1/ Check out our latest @Grayscale research report: The Postmodern Portfolio Crypto Allocation Thesis. A thread on key report insights:

https://twitter.com/Grayscale/status/1499497369381089281

2/ Crypto assets are becoming a key component of The Postmodern Portfolio by offering allocators a new category that extends the risk and return spectrum beyond traditional alternatives like #realestate or #privateequity.

3/ Crypto assets blend the dynamics of investing in emerging markets, the technology sector, and venture capital to provide exposure to the next wave of the internet– Web 3.0 Cloud Economies– which enable investors and users to have direct ownership and control over the internet.

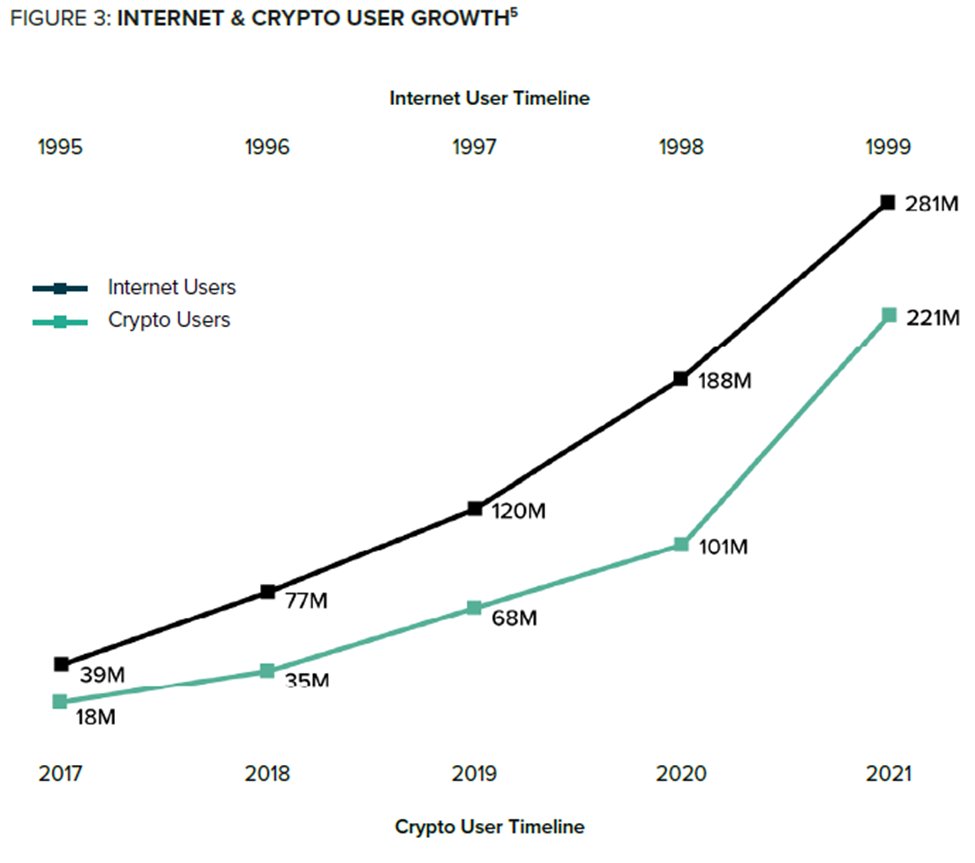

4/ The crypto ecosystem has attracted a rapidly growing user base that has been tracking the growth of the internet. Crypto users have grown to 220 million as of 2021, putting #web3 adoption at roughly where the internet adoption was during 1999.

