🚨🚨 Update: Today just a little market update due my update yesterday was very detailed and not big changes detected yet. However, I will tweet as soon I detect some interesting moves.

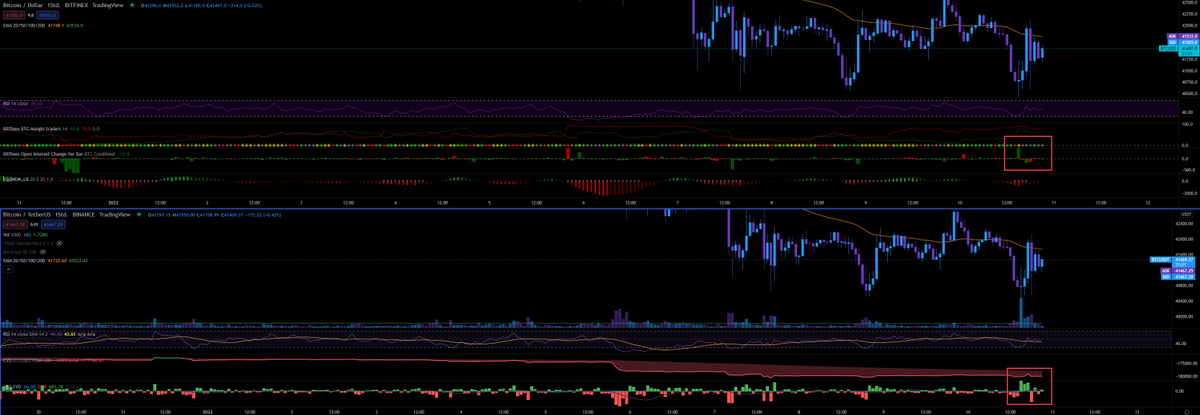

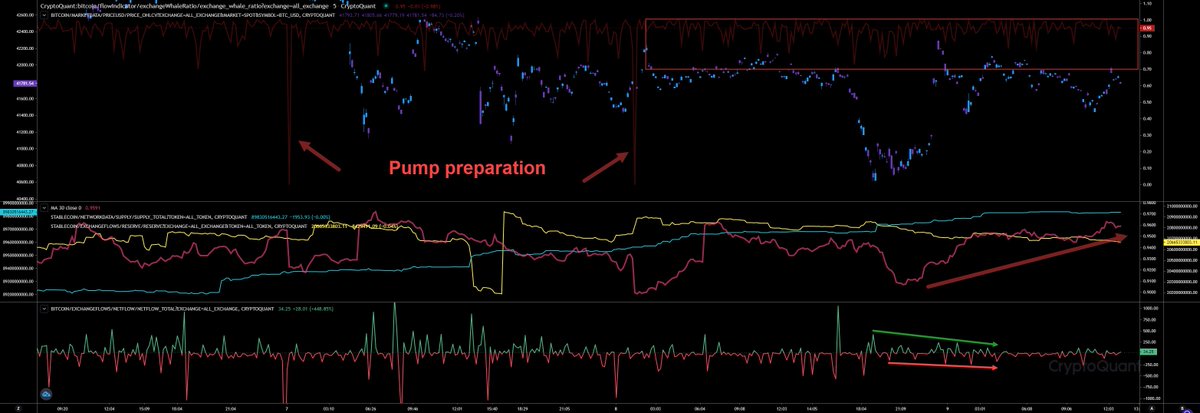

Our hourly view shows clear sign of pump preparation. Our whales ratio dumped

#BTC #ETH #XRP

Our hourly view shows clear sign of pump preparation. Our whales ratio dumped

#BTC #ETH #XRP

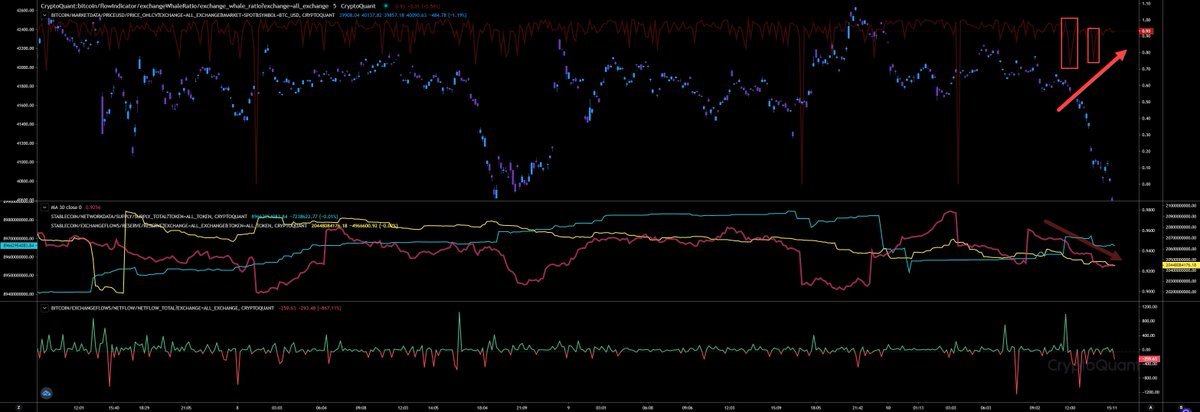

hard before we init the pump sending us back to 42k where we retested EMA50 and have failed several times. Yesterday we had more outflows than inflows confimed by our netflow chart. While we were close to pump they have started to send more tokens to exchanges. While the whales

ratio pumped again indicating that those tokens were from whales. The whales ratio 30d average is lifting up again. Indicating more whales tokens are arriving on exchanges, even if the volume is not that big anymore. Stablecoin supply keeps rising, stablecoin reserve on exchanges

maintains its level. I have detected more #tether outflows from #Binance. Since midnight a total of $170m in #tether.

Our block view shows more in detail what happend yesterday. Whales ratio dumped hard. That happens everytime before we pump. We dump first and pump afterwards.

Our block view shows more in detail what happend yesterday. Whales ratio dumped hard. That happens everytime before we pump. We dump first and pump afterwards.

The chart in the bottom shows our netflows. The positive netflow have started to decline after the dump and immediately afterwards negative netflows started to rise indicating more outflows than inflows. However the whales ration 30d average is rising again since our pump

indicating more whales tokens arriving on exchanges. As mentioned above, not more the volume we had the last couple days. This chart shows also the stablecoins outflow from exchanges (yellow line).

If we check our netflows we can see that the 30D average netflow is rising EoY indicating more inflows than outflows. #Binance as main driver of the dump phase shows big inflows between 01-04-2022 - 01-07-2022, while #Okex is taking over since then. Of course not that volume like

#Binance. #Okex last bigger netflow was friday, but also yesterday we had more in- than outflows. Since last hour rising again. #Gemini and #Bitfinex almost neutral.

