YETI FINANCE - INNOVATIVE LENDING PROTOCOL

Dive in to learn more about @YetiFinance! This thread 🧵will cover 4 main points:

- What problems does CDP solve?

- What is Yeti Finance?

- How does it work?

- Yeti Finance's Stablecoin: $YUSD

#AvaxholicAnalytics #AVAXDT #CSSADT

Dive in to learn more about @YetiFinance! This thread 🧵will cover 4 main points:

- What problems does CDP solve?

- What is Yeti Finance?

- How does it work?

- Yeti Finance's Stablecoin: $YUSD

#AvaxholicAnalytics #AVAXDT #CSSADT

1. PROBLEMS & SOLUTIONS

Lending projects for #DeFi have similar role as banks in traditional markets, where they allow capital to flow freely and stimulating economic development.

Lending projects are classified into 2 types: Third party and First party. 👇

Lending projects for #DeFi have similar role as banks in traditional markets, where they allow capital to flow freely and stimulating economic development.

Lending projects are classified into 2 types: Third party and First party. 👇

Third Party: An intermediary protocol for users to deposit tokens to earn interest and receive profit when lending those tokens back to others.

- Users can borrow & lend

- Not sufficient when the demand for #stablecoins loans is large

- Featured project: @AaveAave with TVL: $6.3B

- Users can borrow & lend

- Not sufficient when the demand for #stablecoins loans is large

- Featured project: @AaveAave with TVL: $6.3B

First Party: also known as CDP (Collateralized Debt Position), allow users to lock up collateral and b able to borrow the #stablecoins of the protocol itself.

- Users can only borrow

- The stablecoin supply is limitless, satisfying the immediate demand for users 🤩

- Users can only borrow

- The stablecoin supply is limitless, satisfying the immediate demand for users 🤩

- Featured project: @MakerDAO with TVL: $8B

=> CDP's mechanism helps effectively solve users' demand for stablecoin loans with an infinite supply and cheaper borrowing rates. 🧐

(Stability fee of MakerDAO: <2.5% depends on collateral, interest fee of AAVE for stablecoins: >3.5%)

=> CDP's mechanism helps effectively solve users' demand for stablecoin loans with an infinite supply and cheaper borrowing rates. 🧐

(Stability fee of MakerDAO: <2.5% depends on collateral, interest fee of AAVE for stablecoins: >3.5%)

2. TRENDS OF USING ON-CHAIN STABLECOINS

The image below is the annual on-chain transaction volume per unit supply of the stablecoin (1 year on-chain volume divided by the total supply of the stablecoin).

The image below is the annual on-chain transaction volume per unit supply of the stablecoin (1 year on-chain volume divided by the total supply of the stablecoin).

$DAI is the most used #StableCoin minted from the CDP @MakerDAO protocol. 👏

=> Decentralize stablecoins from the trusted and heavily used CDP protocol from the community.

=> Decentralize stablecoins from the trusted and heavily used CDP protocol from the community.

3. WHAT IS YETI FINANCE?

@YetiFinance is an advanced decentralized Lending protocol built on #Avalanche that seeks to increase capital efficiency with 0% lending rate to help users maximize profits when farming. 🥰

@YetiFinance is an advanced decentralized Lending protocol built on #Avalanche that seeks to increase capital efficiency with 0% lending rate to help users maximize profits when farming. 🥰

4. TEAM

Despite the anonymous team, we know that there are 3 co-founders:

- 2⃣ Computer Scientists: designing risk parameters, cryptographic codes and strategic visions

- 1⃣ Entrepreneur: promoting the project's vision, developing strategic partnerships and growing the community

Despite the anonymous team, we know that there are 3 co-founders:

- 2⃣ Computer Scientists: designing risk parameters, cryptographic codes and strategic visions

- 1⃣ Entrepreneur: promoting the project's vision, developing strategic partnerships and growing the community

5. BACKERS & PARTNERS

- Invested by the #Avalanche Foundation with @traderjoe_xyz, @gbvofficial

- Collaborations with leading protocols:

+ @AaveAave V3: allows users to mortgage and borrow with more than $1B of assets deposited on Aave at 0% interest.

