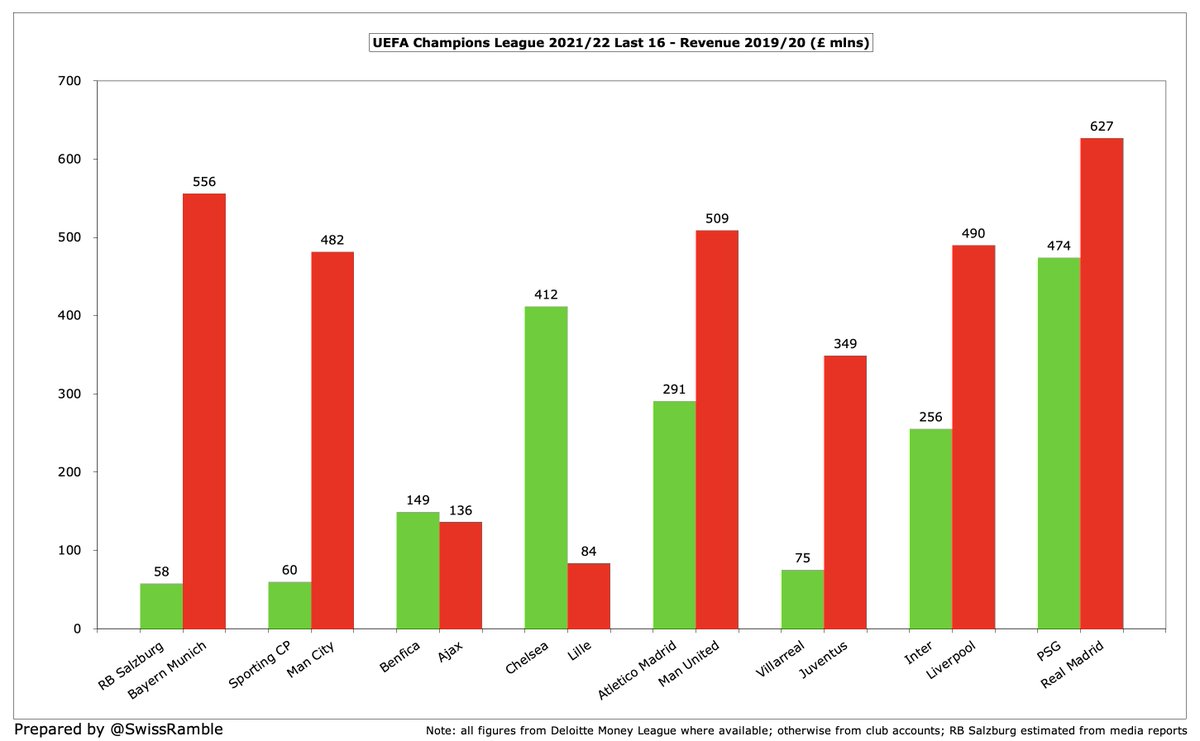

Quick financial comparison of the clubs playing in the last 16 of 2021/22 Champions League. This is based on 2019/20 figures, as: (1) some clubs have not yet published 2020/21 accounts; (2) 2019/20 is less impacted by COVID with only a few games played behind closed doors.

Based on revenue alone, most of the ties in the last 16 would appear to be mismatches, with the exception of Benfica vs Ajax. That said, history tells us that performances on the pitch do not always neatly correlate with turnover.

It’s a similar story with wages, though PSG £363m wage bill is higher than Real Madrid £332m (in contrast to revenue, where the Spaniards are higher). Atletico Madrid’s £199m wages are a fair way below #MUFC £284m, though the gap is smaller than revenue (£291m vs £509m).

Not all club details are available for squad cost (i.e. PSG, Lille and RB Salzburg are missing), but it is worth noting that Inter £609m and #LFC £634m are quite close. The highest squad costs are #MCFC £978m, Real Madrid £837m, #MUFC £831m, Juventus £823m and #CFC £822m.

• • •

Missing some Tweet in this thread? You can try to

force a refresh