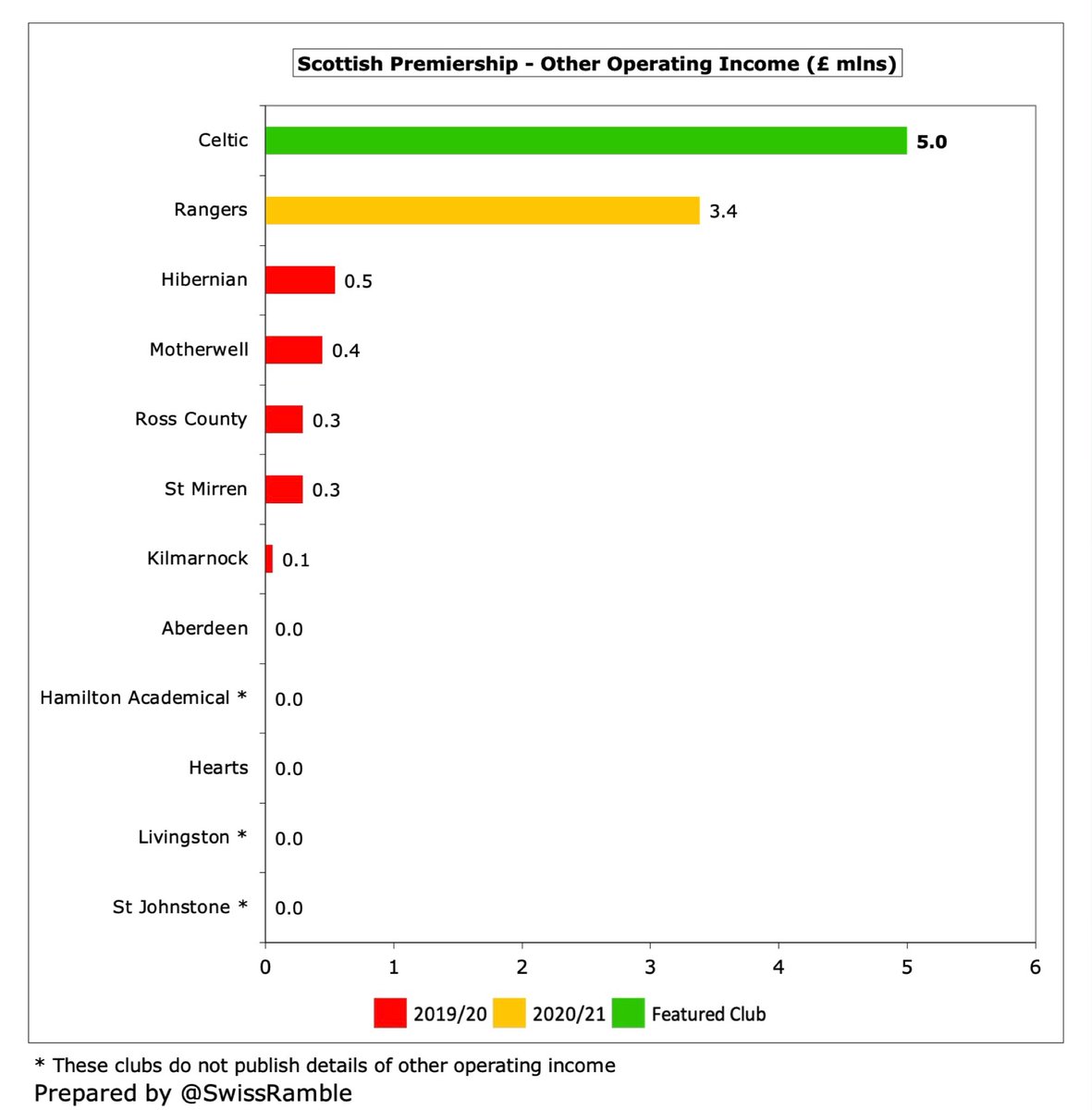

In addition to reported revenue, #CelticFC accounts include £5m other operating income, which “represents a recovery derived from Business Interruption coverage”, i.e. some compensation for matches being played behind closed doors.

