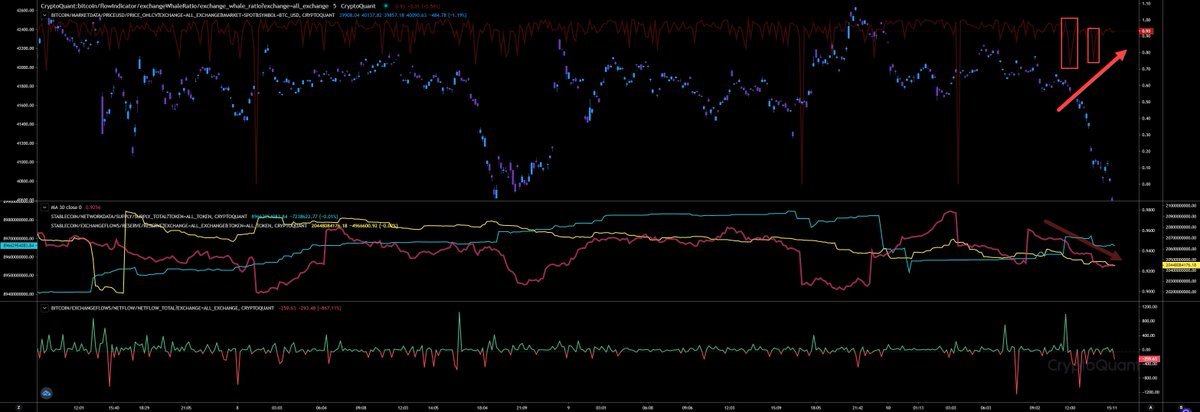

🚨🚨 Update: Our whales ratio maintains high, but decreasing as we can see at the 30D average. However, we have detected big inflows related to whales yesterday after the dump phase. That could be a sign of dump preparation. Stablecoin reserves on exchanges keeps

#BTC #ETH #XRP

#BTC #ETH #XRP

falling while stablecoin supply (circulating supply) keeps lifting up. I've detect some #tether outflows from #Binance again. A total of almost $600m withdrawn from #Binance since monday morning.

Our block view is showing a bigger inflows by whales and outflows afterwards.

Our block view is showing a bigger inflows by whales and outflows afterwards.

Anyway also here the whales ratio 30D average is declining. Indicating less whales inflows.

Checking our netflow chart we see, in general netflows are lifting up indicating more inflows happening. #Okex, #Gemini and #Bitfinex are those showing bigger netflows (more inflows than

Checking our netflow chart we see, in general netflows are lifting up indicating more inflows happening. #Okex, #Gemini and #Bitfinex are those showing bigger netflows (more inflows than

outflows) while #Binance is showing a bigger negative netflow, indicating bigger outflows.

If that maintains in that whay and the 30D average whales ratio would declined more, I would say, the bottom is in. But as we received big inflows related to whales yesterday after our

If that maintains in that whay and the 30D average whales ratio would declined more, I would say, the bottom is in. But as we received big inflows related to whales yesterday after our

dump phase, I think we should be careful. I will observe the whales ratio and tweet as soon as I detect certain bullish/bearish patterns.

