Thread! I found something.

🚨ALERT!🚨

Shipping/Freight are about to become ALOT more expensive. With the war in #Ukraine, it's time to talk bunkers.

No; not the protective kind. The fuel kind.

Bunker Fuel.

CC @DoombergT @WallStreetSilv @goldsilver_pros @ttmygh #fintwit

🚨ALERT!🚨

Shipping/Freight are about to become ALOT more expensive. With the war in #Ukraine, it's time to talk bunkers.

No; not the protective kind. The fuel kind.

Bunker Fuel.

CC @DoombergT @WallStreetSilv @goldsilver_pros @ttmygh #fintwit

First off, what is bunker fuel?

en.wikipedia.org/wiki/Fuel_oil

In short - nasty stuff. When you refine crude oil into petroleum products, you get lots of byproducts. There's still energy in these things, but also more impurities and it's more viscous - meaning thicker, harder to pump.

en.wikipedia.org/wiki/Fuel_oil

In short - nasty stuff. When you refine crude oil into petroleum products, you get lots of byproducts. There's still energy in these things, but also more impurities and it's more viscous - meaning thicker, harder to pump.

You probably know that Gasoline sits at the top while Bitumen sits at the bottom. Bitumen is basically asphalt, not something you want to burn.

Anything too dirty/heavy to burn around humans because it's too toxic, but still viscous enough to pump, is classified as "bunker fuel"

Anything too dirty/heavy to burn around humans because it's too toxic, but still viscous enough to pump, is classified as "bunker fuel"

And when i say viscous enough to pump, i mean some of these fuels need to be heated to make them liquid-y enough to pump through huge freighter pumps, or the whole system freezes up.

I came across bunker fuel when researching applications for small modular reactors or SMRs.

I came across bunker fuel when researching applications for small modular reactors or SMRs.

Just because there aren't humans around, doesn't mean we should burn this toxic waste. It can't POSSIBLY be good for the atmosphere in aggregate. Also why do we burn oil to ship oil?

But; there isn't really a choice. Bunker fuel is used because it's so cheap as a byproduct.

But; there isn't really a choice. Bunker fuel is used because it's so cheap as a byproduct.

As long as we need gasoline, we will get bunker fuel for free, just as much as bitumen. Hence its continued use.

My view is to just make SMR freighters so cheap through economies of scale to force bunker fuel out of the economy completely - but that's a topic for another day.

My view is to just make SMR freighters so cheap through economies of scale to force bunker fuel out of the economy completely - but that's a topic for another day.

As things stand, THE ENTIRE SHIPPING INDUSTRY RUNS ON THIS STUFF!

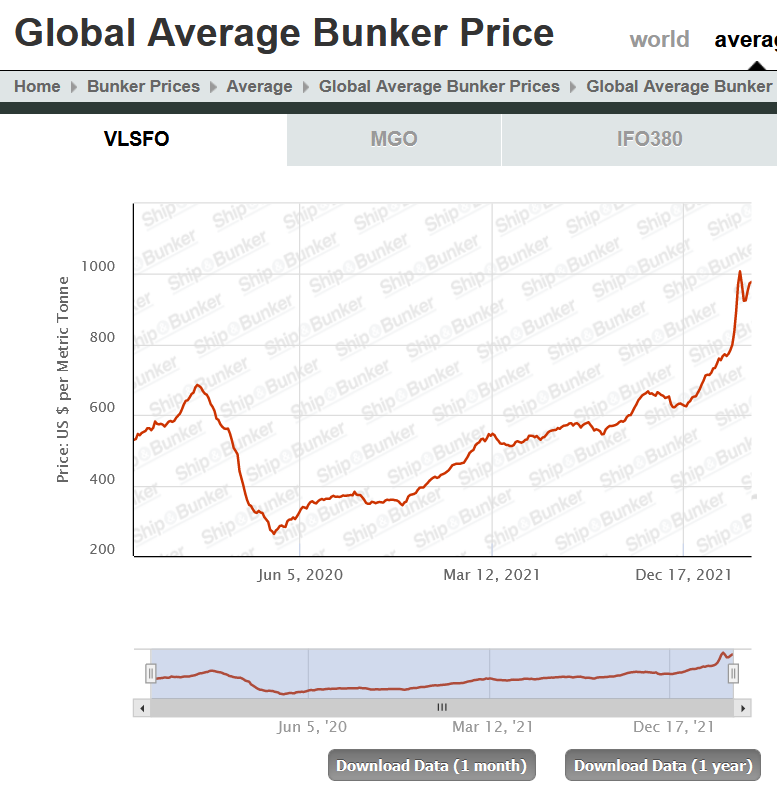

And as the charts show - the price of all types of fuel have blown out since the war. Prices started going up since December anyway, so it's not just due to the war; inflation has spread to bunker fuel too.

And as the charts show - the price of all types of fuel have blown out since the war. Prices started going up since December anyway, so it's not just due to the war; inflation has spread to bunker fuel too.

It's not just the fuels themselves, it's the spread between different fuels too. I don't know that much about the bunker fuel market, but i know that if a spread is important enough to be tracked, and it then blows the fuck out - logic says that's a problem.

So far, shipping prices both in containers as well as the baltic dry index $BDI haven't spiked yet - but they haven't dropped either, while the height of the retail season has long since passed.

If the bunker prices stay this elevated, it's only a matter of time.

If the bunker prices stay this elevated, it's only a matter of time.

So far, ALL the shipping freight price spikes have been on the basis of either container shortages, ship shortages or port congestion. And alot of ships/containers have been built or are under construction to mitigate this. The cure for high prices is high prices.

All those ships require fuel and bunker fuel is industry standard, so don't expect demand to fall.

Since bunker fuel's another oil product, if oil's in low supply, bunker fuel's in low supply. If oil's expensive, eventually (read: now), bunker fuel's (relatively) expensive.

Since bunker fuel's another oil product, if oil's in low supply, bunker fuel's in low supply. If oil's expensive, eventually (read: now), bunker fuel's (relatively) expensive.

In short:

#Shipping is gonna get a lot more expensive AGAIN, because ALL previous problems were NOT based on fuel prices and this one is.

So it compounds. And there is no substitution. Bunker fuel's already LITERALLY the bottom of the barrel.

We run out, global shipping STOPS!

#Shipping is gonna get a lot more expensive AGAIN, because ALL previous problems were NOT based on fuel prices and this one is.

So it compounds. And there is no substitution. Bunker fuel's already LITERALLY the bottom of the barrel.

We run out, global shipping STOPS!

Links:

bunkerindex.com

shipandbunker.com/prices/av/glob…

fbx.freightos.com

desogames.substack.com/p/the-chain-of…

(that last one is fast becoming a must read because these compounding supply chain problems are gonna keep happening, so learn to recognize them ahead of time!).

bunkerindex.com

shipandbunker.com/prices/av/glob…

fbx.freightos.com

desogames.substack.com/p/the-chain-of…

(that last one is fast becoming a must read because these compounding supply chain problems are gonna keep happening, so learn to recognize them ahead of time!).

• • •

Missing some Tweet in this thread? You can try to

force a refresh