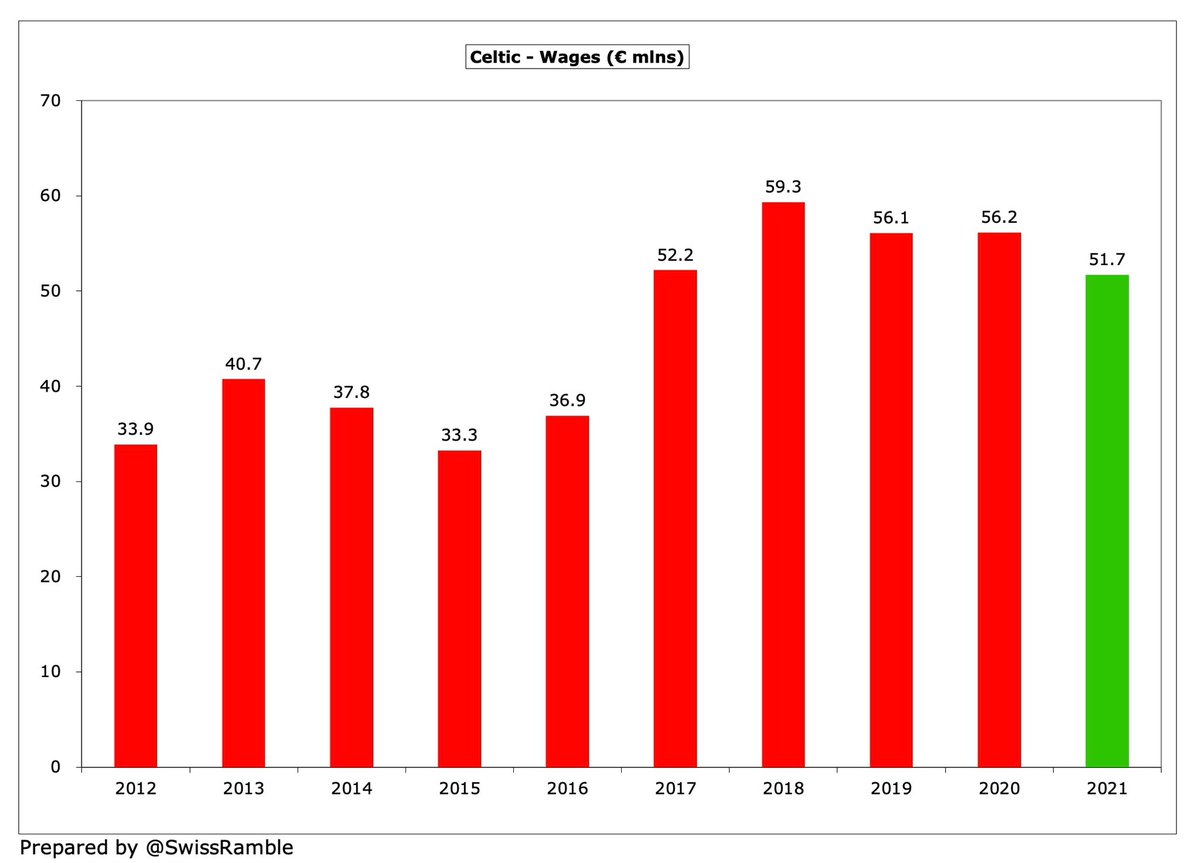

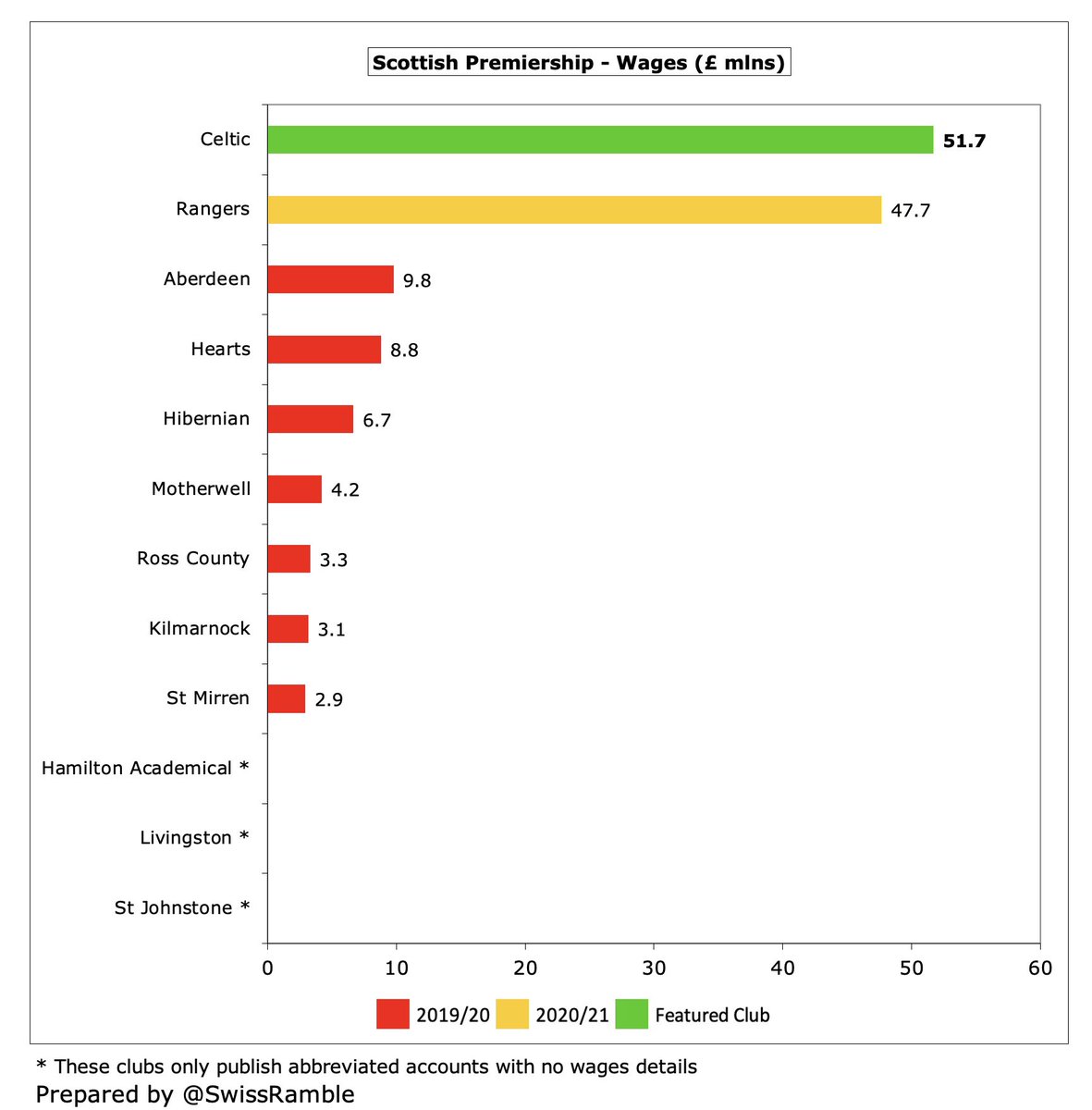

#CelticFC wage bill fell £4.5m (8%) from (restated) £56.2m to £51.7m, which means that this has fallen by £7.6m (13%) from the £59.3m peak in 2018, due to payments from Job Retention Scheme, reduced activity due to COVID and lower performance bonuses.

Similar to revenue, Rangers (£48m) have closed the wages gap to #CelticFC (£52m) from £35m in 2018 to just £4m. However, there remains an abyss between the top two and the other Scottish clubs, e.g. the next highest are Aberdeen £10m, Hearts £9m and Hibernian £7m.

#CelticFC wages to turnover ratio worsened from 80% to 85%, so has shot up from 58% just three years ago. However, this is still better than Rangers, who are now up to 100%. This metric should improve in 2021/22 following the return of fans to the stadium.

