We have found a probable secret🤫to finding multi-baggers like

⚡RACL Geartech 346%

⚡ION Exchange 168%

⚡Deepak Nitrite 167%

(1 year return)

Read the🧵to find out how.

Retweet🔁to reach maximum #investors

#stocks

⚡RACL Geartech 346%

⚡ION Exchange 168%

⚡Deepak Nitrite 167%

(1 year return)

Read the🧵to find out how.

Retweet🔁to reach maximum #investors

#stocks

First, we need to know that how do a company become multi-bagger?

𝗕𝘆 𝗶𝗻𝗰𝗿𝗲𝗮𝘀𝗲 𝗶𝗻 𝘀𝗵𝗮𝗿𝗲 𝗽𝗿𝗶𝗰𝗲

But how do share prices increase🔼

-Earnings growth

-Sudden momentum

-Big Investors "buy"

-Regulatory changes

-Management changes

-other factors

#StockMarket

𝗕𝘆 𝗶𝗻𝗰𝗿𝗲𝗮𝘀𝗲 𝗶𝗻 𝘀𝗵𝗮𝗿𝗲 𝗽𝗿𝗶𝗰𝗲

But how do share prices increase🔼

-Earnings growth

-Sudden momentum

-Big Investors "buy"

-Regulatory changes

-Management changes

-other factors

#StockMarket

Among the above factors, few are out of our reach.

But we can always analyse from 𝗘𝗮𝗿𝗻𝗶𝗻𝗴𝘀 𝗴𝗿𝗼𝘄𝘁𝗵🚀

Revenue🔼

𝗠𝗮𝗿𝗴𝗶𝗻🔼

Profit🔼

𝗥𝗢𝗘🔼

Find companies that are focusing on 𝗠𝗮𝗿𝗴𝗶𝗻 𝗘𝘅𝗽𝗮𝗻𝘀𝗶𝗼𝗻 & hence increasing its 𝗥𝗢𝗘💯

#investors

But we can always analyse from 𝗘𝗮𝗿𝗻𝗶𝗻𝗴𝘀 𝗴𝗿𝗼𝘄𝘁𝗵🚀

Revenue🔼

𝗠𝗮𝗿𝗴𝗶𝗻🔼

Profit🔼

𝗥𝗢𝗘🔼

Find companies that are focusing on 𝗠𝗮𝗿𝗴𝗶𝗻 𝗘𝘅𝗽𝗮𝗻𝘀𝗶𝗼𝗻 & hence increasing its 𝗥𝗢𝗘💯

#investors

Let's see our example:

#RaclGeartech

The company's EBIT Margin increased gradually and thus increasing the ROE of the company.

This change is visible in DuPont analysis.

ticker.finology.in/company/SCRIP-…

#RaclGeartech

The company's EBIT Margin increased gradually and thus increasing the ROE of the company.

This change is visible in DuPont analysis.

ticker.finology.in/company/SCRIP-…

#IonExchange

We can see from the table that other things being constant, the ROE of the company rose with EBIT margin.

During the past 5 years, company gave 47% cagr return.🚀

ticker.finology.in/company/IONEXC…

We can see from the table that other things being constant, the ROE of the company rose with EBIT margin.

During the past 5 years, company gave 47% cagr return.🚀

ticker.finology.in/company/IONEXC…

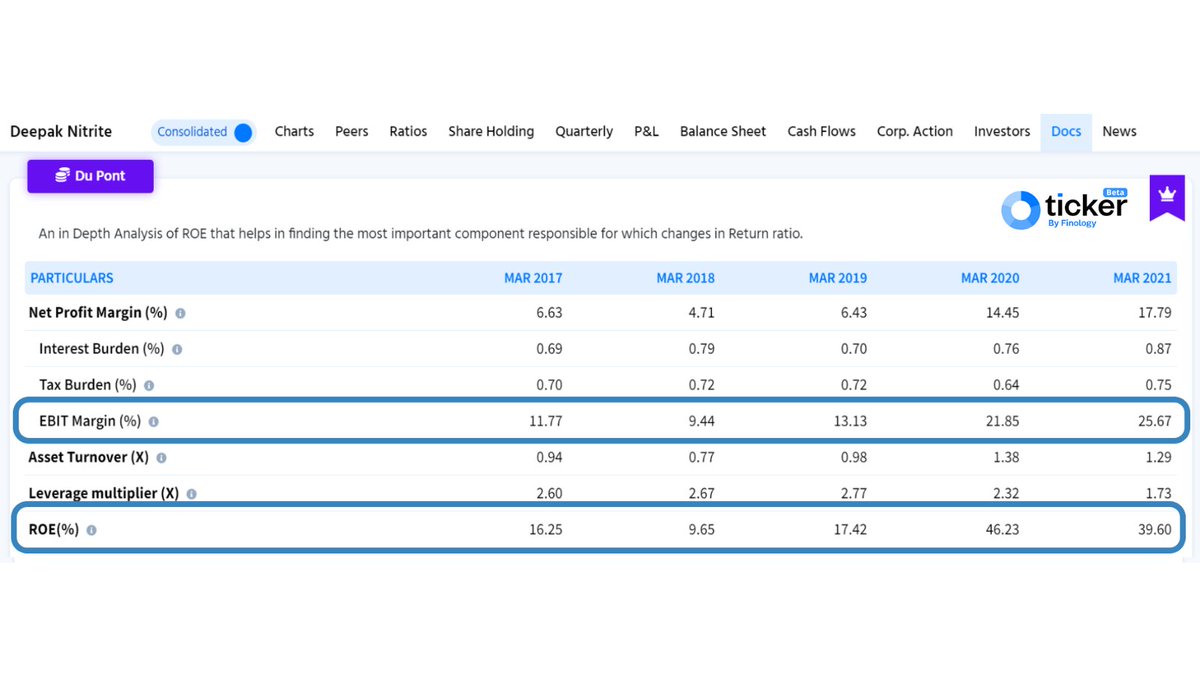

#deepaknitrite

The case is same as ION exchange. The ROE numbers replicated the margins. During past 5 years, the company gave 89% cagr returns. 🚀

ticker.finology.in/company/DEEPAK…

The case is same as ION exchange. The ROE numbers replicated the margins. During past 5 years, the company gave 89% cagr returns. 🚀

ticker.finology.in/company/DEEPAK…

You can check if the company is growing or not by simply checking DuPont table present in every company on ticker.finology.in

For more such stock analysis & strategies, keep checking @finologyticker ❤

For more such stock analysis & strategies, keep checking @finologyticker ❤

• • •

Missing some Tweet in this thread? You can try to

force a refresh