#THREAD on #WHAT is #RBI likely to do tomorrow at the #MPC and #Why and how it would #IMPACT Markets? #RETWEET

(1) A rate Hikes I’d probably 30-40bps

(2) More #Importantly, a 25-50bp CRR Hike as well

What are the Drivers of this Decision?

(1) A rate Hikes I’d probably 30-40bps

(2) More #Importantly, a 25-50bp CRR Hike as well

What are the Drivers of this Decision?

RBI biggest Driver of Policy in my view is FOREX.

India is suffering Daily Forex Outflows Due to

(1) high Commodity Prices (Oil & Coal etc)

(2) FPI outflows

(3) Rising Remittances while FDI has slowed down

Recall that Jndia is still NOT added to the JPM EM debt Index (NA)

India is suffering Daily Forex Outflows Due to

(1) high Commodity Prices (Oil & Coal etc)

(2) FPI outflows

(3) Rising Remittances while FDI has slowed down

Recall that Jndia is still NOT added to the JPM EM debt Index (NA)

Two ways to arrest the INR depreciation is to raise Rates (REPO) or reduce Liquidity (CRR)

But we know India has a Demand Issue.

More #IMPORTANTLY, higher Rates will HURT the Govts Borrowing Cost and Eventually Raise System Deposit Rates

But we know India has a Demand Issue.

More #IMPORTANTLY, higher Rates will HURT the Govts Borrowing Cost and Eventually Raise System Deposit Rates

By Raising CRR, the INR depreciation can be partially reduced without using FOREX which is at a SEVERAL Quarter low.

But what happens if CRR Zia Raised ?

But what happens if CRR Zia Raised ?

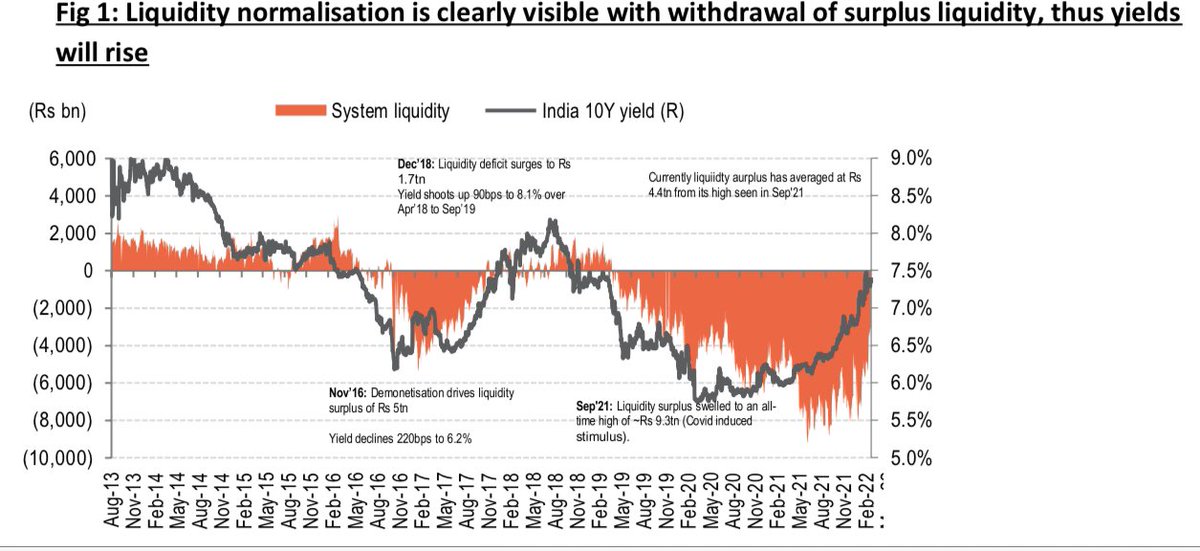

Now let’s look at Banking #System #Liquidity. Give the very strong Credit growth due to Working Capital requirements by SME/CORP India, System liquidity has fallen very sharply (CHART) to Feb 2020 levels (Pre-Covid). It’s important to look af this Chart as % GDP or System Credit

As of May 20…. (source Link) YTD Incremental Credit to Deposit Ratio is 130%. Basically NOT ENOUGH of Deposits. This Ratio for the Whole of FY22 was only 70% (100% plus last few months)

BUT FY23 for System Liquidity is very Complex Vs FY22 - WHY ?

rbidocs.rbi.org.in/rdocs/content/…

BUT FY23 for System Liquidity is very Complex Vs FY22 - WHY ?

rbidocs.rbi.org.in/rdocs/content/…

Why is FY23 More complicated for banking Sector Liquidity?