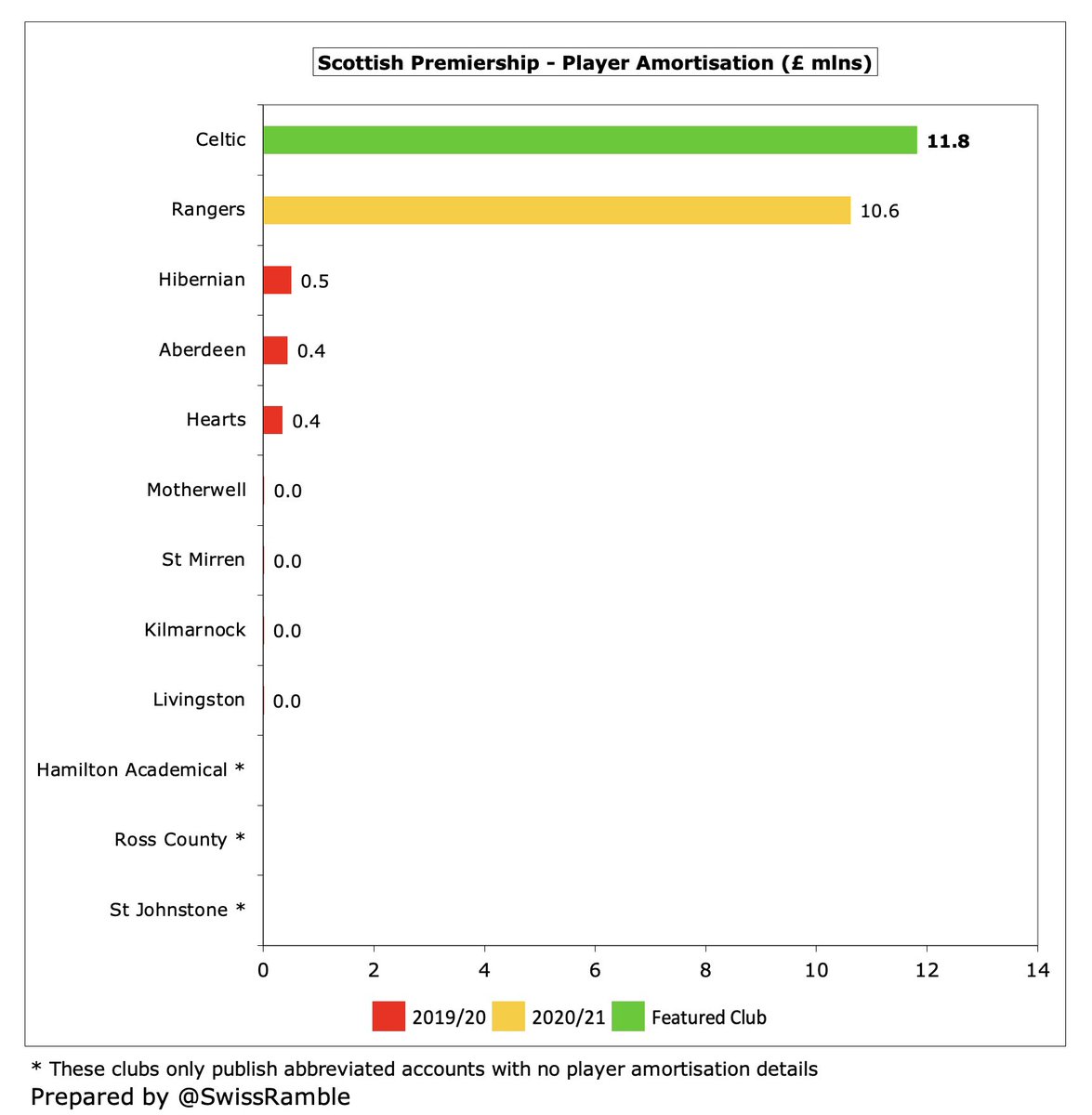

Despite investment in the squad, #CelticFC player amortisation, the annual cost of writing-off transfer fees, decreased by £0.4m (11%) to £11.8m, though has more than doubled in five years from £5.0m in 2016. Still more than Rangers £10.6m, while all other clubs less than £500k.

