Newcastle United’s 2020/21 financial results cover a season when they finished 12th in the Premier League under head coach Steve Bruce, since replaced by Eddie Howe in November 2021. Disrupted by the COVID-19 pandemic. Some thoughts in the following thread #NUFC

This was the last set of accounts under Mike Ashley’s ownership, as the club was acquired in October 2021 by Saudi Arabia’s Public Investment Fund (80% stake), as well as PCP Capital Partners (10%) and RB Sports & Media (10%).

#NUFC pre-tax loss reduced from £26m to £14m, despite revenue falling £13m (8%) from £153m to £140m and profit on player sales dropping £24m to £2m, as operating expenses decreased £51m (25%), mainly due to change in accounting date. Loss after tax narrowed from £23m to £12m.

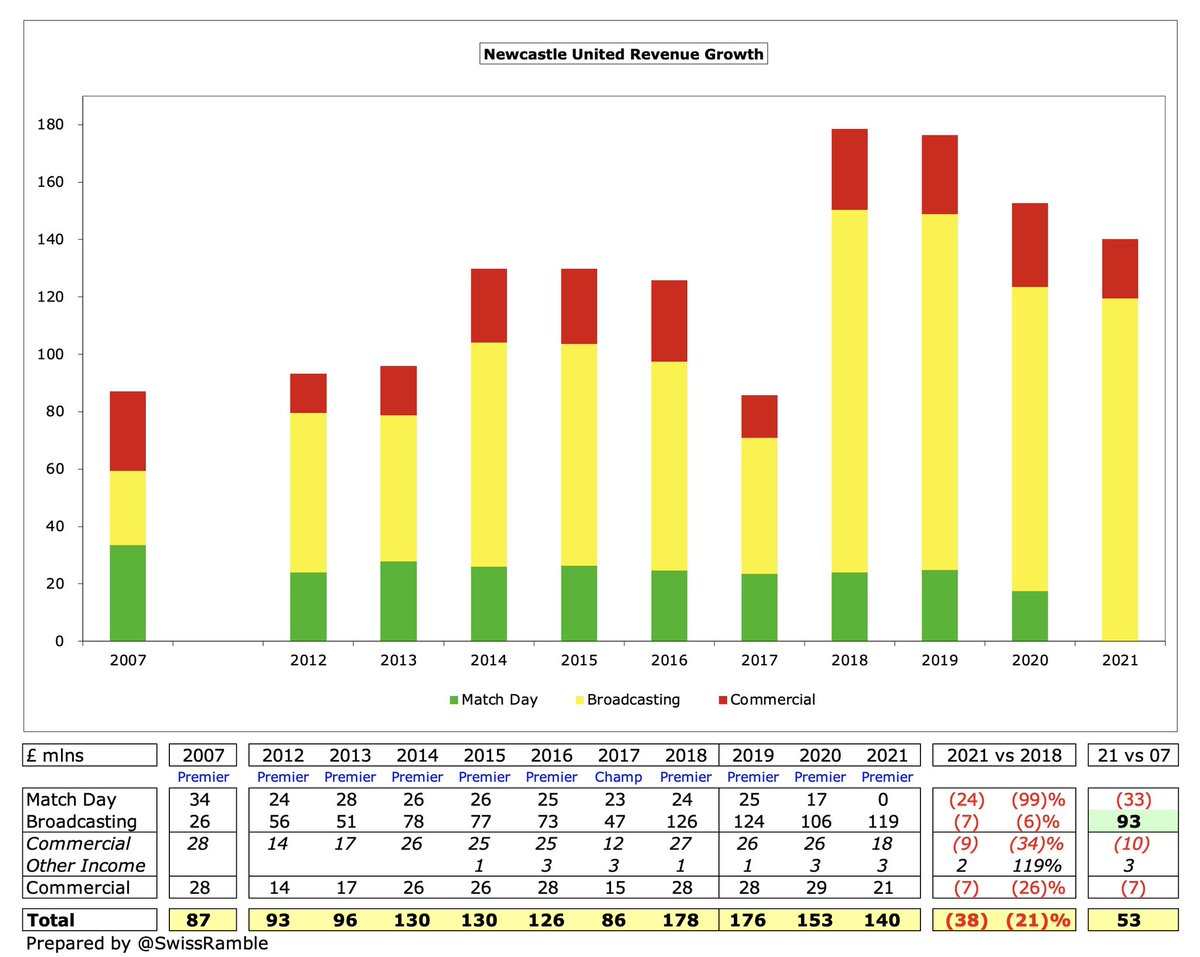

Main driver of #NUFC revenue fall was COVID, which led to reductions in match day, down £17m (99%) to just £176k, and commercial, down £8m (29%) to £21m. Partly offset by TV money rising £13m (12%) to £119m, mainly due to broadcasters’ rebate in prior year.

#NUFC wage bill decreased £14m (12%) from £121m to £107m, while player amortisation fell £15m (32%) to £32m and there was no repeat of prior year’s £11m impairment charge. Other expenses were also down £10m (40%) to £14m, partly due to the lower cost of staging games.

Worth noting that #NUFC 2020/21 accounts only cover 11 months, but prior year was 13 months, as financial reporting period extended to 31st July 2020 to take into consideration COVID delaying end of season. Little impact on revenue, but significant cost reduction year-on-year.

