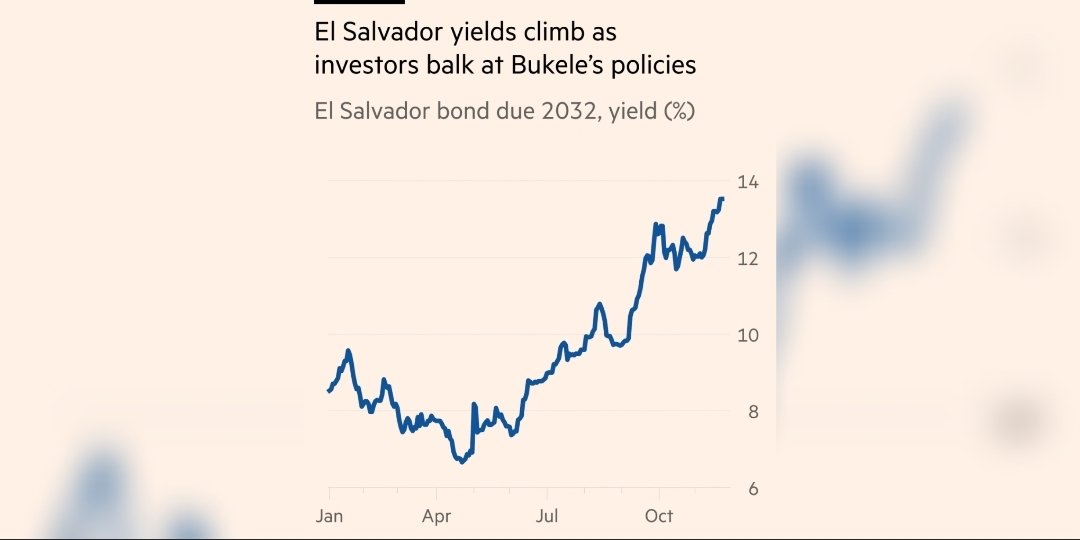

🚨 DEBT PROBLEMS: Moody's has warned that El Salvador faces debt restructuring & another downgrade due to #Bitcoin trades. "El Salvador’s Bitcoin trades are adding risk to a sovereign credit outlook that was already weak and reflecting a growing chance of default". #Retweet (1/5)

El Salvador’s current ownership is 1,391 #Bitcoin. At current prices, the holdings are potentially down between $10-20M, Moody’s estimates. President #NayibBukele has said he buys the #cryptocurrency using his phone, but the government doesn’t publish data on its holdings. (2/5)

El Salvador has an $800M bond maturing in Jan 2023, trading at 78.8 cents on the dollar, giving it a yield of over 35%. The high yields have cut off access to foreign bond markets & lack of a deal with IMF is adding to the country’s risk of defaulting, according to Moody’s. (3/5)

The ratings agency downgraded El Salvador in July to Caa1, which reflects “very high credit risk”. Moody’s cited a “deterioration in the quality of policymaking” in their decision. (4/5)

Selling a large amount of #Bitcoin bonds could potentially help #Bukele with short-term liquidity pressures, but unless the bonds are very well received & oversubscribed, we are seeing that the probability of El Salvador defaulting & restructuring their bonds is increasing. (5/5)

• • •

Missing some Tweet in this thread? You can try to

force a refresh