🚨🚨 Market Update: This time I will go a bit deeper in my analysis showing different time frames.

Our block (minutes) time is showing a high whales ratio (1) indicating the incoming inflows are mostly from whales and not from retailers.

#BTC #ETH #XRP

Our block (minutes) time is showing a high whales ratio (1) indicating the incoming inflows are mostly from whales and not from retailers.

#BTC #ETH #XRP

Few hours ago we have detect a big netflow (2) indicating a big inflow to exchanges. Keep in mind, netflow means more inflows than outflows. Our 30d average (3) whales ratio here also showing a positive trend indicating more sell pressure will come from whales soon.

Our hourly view also shows the whales ratio (1) keeps high in a range between 0.75 - 1.00 also here indicating the incoming inflows are mostly coming from whales. Since last night we had more outflows than inflows, but didn't pump, even if it was a good opportunity due a low

volume.

Instead we received more inflows showing a green netflow (2) indicating a netflow of almost 500 #BTC. Bullish here is the 30d average (3) showing the whales ratio is falling. Stablecoins supply (5) keeps rising while the stablecoin reserve on exchanges (4) keeps on its

Instead we received more inflows showing a green netflow (2) indicating a netflow of almost 500 #BTC. Bullish here is the 30d average (3) showing the whales ratio is falling. Stablecoins supply (5) keeps rising while the stablecoin reserve on exchanges (4) keeps on its

level since the $750m #tether inflow to #Binance yesterday. The current exchange reserves showing $20.8 billion in stablecoins.

If we zoom out even more the picture changes a bit. Our whales ratio (1) here indicates that whales inflows has declined from 01-01-2022 until

If we zoom out even more the picture changes a bit. Our whales ratio (1) here indicates that whales inflows has declined from 01-01-2022 until

01-05-2022 and is rising again since 01-06-2022. We need to see if the keeps rising. We can see here the dump preparation when the whales ratio pumped hard from 12-25-2021 to 01-01-2022 indicating whales sending their tokens to exchanges.

Our total netflow (2) for yesterday was

Our total netflow (2) for yesterday was

positive showing more inflows than outflows, a total of 2,282 #BTC. But the most interested part is the 30d average ratio in the daily view indicating whales are sending its tokens to exchanges since March of 2021. It's very interesting for me, because I did an analysis about

#BTC entities months ago, showing that big entities have started to distribute in Q1 2021 their assets. The biggest entity with 1,000 - 10,000 #BTC balances with imo the best trade behavior in timing started to distribute its #BTC in Feb 2021. But they distributed hard in March.

In Feb 5th they owned almost 5.56 million #BTC, not owning 5.18 million tokens, indicating a declining of almost 380,000 #BTC or almost 7%. Even entities with 10,000 - 100,000 #BTC most of them related to exchanges has reduced its balances from 2.32 million #BTC in March to 2.07

million today, also indicating a reduction of almost 250,000 #BTC or almost 11% since then. As you can see, the whales ratio is very useful if you want to know if this reduction of entity balances are related to whales or exchanges. To make clear, I'm just interpreting here the

data.

EXCHANGE RESERVES

Total exchange reserve has declined by 350 #BTC since 01-07-2022 midnight.

While #Binance has added 750 #BTC more to its reserve in the same period of time.

#Bitfinex reserves almost neutral, showing a reduction of almost 30 #BTC since friday morning.

EXCHANGE RESERVES

Total exchange reserve has declined by 350 #BTC since 01-07-2022 midnight.

While #Binance has added 750 #BTC more to its reserve in the same period of time.

#Bitfinex reserves almost neutral, showing a reduction of almost 30 #BTC since friday morning.

#Gemini keeps declining its reserves, since friday almost 1,000 #BTC.

#Okex receiving more #BTC and rising its reserves by almost 1,600 #BTC.

#Okex receiving more #BTC and rising its reserves by almost 1,600 #BTC.