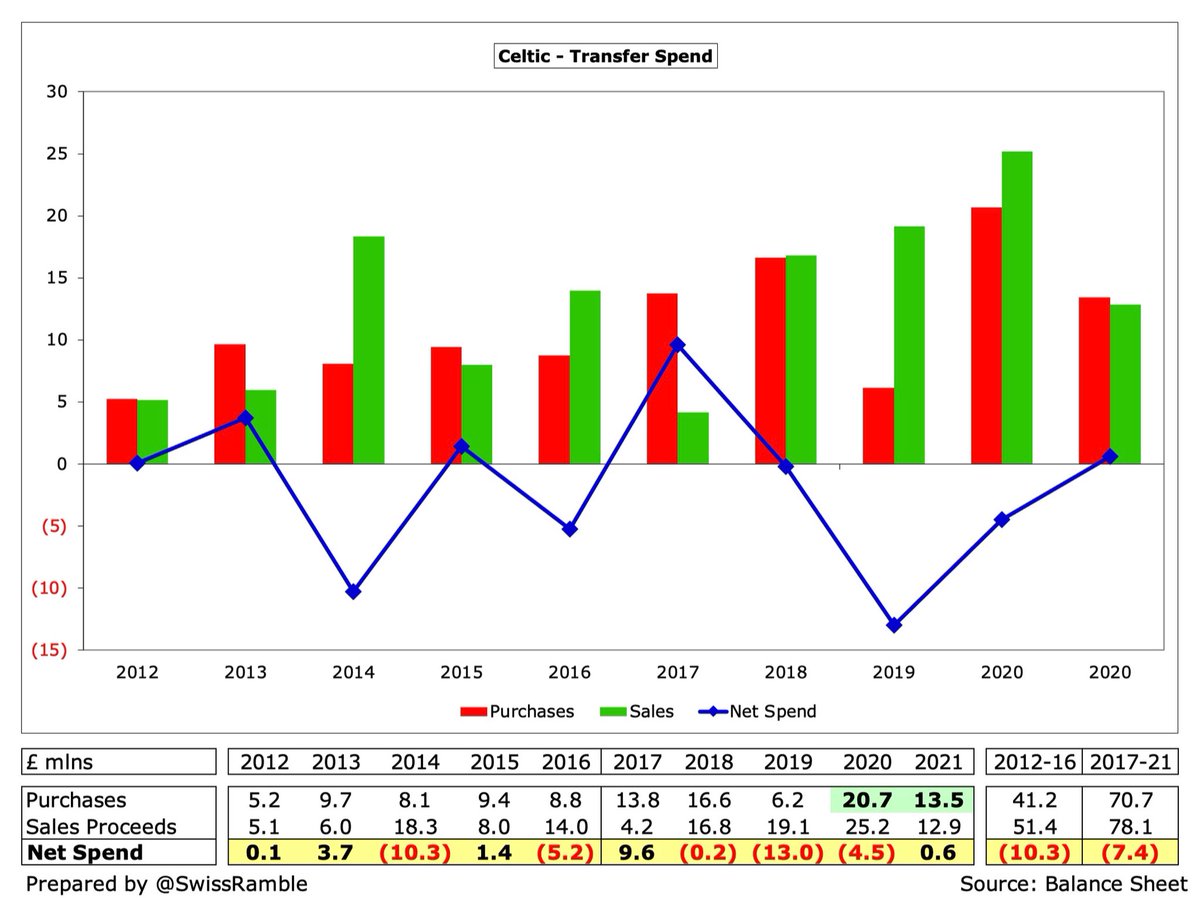

#CelticFC spent £13.5m on player purchases in 2020/21, which was down from prior season’s record £20.7m, but still meant a £71m gross outlay in the last 5 years. Net spend was less than £1m. In fact, the last time the club had meaningful net spend was £10m in 2017.

#CelticFC £13.5m player purchases in 2020/21 were lower than Rangers £16.8m. Both clubs spend significantly more than the rest of the Premiership combined. Acquisitions included Albian Ajeti, Vasilis Barkas and David Turnbull with Shane Duffy and Diego Laxalt arriving on loan.

It is worth noting that #CelticFC splashed the cash this summer (relatively speaking) by bringing in £20m worth of players after the arrival of new manager Ange Postecoglou: Furuhashi, Starfelt, Abada, Juranovic, Giakoumakis, Hart, Scales, Shaw and Urhoghide.

#CelticFC gross debt decreased from £5.3m to £4.1m, comprising £2.9m Co-operative bank loans (LIBOR + 3%) plus £1.2m finance leases. The revolving credit facility was increased from £2m to £13m as a buffer, but that had not been utilised at the date of the accounts.

#CelticFC £4.1m debt is the third largest in Scotland, but is a long way below Rangers £13.2m, which would have been even higher without them converting £60m of loans into shares in the last three seasons. Note: Celtic’s figure excludes £4.2m convertible preference shares.