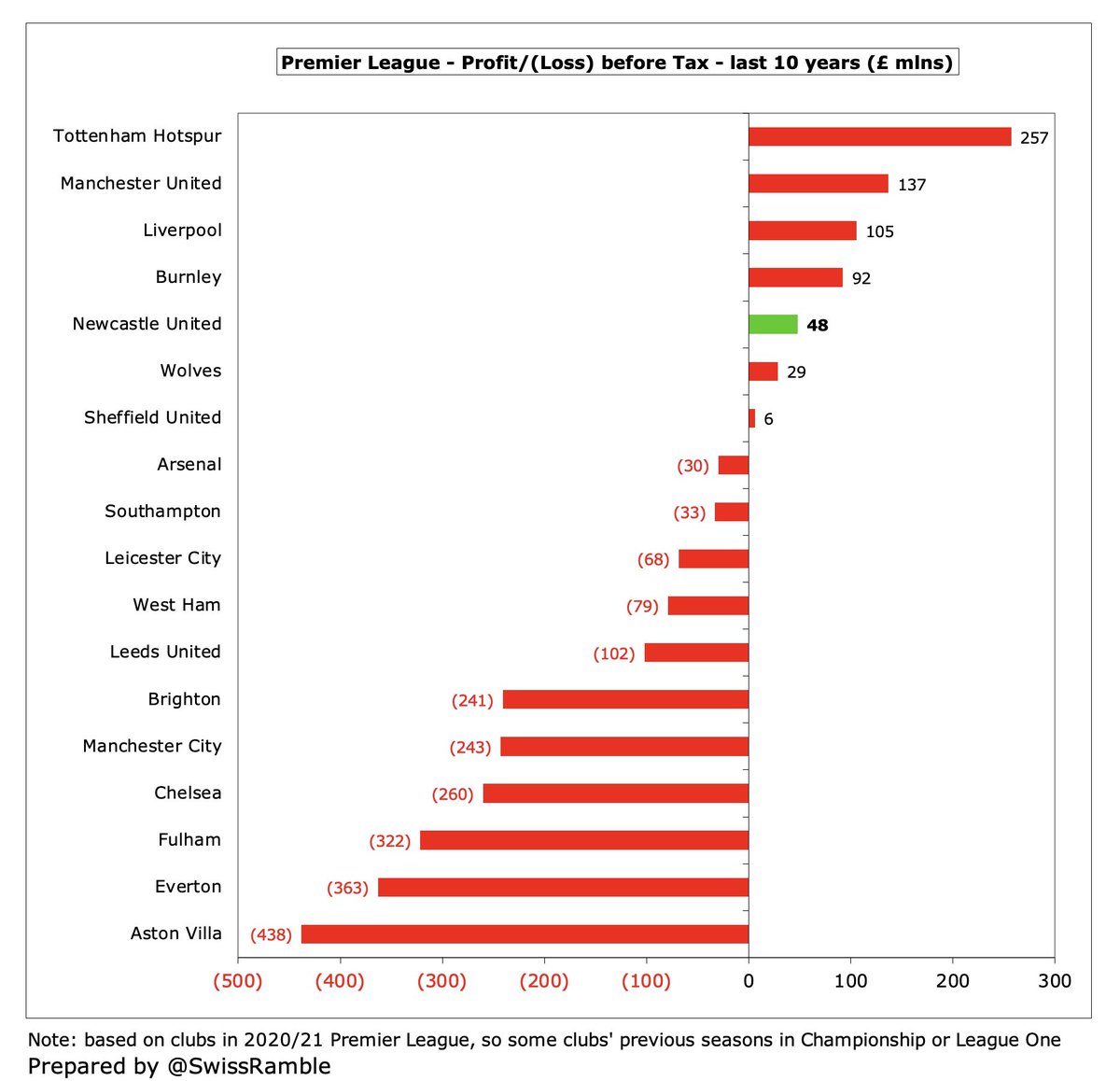

Although #NUFC £14m loss is not ideal, it is actually one of the better financial results in the 2020/21 Premier League, when football was badly impacted by the pandemic. Only four clubs were profitable, while many reported huge losses, e.g. #CFC £156m, #AFC £127m and #EFC £121m.

Adverse COVID impact for #NUFC in 2020/21 was £25.9m (revenue loss net of cost savings), but costs were £12.7m lower, due to only 11 months in accounts, so underlying loss was only £0.4m. Total revenue loss over two years amounts to £40m.

#NUFC profit from player sales fell from £26m to £2m, partly due to COVID depressing the transfer market, though some clubs did manage to generate good money from player trading, e.g. #MCFC £69m, #WWFC £61m and #LCFC £44m.

#NUFC posted profits in 7 of last 10 years, the only exceptions being 2017 (Championship) plus 2020 and 2021 (COVID), adding up to £48m over this period. That’s impressive from a financial perspective, though the Toon Army would have liked to see more of that money on the pitch.

Ashley’s focus on the bottom line is very well illustrated by #NUFC reporting the 5th highest aggregate profit in England in the last decade of £48m. The only clubs with higher profits than Newcastle were #THFC £257m, #MUFC £137m, #LFC £105m and Burnley £92m.

Until the slowdown in 2020/21, when departures were mainly free transfers, #NUFC had been making some decent money from player sales with £97m in the previous 4 years (annual average £24m). There will also be hardly any profit from player trading this season.

#NUFC operating loss (i.e. excluding player sales and interest) reduced from £54m to £15m, which is the fourth best result to date in the Premier League, where only #SUFC and #LUFC posted profits, while some had huge losses: #CFC £159m, #EFC £118m, #FFC £94m and #AFC £91m.

#NUFC revenue fell for the 3rd year in a row, so £140m is £38m (21%) lower than £178m club record, largely due to the pandemic. Revenue has grown £53m since Ashley’s arrival in 2007, but £93m is from centrally negotiated TV contracts, with both match day and commercial lower.

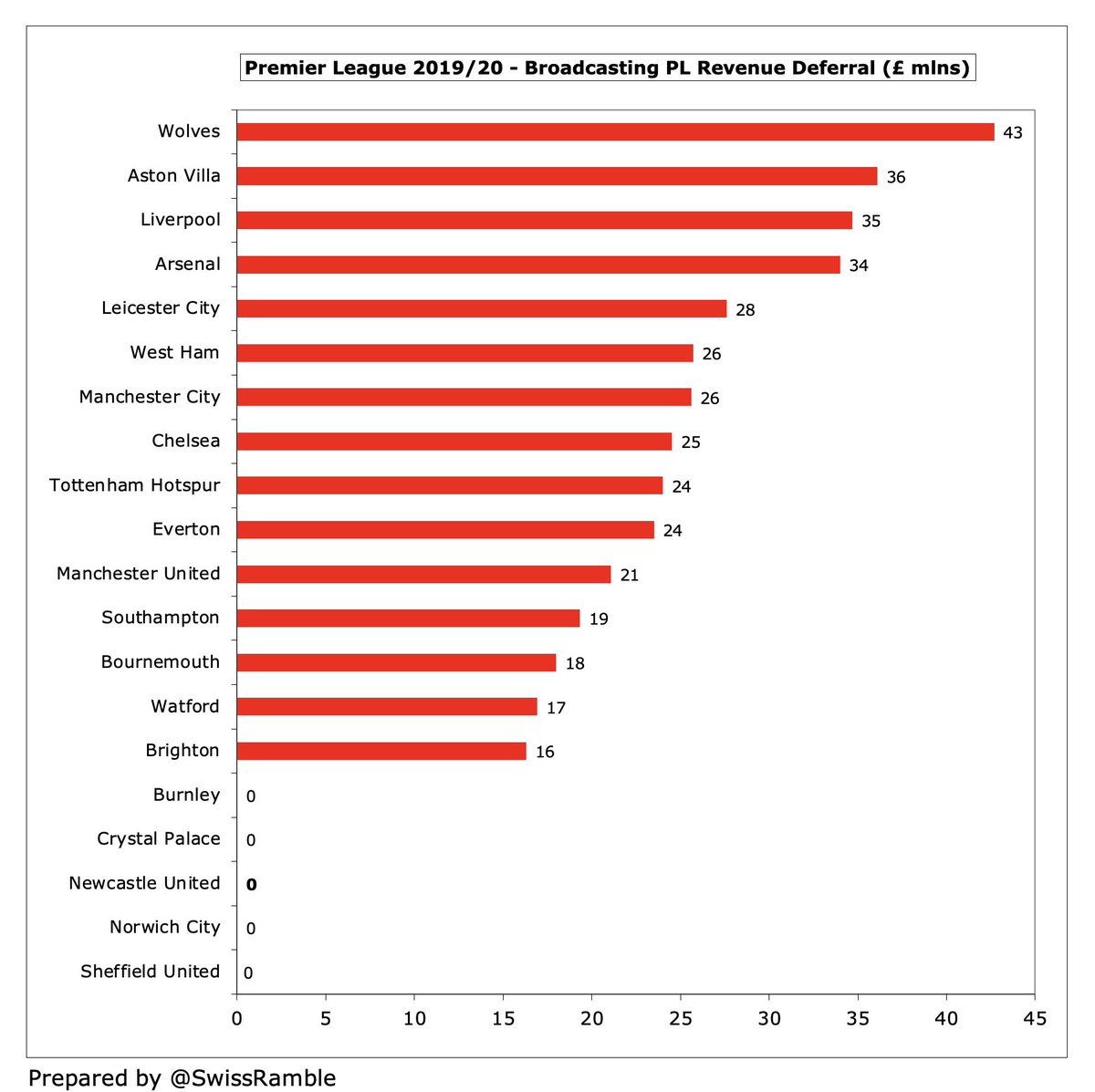

#NUFC £140m revenue is normally in the Premier League top 10, but only 15th highest to date in 2020/21, as this season’s rankings are distorted by different amounts of revenue deferred from 2019/20 accounts. For some perspective, only around a quarter of #MCFC £570m.

