When #EV OEMs need to become miners has been the Benchmark story of 2022. @benchmarkmin

What we mean by this is outlined in this thread:

What we mean by this is outlined in this thread:

Future EV demand is surging beyond the ability of the lithium ion battery supply chain to respond in full.

As we approach the end of the decade, the number of EVs that’s OEMs want to produce become impossible to make considering the critical battery raw material volumes in the pipeline … if all existing expansions and new mines make it, in most cases there still wont be enough

Battery raw material availability is *the* limiting factor in the production of electric vehicles.

In 2015, 30-40% of the cost of a lithium ion battery cells was minerals, metals and chemicals - especially cathode and anode materials.

Today, this is number is 70-80%

In 2015, 30-40% of the cost of a lithium ion battery cells was minerals, metals and chemicals - especially cathode and anode materials.

Today, this is number is 70-80%

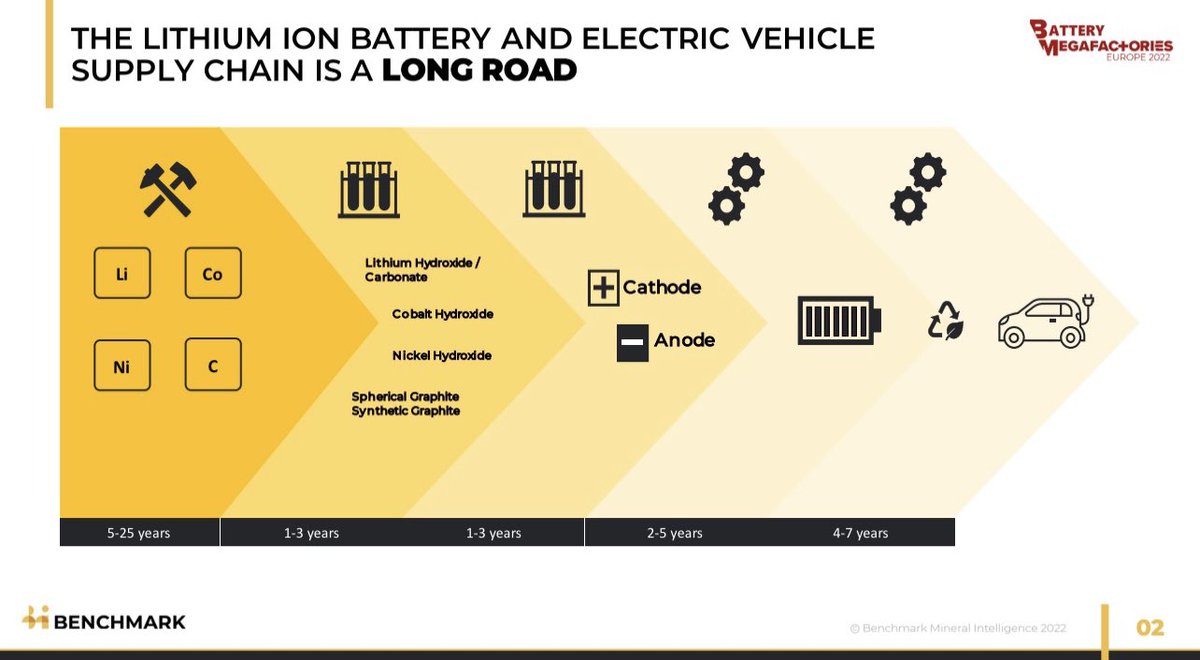

Another big issue: it takes 7 years to build a lithium mine and 24 months to build a #gigafactory

Therefore if EVs mean lithium ion batteries, EVs mean mining

It’s been a obvious link since day one but now we have reached the “impossible” area of supply and demand for many of these critical minerals

This means the traditional ways of funding the mines of tomorrow need to change

This means the traditional ways of funding the mines of tomorrow need to change

This means the ultimate end users - the EV makers - have to get involved in mining if they want to make EVs at scale

How they get involved? With actual money to fund new projects: 25%, 50%, 100% of total investment.