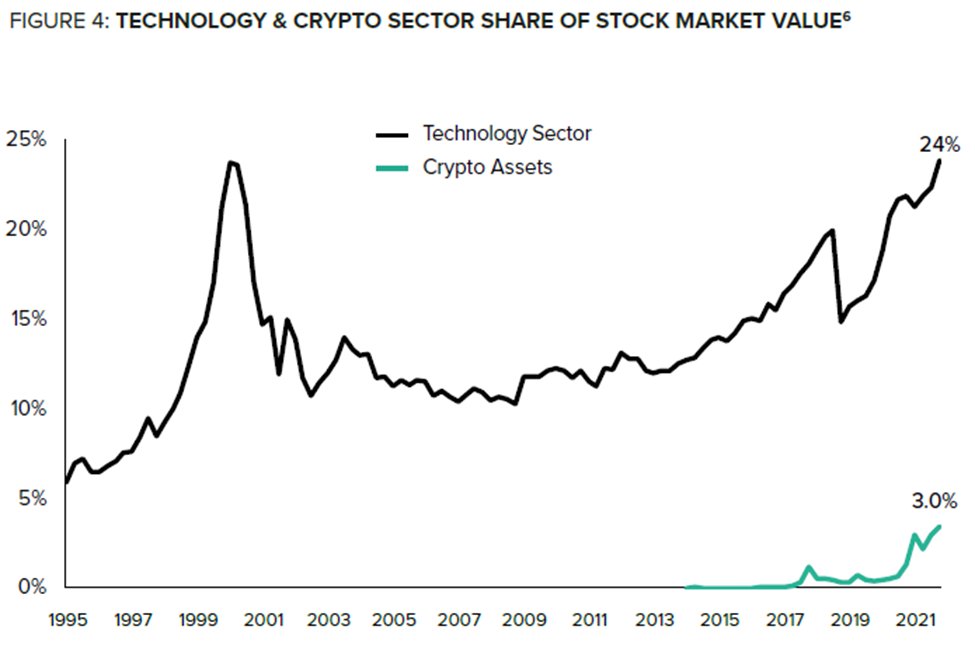

5/ How early are we?

Crypto assets today are only ~3% of the global stock market value vs. ~14% for the technology sector in Q1 1999. Viewed through this lens, crypto assets are even earlier in their market valuation cycle than the internet was in the mid-1990s.

Crypto assets today are only ~3% of the global stock market value vs. ~14% for the technology sector in Q1 1999. Viewed through this lens, crypto assets are even earlier in their market valuation cycle than the internet was in the mid-1990s.

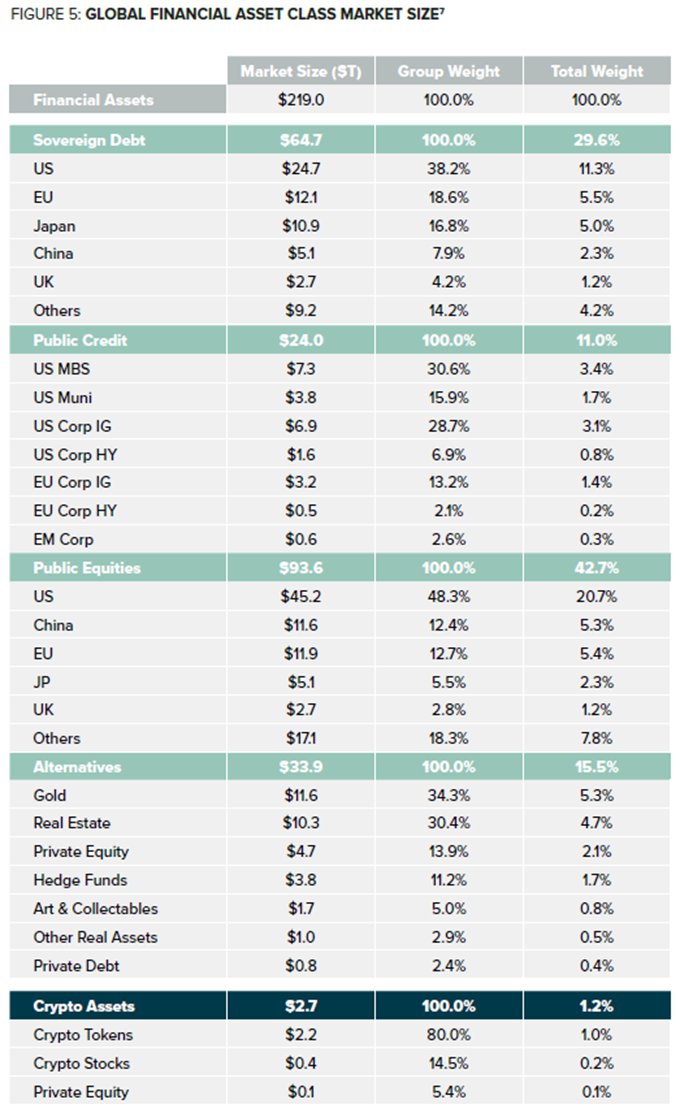

6/ The investable crypto universe stands at a market size of ~$2.7 trillion (as of 12/31/21), making the category now above ~1% of core global financial assets and large enough to be included in institutional portfolios.