As the 2019/20 season was extended, many clubs deferred revenue into 2020/21 for games played after the accounting close. However, as #NUFC moved year-end to 31st July, they deferred nothing, while clubs with a May year-end benefited significantly, e.g. #WWFC £43m.

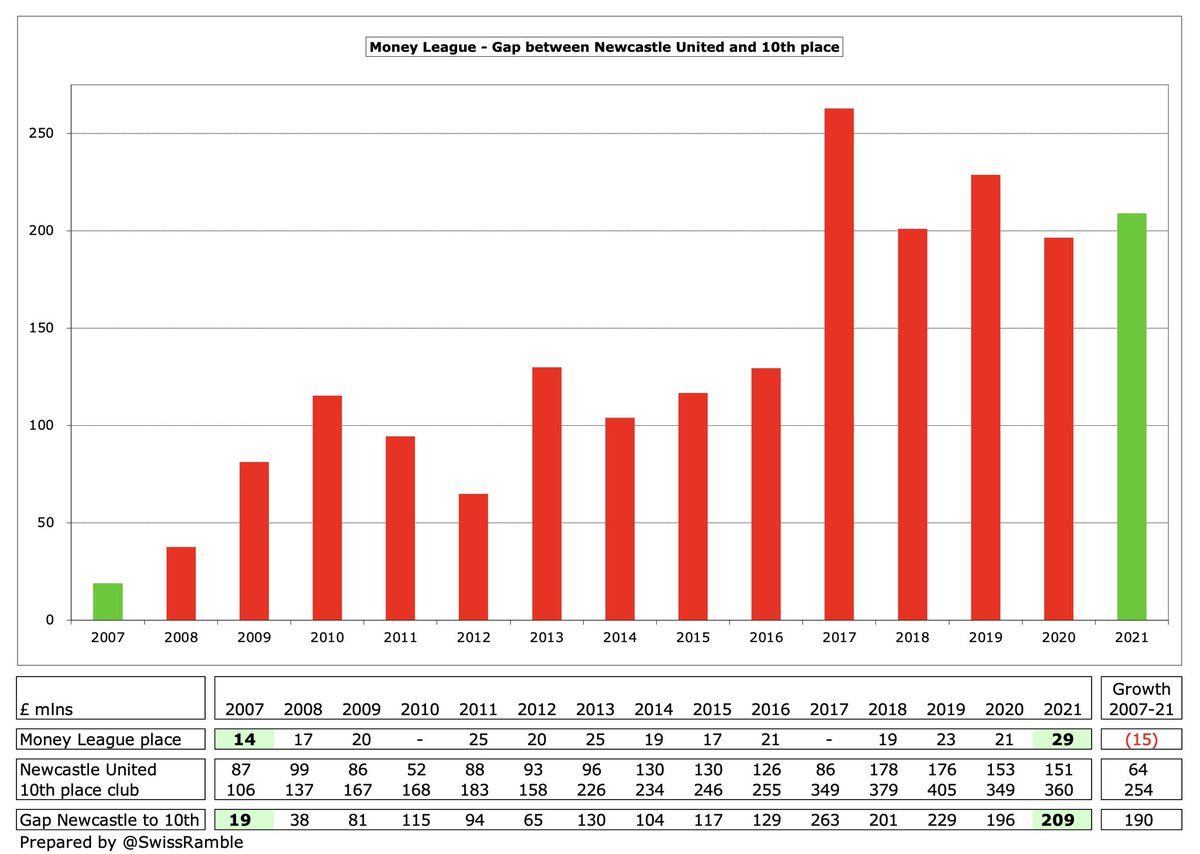

#NUFC were in 29th position in the Deloitte Money League, which ranks clubs globally by revenue, just behind Napoli. Interestingly, they reported £151m revenue, which is £11m higher than club’s £140m, possibly because they have annualised the 11 months in 2020/21.

Before Ashley’s takeover, #NUFC had 14th highest revenue in the world, just £19m lower than 10th placed club, but this gap has soared to £209m in 2021, as Newcastle have been left behind by other clubs. In fact, they had 6th highest revenue in England before the big man arrived.

#NUFC broadcasting income rose £13m (12%) to £119m, as prior year included broadcaster rebate, plus higher facility fee (more live games on TV) and merit payment (league position up one to 12th). On low side in the PL, as others benefited from revenue deferrals from 2019/20.

#NUFC only qualified for Europe once under Ashley, earning just €5m in 14 years. In contrast, they qualified in 10 of the 13 years before he became owner, including 3 times for the Champions League. As an example of what they could have won, #THFC got €313m in last 6 years.

