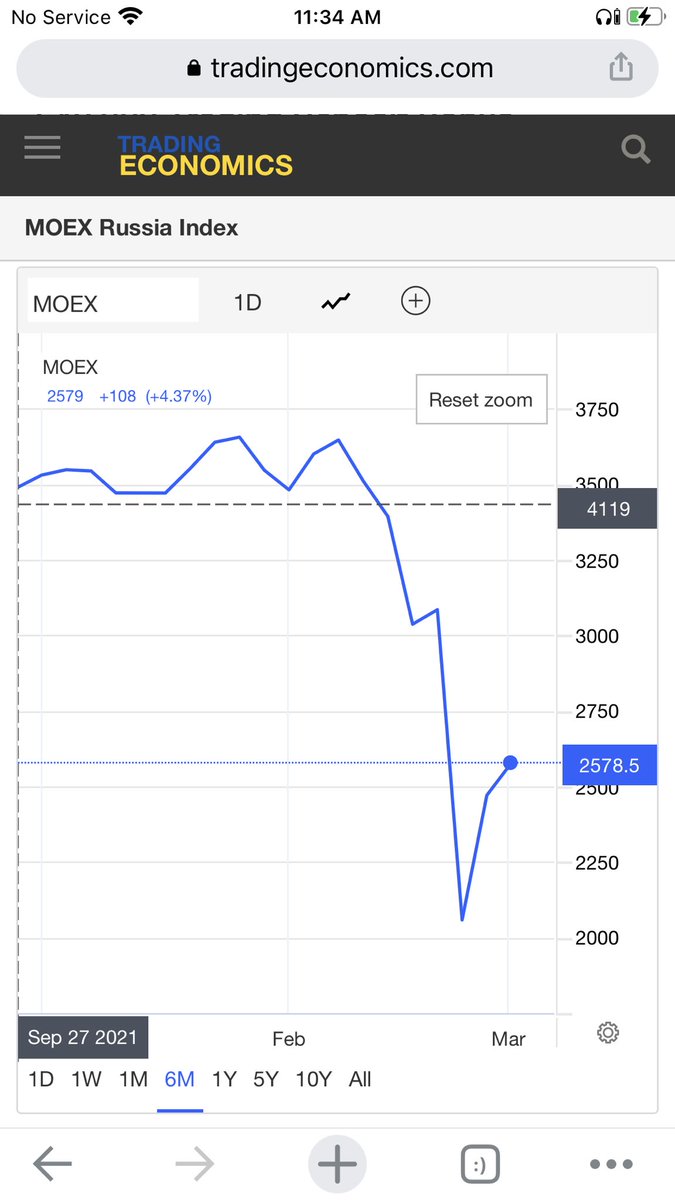

#Moscow Exchange in #Russia reopens for limited trading in 33 most liquid shares for the first time since Feb 25. In opening minutes it’s up approx. 10%, with foreign sales and #short selling banned and the Ministry of Finance purchasing 1T Rubles (almost 10B USD) of shares

First day of #MOEX resumed trading finished up 4.4%, after giving up early gains that approached 12%

@AnthonyMVos for your update in the Ukraine space

• • •

Missing some Tweet in this thread? You can try to

force a refresh