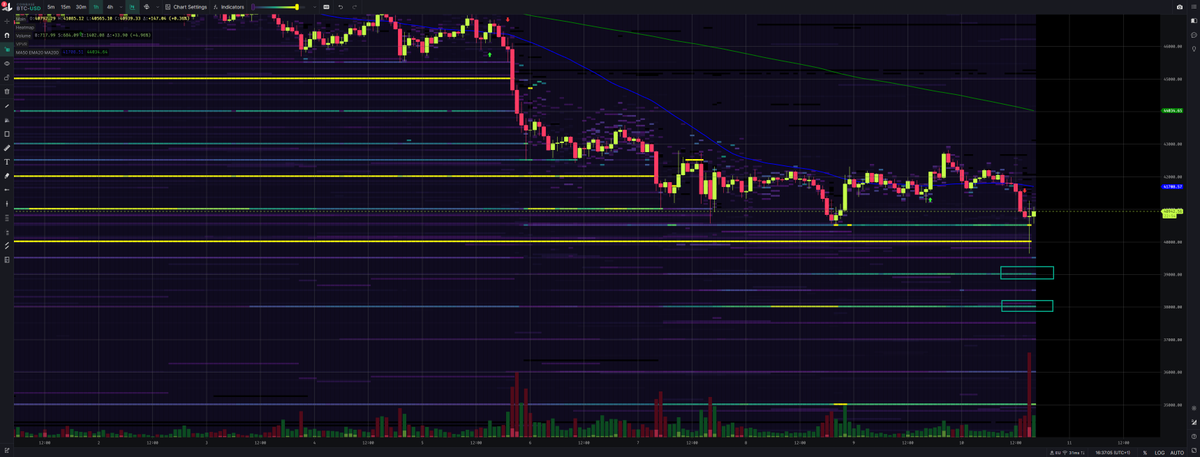

Future traders flipping to bullish again. Funding rates declining while we maintain our high leverage ratio. No

Future traders flipping to bullish again. Funding rates declining while we maintain our high leverage ratio. No

big liquidations happend yesterday. If I compare the longs liquidations of the recent last weeks with the short liquidations it shows a clear pitcure. We still have much more high leverage longs than shorts. It's easier to dump with those high leverage longs than to pump with the

few high leverage shorts. Also confirmed by Coinglass funding rates quotes.

Our max pain for the next expiry tuesday 11Jan22 is 42k at the moment. For the expiry 14Jan22 44k and for the expiry 28Jan22 50k. The all expiries max pain has dropped once again from 52k to 50k

Our max pain for the next expiry tuesday 11Jan22 is 42k at the moment. For the expiry 14Jan22 44k and for the expiry 28Jan22 50k. The all expiries max pain has dropped once again from 52k to 50k

indicating more volume in lower ranges also in options. The top traded option within the last 24h is Call at 42k for the 28Jan22 expiry. Also bullish.