(1) In FY22, small savings collections exceeded budgeted by Rs2 trn resulted in net borrowing falling short by Rs1.7trn

(2) FY23 with net borrowings increasing Rs 4.1trn & small savings supposed less by Rs 1.7trn

(1) In FY22, small savings collections exceeded budgeted by Rs2 trn resulted in net borrowing falling short by Rs1.7trn

(2) FY23 with net borrowings increasing Rs 4.1trn & small savings supposed less by Rs 1.7trn

RBI is Torn between the INR, FOREX and System Liquidity. Given that Banks Enjoyed all these years of RECORD NIMS, RBI will likely to be okay with Raising CRR to help INR so that FX RESERVES are not used !!

NOTE: RBIs FX reserves is key DRIVER of GOVT Dividends. Let me explain

NOTE: RBIs FX reserves is key DRIVER of GOVT Dividends. Let me explain

DID YOU KNOW @RBI recorded a Significant MTM of Rs94000 CR in their FX RESERVES. Overall RBI lost Rs110000 Cr in FY22 due to this FX (UST Rates rising) and Money Market Intervention to Help the Govt.

DETAILS in the RBI Annual Rpt.

EXCELLENT #Thread

DETAILS in the RBI Annual Rpt.

EXCELLENT #Thread

https://twitter.com/felmanjosh/status/1530355081027149824

One more UNDER Appreciated issue for the RBI (Table) . There is now precisely ZERO BUFFER in the foreign account (IRA-FS). The buffer in the rupee account (IRA-RS) is also low. So, as interest rates continue to rise, provisions will soar. Then RBI profits will really crash.

https://twitter.com/felmanjosh/status/1530355086022647808

WHAT does all of this mean ?

RBI Dividends CRASHED in FY22 to Rs0.3tr. from Rs1trn in FY21.

With NO BUFFER Available to generate DIV (rising UST 10yr causing MTM Loss) for Govt which is short of Revenues in FY23, RBI has NO choice but to Allow the INR To FALL!

RBI Dividends CRASHED in FY22 to Rs0.3tr. from Rs1trn in FY21.

With NO BUFFER Available to generate DIV (rising UST 10yr causing MTM Loss) for Govt which is short of Revenues in FY23, RBI has NO choice but to Allow the INR To FALL!

Now the #Beauty of this is #RBI can always #JUSTIFY #INR #DEPRECIATION given several ASIAN EXPORTING Currencies like #JPY, #KRW, #CNH which have SEVERELY Depreciated YTD (INR Stands out)

So Expect the INR to keep depreciating. It’s not as inflationary as people might believe.

So Expect the INR to keep depreciating. It’s not as inflationary as people might believe.

So now that you KNOW that @RBI is caught in a hard position, to reduce the USE of PRECIOUS USD FOREX (Namo’s “Narrative”) to defend the INR due to OUTFLOWS & Fund the rising Current account Deficit (CAD) RBI is likely to use a combination of CRR and RATES tomorrow.

I FEEL #Indian #equity Markets are #Underestimating the impact of a CRR hike on Yields, Deposit Rates and Liquidity…

HERE IS WHY….

HERE IS WHY….

At the Beginning I mentioned that INCREMENTAL CREDIT TO DEPOSIT Ratio was upwards of 100% and there is an Issue for Small Savings Schemes in FY23, with Just Rs3.5-3.8 Trn of Liquidity, every 50bps impact of CRR will suck out 0.85trn.

Naturally DEPOSIT RATES will rise Rapidly

Naturally DEPOSIT RATES will rise Rapidly

#HDFC & @HDFCBank_Cares Angle. If my memory serves me right HDFC Bank is already Garnering 25% of System Incremental Deposits Pre the @HomeLoansByHDFC merger. With the Merger, My guess is that @HDFC_Bank will be trying to garner 35% of the SYSTEMS INCREMENTAL DEPOSITS

#BottomLine - Liquidity will be very Tight, IND 10yr GSEC Rates will break though 7.8-8%

#REMEMBER that IND 10yr GSEC of 7.4% is a VERY CRUCIAL level. Bank Treasury Books are Protected till 7.4%. So further rally will hurt Bank Profitability especially of PSU banks

#REMEMBER that IND 10yr GSEC of 7.4% is a VERY CRUCIAL level. Bank Treasury Books are Protected till 7.4%. So further rally will hurt Bank Profitability especially of PSU banks

So when IND GSEC Spikes while Analysts will Argue that Bank NIMs will benefit. UNFORTUNATELY Bank NIMs have already started falling In Nov-21 (Chart of Weighted Avg Deposits vs Weighted Avg Lending Rate)

So RBI REPO hikes (for loans) Might NOT OFSET DEPOSIT rates increase

So RBI REPO hikes (for loans) Might NOT OFSET DEPOSIT rates increase

UPDATE: So the RBI chose to only hike up rates by 50bps rather than use the CRR window. Well, it simply means they are okay with the depreciation of the INR & won’t intervene aggressively.

• • •

Missing some Tweet in this thread? You can try to

force a refresh