Just so everybody knows where we're at with the #gold backed #ruble:

The announcement i'm waiting for now is the Russian central bank buying rubles for gold (selling gold) at a set price. I'd expect this to be higher than 5k per gram, more like 6k a gram.

This'd be a soft-peg

The announcement i'm waiting for now is the Russian central bank buying rubles for gold (selling gold) at a set price. I'd expect this to be higher than 5k per gram, more like 6k a gram.

This'd be a soft-peg

Right now, Russia's waiting for the RUB to appreciate further before implementing an upper band. If the RUB is worth less per gram than the peg they've got in mind, people would immediately sell it for gold and it'd drain reserves. Hence the delay.

I don't think a traditional hard peg is favorable, as stated, when the RUB exceeds the central bank price it'll drain their reserves. By keeping an upper and lower band, both can be moved individually and adjusted to market changes.

This will dampen RUB selling pressure.

This will dampen RUB selling pressure.

Participants will psychologically front-run themselves into not-dumping the ruble in forex markets in order to get cheap gold, because should that happen, the Russian central bank will adjust the upper band and all you're doing is hurting the rubles you wanted to spend on gold.

A soft peg is as good as a hard peg in practice, as should the Russian central bank print rubles without collecting more gold, the price in the forex markets would drift up until it hits the buying rubles for gold limit, and their gold reserves would start draining.

This would also drain Rubles from the market, so either the Russian central bank stops printing money and the price stabilizes, raises the upper peg, or continues to print and lose reserves while the black market price shoots up.

(gold backed currencies aren't silver bullets.)

(gold backed currencies aren't silver bullets.)

This mechanic then also serves as an automatic redemption mechanic, where you can't "redeem" your rubles for gold, but you can "sell" them for gold. This system suits our current floating exchange rates more than the traditional agreements. None of those are happening right now.

The additional gold to expand liquidity comes from "unfriendly" countries, which basically will buy rubles with gold via one way or another, then spend those rubles on gas.

Those rubles then circulate domestically to provide liquidity; while the gold backing keeps prices stable.

Those rubles then circulate domestically to provide liquidity; while the gold backing keeps prices stable.

Here's a little lesson on liquidity:

Money stock matters VASTLY LESS than liquidity, meaning money readily available for trade.

This is for economic development. If there is no liquidity, no matter how much money there is - there cannot be economic development. See USA '08-'22

Money stock matters VASTLY LESS than liquidity, meaning money readily available for trade.

This is for economic development. If there is no liquidity, no matter how much money there is - there cannot be economic development. See USA '08-'22

In a dollar system, there's relatively little liquidity available to Russia, as "international purchasing power" is measured in dollars. If they print more rubles to acquire dollars the ruble falls in price. The eurodollar market is a direct EM fix for this liquidity problem.

Additional liquidity for Russia in that system comes from foreign dollar investments. 2014 cut them off from that, which is why it hit them so hard. And dollars flow out of the country again with imported goods.

With a gold backed ruble, that liquidity is gold based.

With a gold backed ruble, that liquidity is gold based.

10 grams of gold, 10 rubles = 1:1.

20 grams of gold(to get rubles), 10 rubles = 2:1.

20 grams of gold, 20 rubles(to get gas) = 1:1.

They can't print gold, but they continually produce consumable gas, leading to gold inflows without gold outflows.

It's really not that difficult.

20 grams of gold(to get rubles), 10 rubles = 2:1.

20 grams of gold, 20 rubles(to get gas) = 1:1.

They can't print gold, but they continually produce consumable gas, leading to gold inflows without gold outflows.

It's really not that difficult.

