Deloitte have published the 25th edition of their annual Football Money League, which ranks the world’s leading football clubs by revenue, this time covering the 2020/21 season. Some thoughts in the following thread.

Deloitte said that the Money League remains “the most contemporary and reliable independent analysis of the top clubs’ relative financial performance”, which is largely true, even though they had to re-issue this year’s report after initially mis-stating #Milan revenue.

Revenue has obviously been significantly impacted by COVID-19. Deloitte estimate that the Money league clubs have missed out on well over €2 bln of revenue over the 2019/20 and 2020/21 season as a result of the pandemic.

That said, Top 20 Money League clubs’ 2020/21 revenue was more or less unchanged at £7.2 bln, despite match day and commercial falling £995m (91%) and £196m (6%) respectively, as this was compensated by broadcasting rising £1.2 bln (43%), largely due to deferred 2019/20 money.

As almost all games were played behind closed doors, match day fell €1.1 bln (91%) from €1.2 bln to just €111m, lowest ever in Money League history, due to the absence of fans. The €1.5 bln peak for this revenue stream came in 2018/19, the season before the pandemic struck.

In contrast, broadcasting rose €1.3 bln (43%) from €3.2 bln to €4.5 bln, a record high for this revenue stream, largely due to the deferral of some revenue from 2019/20 to 2020/21 for games played after the accounting close, both in domestic leagues and UEFA competitions.

As an illustration of the impact of deferred TV distribution, English Premier League clubs’ revenue benefited by around £400m in 2020/21, as the 2019/20 season was extended. The amount deferred depended on the accounting year-end, e.g. clubs with May close benefited the most.

Commercial fell €222m (6%) from €3.7 bln to €3.5 bln. The impact of COVID was not as significant as expected, as lower merchandising sales, impacted by closure of retail outlets, was partly offset by new sponsorships and partnership agreements for several Money League clubs.

Comparisons between clubs are more challenging this year, as leagues adopted different responses to the pandemic. Some completed the 2019/20 season before end-June, while others extended their seasons beyond this date, meaning some revenue was deferred to 2020/21 accounts.

Bundesliga managed to complete 2019/20 in June, while Ligue 1 was cancelled in April, so German and French clubs did not include any deferred revenue in 2020/21. However, Premier League, Serie A and La Liga extended to July and August, so their clubs saw a benefit in 2020/21.

#MCFC climbed 5 places to top the Money League for the first time (only the fourth club to ever do so), as revenue increased £89m to £571m. Three other clubs reported more than half a billion: #RealMadrid £567m, #FCBayern £541m and #FCBarcelona £515m (down 3 places).

There are no fewer than 10 English clubs in the top 20, including #MUFC £494m (5th), #LFC £487m (7th), #CFC £437m (8th), #THFC £360m (10th) and #AFC £325m (11th). There were 4 new entrants to the top 20: #LCFC, #WHUFC, #WWFC and #Milan.

The top 20 clubs have a very different revenue mix, so the highest/lowest amount of each revenue stream are: match day – #PSG £15m / #Milan £0m; broadcasting – #MCFC £297m / Zenit St Petersburg £38m; commercial – #FCBayern £306m / #WWFC £24m.

Despite the pandemic, revenue grew at many clubs, partly due to deferred income. #MCFC led the way with £89m increase, followed by 3 other English clubs (#LCFC £76m, #WWFC £62m and #WHUFC £58m), then 3 Italian clubs. The largest falls were #FCBarcelona £110m and #RealMadrid £39m.

In percentage terms, biggest increases came at clubs with 31st May year-end, so benefiting from more revenue deferred from extended 2019/20 season: #LCFC (plus return to Europe), #WWFC and #WHUFC. Steepest declines were at #FCBarcelona 18% and Zenit Saint Petersburg 9%.

The majority of the revenue decrease at the top 20 clubs was obviously driven by match day. Clubs with high gate receipts were particularly hard hit with the largest falls in Spain (#FCBarcelona £97m and #RealMadrid £87m) and England (#THFC £93m, #MUFC £80m and #AFC £75m).

