Random FACT - LIC is a part insurance and part investment products company.

The price band is set at Rs 902 - Rs 949 per equity share, and I find it very attractive.

50% shares are reserved for (QIB), 15% shares reserved for non-institutional investors while the rest is for retail investors. 7% for Employees (Rs 45 disc) and approx 10% for policy holders (Rs. 60 disc) (a brilliant move IMO).

The government was originally planning to sell 5% of its stake in the company, but it brought down the stake sale on offer to 3.5%

With 22.13 crore shares, the issue size of the IPO is Close to Rs 20,557 crore with a valuation of approx Rs 6 Lakh CRORE

It was expected during the last time that the IPO would be launched at the valuations of Rs 13 lakh crore. I wonder what happened that the valuation dropped to almost half.

Was it too expensive then or is it too cheap now??

Was it too expensive then or is it too cheap now??

Interesting comparison - With 6 lakh cr valuation, the LIC IPO is valued at around 1.1X of its embedded value. Private players are trading at around valuations of 2X-3X times of embedded value. That makes it relatively cheap.

At the same time It's very difficult to value LIC as the business model is unlike any other company. LIC takes money now with a promise to compensate later. The premiums (part insurance and part investment) cannot be recognized as revenue.

Purely technically its advances, till the time policy is settled / lapsed / expired without claims. So the analysts will have varied opinions on valuations.

Product Portfolio LIC offers a range of life insurance products to meet varied insurance needs of individuals. Their plans are a combination of insurance and investment with a guaranteed return.

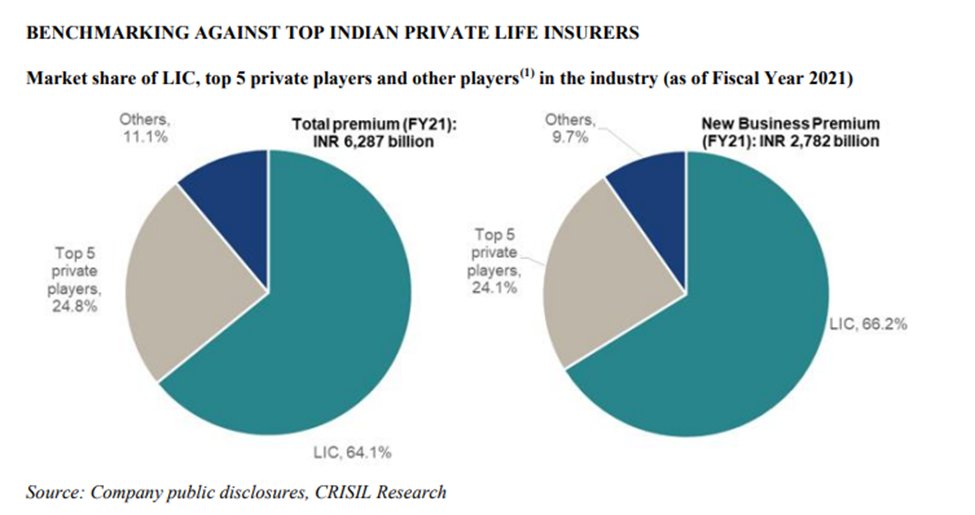

LIC has 64% market share in its segment. The second player is approx 24% share. That is some MOAT. IT IS THE LARGEST PLAYER.

Growth Story - The AUM of LIC grew by approx 10% in FY 2021-22 compared to FY 2020-21. The net profit of the company jumped to in a very similar proportion of 10%.

That is a healthy growth, however my opinion is that every time the revenues increase the costs CAN NOT increase in the same proportion. Some efficiencies have to kick in, however small.

But the premiums are not revenues, as per some technicalities, so this is where it gets confusing, and focus shifts to "unrealized gains"

Interesting fact – AUM of LIC Rs.15 Lakh crore, is more than GDP of some countries. If LIC was a country and its AUM was GDP, It would occupy 24th Place on the table. 😈

Also that is more money than the entire mutual fund industry combined.

Also that is more money than the entire mutual fund industry combined.

LIC owns 4% of all #listed #stocks in India and more government #bonds than the RBI. 🙄🙄🙄🙄🙄 The investments I spoke about in first tweet.

The sheer scale or operations, customer base, penetration, distribution network and #TRUST that LIC carries is enough to make this a #bumper IPO.

LIC operates over 2000 branches, 113 div offices, and 1,554 Offices. It operates #globally in Fiji, Mauritius, Bangladesh, Nepal, Singapore, Sri Lanka, UAE, Bahrain, Qatar, Kuwait, and the United Kingdom

Key Challenges - LIC has poor "new policy growth" as they continue their market share is snatched by private insurance players, especially in urban areas.

The margins in #insurance + #investment products is low.

The margins in #insurance + #investment products is low.

As most analysts are giving a cautiously optimistic approach to the IPO, I feel, that this would give a breath of fresh air to the confused investors and will bring in new #investors in the #equity fold.

I firmly believe that there would be #listing gains and after a bit of minor ups and downs, it will create wealth for long term investors. I intend to apply for IPO.

#optimistic

#optimistic

Please note that the LIC DRHP is a data trove if you want to read about some crazy data on India's growth story.

#Indiyeah

#Indiyeah

All the above tweets are my personal opinion. These are not recommendation for or against the IPO. Please do your own diligence before investing.

#SochKarSamajhKarInvestKar

#SochKarSamajhKarInvestKar

• • •

Missing some Tweet in this thread? You can try to

force a refresh