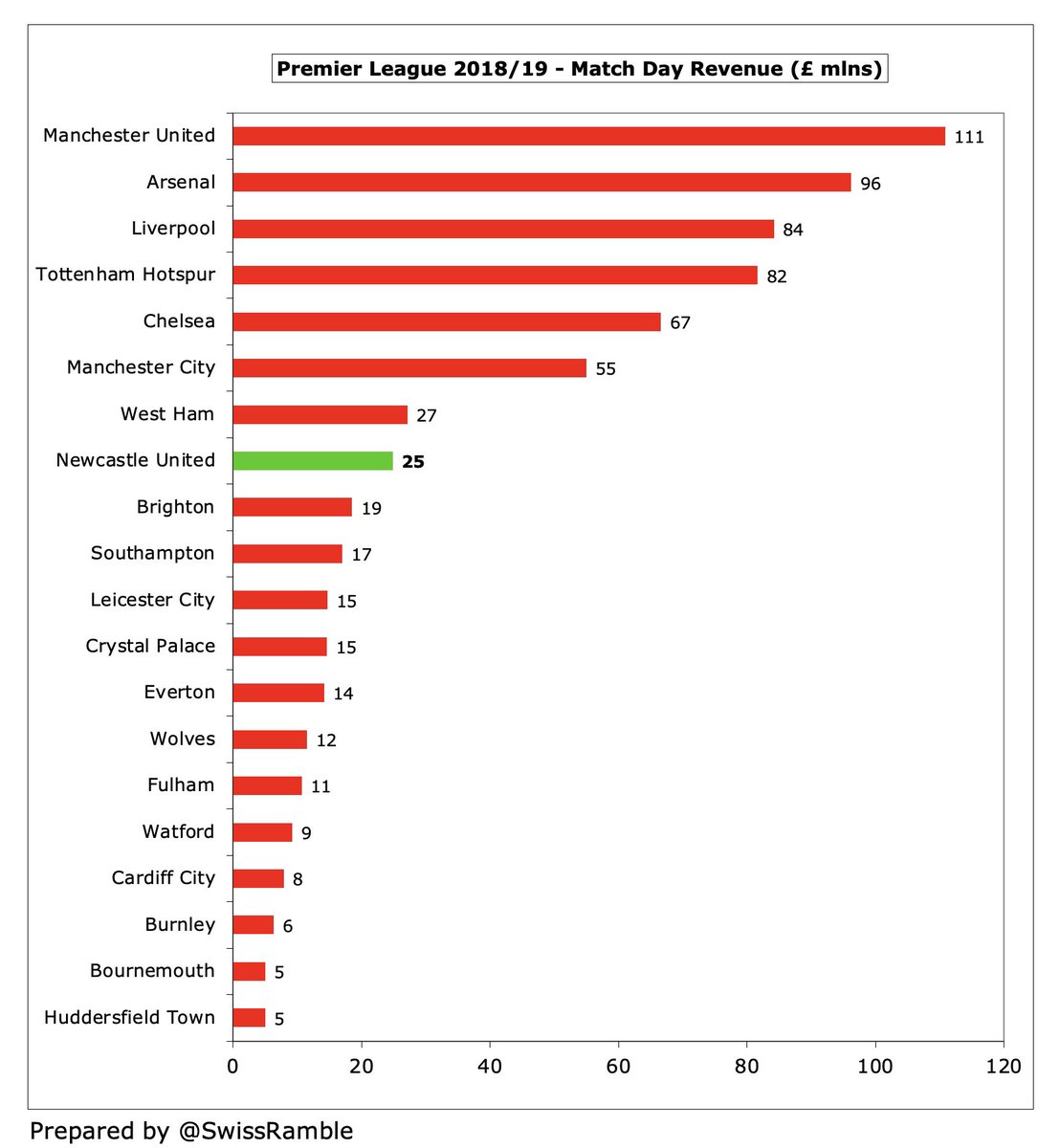

#NUFC match day income fell £17m (99%) to just £176k, as all home games were played behind closed doors (except one with restricted capacity). Newcastle were 8th highest in Premier League before the pandemic with £25m in 2019, only behind the Big Six and West Ham.

However, #NUFC £17m match day revenue in 2020 was only half the £34m in last season before Ashley’s arrival. Obviously impacted by COVID, but other clubs have surged ahead in this period via stadium developments or success on the pitch, notably #THFC (up £59m) and #LFC (up £32m).

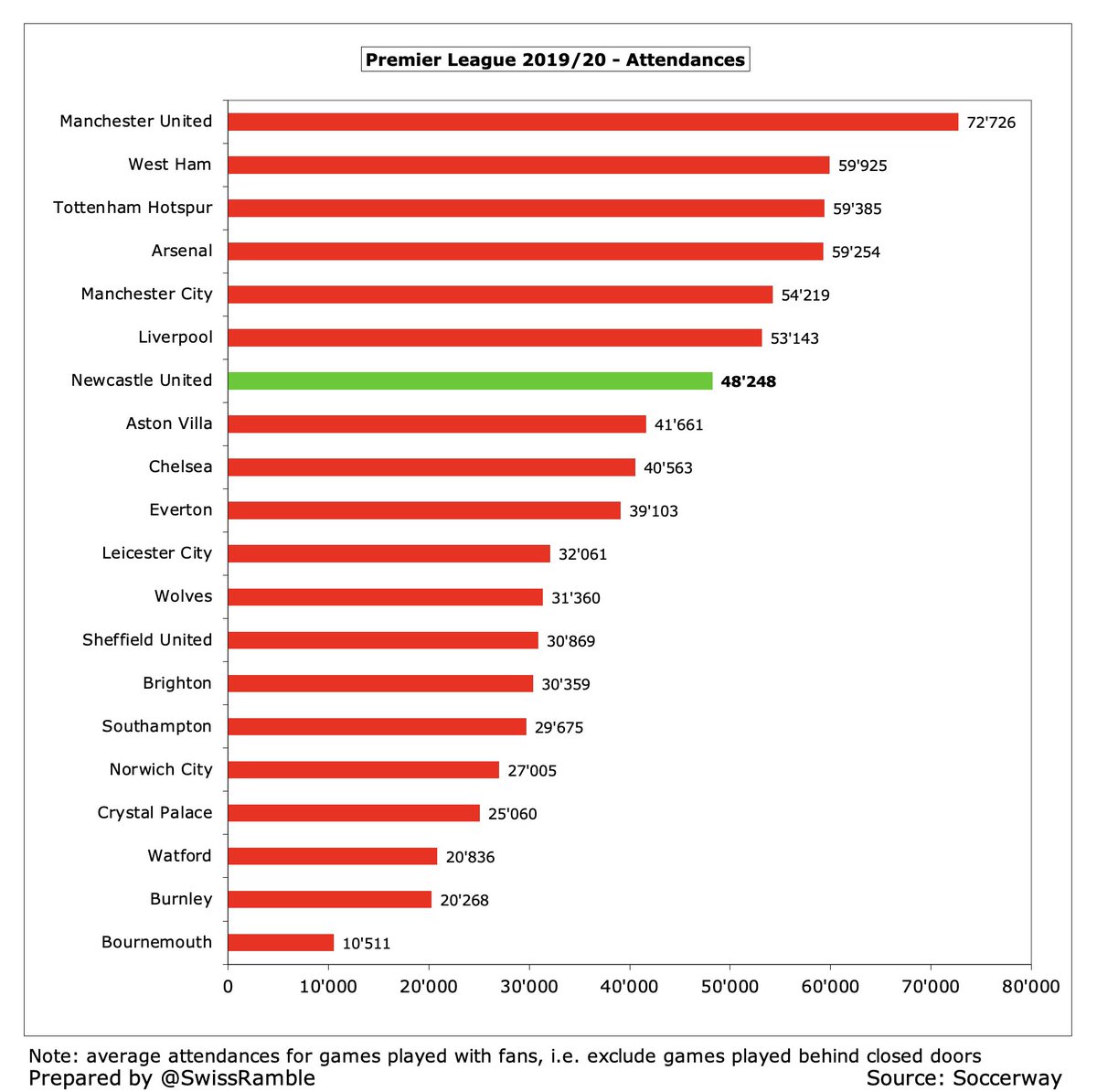

As testament to #NUFC fans’ loyalty, average attendance has been around 50,000 for last 10 years, including 51,000 in Championship. Fell to 48,248 in 2019/20 (for games played with fans), but this was still 7th highest in Premier League and it is back up over 50,000 this season.