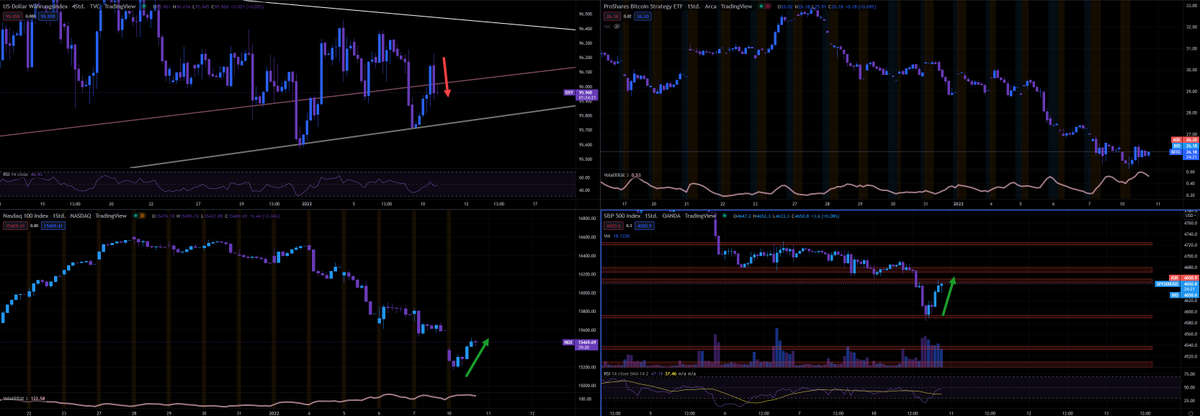

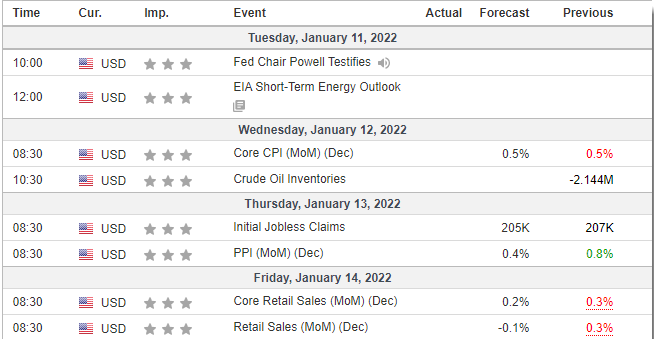

I expect a green start and we will flip back to red as Powell testifies next tuesday. That could let the sell pressure rise

I expect a green start and we will flip back to red as Powell testifies next tuesday. That could let the sell pressure rise

rise again. This coming week is going to be tough imo. Almost everyday we will receive important data that could affect the markets. So, keep these events in your mind. If next week no flash crash happens and we maintain above of 40k, I would consider 40k our bottom.

After 11Jan22 they should start to lift up heading 44k.

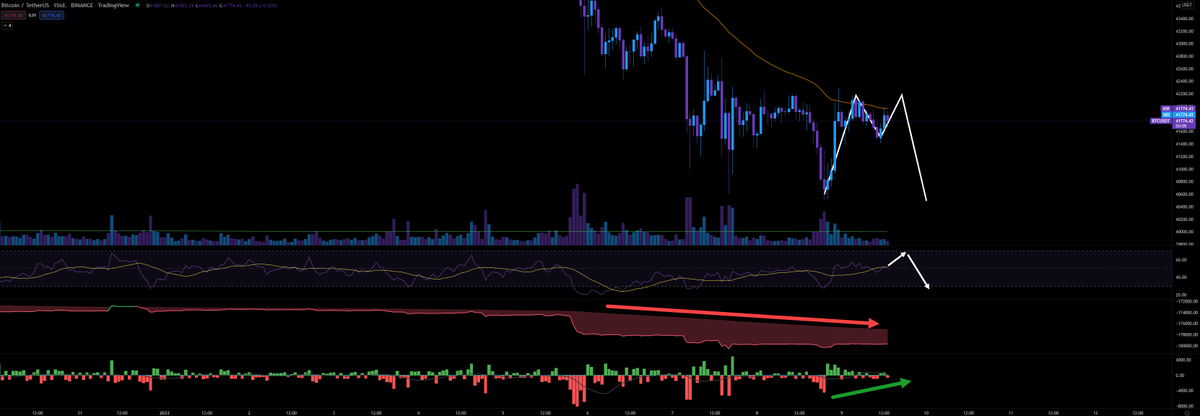

My trade strategy for the next 24 hours: I expect another lift up heading 42k - 42.3k to form a double top (or batman) as the buy pressure is rising. Our hourly RSI shows enough space in the upper range for that and I

My trade strategy for the next 24 hours: I expect another lift up heading 42k - 42.3k to form a double top (or batman) as the buy pressure is rising. Our hourly RSI shows enough space in the upper range for that and I

expect red candles afterwards. At the moment we maintain above of our recent trendline. Expecting here a bounce with a little low volume pump to lift up as mentioned above. Maintain the level until tonight or tomorrow start to declined again heading Powells testify.

No changes detected related to #Bitfinex or #Coinbase walls, but #FTX perp lower walls are disappearing and the upper wall disappeared completely while #Binance has reduced its wall at 42.3k and mantains its wall at 40k. They were expecting the pump yesterday it seems, they

don't expect more pump heading 43k now. At least that's my interpreation. We will see what happens in the next 24h.

So, make your plan and stick to it. I'm still expecting a high volatility week. Let us rest sunday and make some good trades next week. 😎

So, make your plan and stick to it. I'm still expecting a high volatility week. Let us rest sunday and make some good trades next week. 😎

• • •

Missing some Tweet in this thread? You can try to

force a refresh