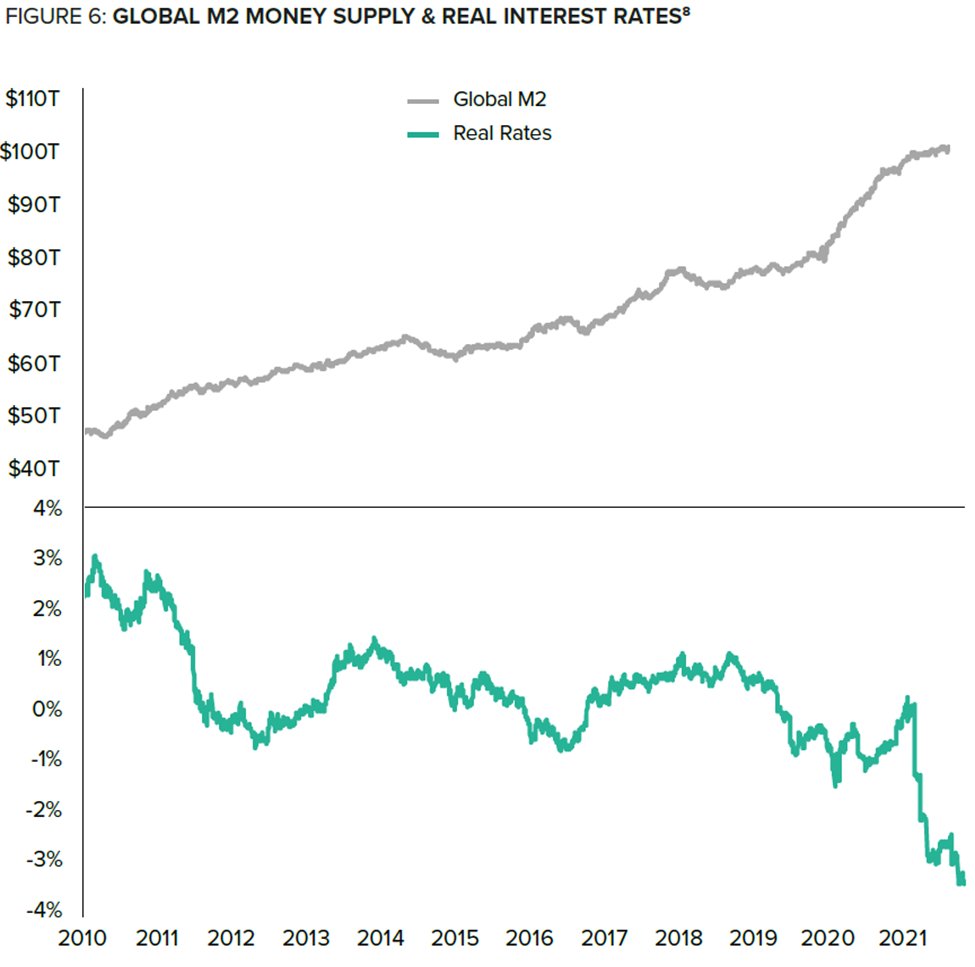

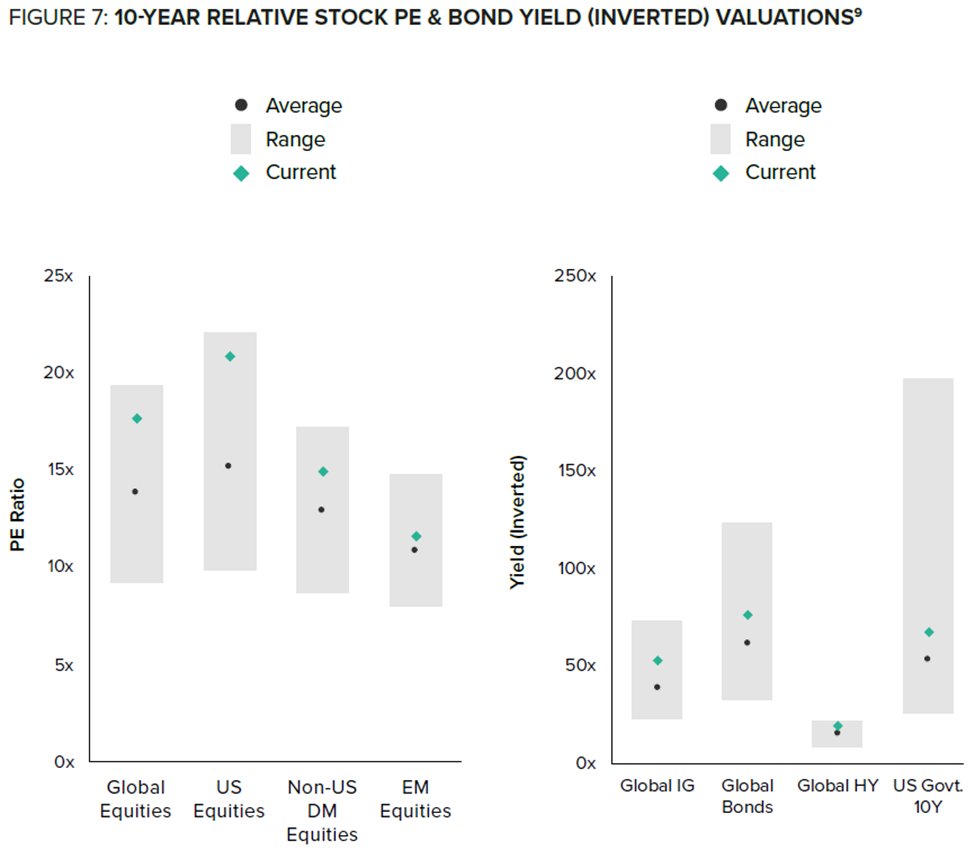

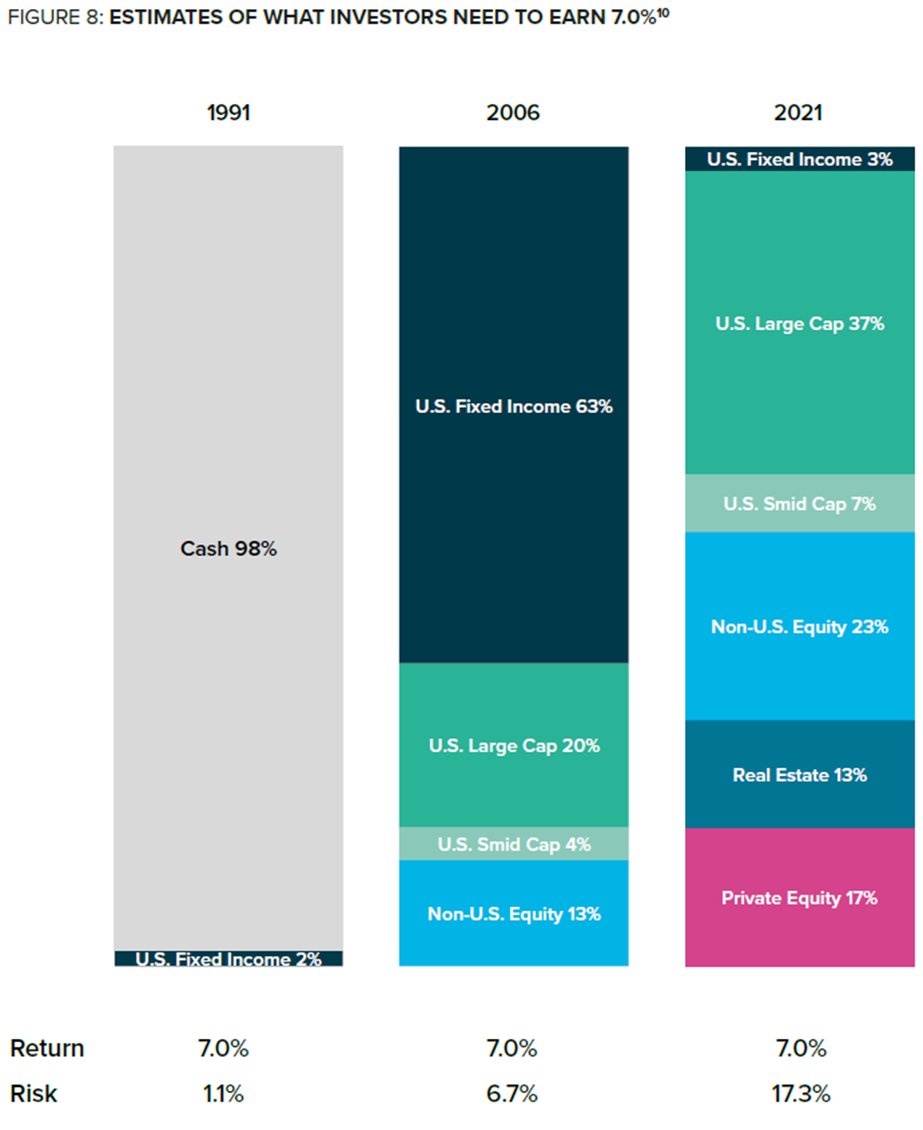

7/ Institutions are now using crypto assets as a new portfolio construction tool in a macro environment where money supply growth and negative real rates have created a dynamic where not taking risks is actually one of the biggest risks.

8/ There is no alternative for many cash-flushed investors with traditional asset mandates, which has driven stocks and bonds to historically elevated valuations.

9/ As a result of falling expected returns on traditional assets, investors have been required to allocate an increasing portion of their portfolio to less liquid private market alternative assets, while taking on greater volatility, to maintain a 7.0% expected return.

10/ Here we rank major asset classes by % return each of the last 10 years. Crypto (represented by #Bitcoin) is #1 for 8 of them. We believe it could further meet the challenges of this macro environment by serving as a risk-on asset and hedge against inflation.