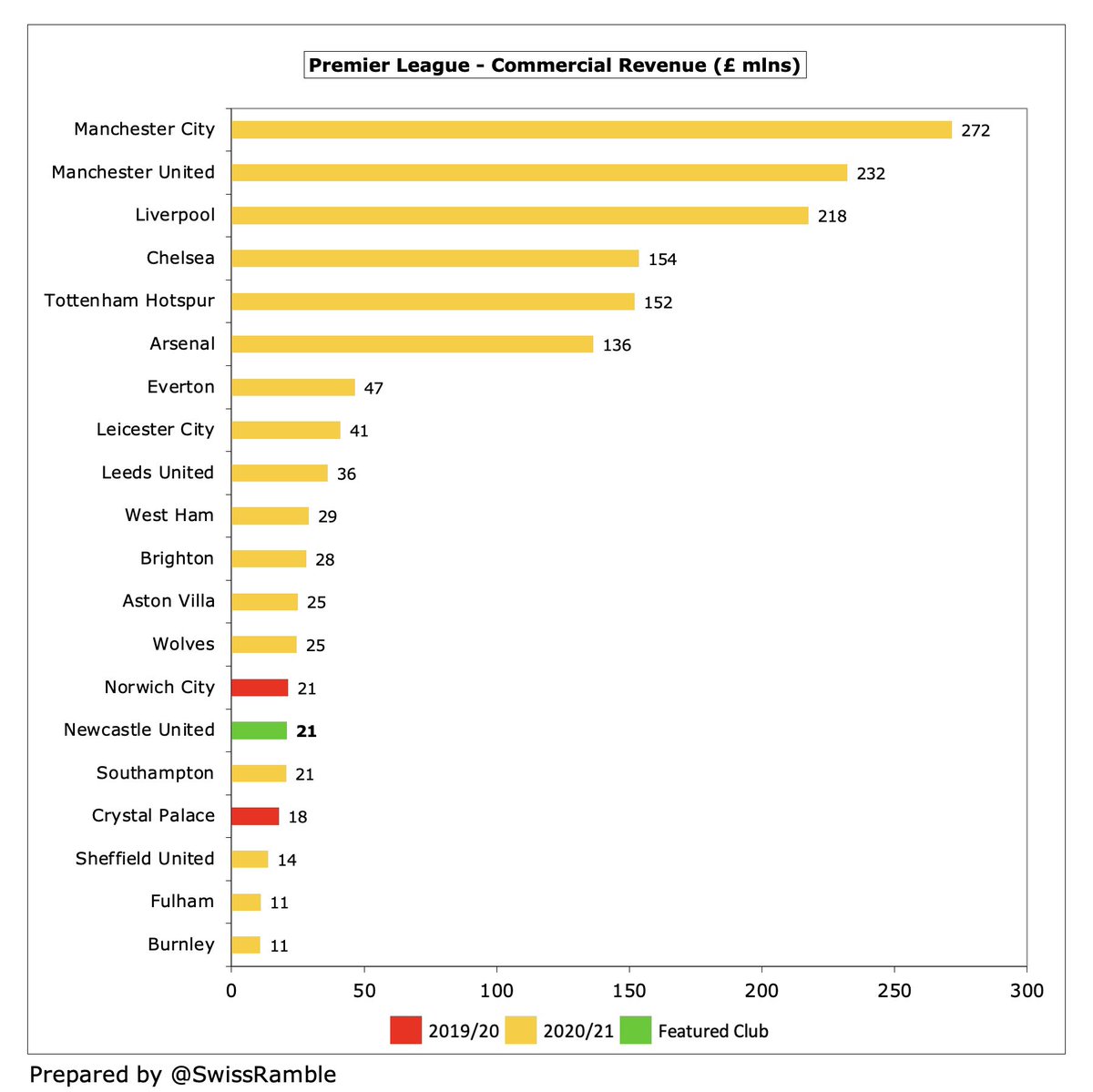

#NUFC commercial income fell £8m (29%) from £29m to £21m, due to less money from sponsors (11 months) plus lower revenue from events, catering and club shop (COVID). This is firmly in the bottom half of the Premier League, even below clubs like #BHAFC, #AVFC and #WWFC.

Ashley did not manage to grow #NUFC commercial income at all in 14 years. In fact, it has actually decreased, so club has fallen way behind rivals in this revenue stream. Newcastle outsourced catering in 2009, but that was only worth £6m, so does not explain the poor performance.

The new owners claimed that #NUFC had not received any sponsorship from Ashley for Sports Direct stadium advertising for the last three seasons, though the accounts state that the club made sales of £253k to the owner’s companies, while purchasing £40k of goods.

#NUFC shirt sponsorship with Fun88 has been extended, reportedly for £8m a year, while Puma’s kit supplier deal was replaced in 2020 by Castore, who will also take over the club’s retail operations. Sleeve sponsor for 2021/22 is Kayak, succeeding ICM.

#NUFC will look to significantly grow commercial income under new ownership in the same way that #MCFC did when they were bought by Abu Dhabi United Group, increasing revenue from £21m to £272m, though new Premier League rules to assess deals for fair value might hold them back.

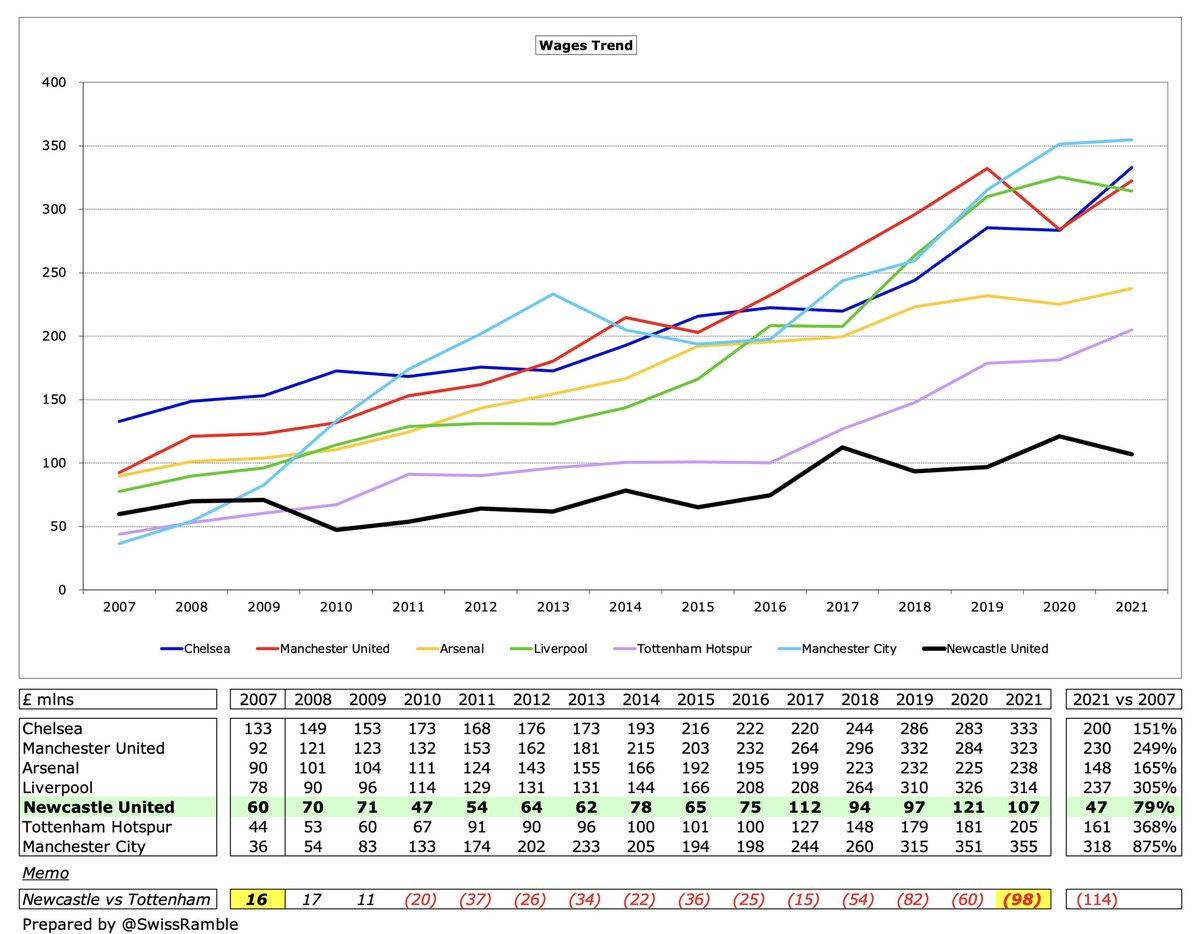

#NUFC wage bill fell £14m (12%) from £121m to £107m, mainly because the accounting period only covered 11 months in 2020/21 (prior year 13 months). On a like-for-like basis, wages would have actually increased by £5m (4%) from £112m to £117m.

