Queens Park Rangers 2020/21 financial results covered a season when they finished a creditable 9th under Mark Warburton, their highest in the Championship since 2013/14, though the campaign was badly disrupted by COVID. Some thoughts in the following thread #QPR

#QPR pre-tax loss narrowed from £16.4m to £4.5m, despite revenue falling £3.8m (21%) from £18.3m to £14.5m, as profit on player sales rose £11.7m to £17.6m and there was no repeat of prior year’s £4.5m write-off of previous training ground development.

#QPR £3.8m revenue reduction was entirely due to the COVID driven £3.8m fall in match day income from £4.0m to just £207k. Broadcasting rose £0.1m (2%) to £8.6m, including iFollow streaming income, while commercial was flat at £5.8m, thanks to furlough payments.

Despite the revenue reduction, #QPR wage bill rose £4.1m (21%) from £20.0m to £24.1m and player amortisation increased £0.8m from £0.6m to £1.4m. On the other hand, other expenses decreased by a third (£4.6m) from £13.2m to £8.6m.

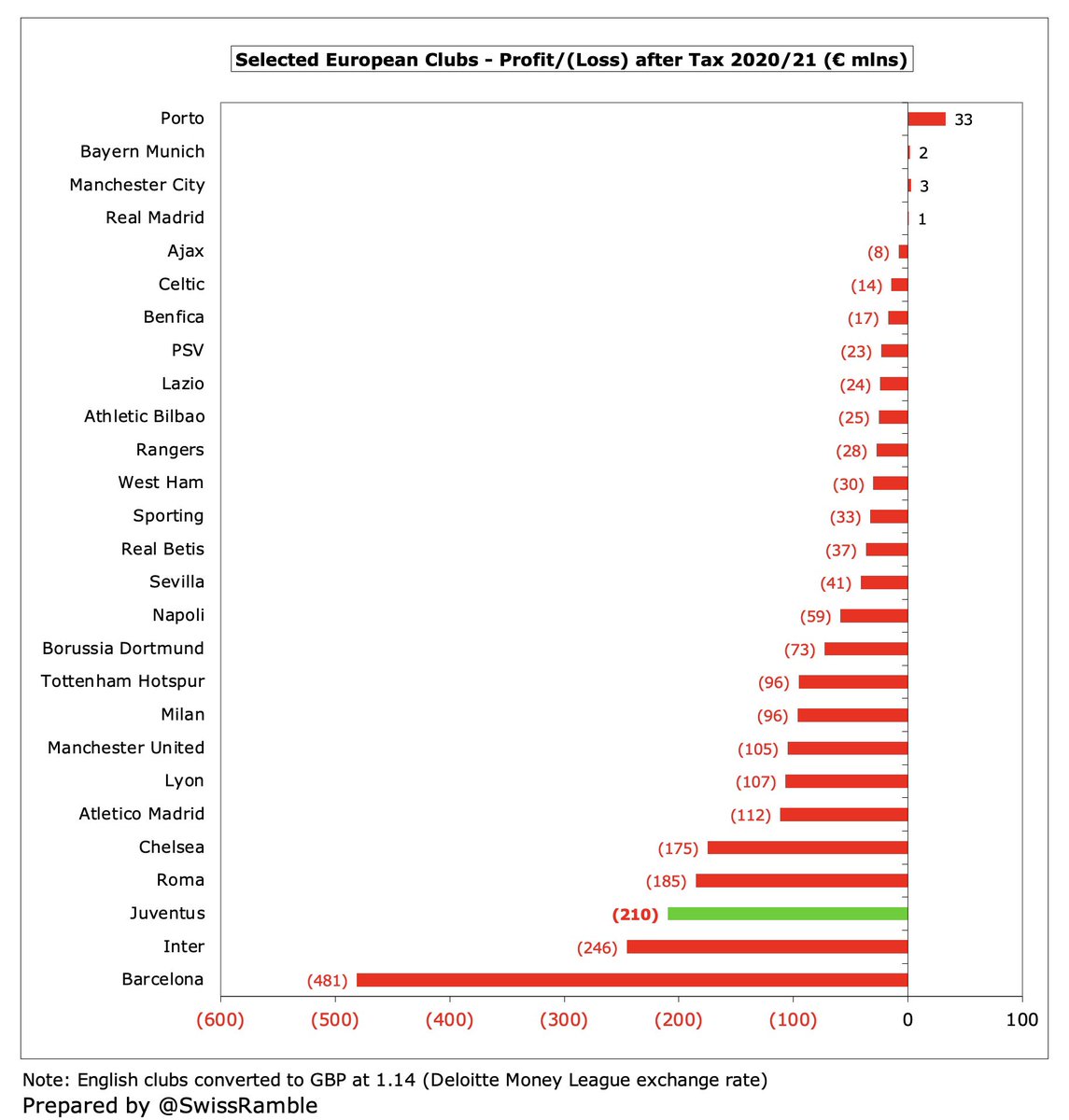

#QPR £4.5m loss is actually one of the better results in the Championship. Even before the full effects of the pandemic were felt in 2020/21, many clubs lost more than £20m, while Bristol City and Millwall lost £38m and £14m respectively last season.

#QPR have not quantified the effect of COVID, but I estimate they lost around £3m revenue in 2020/21, mainly £4m gate receipts, as games played without fans. Partly offset by £1.3m iFollow streaming & £0.5m furlough payments. Would have been close to break-even without pandemic.

#QPR financials boosted by £17.6m profit on player sales, £11.6m higher than prior year £6.0m, almost compensating for operating loss. Very largely driven by sale of Eberechi Eze to #CPFC, though also included Bright Osayi-Samuel to Fenerbahce and Ryan Manning to Swansea City.

Although #QPR continue to lose money, their turnaround is emphasised by the 2020/21 £4.5m loss being the lowest since 2006. However, since Tony Fernandes arrived in August 2011, total losses have been £230m – or £290m if we exclude the £60m loan write-off in 2014.