After adding back non-cash items and working capital movements, #CelticFC had £12m negative operating cash flow, covered by £12m net player sales (sales £26m, purchases £14m). Spent less than £1m on capex, interest and tax, but repaid £2m loans and paid £0.5m dividends.

As a result, #CelticFC had £2.9m net cash outflow, so cash balance fell from £22.4m to £19.5m, though still by far the highest in Scotland, almost as much as the rest of the Premiership combined. The club said this gave them “a base to invest in the summer transfer window”.

Over the last 10 years #CelticFC have had £48m available cash, entirely generated from their operations and player sales. Highest expenditure: infrastructure £20m, debt repayment £10m, dividends £5m, tax £4m and interest £1m. Bank balance increased by £9m.

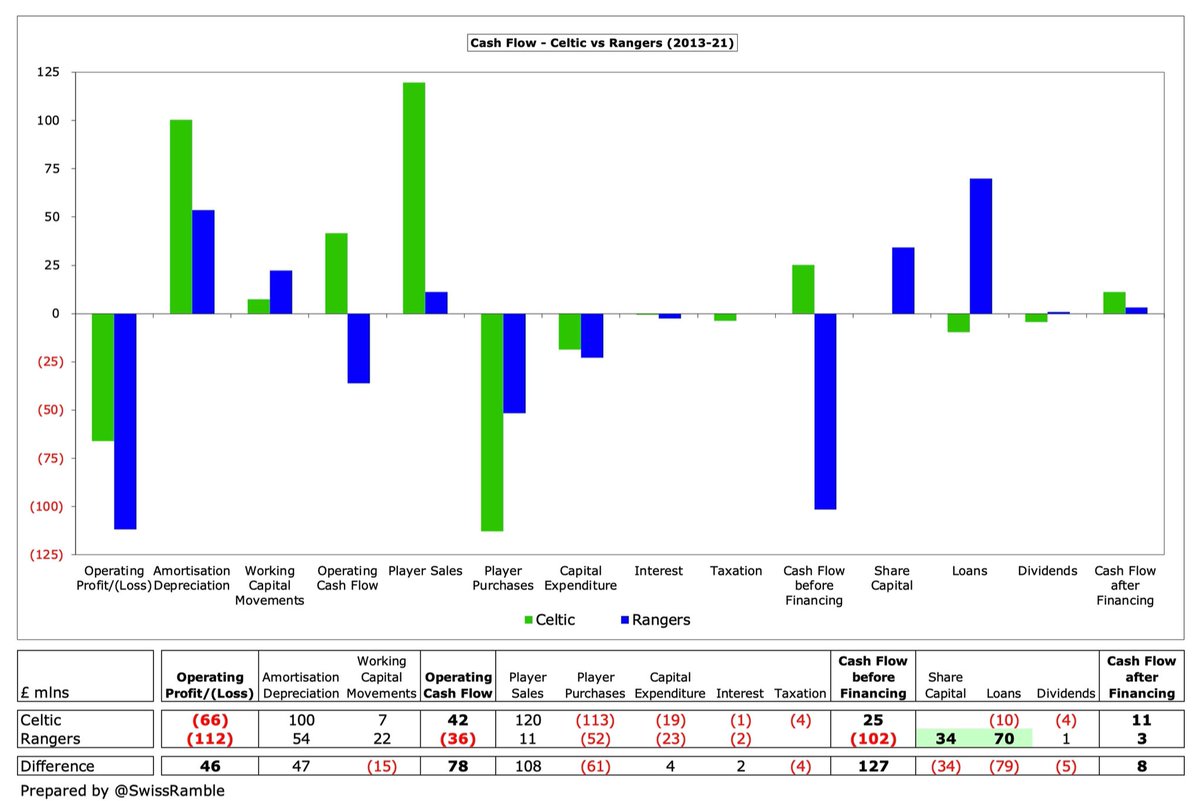

Comparing #CelticFC with Rangers since 2013, we can see that net cash flow is very similar (£11m vs. £3m), but there is a big difference in approach. Celtic have made much more from operations and player sales, which Rangers early matched via £70m loans and £34m share capital.

#CelticFC are in good shape financially, despite the pandemic, thanks to their sustainable model, though their fans might prefer more investment in the squad. The club will hope that the arrival of a new manager and expenditure on summer signings will deliver better results.

• • •

Missing some Tweet in this thread? You can try to

force a refresh