#NUFC enjoyed the 5th highest wage bill in England before Ashley bought the club in 2007. Although wages have increased from £60m to £107m since then, other clubs have increased wages by significantly more, e.g. #LFC quadrupled from £78m to £314m.

As a result, #NUFC £107m was 17th highest wage bill in England in 2020/21. If it were adjusted to £117m, based on a 12-month accounting period, it would still only be in 14th place. Either way, this is at least £200m below the top four clubs, led by #MCFC £355m.

#NUFC wages to turnover ratio decreased from 79% to 76%, which was at the higher end of the Premier League. This was impacted by COVID-driven reduction in revenue, though on the other hand it would have been higher with 12 months of wages.

Remuneration for #NUFC highest paid director (presumably former managing director Lee Charnley) fell from £675k to £260k, which is pretty low for the Premier League, much less than #MUFC and #THFC, where Ed Woodward and Daniel Levy trousered £2.9m and £2.7m respectively.

#NUFC player amortisation, the annual charge to expense transfer fees over contract, fell £15m (32%) to £32m, partly due to shorter accounting period, but also prior year £11m impairment reducing player values. One of the lowest in the PL, reflecting club’s limited investment.

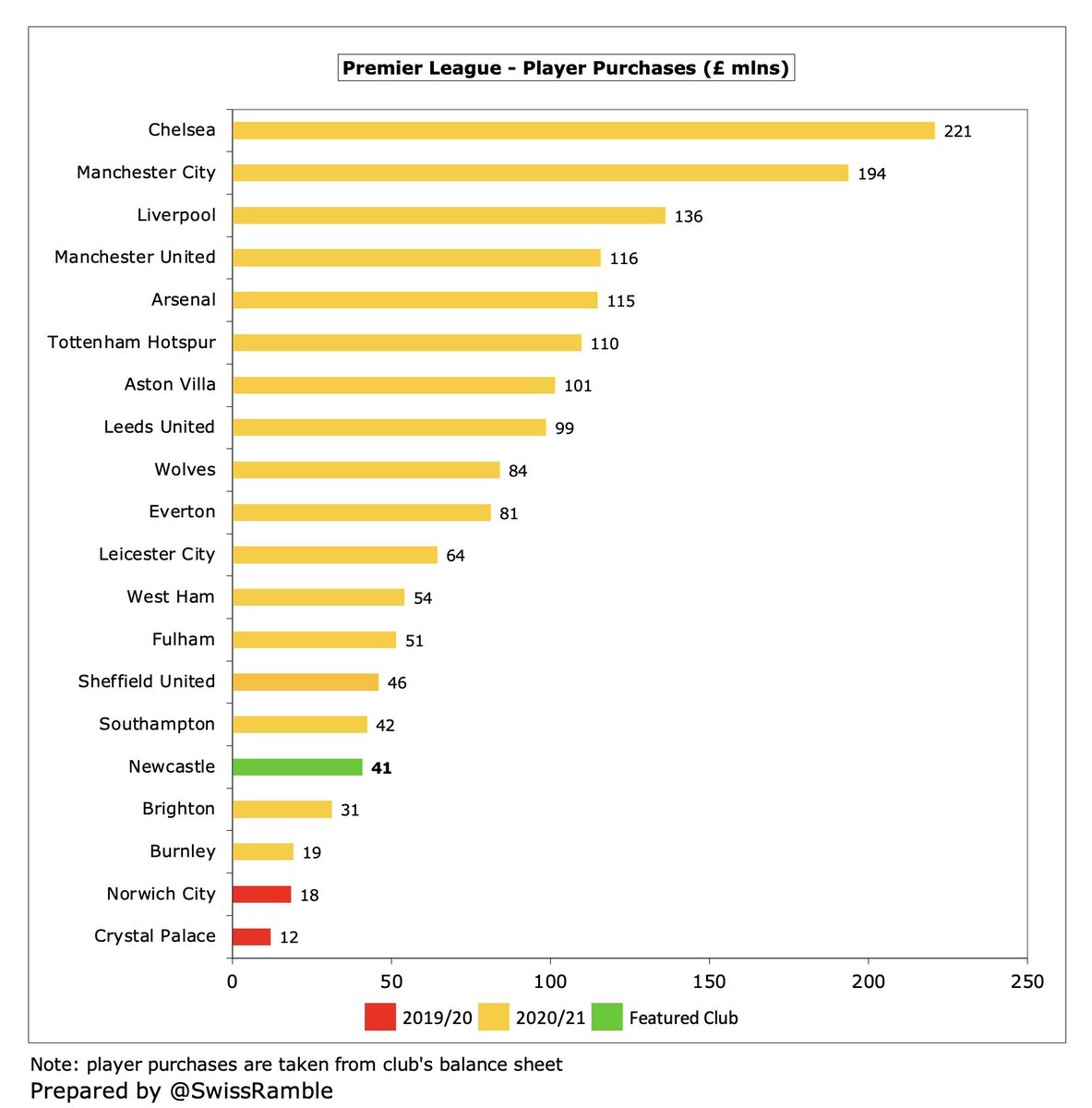

#NUFC spent just £41m on player purchases, mainly Callum Wilson from #AFCB and Jamal Lewis from #NCFC, which was around half previous season’s £76m. To date, only #BHAFC and Burnley spent less than Newcastle in 2020/21. Much lower than #CFC £221m and #MCFC £194m.