FUTURE TRADING

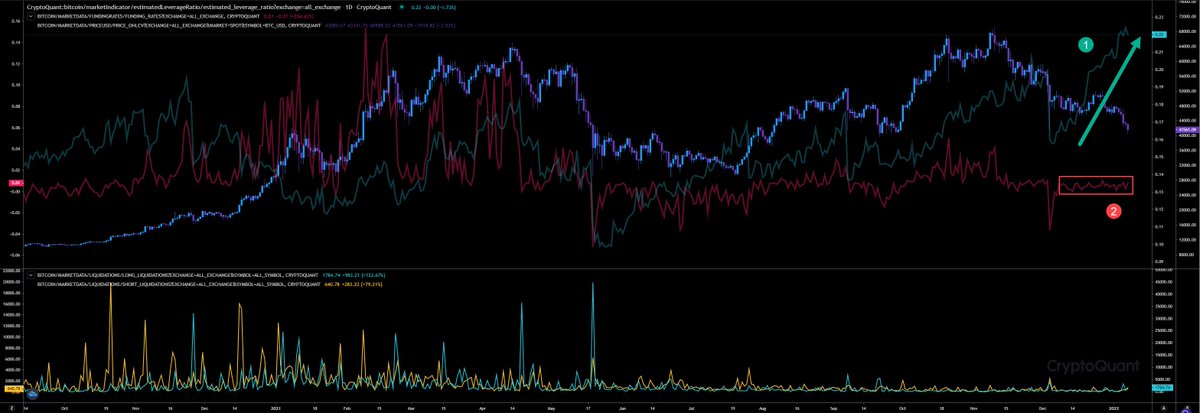

The daily view showing clearly an insane leverage ratio (1) showing high leverage future positions still waiting to get rekt. Since May we can detect the rising leverage ratio. The only good thing here, the funding rates (2) maintains a normal range. However, only

The daily view showing clearly an insane leverage ratio (1) showing high leverage future positions still waiting to get rekt. Since May we can detect the rising leverage ratio. The only good thing here, the funding rates (2) maintains a normal range. However, only

a rising volatility would rekt those high leverage positions. That would also explain why option traders started with long gamma to max its risk management for an incoming big volatility.

If we check the hourly view we can detect a falling funding rate (1) indicating more longs

If we check the hourly view we can detect a falling funding rate (1) indicating more longs

on the way expecting a rising price action, while the leverage ratio (2) has lifted up a bit indicating that some of those new longs are high leverage positions.

Coinglass also confirming the observations described above.

Coinglass also confirming the observations described above.

OPTION TRADING

The max pain for our incoming expiry 14Jan22 is at $44k atm. Showing big Puts volume (within 24h) there. For our expiry 28Jan22 we can see a main pain at $50k showing big Puts volume at $40k and Call volume at $50k. However that would match to my expectation of a

The max pain for our incoming expiry 14Jan22 is at $44k atm. Showing big Puts volume (within 24h) there. For our expiry 28Jan22 we can see a main pain at $50k showing big Puts volume at $40k and Call volume at $50k. However that would match to my expectation of a

bullish trend after 14Jan22. The expirires 14Jan22 and 28Jan22 are in scope of option traders showing the biggest volume within the last 24h. Top traded instruments are $50k Calls for 28Jan22 expiry, but also $40k Puts. For 25MAR22 its shows Puts at $25k and Calls at $50k. Make a

long story short option traders expecting bearish trends until Jan14 but a pump afterwards heading $50k and for March a crash heading $25k or just maintain the Jan price level. Actually it matches well to my prediction. Jan we will lift up init a rally by whales and let

retailers push the price up while their are able to distribute more the way up. In march when rate hike and tapering will init the market should flip to bearish again.

My personal conclusion is, I'm on track. The current data confirms my current trade strategy. Expecting more sell pressure rising the volatility to clean the high leverage positions, after Jan14 start to lift up again. Init a pump heading $50k and beyond. Again, retailers push

the price up, whales just initiate rallys! They never buy all the way up, they buy the bottom and sell the way up! So, its up to you guys what our next top will be! As soon whales starts to notice a stalling rally they will start to dump again. And yes, I'm expacting a dump

heading our remaining CME gap to get it filled at $24k - $26k. Due the fact that institutionals are more and more involved in #BTC Future ETFs does that make sense to me.

As usual, stick to your plan. Don't let you guide by fear or price action. Don't forget to enjoy ur weekend!

As usual, stick to your plan. Don't let you guide by fear or price action. Don't forget to enjoy ur weekend!

• • •

Missing some Tweet in this thread? You can try to

force a refresh