#QPR 2014 loss would have been much higher without £60m shareholder loan write-off, while FFP has also had a big impact in last few years: 2018 hit by a £20m fine, while last 3 seasons all included £1m finance cost. Prior year featured £4.5m write-off of previous training ground.

#QPR have not traditionally made much money from player sales, but this has been on an upward trend with £26m profit in the last three years. That said, very little has been generated from player trading in 2021/22.

However, Director of Football Les Ferdinand noted, “There’s value in the squad that we didn’t have before”, including the likes of Ilias Chair, Chris Willock and Lyndon Dykes. In recent years ago the club had few saleable assets, so had to release players for free.

#QPR operating loss (i.e. excluding player sales and interest) worsened from £17m to £21m, though this is actually one of the better performances in the Championship, as almost every club in this division posts substantial operating losses, i.e. half of them are above £30m.

#QPR revenue has dropped £20m (58%) in last 2 years from £35m to £15m, partly due to the pandemic, which has driven reductions in match day £5.2m and commercial £1.5m, but largely due to £13.4m less TV money after parachute payments ended. Lowest since £14.4m in 2010.

Following the decrease, #QPR £15m revenue is now firmly in the bottom half of the Championship, highlighting the club’s ability to punch above its weight, as this is only around a quarter of clubs benefiting from parachute payments, e.g. #NCFC £57m in 2020/21.

#QPR no longer benefit from parachute payments, having received £90m in the 4 years up to 2019. These are so significant that they make it difficult for others to compete, e.g. in 2019/20 a relegated club received £42m in year one, £34m in year two and £15m in year three.

#QPR broadcasting income rose £0.1m (2%) to £8.6m, including £1.4m from iFollow streaming, up from £143k, as EFL allowed fans to view most games. Second season without parachute payments. Most Championship clubs earn £7-9m, but there is a massive gap to clubs with parachutes.

#QPR match day income fell £3.8m (95%) from £4.0m to just £207k, as all home games were played behind closed doors (except two with severely restricted capacity of 2,000 in December). This was as high as £8.1m the last time they were in the Premier League in 2015.