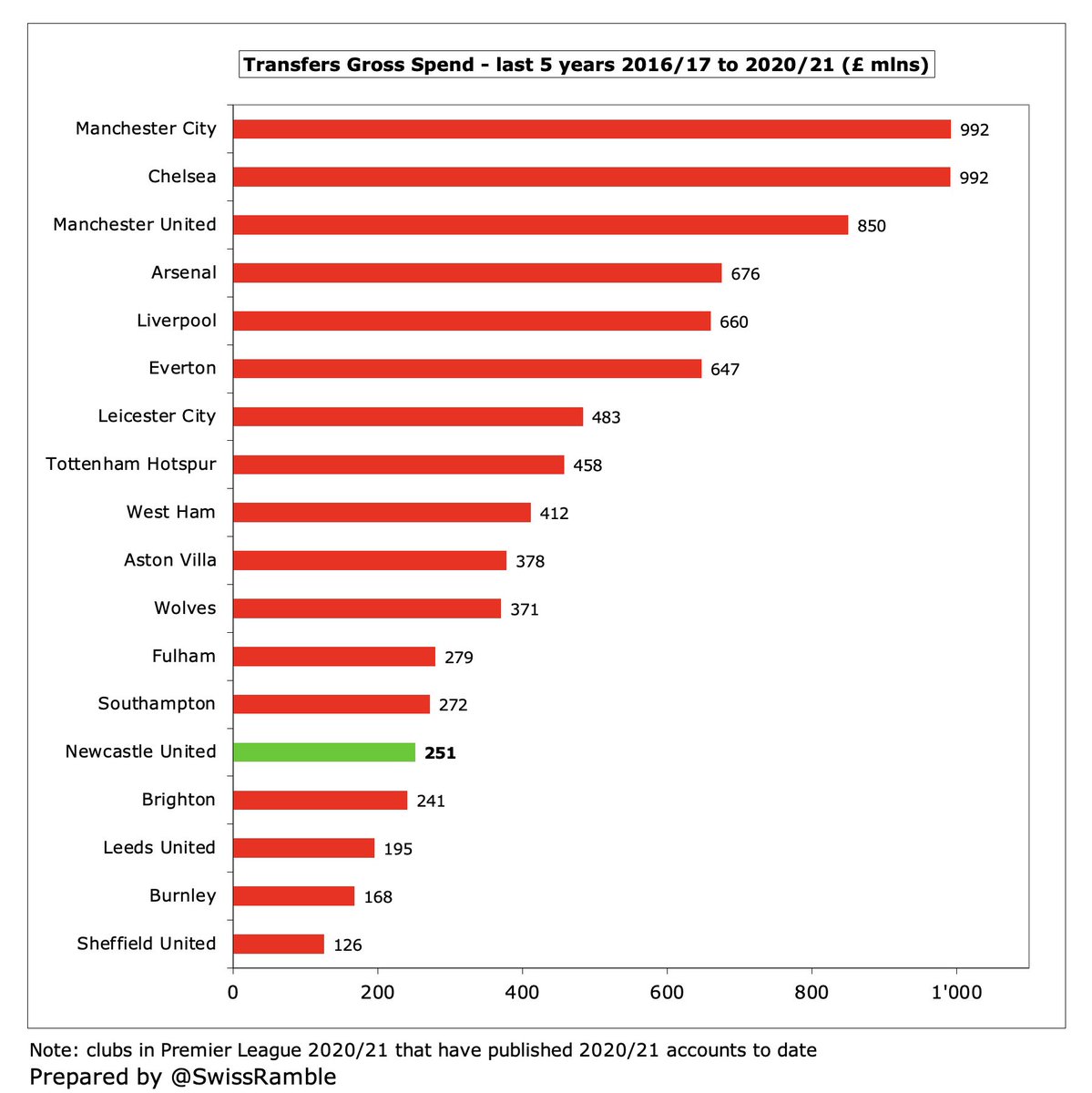

#NUFC gross transfer spend was £251m in last 5 years, though this was fairly low for the top flight. However, that looks set to change under the new owners with the £92m outlay in January being highest in Europe, including Bruno Guimaraes, Chris Wood, Kieran Trippier & Dan Burn.

#NUFC gross debt rose from £107m to £112m, mainly £107m owed to Mike Ashley plus a £5m promissory note (repaid after accounts in August 2021). Ashley’s loan was also settled after the takeover, so the club is likely to be debt-free now.

#NUFC £112m debt was 9th highest in top tier, far below THFC £854m (stadium) & #MUFC £530m. However, this was £35m more than £77m Ashley took on in 2007, including £58m mortgage for stadium development. Unlike owners at many other clubs, he did not convert any debt into equity.

#NUFC only paid £9k interest, as Ashley’s loans were interest-free, far below ##AFC £34m (debt break fee), #MUFC £21m and #THFC £18m. In fairness to Big Mike, the switch from external bank debt to owner financing saved a lot of money in interest, which was as high as £8m in 2008.

#NUFC have managed to clear transfer debt, with their zero balance being the lowest (best) in the Premier League and a lot less than many other clubs, e.g. no fewer than seven of them owed more than £100m with #THFC “leading the way” with £170m.

#NUFC £15m operating loss became £25m negative cash flow (after adjusting for non-cash movements) before spending £25m on players (purchases £40m, sales £15m), though nothing really spent on infrastructure or interest payments. After £5m external loan, net cash outflow of £45m.

As a result, #NUFC cash balance dropped from £63m to £17m, though the club emphasised that the 2019/20 accounting period extension meant that prior year included advance payment of 2020/21 TV money from the Premier League, so balance was artificially high.

During the Ashley era, #NUFC generated £212m from operations, boosted by his £111m loan. Most of this was spent on the squad £212m, while £68m was used to repay bank loans and make £11m interest payments (mostly in the early years of his reign).