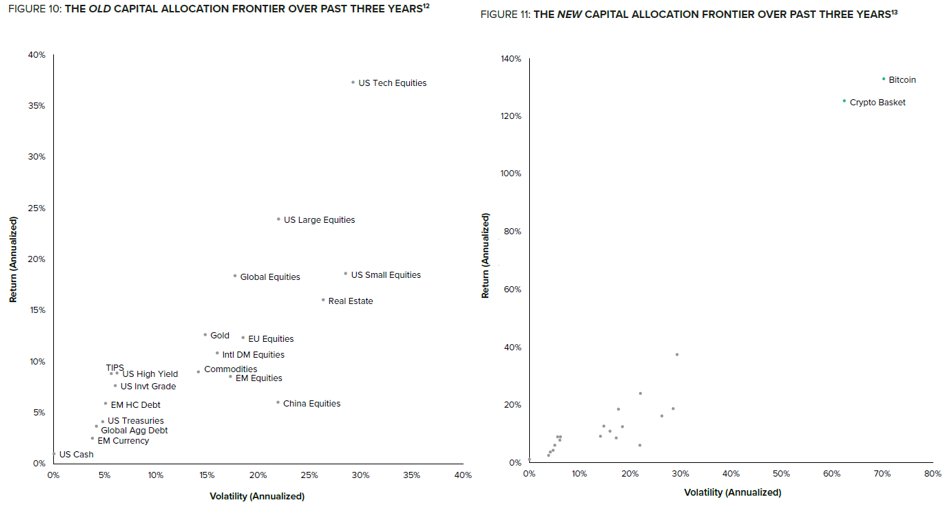

11/ The ability to include crypto assets has given previously constrained portfolio managers the ability to allocate across a new vastly expanded risk and return spectrum. This is what we’re calling the Postmodern Portfolio Thesis.

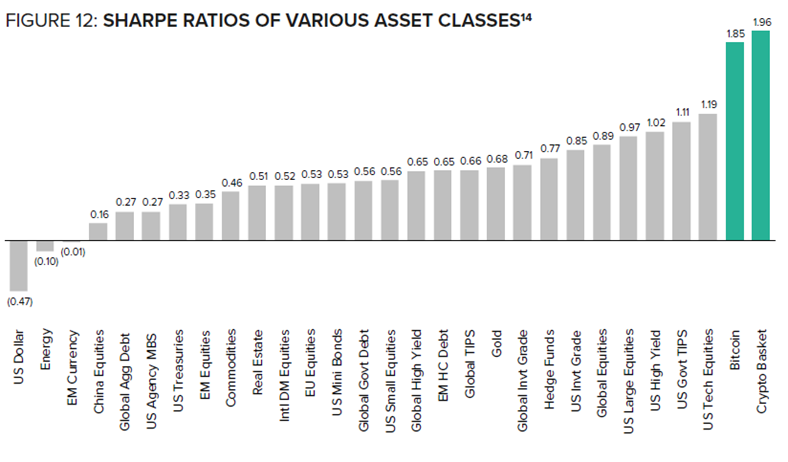

12/ While crypto assets have delivered higher returns with higher volatility, they have also offered investors higher risk-adjusted returns than all other asset classes over the past three years.

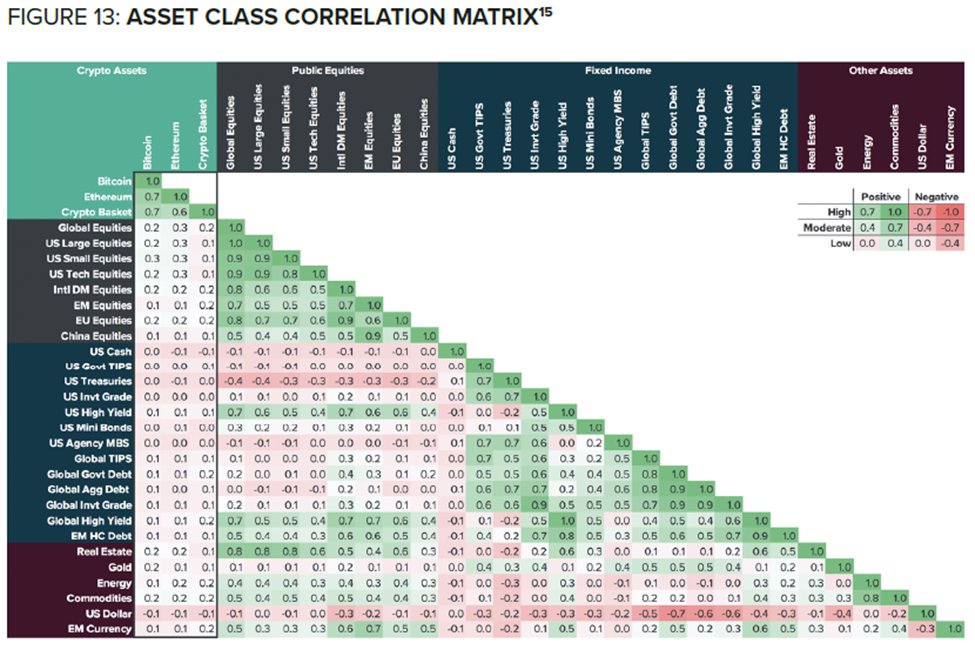

13/ Crypto assets have had low correlations with global asset classes and moderate correlations with other crypto assets, giving them an attractive portfolio diversification benefit. Here we compare #Bitcoin, #Ethereum and a diversified basket vs. traditional asset classes.