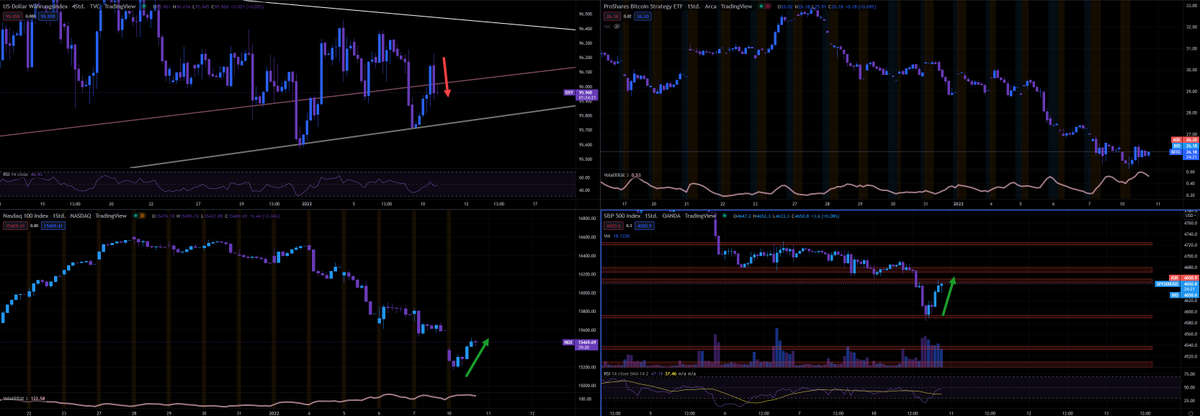

Our funding rates are declining in trend while our leverage ratio maintains high. Also confirmed by Coinglass. Indicating more shorts are

Our funding rates are declining in trend while our leverage ratio maintains high. Also confirmed by Coinglass. Indicating more shorts are

coming in since last hour. The 24h view shows also more shorts than longs. #Bitfinex traders went long at 39.7k and have started to close those the way up. Long and shorts get liquidated yesterday. But no big volume.

Option traders are trading the 28Jan expiry. Showing a bullish

Option traders are trading the 28Jan expiry. Showing a bullish

sentiment. We have a max pain of 50k right now and a total volume of almost $1.8 billion ($1.19b Calls vs. $560m Puts). So, 28Jan 50k is a must have for them.

Our next expiry is 14Jan with a max pain of 44k and a total volume of almost $640m.

The expiry has a max pain of 43k

Our next expiry is 14Jan with a max pain of 44k and a total volume of almost $640m.

The expiry has a max pain of 43k

as it has just a total volume of $300m I wouldn't consider that as an accurate indicator to predict a price level for next week.

I hope these little update gives you enough information to plan your next trade strategy.

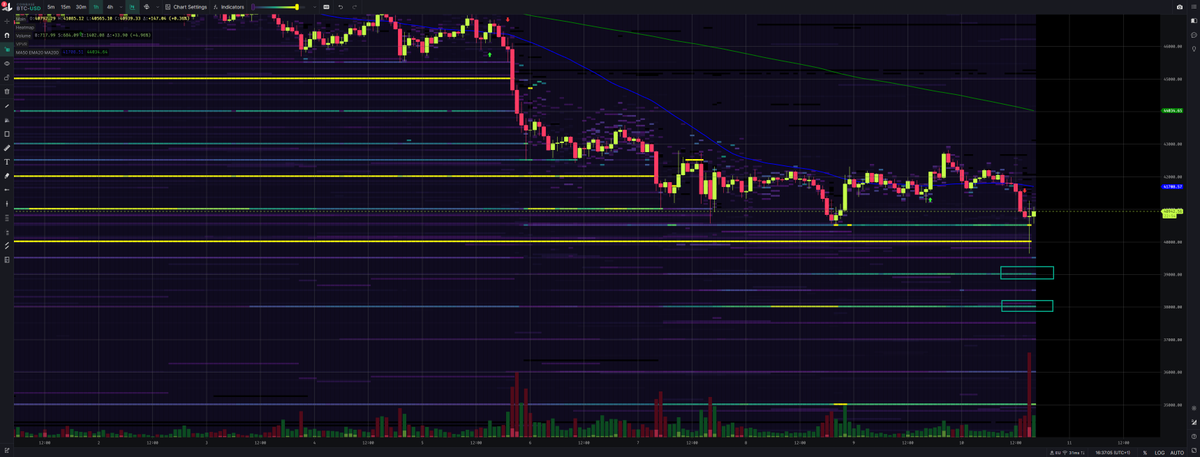

I'm expecting some sell pressure. I'm bearish until this

I hope these little update gives you enough information to plan your next trade strategy.

I'm expecting some sell pressure. I'm bearish until this

week due the incoming events, but bullish from friday on. Anyway, I will trade carefully.

• • •

Missing some Tweet in this thread? You can try to

force a refresh