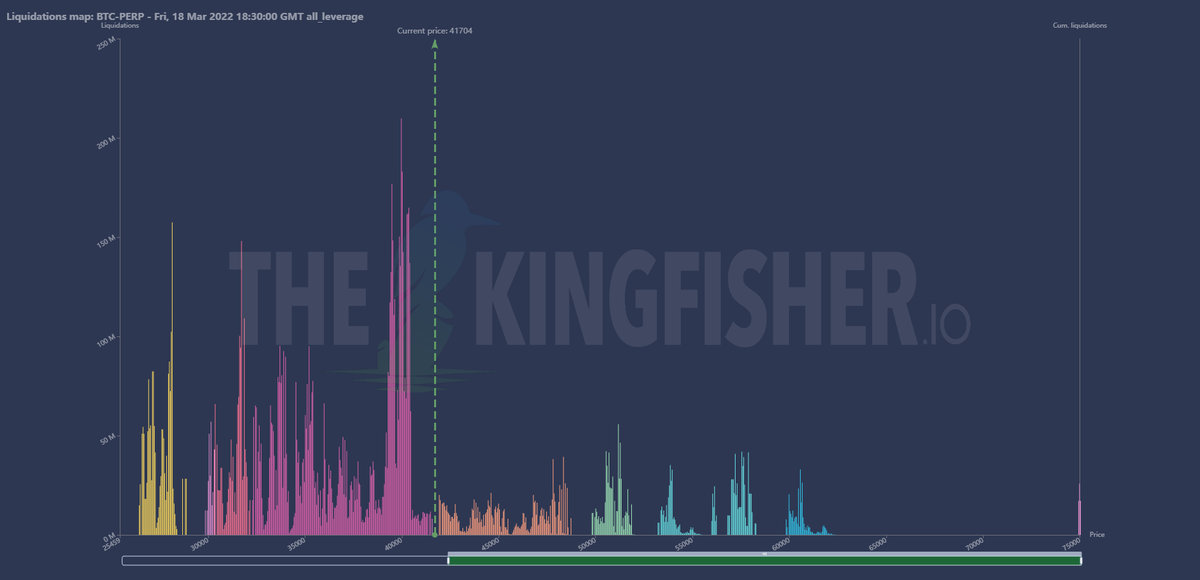

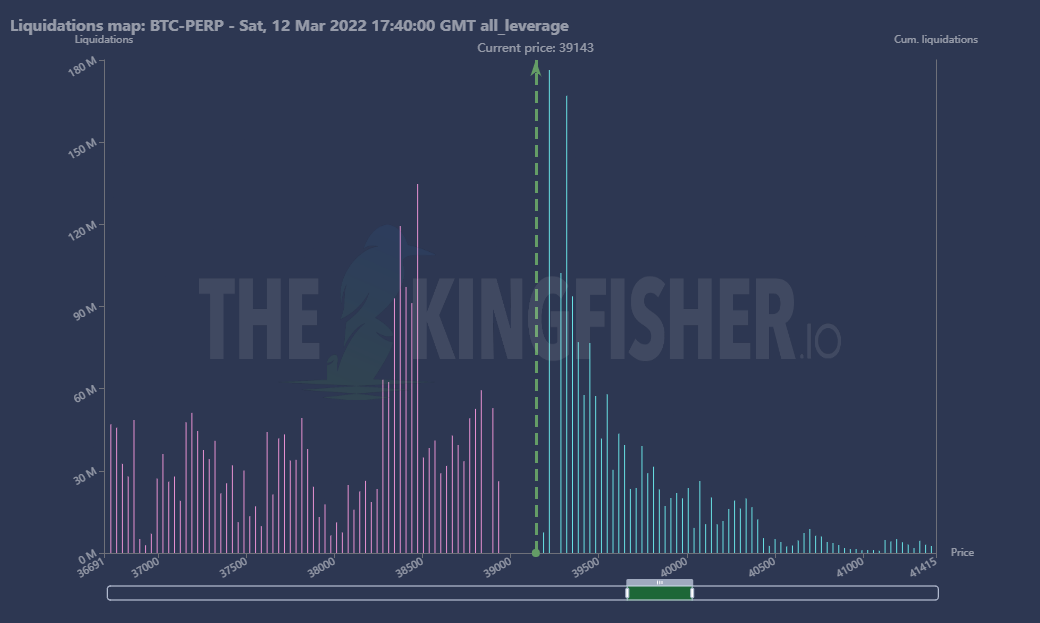

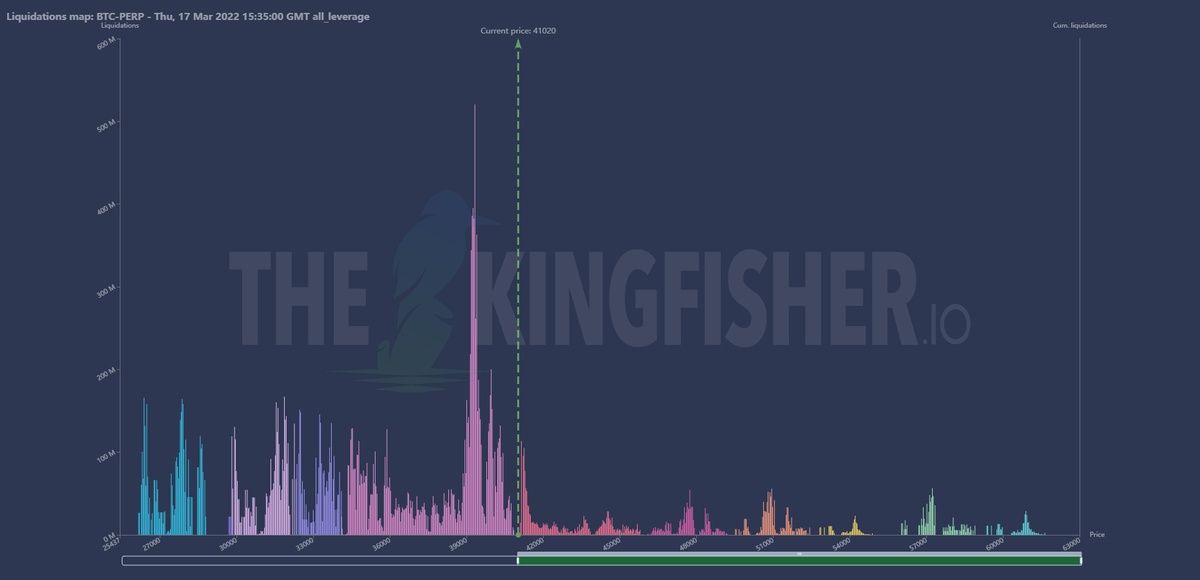

GM folks, patience is key. Even if we lift up heading 42k again or even 44k, that's the local top imo. Afterwards down again. 🤷♂️

#BTC #ETH #XRP

https://twitter.com/whale_alert/status/1504356106675630082?s=20&t=7oFFVs4Jpe2cC3j8oVjXmQ

#BTC #ETH #XRP

What Is a Bull Call Spread?

A bull call spread is an options strategy used when a trader is betting that a stock will have a limited increase in its price.

investopedia.com/terms/b/bullca…

A bull call spread is an options strategy used when a trader is betting that a stock will have a limited increase in its price.

investopedia.com/terms/b/bullca…

What Is a Short Straddle?

A short straddle profits from an underlying lack of volatility in the asset's price.

They are generally used by advanced traders to bide time.

investopedia.com/terms/s/shorts…

A short straddle profits from an underlying lack of volatility in the asset's price.

They are generally used by advanced traders to bide time.

investopedia.com/terms/s/shorts…

What Is a Short Strangle?

A short strangle profits when the price of the underlying stock trades in a narrow range between the breakeven points. The ideal forecast, therefore, is “neutral or sideways.” In the language of options, this is known as “low volatility.”

A short strangle profits when the price of the underlying stock trades in a narrow range between the breakeven points. The ideal forecast, therefore, is “neutral or sideways.” In the language of options, this is known as “low volatility.”

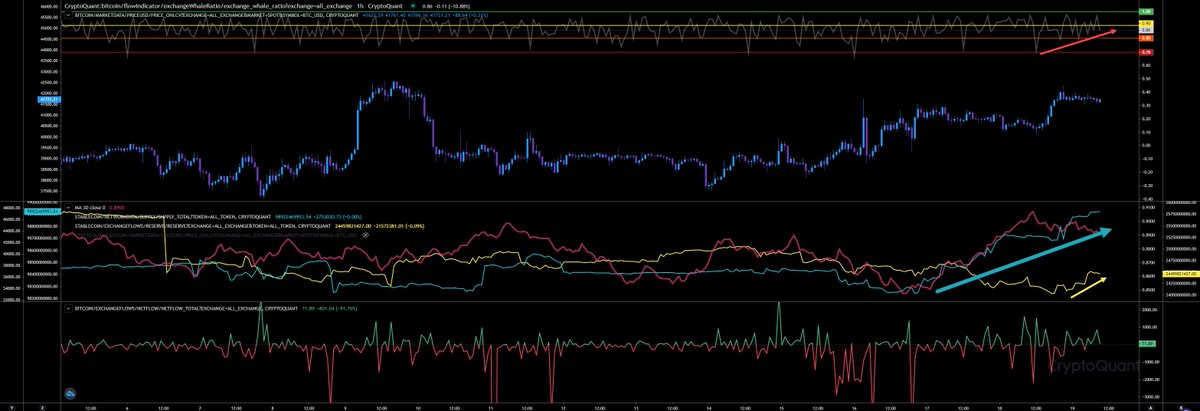

#FTX very active today. Sent $52.7m USDT to #Binance.

tronscan.org/#/transaction/…

tronscan.org/#/transaction/…

Also here another $50m USDT from #FTX to #Binance

tronscan.org/#/transaction/…

tronscan.org/#/transaction/…

Scam pump coming?🙄

tronscan.org/#/transaction/…

tronscan.org/#/transaction/…

Also here another $50m USDT from #FTX to #Binance

tronscan.org/#/transaction/…

tronscan.org/#/transaction/…

Scam pump coming?🙄

Those stablecoins arriving on derivative exchanges it seems. So, both ways possible here. Could be bullish or bearish. 😬

🚨🚨 Almost $5 billions in one option trade detected!

My bro @GeorgeWegwitz explains here in an easy way what short call buttlerfly strategy means.

Expiry 1APR22. Something huge will happen soon!

#BTC #ETH #XRP

My bro @GeorgeWegwitz explains here in an easy way what short call buttlerfly strategy means.

https://twitter.com/GeorgeWegwitz/status/1504481927687917572?s=20&t=kEax6ccVA0E7uHbBdYI19w

https://twitter.com/GeorgeWegwitz/status/1504486427526008837?s=20&t=kEax6ccVA0E7uHbBdYI19w

Expiry 1APR22. Something huge will happen soon!

#BTC #ETH #XRP

@GeorgeWegwitz #BTC to derivative exchanges rising too. Volatility folks... we can make big move up and big move down afterwards or the opposite. We will see.

@GeorgeWegwitz Another huge option trade. Volume almost $1.5 billions! Everything just calls. 34k and 42k 🧐 Looks like insider trading happening here. Some FOMO news coming?

@GeorgeWegwitz @GeorgeWegwitz custom strategy. I'm really lost here. GEX rising more and more. 🤷♂️😂

• • •

Missing some Tweet in this thread? You can try to

force a refresh