Clubs were protected from a worse COVID impact by higher broadcasting revenue, especially in England with #MUFC up £115m (return to Champions League) and Champions League finalists #MCFC £107m and #CFC £91m. The only club with lower TV money was Zenit Saint Petersburg £(3)m.

Commercial was a mixed bag, as some clubs reported good growth, especially #PSG £37m and #MCFC £23m, while others experienced significant falls, particularly #FCBarcelona £54m, #RealMadrid £51m, #MUFC £50m and #EFC £30m (no repeat of naming rights option).

In England #MCFC £571m overtook both #MUFC £494m and #LFC £487m to top the table. Liverpool fell two places to 7th, while #CFC Champions League win helped retain 8th place. #WWFC entered Money League for first time in 17th, while promotion saw first appearance for #LUFC (23rd).

Importance of European qualification is clear, especially #CFC & #MCFC, who earned €120m for reaching Champions League final. #MUFC were boosted by returning to CL, then reaching Europa League final. #THFC hurt by dropping to Europa League, though this competition helped #LCFC.

The two Spanish giants both saw large revenue falls, though #RealMadrid £567m was enough to retain 2nd place. #FCBarcelona drop from £627m to £515m meant they fell from 1st to 4th, their lowest since 2014. Still a big gap to #Atleti £295m and Sevilla £177m (boosted by CL return).

As the Bundesliga season was completed in 2019/20 financial year, German clubs were disadvantaged in 2020/21, because no revenue was deferred. Nevertheless, #FCBayern retained 3rd place with £541m, while #BVB £299m kept them in 12th. Borussia Mönchengladbach boosted by CL money.

#Juventus rose one place to 9th as Italy’s highest club with £384m, followed by #Inter £293m (14th) and #Milan £192m (19th). The Rossoneri appeared in the Top 20 for the first time since 2018 following a return to European competition. Worth noting Atalanta in 25th with £166m.

After the early cancellation of Ligue 1 2019/20 season, no revenue was deferred, thus hurting relative performance in 2020/21. #PSG climbed one place to 6th with £492m, but they were the only French club in the Money League. #TeamOL dropped out after no European qualification.

The only club outside the Big Five leagues to feature in the Money League was Zenit Saint Petersburg (20th with £188m). However, Benfica and #Ajax, who featured in the top 30 in the previous season, fell below the threshold.

Revenue for Top 20 clubs was basically flat at €8.2 bln, which is €1.1 bln (12%) lower than 2019 peak of €9.3 bln, though still 3rd highest ever total. Moreover, revenue has more than doubled from €3.9 bln in 2009, growth led by broadcasting €2.9 bln & commercial €2.3 bln.

Following revenue deferrals to 2020/21, broadcasting is once again the most valuable revenue stream, rising from 39% to 56%. As a result, commercial fell from 46% to 43%. As games were played without fans match day was down to 1% (16% pe-pandemic, but as high as 26% in 2009).

All clubs saw falls in match day revenue, as games were played behind closed doors, with some clubs particularly hard hit: #FCBarcelona £97m, #THFC £93m #RealMadrid £87m, #MUFC £80m and #AFC £75m. #MCFC rise to overall 1st place was helped by “only” losing £41m here.

As fans return to the stadium, some clubs will benefit more from the increase in match day income. For example, in 2019/20 #FCBarcelona & #RealMadrid had £111m and £95m respectively, while the highest percentage of match day revenue was in North London with #THFC 24% & #AFC 23%.

Six clubs earned more than quarter of a billion pounds from broadcasting, namely #MCFC £297m, #RealMadrid £275m, #CFC £274m, #LFC £269m, #FCBarcelona £256m and #MUFC £255m. English clubs benefited most from revenue deferrals, in the same way they were worst hit last year.

The size of the Premier League TV deal is highlighted by the significant percentage generated by “smaller” English clubs, e.g. #WWFC 87%, #WHUFC 83%, #LCFC 82% and #EFC 76%. The top placed clubs are far less reliant on TV, e.g. #PSG 36% and #FCBayern 42%, though Zenit only 20%.