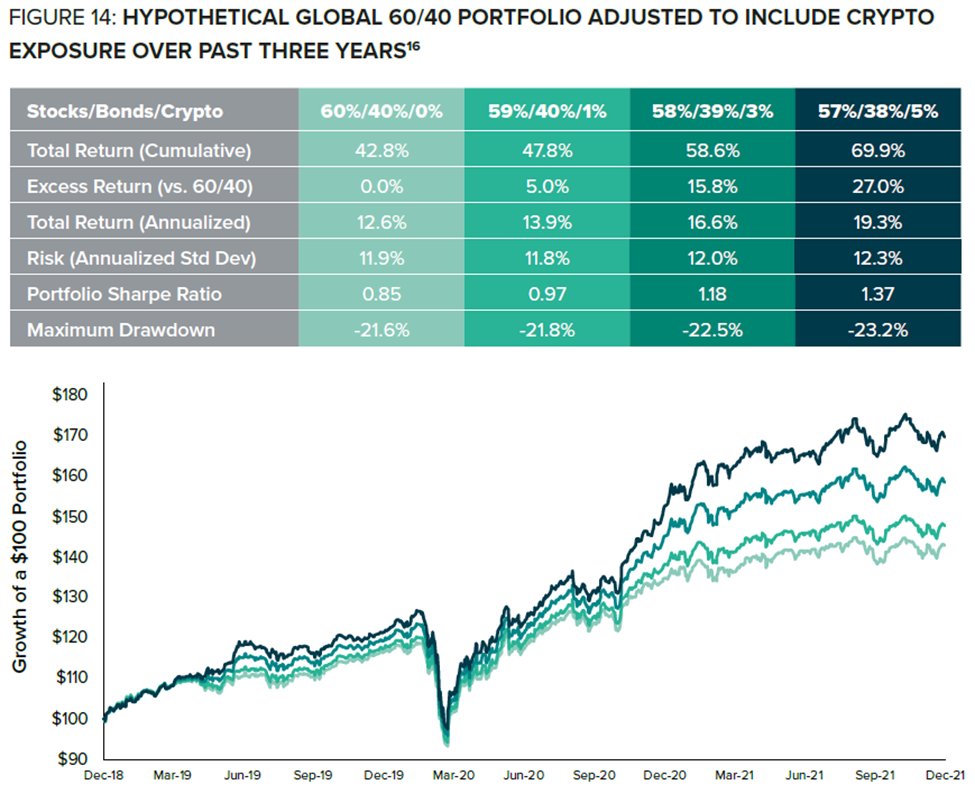

14/ Combining a Global 60/40 Stock & Bond portfolio with crypto exposure over the last three years would have resulted in modestly higher volatility and maximum drawdowns, but with higher risk-adjusted returns than the Global 60/40 Portfolio alone.