Off-takes with no active mines are not enough.

How they get involved? With actual money to fund new projects: 25%, 50%, 100% of total investment.

Off-takes with no active mines are not enough.

Another way in? Acquire the guys they own the mines and especially the guys they own the mines and the refining / chemical conversion capacity

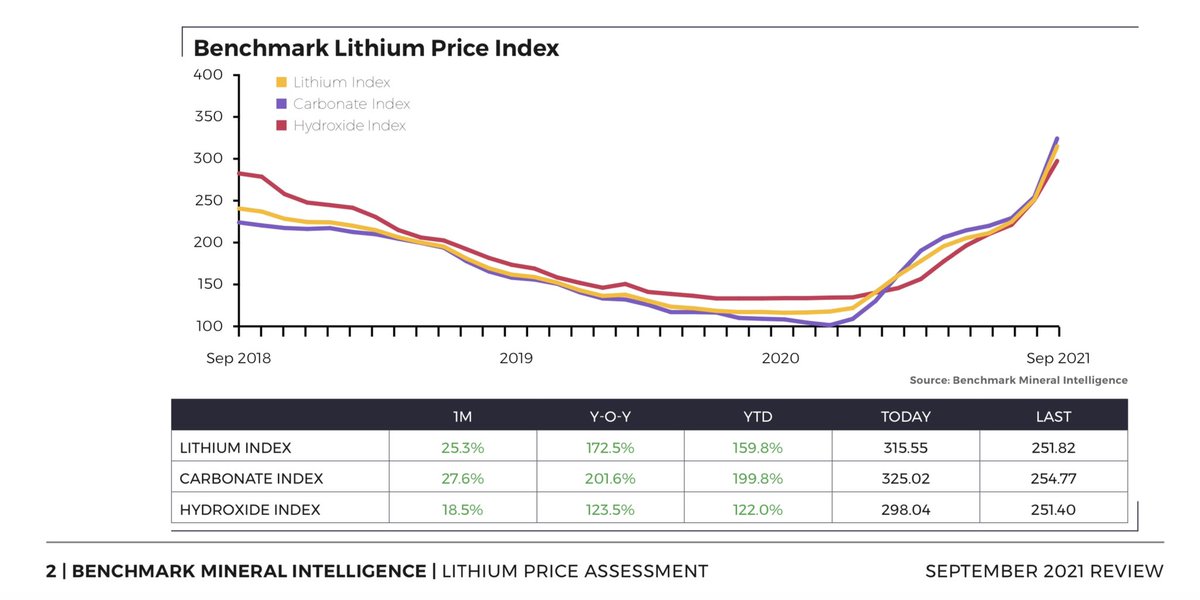

If OEMs don’t get a grip on this soon … raw materials prices will continue to go up #lithium #nickel #cobalt #graphite #manganese

And #EV battery will continue to go up

The global battery arms race has become a global battery supply chain race.

And it will take the rest of this decade to build a blueprint that will last generations

Building the supply chain is a long road:

And it will take the rest of this decade to build a blueprint that will last generations

Building the supply chain is a long road:

Our #GigaUSA event in Washington DC in June will put all of this under the microscope.

Join us: benchmarkminerals.com/events/battery…

Join us: benchmarkminerals.com/events/battery…

A perfect example of OEMs becoming miners

“BYD has become the second automaker to take a stake in a major lithium miner, Chengxin Lithium, in a move that secures supplies of the battery raw material following a surge in prices.”

benchmarkminerals.com/membership/byd…

“BYD has become the second automaker to take a stake in a major lithium miner, Chengxin Lithium, in a move that secures supplies of the battery raw material following a surge in prices.”

benchmarkminerals.com/membership/byd…

• • •

Missing some Tweet in this thread? You can try to

force a refresh