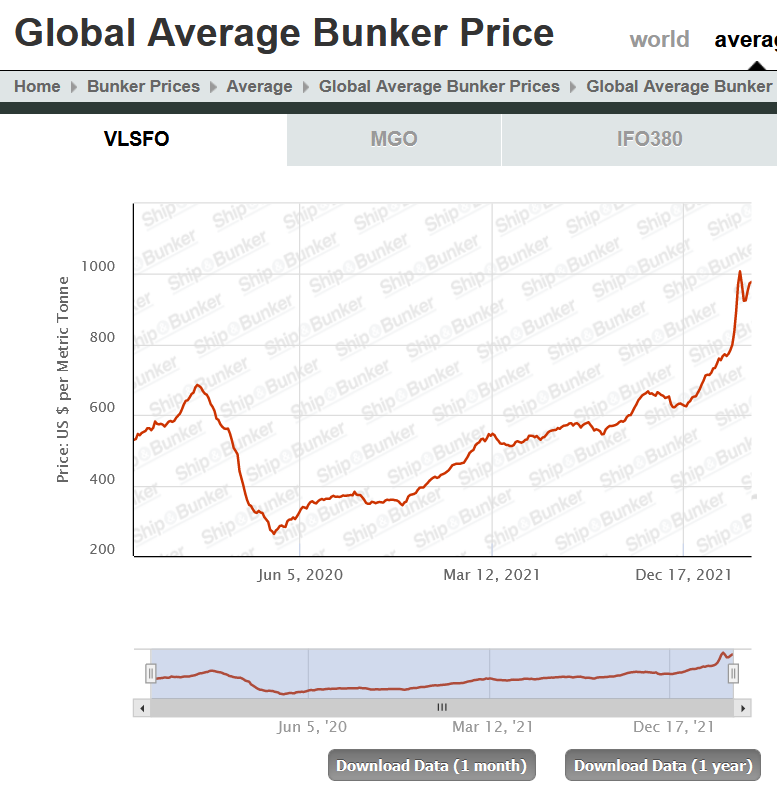

As more rubles become available domestically, the same thing happens to the Russian economy as happened to the US economy over the past 2 years:

Investment becomes rampant. Money either gets spent on goods (good luck with sanctions), or invested in production (the goal).

Investment becomes rampant. Money either gets spent on goods (good luck with sanctions), or invested in production (the goal).

Russia is exceedingly poor. Only Moscow and St. Petersburg basically have western salaries.

My best friend who lives in a region capital the middle of nowhere got (pre-war) about 950 euros a month, which is 3.5 TIMES his local average; which is double the surrounding villages!

My best friend who lives in a region capital the middle of nowhere got (pre-war) about 950 euros a month, which is 3.5 TIMES his local average; which is double the surrounding villages!

We've often talked about starting a company in Russia and he's said that there's plenty of talent, but nobody ever invests in it.

And i understand why, there isn't any liquidity to invest. Any purchasing power goes towards the military because of outside threats.

And i understand why, there isn't any liquidity to invest. Any purchasing power goes towards the military because of outside threats.

Simply put; the few dollar inflows Russia does get for its goods, Russia needs to spend on defense or commodity production. There's not just a gap between moving from manufacturing to consumption, there is one between raw resource production and manufacturing too.

If Russia is to not just recover, but prosper, it needs industry.

With the current geopolitical climate, all the countries that have purchasing power, won't invest. Infact they're reducing.

With gold based liquidity, and gas providing gold inflows - Russia gets it by force.

With the current geopolitical climate, all the countries that have purchasing power, won't invest. Infact they're reducing.

With gold based liquidity, and gas providing gold inflows - Russia gets it by force.

Meanwhile, buying foreign goods can be done in Rubles rather than Dollars. Regardless of the GRC, all it requires for the Ruble to be used in global trade, is for liquidity to be there, and people to accept rubles for goods.

With gold backing the ruble why wouldn't you.

With gold backing the ruble why wouldn't you.

It wouldn't supplant the dollar overnight, as Russia doesn't require that many outside goods. Liquidity would grow over time, and i don't think the plan is to replace the USD.

But it would force the west to match Russia's offer in order to stop their own currencies from falling.

But it would force the west to match Russia's offer in order to stop their own currencies from falling.

The west needs to buy gold with their currencies to trade for rubles, making their currencies fall against gold - meaning in real terms. The only way to stop it, is to peg the currency, and that'll destroy the west as it cannot stop spending, and thus printing.

In the end the Ruble will be used more in global trade because its liquidity requirements will become less.

If it suffers hyperdeflation, meaning it goes from say 1:80 USD/RUB to 1:8 USD/RUB;

Then the liquidity required to represent $1000 worth of goods drops from 80k to 8k!

If it suffers hyperdeflation, meaning it goes from say 1:80 USD/RUB to 1:8 USD/RUB;

Then the liquidity required to represent $1000 worth of goods drops from 80k to 8k!

It's long been stated that one of the reasons that the Dollar is used in global trade over other currencies, is because it's so liquid and widely available/accepted. It's often been trumpeted as a reason for why the world cannot do without the US's consumption habits.

But here's the thing:

If i've got $10,000 worth of goods at a 1:80 USD/RUB exchange ratio (800,000 RUB of goods), and the RUB doubles in value while the USD loses 5x its value;

I still end up with 1:8 of previous. 80/2 = 40, /5 = 8.

BUT - the goods cost $50,000/80,000RUB!

If i've got $10,000 worth of goods at a 1:80 USD/RUB exchange ratio (800,000 RUB of goods), and the RUB doubles in value while the USD loses 5x its value;

I still end up with 1:8 of previous. 80/2 = 40, /5 = 8.