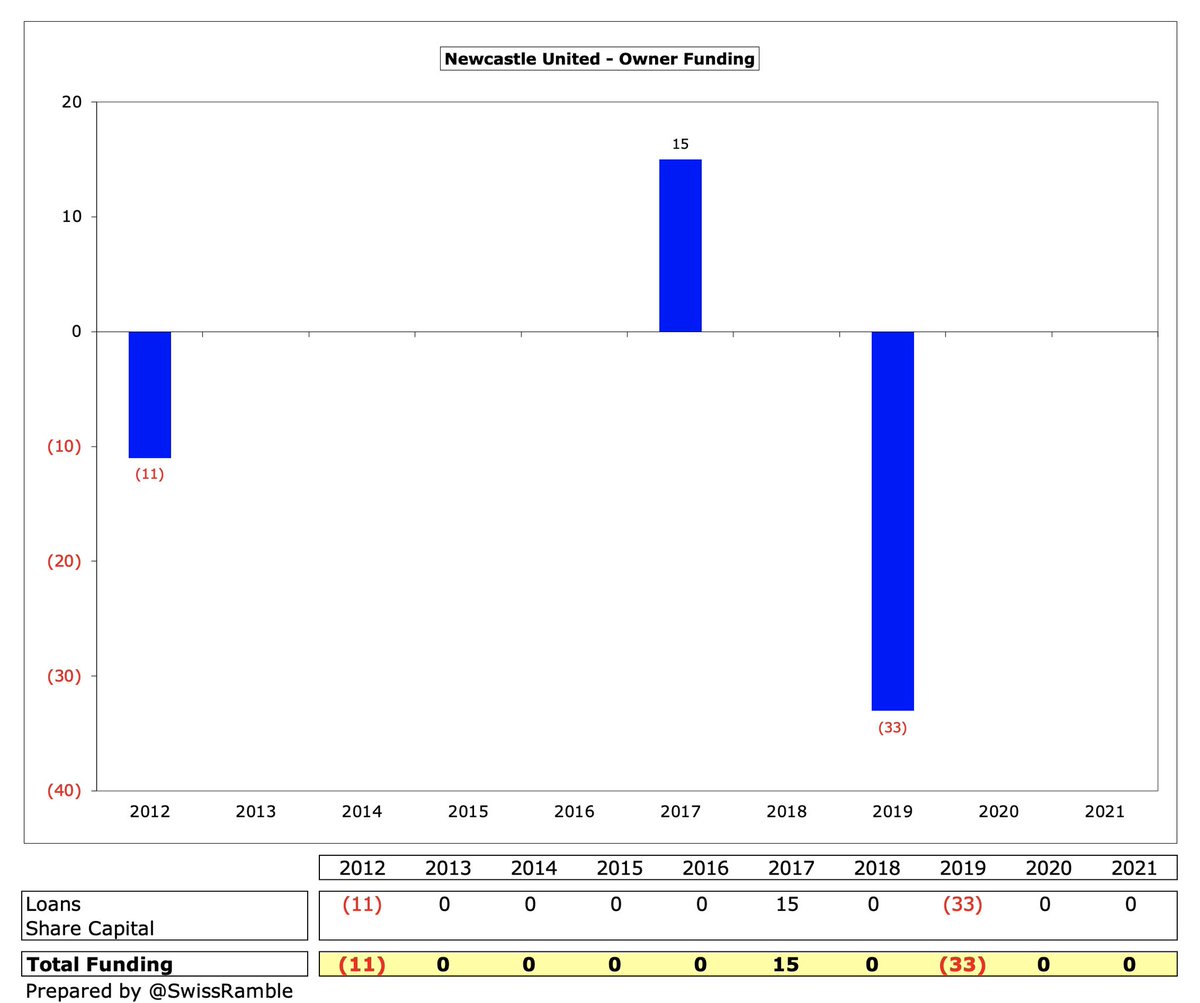

Looking at owner financing in the last 10 years (defined as owner loans plus share capital), #NUFC have repaid £29m of Ashley’s loans. In contrast, some other clubs received substantial amounts from their owners in that period, e.g. #MCFC £684m, #CFC £516m and #AVFC £506m.

One more indication of Ashley’s unwillingness to invest is capital expenditure, i.e. stadium and training ground, which was a feeble £7m at #NUFC in the last 10 years, the lowest in the top tier. For some context, infrastructure investment was £141m at #LCFC and £136m at #FFC.

In a likely sign of things to come, #NUFC Saudi owners injected £168m of equity into #NUFC since the acquisition, partly to settle Ashley’s outstanding loan and partly to fund the significant investment into the playing squad in the January 2022 transfer window.

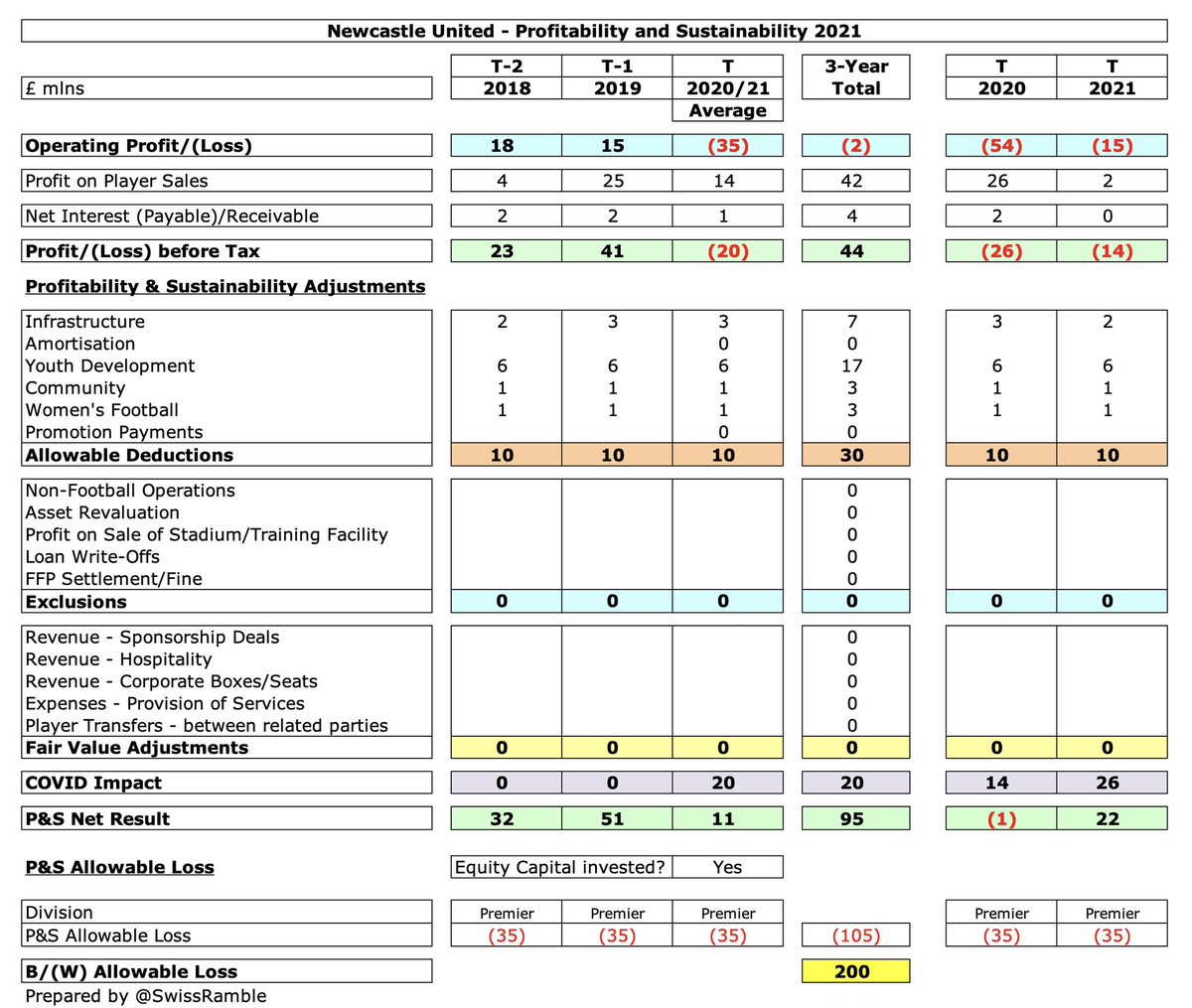

Ironically, Ashley’s parsimonious approach to spending in the last few years has left #NUFC with plenty of wriggle room under the Premier League’s Profitability & Sustainability rules. After allowable deductions and adjustments for COVID impact, I estimate this as £200m.

In theory, #NUFC could splash out around £600m on transfers (say, 4 top class players at £150m each), increasing player amortisation by £120m a year (assuming 5-year contract), while increasing the wage bill by £62m (with players paid £300k a week) and still be below £200m.

However, that would use up #NUFC entire FFP limit in one year, which would cause a problem in following years – unless they grow revenue. So it might be more sensible to spend less, say 4 players for £50m each on £100k wages, which would give a £61m annual impact.

In fact, #NUFC transfer activity last summer and the January transfer window has already led to an increase in annual costs of around £52m, so the point here is that the club *could* spend more, but they will want to give themselves some room to manoeuvre in future windows.

Eddie Howe confirmed the #NUFC approach: “With FFP, we have restraints. We can't just go out and spend money on players like maybe teams could have done in the past. The more money you spend in one window, the more it impacts your ability to then spend in windows beyond.”

While #NUFC will undoubtedly spend this summer, it is therefore unlikely they will make a huge splash in the transfer market. However, it is a whole new ball game under the Saudi owners with Amanda Staveley stating, “We have the same ambitions as #MCFC – in terms of trophies.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh