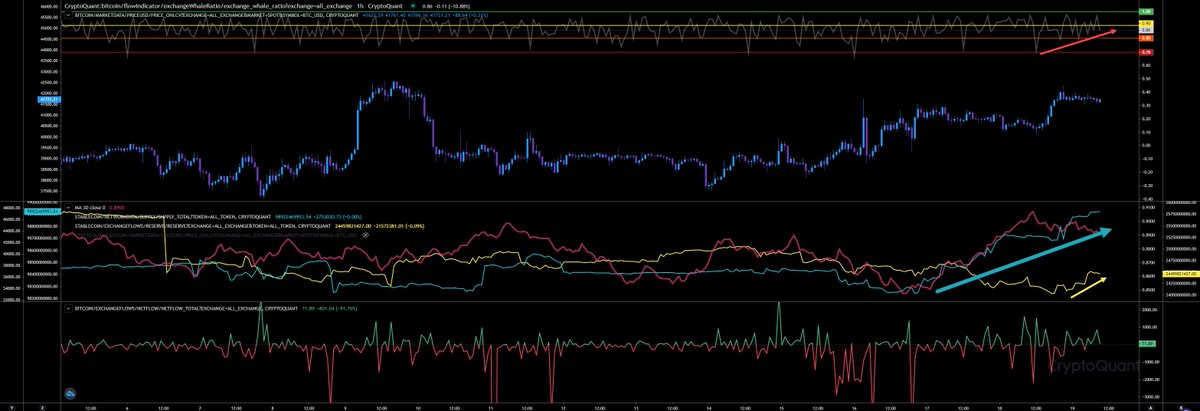

Yesterdays pump was driven by futures, mainly #Binance Perp BTC/USD pair via coin-margin more than stablecoins. Spot exchanges still in distribution mode. 🤬 Tonight I will stream again. Stay tuned folks! 😎

#BTC #ETH #XRP

#BTC #ETH #XRP

Whales ratio hourly view rising indicating more inflows coming from whales, we have received in the last hours almost $260m in stablecoins and 1,400 #BTC to derivative exchanges. Stablecoin supply rising since 16MAR22 by almost $700m and stablecoin reserves on exchanges rised by

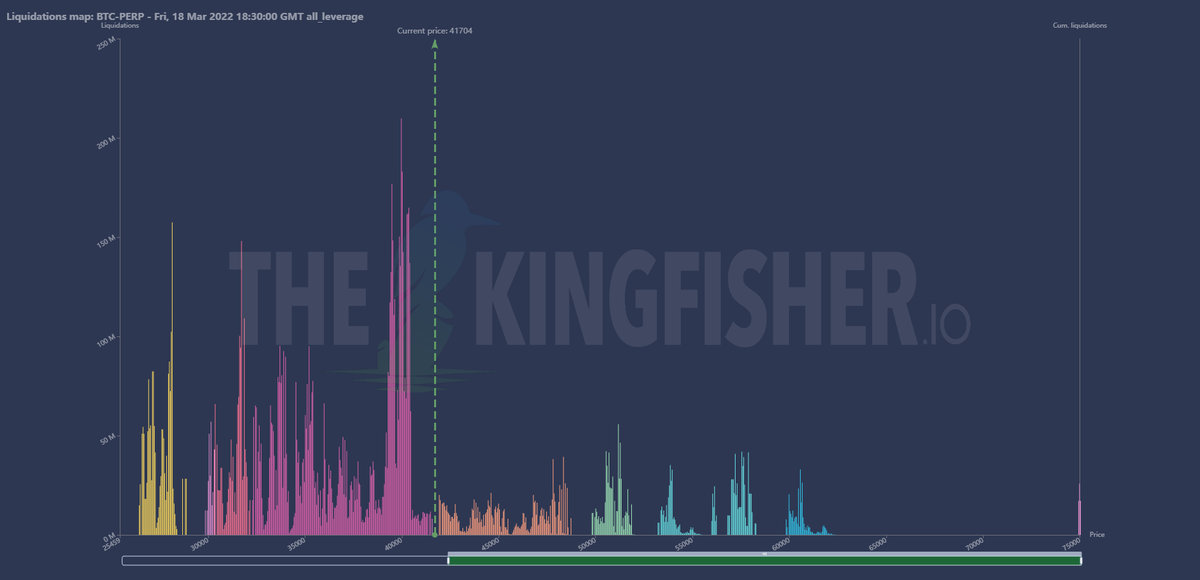

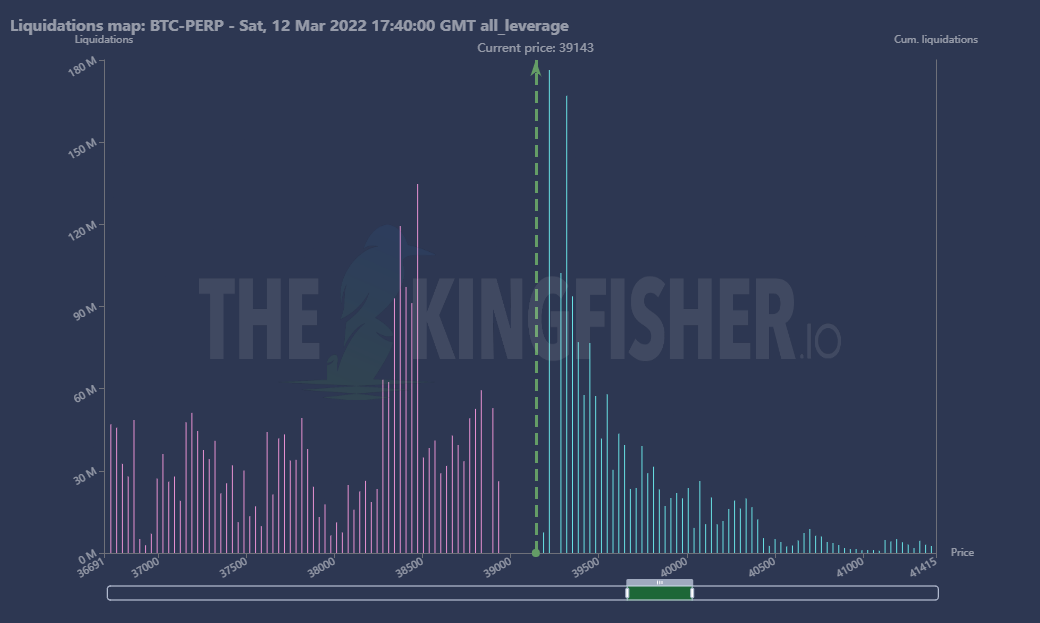

$400m since yesterday. Funding rate rised after our stablecoin and #BTC inflows on derivative exchanges, but open interest is declining. It seems they didn't used those $260m and 1,400 #BTC yet. Liquidation map at #FTX showing a growing liquidation volume, 39.4k is here key. 🙄

Binance Perp holding the price up, but upper wall disappeared now. Almost no pressure from above.

They don't need any upper pressure to let the price decline. But we can rest easy, the price is under control. 🤣🙄🤦♂️

🚨🚨 Update

As you know #Binance #Bybit and #Okex were the main driver of yesterdays pump. We received $260m in stablecoins and I was waiting to see any change in funding rates. Here we go. All 3 positive indicating more long demand than shorts in the last hours.

#BTC #ETH #XRP

As you know #Binance #Bybit and #Okex were the main driver of yesterdays pump. We received $260m in stablecoins and I was waiting to see any change in funding rates. Here we go. All 3 positive indicating more long demand than shorts in the last hours.

#BTC #ETH #XRP

Here the liquidation maps of FTX (BTC-Perp) and Bybit (BTC/USD) to compare.

#FTX the only exchange buying spot against the trend. 🧐

To be honest it looks more like pump than dump atm. But hey, market conditions can change quick. I will keep checking the data.

#FTX the only exchange buying spot against the trend. 🧐

To be honest it looks more like pump than dump atm. But hey, market conditions can change quick. I will keep checking the data.

• • •

Missing some Tweet in this thread? You can try to

force a refresh