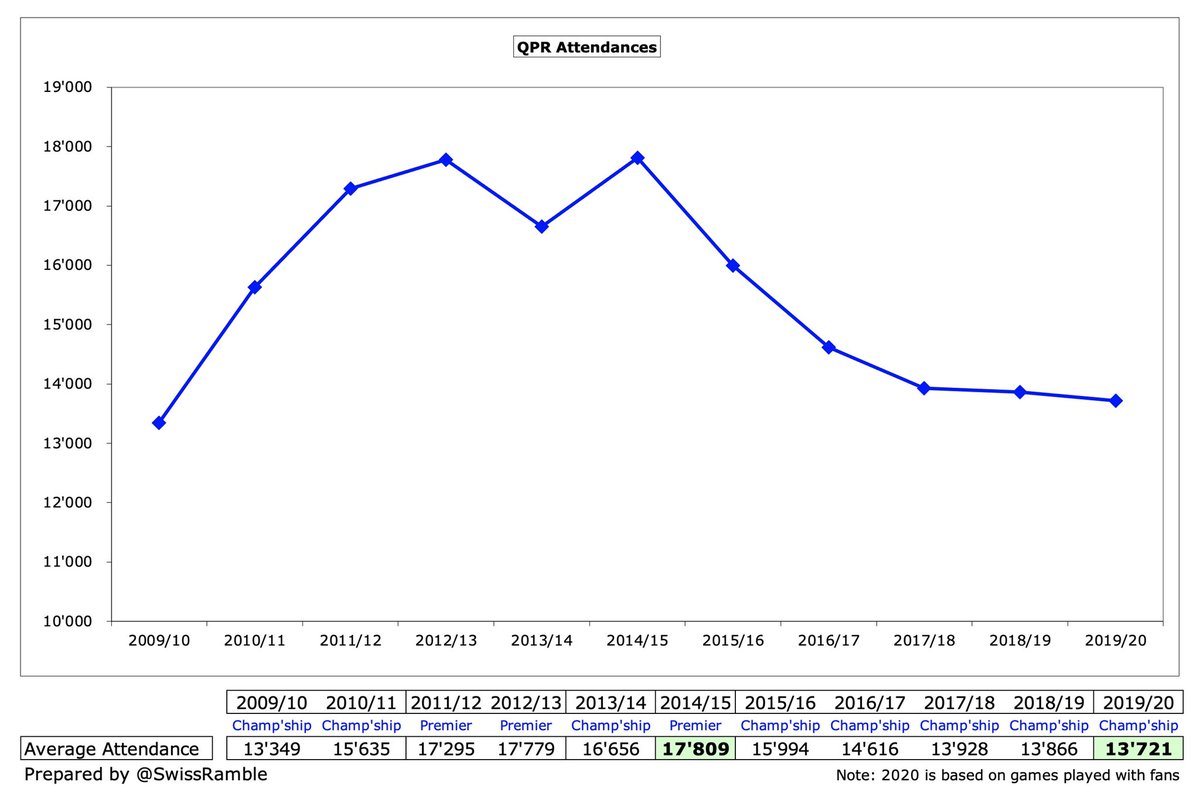

#QPR average attendance (for games played with fans) was 13,721 in 2019/20, which was down 4,100 since relegation and is one of the lowest in the Championship. However, the club noted that attendance to date this season has seen “a marked improvement”.

#QPR have been looking for a new ground for some time, as the club “is not financially sustainable in the long-term” at the Kyan Prince Foundation Stadium). The Linford Christie Stadium in Wormwood Scrubs is the preferred choice, but they may have to look further afield.

#QPR commercial income was unchanged at £5.8m, comprising sponsorship & advertising £1.5m, commercial income £2.0m, sales of inventories £0.9m and other income £1.4m (including £0.5m furlough payments). Mid-table in the Championship, far below Stoke City £14m.

After Football Index went into administration, #QPR terminated their 2020/21 shirt sponsorship, replacing them with builders Senate Bespoke for the rest of the season, then Ashville Holdings in 2021/22. The kit supplier has been Errea since 2017.

#QPR did not report any other operating income, while other clubs classified some revenue elements here, e.g. #HTAFC included £5.7m player loans in 2019/20, while this is where many reported government furlough payments.

#QPR wage bill rose £4m (21%) from £20m to £24m, as the number of players, managers & coaches increased from 99 to 113, though wages have still fallen by a staggering £51m (68%) compared to £75m under Harry Redknapp in the 2014 Championship.