Commercial held up pretty well with #FCBayern leading the way with £306m, followed by #PSG £299m, #RealMadrid £285m and the highest English club #MCFC £273m. Largest year-on-year growth at #PSG £37m and City £23m, though big reductions over £50m for Barca, Madrid and #MUFC.

During the pandemic, commercial partnerships have become increasingly important with four clubs generating more than half of their income from this revenue stream: Zenit 76% (mainly Gazprom), #PSG 61%, #FCBayern 56% and #RealMadrid 50%. Then come #MCFC with 48%.

The total number of English clubs in top 20 increased from 7 to 10 (the same as the previous high in 2017), followed by Spain and Italy with 3 apiece. Germany fell from 4 to 2, as 2019/20 was boosted by them completing the season. France and Russia both had 1 club.

England has an amazing 14 clubs in the top 30, which is twice as much as the next highest country, Italy 7, followed by Spain 4, Germany 3, France 1 and Russia 1.

Incredibly, the number of English clubs in the top 30 is only the second highest ever, below the peak of 17 in 2015. However, to underpin the financial strength of the Premier League, #LUFC achieved 23rd place immediately after promotion to the top tier with £171m.

#MCFC have proved most resistant to COVID, having actually grown revenue by €34m (6%) since the pandemic struck. All other leading clubs from the Big Five leagues have suffered large reductions. City have increased revenue by more than half a billion since 2009.

The gap between top and bottom, defined as 1st place to 20th place, has decreased from a record €633m two years ago to “only” €433m in 2021. This had been on a steadily upward trend, up from €207 million in 2006, before the pandemic struck.

In contrast, the gap between the 10th placed club and 11th placed club widened from €10m to €40m. This was as high as €57m in 2016, but has reduced since then, mainly due to #AFC dropping out of the top 10 to 11th.

The financial threshold for membership of the Money League club has increased to €212m, the highest ever. This has more than doubled since 2009, when you only needed €102m to become a member of the moneyed elite.

Just for fun, let’s now take a look at some of the comparisons between the leading clubs in each country to better understand the reasons for the differences in revenue between them.