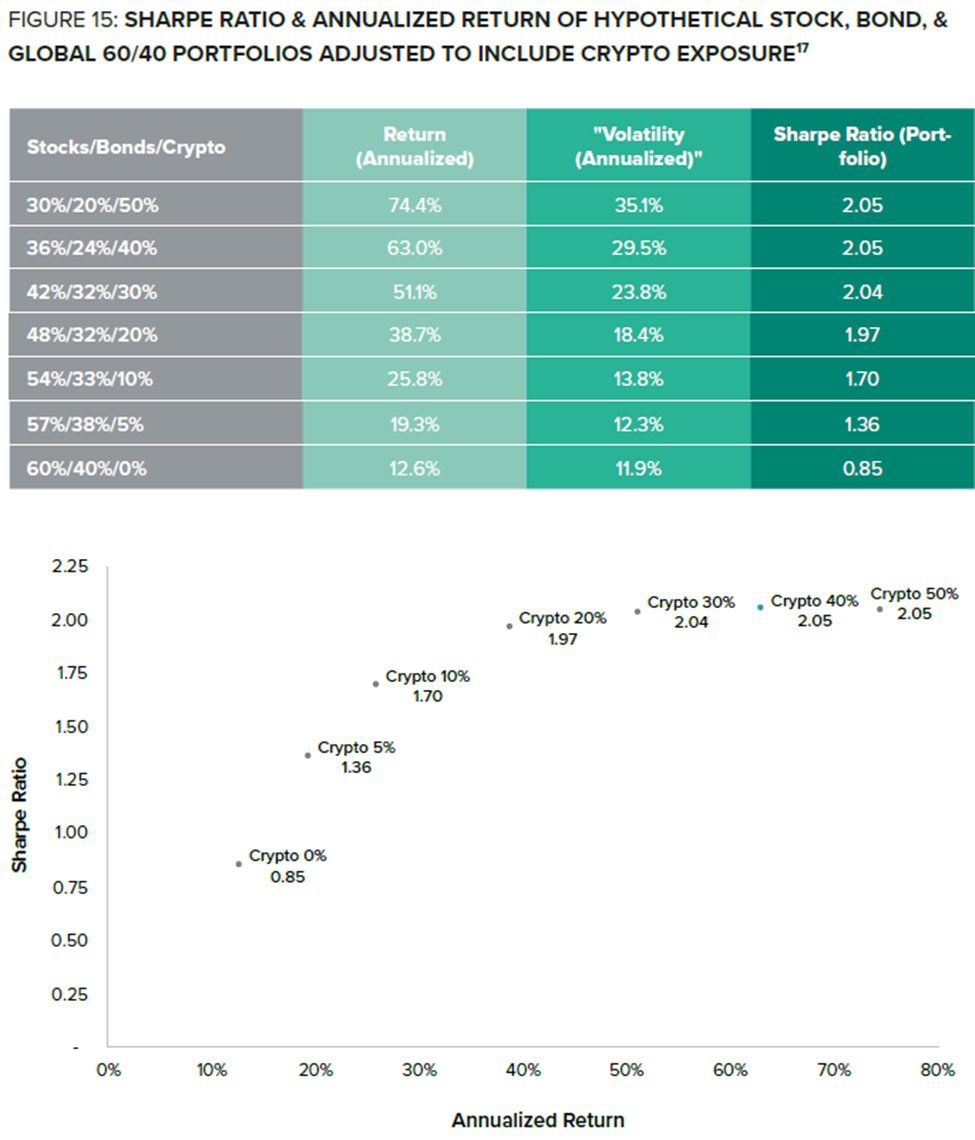

15/ What would have been the optimal allocation? We found that increasing a Global 60/40 Stock & Bond portfolio’s exposure to crypto would have continued to improve risk-adjusted returns until crypto surpassed a ~40% portfolio weighting(!)

