🇺🇸 #Jobsreport: Springs forward in March

🟢Payrolls +431k

🟢Private +426k

▶️Gds +60k

▶️Services +366k

🟢Gov +5k

🟢Revision: +95k

✅#Unemployment 3.6% (-0.2pt)

✅Part rate 62.4% (+0.1pt:post #Covid high)

⬆️Wages +0.4% m/m & +5.6% y/y

❌Jobs shortfall🆚pre-#Covid: 1.6mn

🟢Payrolls +431k

🟢Private +426k

▶️Gds +60k

▶️Services +366k

🟢Gov +5k

🟢Revision: +95k

✅#Unemployment 3.6% (-0.2pt)

✅Part rate 62.4% (+0.1pt:post #Covid high)

⬆️Wages +0.4% m/m & +5.6% y/y

❌Jobs shortfall🆚pre-#Covid: 1.6mn

While jobs growth moderated in April, this report continues to show a very robust and historically tight labor market.

Here are the 4 key elements in this report:

1. Payroll growth was softer than in prior months, but still broad-based

2. Unemployment rate fell to a new post-pandemic low

3. Sidelined workers rejoined the labor force

4. Wages advanced moderately.

1. Payroll growth was softer than in prior months, but still broad-based

2. Unemployment rate fell to a new post-pandemic low

3. Sidelined workers rejoined the labor force

4. Wages advanced moderately.

Nonfarm payrolls posted a healthy 431k advance in March – ahead of the 400k consensus.

Job gains were diffuse with 70% of private sector categories recording gains

What is more, the payroll gains for January and February were revised up a solid 95k.

Job gains were diffuse with 70% of private sector categories recording gains

What is more, the payroll gains for January and February were revised up a solid 95k.

The pre-pandemic jobs shortfall is now 1.2 million with the economy having regained 93% of the March-April 2020 job losses.

Relative to the pre-pandemic trend, the shortfall is closer to 5.7 million jobs

Relative to the pre-pandemic trend, the shortfall is closer to 5.7 million jobs

Tight labor market conditions enticed employers to retain their existing workforce despite lingering Omicron concerns, geopolitical worries and financial market volatility.

There were 1.1mn workers reporting being absent from work due to illness, down from 3.6mn in January.

There were 1.1mn workers reporting being absent from work due to illness, down from 3.6mn in January.

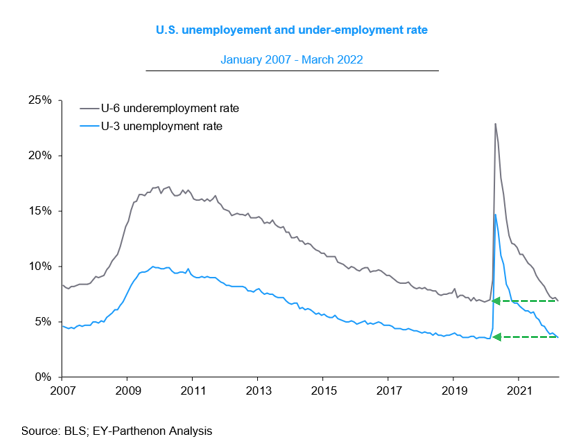

The unemployment rate fell 0.2ppts to a new post-pandemic low of 3.6% while a strong labor market and improving health conditions attracted people back into the labor force.

The unemployment rate is now only 0.1% above its 50-year low recorded just before the onset of Covid!

The unemployment rate is now only 0.1% above its 50-year low recorded just before the onset of Covid!

Most encouragingly, the labor force participation rate simultaneously rose 0.1ppt to a new post-pandemic high of 62.4%.

This came despite the fact that 870k reported not looking for work because of the pandemic, down from 1.8 million in January.

This came despite the fact that 870k reported not looking for work because of the pandemic, down from 1.8 million in January.

Average hourly earnings rose a healthy 0.4% on the month with wage growth firming to 5.6% y/y (+0.4ppt) as a historically tight labor market continues to pressure companies reward, retain and recruit new talent.

As health conditions improve, labor supply constraints (like childcare) ease and reduced personal savings buffers entice more workers to return to the labor market, we anticipate the economy will add over 4m jobs in 2022 with the unemployment rate moving toward 3% by year-end.

Is a 2%-handle on the unemployment rate by year-end a fantasy?

• • •

Missing some Tweet in this thread? You can try to

force a refresh