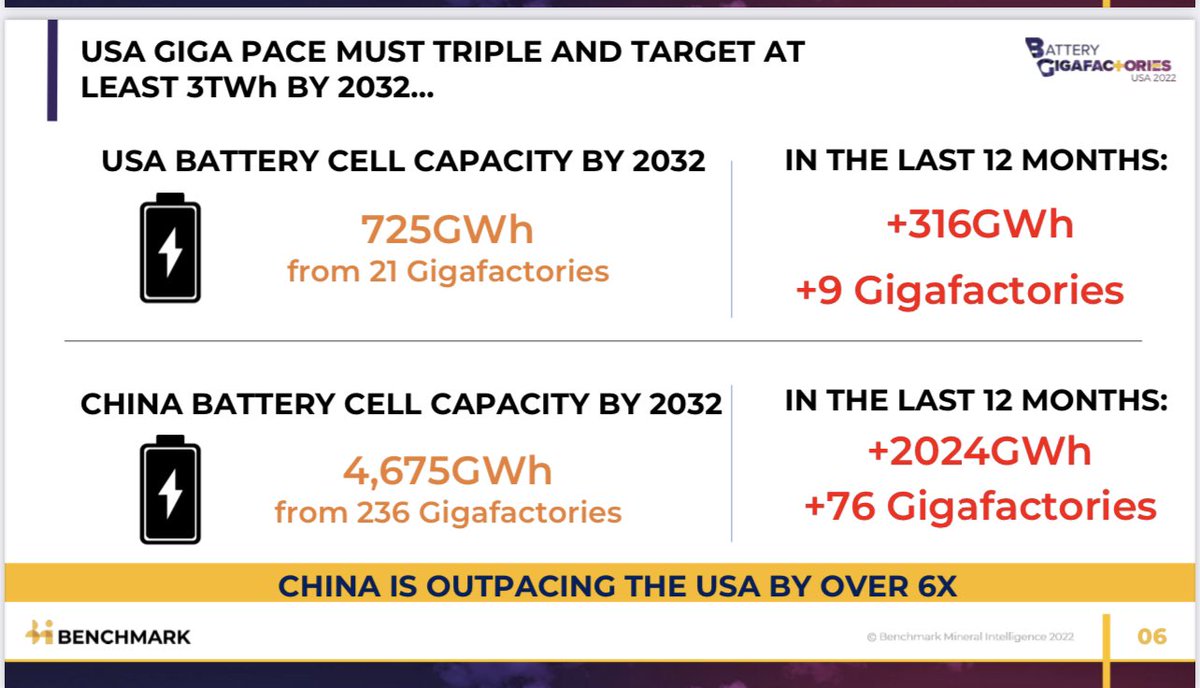

Benchmark Mineral Intelligence ~ Critical Minerals - Energy Supply Chains - From Mine to Grid #MUFC

How to get URL link on X (Twitter) App

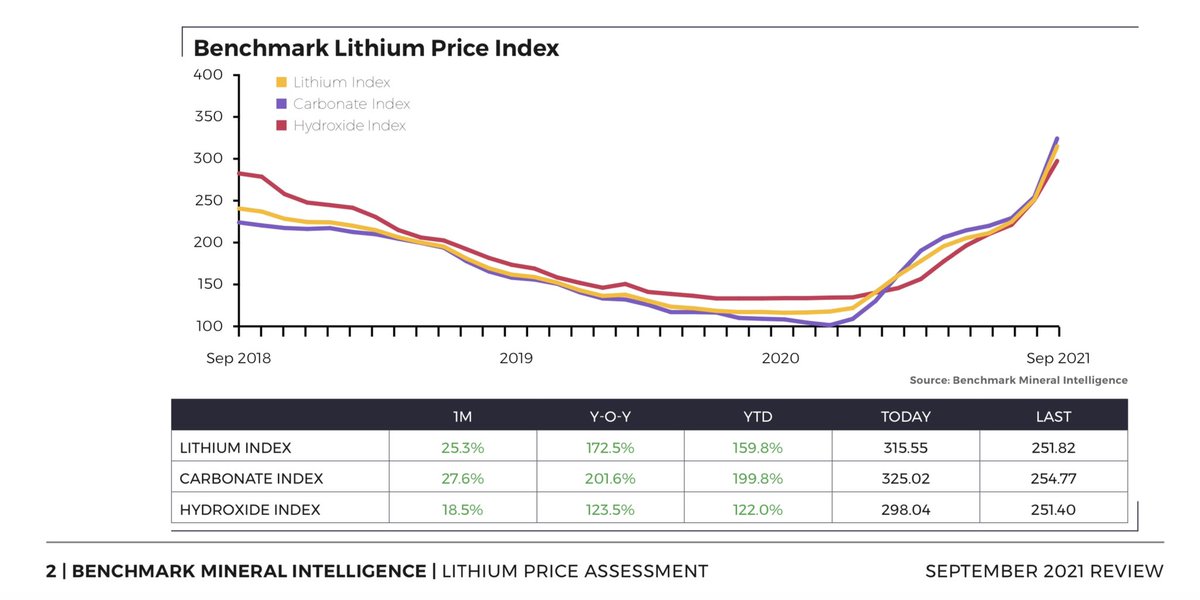

The chart shows a few things:

The chart shows a few things:

Lithium is the key element that this entire low carbon economy is being built on. With low cost energy storage en masse, speed, scale and economics will fall apart

Lithium is the key element that this entire low carbon economy is being built on. With low cost energy storage en masse, speed, scale and economics will fall apart

Lithium carbonate price increases have hurt the most.

Lithium carbonate price increases have hurt the most.

This time there are more buyers than in 2016.

This time there are more buyers than in 2016.

2. Lithium chemical refining is going global, not just in China

2. Lithium chemical refining is going global, not just in China

New lithium hydroxide facility expect to be co-located next to Terafactory in Austin

New lithium hydroxide facility expect to be co-located next to Terafactory in Austin