To give some more colour to those free spending days, #QPR’s £75m wage bill back in 2013/14 is still the fourth highest ever in the Championship, only surpassed by #AVFC £83m, (2018/19), #NUFC £80m (2016/17) and #LUFC £78m (2019/20). All the high earners have long since gone.

Despite the 2020/21 growth, #QPR £24m wage bill is still comfortably in the bottom half of the Championship, ahead of Millwall £21m. Far below #NCFC £67m and Brentford £41m in 2020/21, though both of those clubs included hefty promotion bonuses.

#QPR wages to turnover ratio increased from 109% to 166%, which is clearly not sustainable, though was severely impacted by the COVID revenue decrease in 2020/21. Even before the pandemic, most clubs in the ultra-competitive Championship had ratios well above 100%.

No remuneration was paid to #QPR directors for the 9th year in a row. In contrast, the directors at some clubs received a tidy sum, e.g. Birmingham City (senior management) £1.6m, Fulham £948k, Stoke City £834k and Cardiff City £712k.

#QPR player amortisation, the annual charge to write-off transfer fees, rose from £0.6m to £1.4m, significantly lower than the club’s £17m peak in 2013. One of the very smallest in the Championship, miles below clubs relegated from PL, and lower even than Millwall.

#QPR spent £8.3m on player purchases in 2020/21, including Dykes from Livingston, Bonne from #CAFC, Dickie from #OUFC, Willock from Benfica and Amos from #THFC. This was more than four times as much as the previous three seasons combined.

#QPR have spent £25m on new players in the last 5 years, though 2019 included a transfer embargo as part of the FFP settlement. This is a huge reduction from the £124m they splashed out on transfers in the preceding 5-year period. Less than £3m expenditure since year-end.

#QPR gross debt rose £9m from £53m to £62m, including £55m from the owners (£46m loan plus £9m convertible bond issued to Ruben Gnanalingham’s wife) and £7m EFL loan. Would have been much higher without capitalising £232m loans (£17m last year) and writing-off another £60m.

Nevertheless, #QPR £62m debt is still 9th highest in the Championship, though far below the likes of Stoke City £187m, #BRFC £156m, Birmingham City £116m and #Boro £116m. Since accounts closed, raised further £6.8m from a retail bond to supporters and other investors.

#QPR debt has increased to finance the £20m training ground at Heston. Around £17m has already been raised (£10m from the convertible bond and £7m from the retail bond) with the owners committed to covering the remaining balance.

#QPR only paid £56k interest, as owner loans and EFL loans are interest-free. However, this will increase, as the convertible bond carries a 6% interest rate per annum, while the retail bond is 5%. Most debt in the Championship is provided interest-free by club owners.

#QPR outstanding payments on transfer fees increased from £0.6m to £2.2m, though this is much reduced from £23m six years ago. Still one of the lowest in the Championship. They are in turn owed £9.1m by other clubs, so they have £7.0m net receivables.

#QPR improved £17m operating loss by adding back £3m amortisation and £7m working capital movement to give £11m negative cash flow. Boosted by £5m net player sales, but spent £6m on training ground. Funded by £21m from owners (£11m shareholder loan and £10m bond issue).

#QPR cash balance therefore rose £7.6m from £1.1m to £8.7m. This is quite high for the Championship, though is a little misleading, as much of this will be ring-fenced for the training ground development.