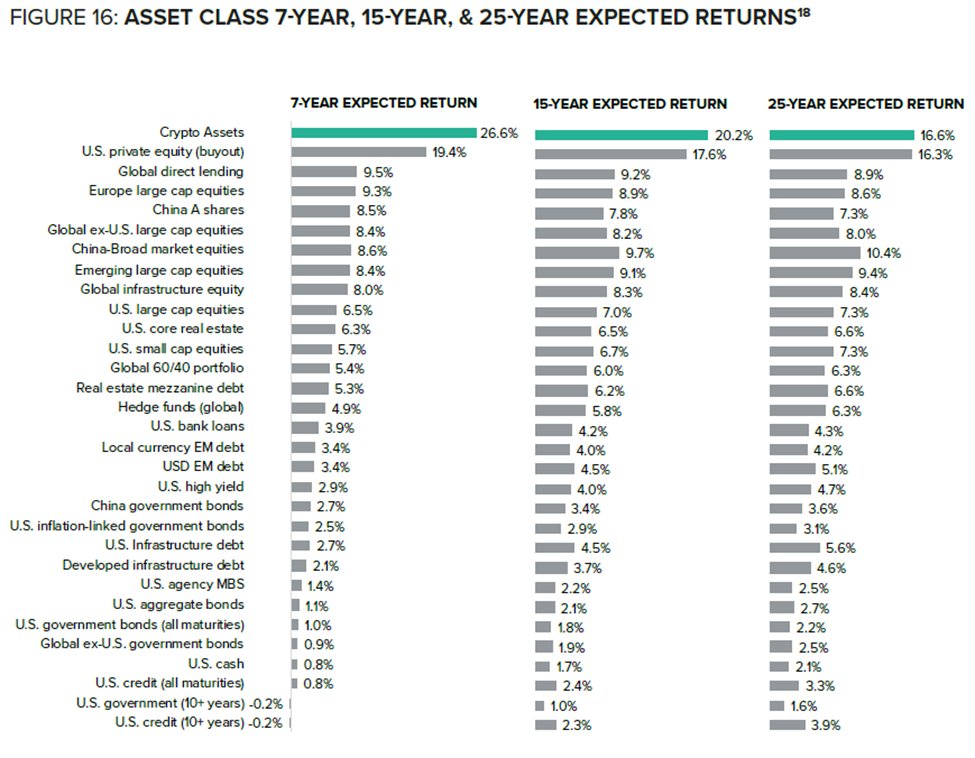

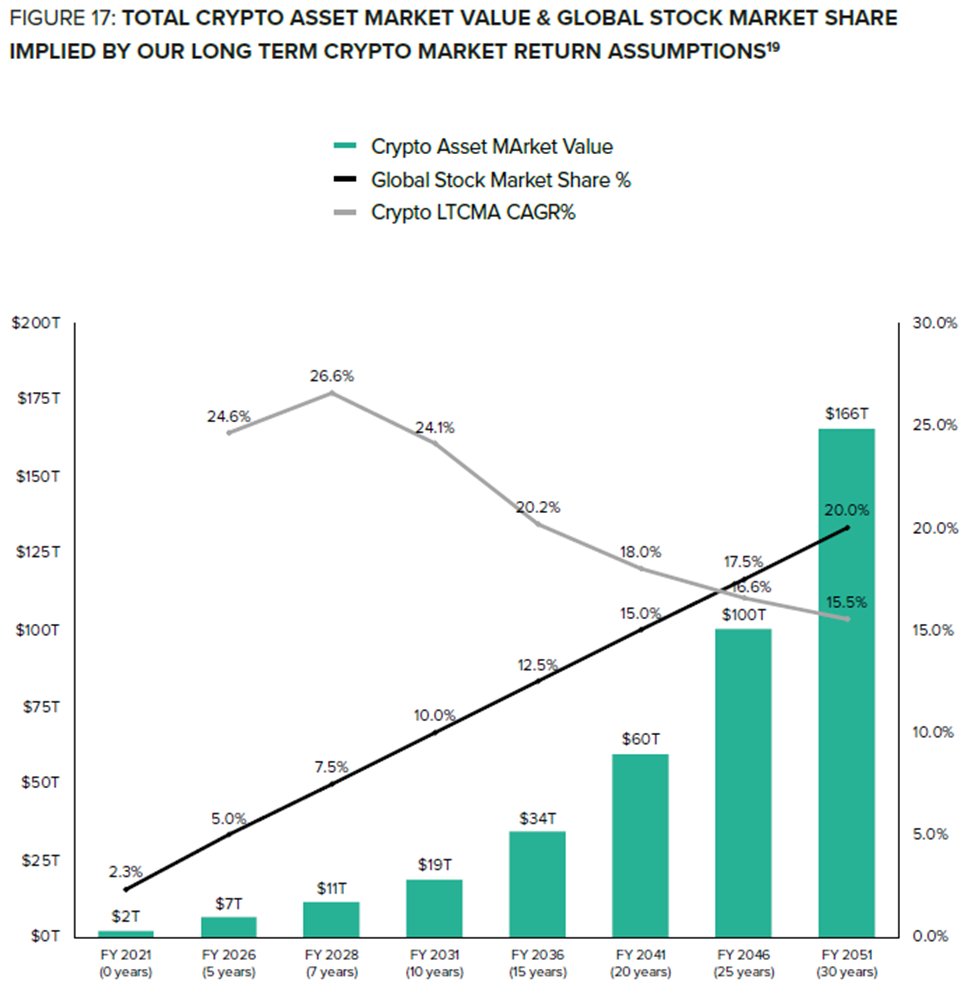

16/ Based on our current Grayscale Long Term Crypto Market Assumptions (LTCMAs), we believe the asset category can offer higher expected returns than nearly all other asset classes over the next few decades before coming in line with other alternatives.

17/ Our LTCMAs, which factor in global financial market growth expectations, imply the total crypto market value could rise to ~$10 trillion over seven years, ~$35 trillion over 15 years, and ~$100 trillion over 25 years.

18/ Our LTCMAs are based on the view that the asset category can continue to disrupt the tech sector by gaining a greater share of global stock market value over the next 30 years as a rate that conservatively approximating the internet’s share growth from 1996 to 2021.

19/ As the investment environment evolves, investors must evolve their portfolios, and crypto assets could become a key component.

Thanks for reading. If you find this kind of thing interesting, you can find more from me and my team on Grayscale’s website: grayscale.com/learn/

Thanks for reading. If you find this kind of thing interesting, you can find more from me and my team on Grayscale’s website: grayscale.com/learn/

20/ And finally, click here and scroll to page 27 for important risk disclosures relating to hypothetical forward looking data contained within this report:

grayscale.com/wp-content/upl…

grayscale.com/wp-content/upl…

• • •

Missing some Tweet in this thread? You can try to

force a refresh