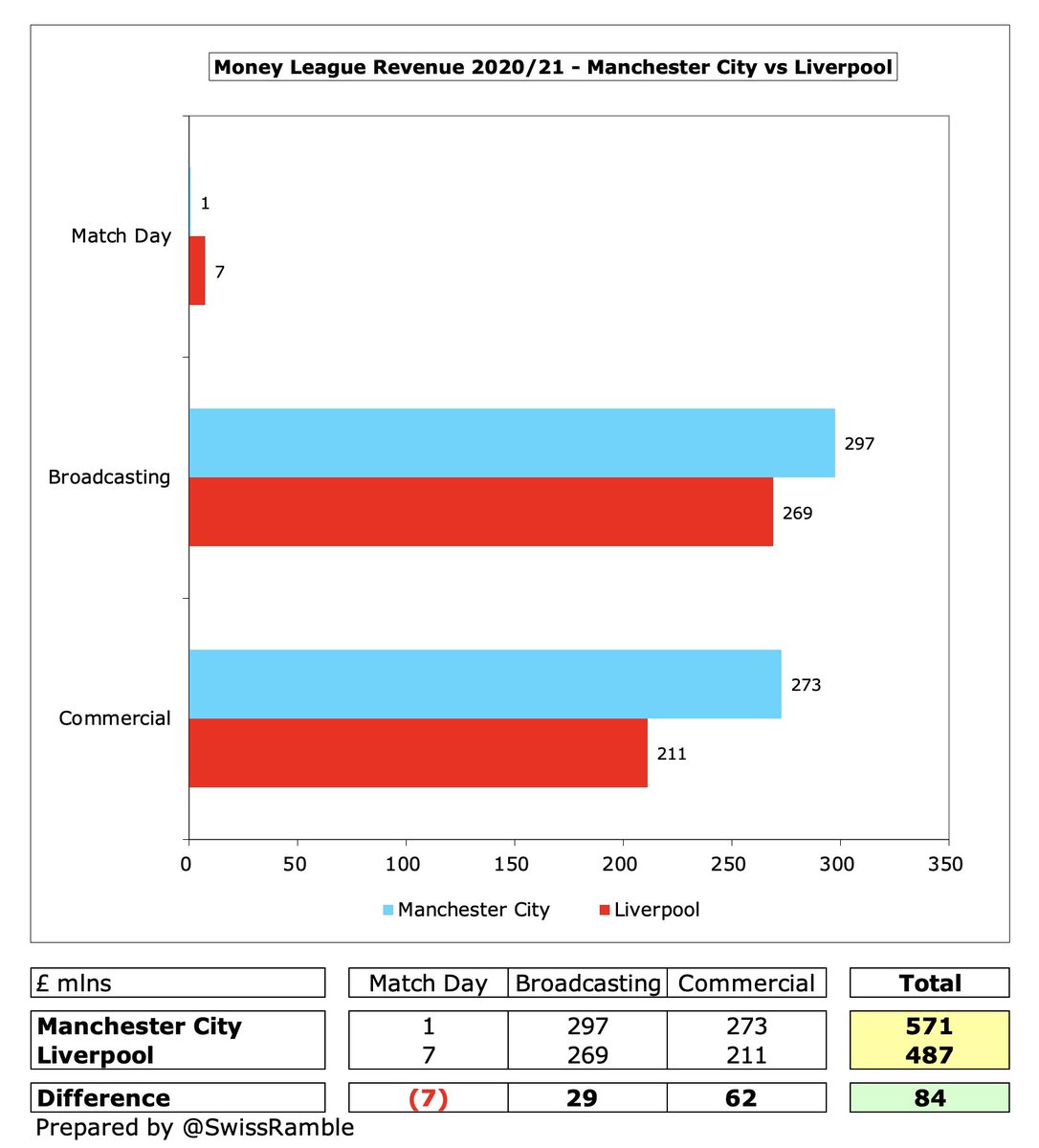

#MCFC £571m overtook #MUFC £494m with City ahead of United in both broadcasting (£43m higher, due to winning Premier League & reaching Champions League final) and commercial (£41m). United were badly hit by £80m reduction in match day, which was twice as much as City’s £41m fall.

It’s a similar story when comparing #MCFC and #LFC, as City have higher broadcasting (£297m vs. £269m) and much higher commercial (£273m vs. £211m). Liverpool will reduce the deficit via higher match day, but it is difficult for the Reds to close the gap.