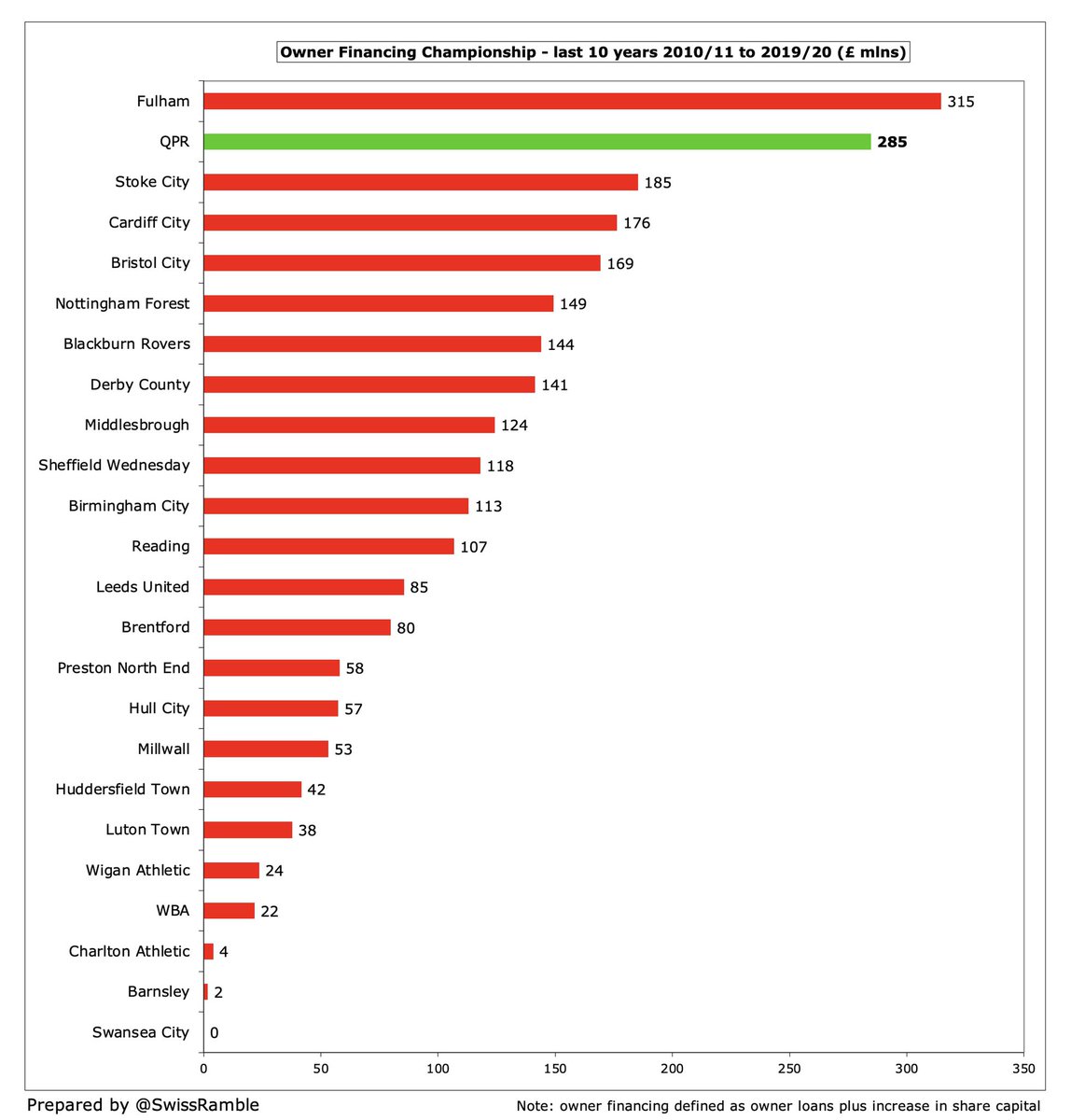

Since Fernandes arrived at #QPR, the owners have put in an incredible £283m., though most of that in first 5 years. The majority (£177m) was used to cover operating losses with £71m spent on net player purchases (pretty much all in the early years) plus £18m on infrastructure.

#QPR are “dependent on the continued support of its significant shareholders”. In fact, they provided the second highest financing (£285m) of any owners in the Championship in the 10 years up to 2020, only surpassed by Fulham £315m, but £100m more than Stoke City.

Even though #QPR have fallen foul of FFP regulations in the past, they have no issues these days. Their £31m reported loss over the FFP 3-year monitoring period is below the £39m limit, even before allowable deductions for academy, community & infrastructure, COVID impact, etc.

Chairman Amit Bhatia said, “We have a clear vision for QPR: to deliver competitive and entertaining football, while ensuring the club becomes self-sustainable.” The short-term target is a play-off place, but their future is likely to involve the development of academy products.

• • •

Missing some Tweet in this thread? You can try to

force a refresh