BUT - the goods cost $50,000/80,000RUB!

SUDDENLY the liquidity gap isn't that big anymore, and thus, the amount of RUB required for global trade in order to make it more viable as a reserve currency.

If China pulls the same trick with the Yuan it overnight becomes the defacto global reserve currency.

If China pulls the same trick with the Yuan it overnight becomes the defacto global reserve currency.

Sounds crazy?

reuters.com/article/reserv…

Maybe not. Going by (official) US central bank gold (8k tons) / M1 stock ($20,6T), that implies $2,586 per gram, or $80,456.46 per oz. Same for Russia; 15,617.37 Rub per gram.

USD would drop -97.61% (42x), the RUB falls -65.47%(2.89x).

reuters.com/article/reserv…

Maybe not. Going by (official) US central bank gold (8k tons) / M1 stock ($20,6T), that implies $2,586 per gram, or $80,456.46 per oz. Same for Russia; 15,617.37 Rub per gram.

USD would drop -97.61% (42x), the RUB falls -65.47%(2.89x).

That also means the global liquidity requirement for the dollar goes up 42 TIMES.

$1000/85,250 RUB of goods currently becomes $42,000/246,372.5 RUB.

This'll be our generation's Suez crisis, with USA/EU on one side, and Russia/China on the other.

$1000/85,250 RUB of goods currently becomes $42,000/246,372.5 RUB.

This'll be our generation's Suez crisis, with USA/EU on one side, and Russia/China on the other.

I think y'all get the picture. It'd be one heck of a move to do, but i also think it's something that should be timed. Also - i have no clue whether Putin's this smart.

Finally, as a bonus; doing these calculations in reverse yields 7,179 tons of Russian gold @ 5k RUB per gram.

Finally, as a bonus; doing these calculations in reverse yields 7,179 tons of Russian gold @ 5k RUB per gram.

As an addendum btw; this also explains why China's on the fence about the whole thing.

As a big importer nation, it would mean Yuan outflows for them, even if the gold stays within the nation.

That's key btw. Even if RUB leaves Russia, that just causes deflation domestically.

As a big importer nation, it would mean Yuan outflows for them, even if the gold stays within the nation.

That's key btw. Even if RUB leaves Russia, that just causes deflation domestically.

That pesky liquidity again. RUB outside of Russia does not count as liquidity inside of Russia. The RUB appreciates VS gold, and at the lower bound, it also increases central bank liquidity again.

The important part is they can't print gold, but they CAN print RUB.

The important part is they can't print gold, but they CAN print RUB.

So you hold all the gold domestically, and you let RUB be exported (when in doubt: reset the paper). It's even advantagous that way! A whole new paradigm!

But China isn't getting gold - they're getting raw commodities they consume and they're paying (gold backed) yuan for it.

But China isn't getting gold - they're getting raw commodities they consume and they're paying (gold backed) yuan for it.

Which also means they require gold-backed currencies to trade with (or liquidity becomes an issue) - and the US/EU markets are about to get obliterated and Russia alone CANNOT make up. Especially not if China keeps producing low quality crap.

Which is where Taiwan comes in.

Which is where Taiwan comes in.

Semiconductors are the new oil. I said that back in 2020 when people were still talking deflation but semiconductors already ran out - and even back then there were reports of this impacting even farmers through tractors.

If China controls Taiwan, they can ask gold for semis.

If China controls Taiwan, they can ask gold for semis.

We cannot say no. The semi shortage is bad enough for western governments to invest tens of billions in new domestic production. That tells you its relative value.

It's still simple too; only pay TSMC in gold, profits of which then flow to the PBOC. That's all they need.

It's still simple too; only pay TSMC in gold, profits of which then flow to the PBOC. That's all they need.

The gold flow into the PBOC serves the same function as the gold flow from gazprom into Russia's state coffers.

Ofcourse they can ask Yuan for everything like the Russians ask for RUB, but they must account for their exports taking a huge hit. They need a *critical* export.

Ofcourse they can ask Yuan for everything like the Russians ask for RUB, but they must account for their exports taking a huge hit. They need a *critical* export.

They've already got it with their low-tech semiconductor production, but those are also easy to copy, by them and by us. That's not long lasting.

They take TSMC they're good for 30+ years. Catch-up time is a bitch.

If Russia pegs and the dollar falls, watch China make a move.

They take TSMC they're good for 30+ years. Catch-up time is a bitch.

If Russia pegs and the dollar falls, watch China make a move.

• • •

Missing some Tweet in this thread? You can try to

force a refresh