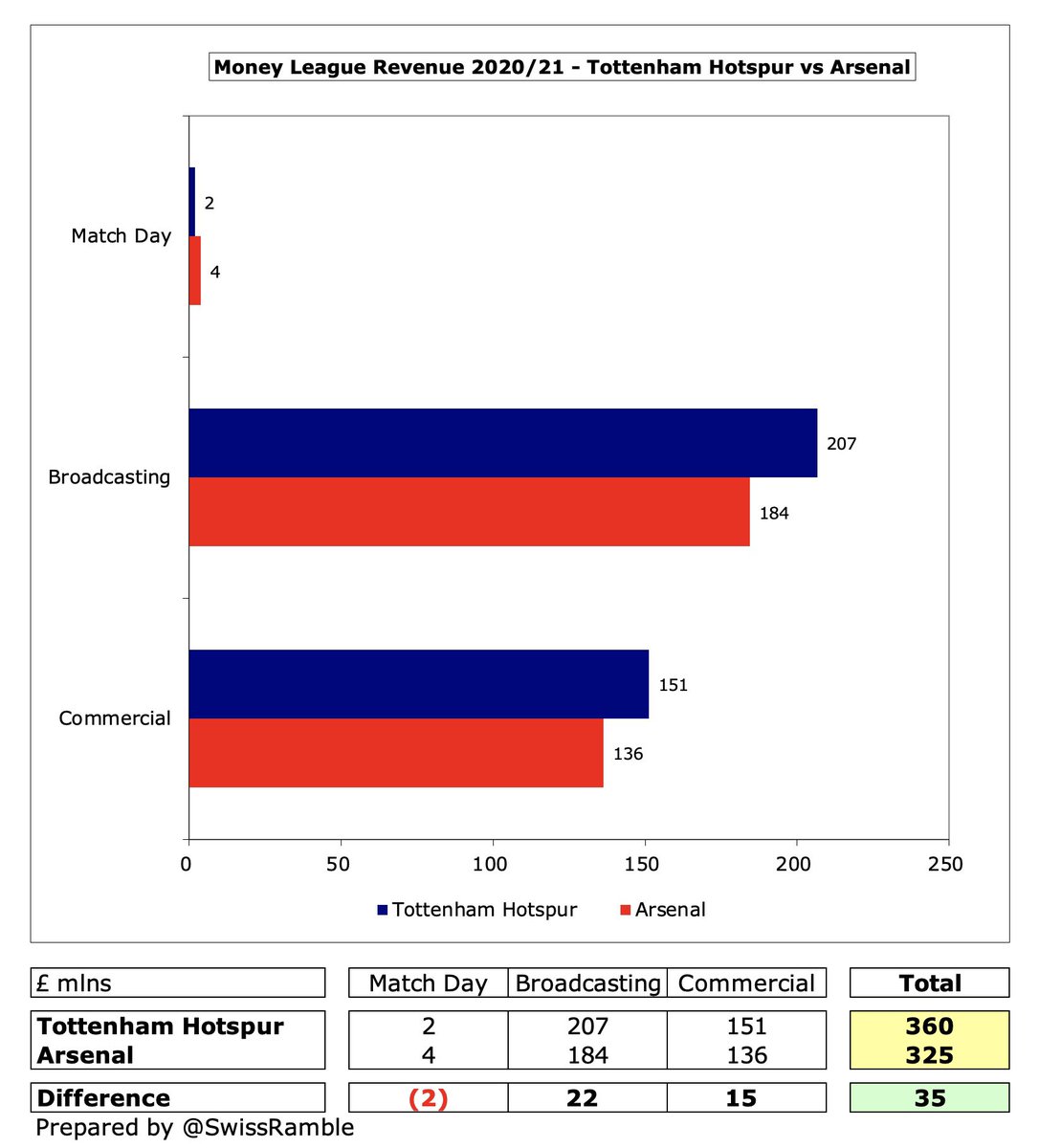

In North London #THFC overtook #AFC in 2019 and revenue now outperforms their rivals in broadcasting (£22m higher) and commercial £(15m). They will also benefit from their new stadium with the return of fans. It is imperative for Arsenal to qualify for the Champions League.

After the two Spanish giants had identical revenue of £627m the year before, in 2021 #RealMadrid £567m opened up a £52m gap with #FCBarcelona £515m, largely due to £40m commercial difference. Both clubs experienced big year-on-year decreases.

#FCBayern £541m revenue is nearly quarter of a billion more than Germany’s next highest club, #BVB £299m. The Bavarians earn more in all categories, but the major difference of £173m is in commercial income.

In Italy the gap between #Juventus £384m and #Inter £293m is much the same as the previous year at £91m, mainly due to Juve generating £67m more commercial income, as some of Inter’s Chinese sponsorships have been terminated.

In France #PSG £492m is miles ahead of the closest challenger, as they generate nearly five times as much revenue as #TeamOL £105m, who did not even make the Money League. The commercial difference of £257m is enormous, but broadcasting is also £118m higher.

Given the timing differences between leagues caused by different completion dates in 2019/20, Deloitte also provided a ranking based on average revenue of 2019/20 and 2020/21 seasons, where the top five were #RealMadrid, #FCBarcelona, #FCBayern, #MCFC and #MUFC.

Although the Money League only gives a partial picture of finances, focusing purely on revenue without taking into consideration other factors such as wages and debt, it remains a useful indicator of success on the pitch, even though distorted by the COVID-19 pandemic.

Next year’s revenue figures should look better, as match day income returns to previous levels. Broadcast revenue will fall, as there will be no artificial boost from deferred money, though this will be partly offset by the new TV deal for UEFA competitions.

• • •

Missing some Tweet in this thread? You can try to

force a refresh