- Invested by the #Avalanche Foundation with @traderjoe_xyz, @gbvofficial

- Collaborations with leading protocols:

+ @AaveAave V3: allows users to mortgage and borrow with more than $1B of assets deposited on Aave at 0% interest.

+ @BenqiFinance: AVAX's largest lending protocol with over $200M TVL

+ @traderjoe_xyz: AVAX's Top 1 DEX

+ @Platypusdefi: Largest stablecoin pool on AVAX, creating liquidity for $YUSD

+ @chainlink: Top 1 Oracle - whose Price Feeds has been integrated by Yeti on AVAX mainnet

+ @traderjoe_xyz: AVAX's Top 1 DEX

+ @Platypusdefi: Largest stablecoin pool on AVAX, creating liquidity for $YUSD

+ @chainlink: Top 1 Oracle - whose Price Feeds has been integrated by Yeti on AVAX mainnet

6. TOKENOMICS

Total Supply: 500,000,000 $YETI 😯

- Community Incentives: 50%

- Team: 25%

- Foundation: 15%

- Strategy Investors: 1.17%

- Future Investor: 8.83%

#AVAX #Crypto #Blockchain #DeFi #lendingprotocols

Total Supply: 500,000,000 $YETI 😯

- Community Incentives: 50%

- Team: 25%

- Foundation: 15%

- Strategy Investors: 1.17%

- Future Investor: 8.83%

#AVAX #Crypto #Blockchain #DeFi #lendingprotocols

7. OPERATING MODEL

There are 4⃣ main components:

- Trove: Helps manage collateralized debt (CDP) positions.

- Stability Pool: Mechanism to make liquidation of debt positions simpler and more efficient

There are 4⃣ main components:

- Trove: Helps manage collateralized debt (CDP) positions.

- Stability Pool: Mechanism to make liquidation of debt positions simpler and more efficient

- Recovery Mode: Activated when the total collateral ratio is < 150%, increasing the security of this protocol

- Cross-margin: Allows opening a loan position in the entire portfolio

- Cross-margin: Allows opening a loan position in the entire portfolio

7.1/ Collateral assets are accepted 😉

- Synthetics tokens: aWAVAX, aWETH, aUSDT, aDAI, qiUSDC, qiAVAX, qiDAI, sAVAX, sJOE, etv

- Native tokens: USDC

- Liquidity Provide tokens: USDC/AVAX JLP WETH/WAVAX JLP

- Synthetics tokens: aWAVAX, aWETH, aUSDT, aDAI, qiUSDC, qiAVAX, qiDAI, sAVAX, sJOE, etv

- Native tokens: USDC

- Liquidity Provide tokens: USDC/AVAX JLP WETH/WAVAX JLP

7.2/ Mint & Redeem Mechanism

1. Select the token you want to mortgage to create a Trove.

2. Mortgage your token in and choose the amount of $YUSD you want to borrow (📌 less than the collateral value).

3. The user pays the $YUSD owed and gets the collateral back.

1. Select the token you want to mortgage to create a Trove.

2. Mortgage your token in and choose the amount of $YUSD you want to borrow (📌 less than the collateral value).

3. The user pays the $YUSD owed and gets the collateral back.

7.3/ How Yeti Finance make revenue

The protocol only charges 1 time per user loan, unlike the % interest rate of @MakerDAO & @AaveAave.

- Deposit fees 0.15%-1% depending on collateral risk

- $YUSD Borrow Fee: ~1.4%

- $YUSD Redemption Fees ~1%

- Liquidation Fees ~10%

The protocol only charges 1 time per user loan, unlike the % interest rate of @MakerDAO & @AaveAave.

- Deposit fees 0.15%-1% depending on collateral risk

- $YUSD Borrow Fee: ~1.4%

- $YUSD Redemption Fees ~1%

- Liquidation Fees ~10%

👀 Currently, the project has not yet announced how the protocol's revenue will be distributed.

8. USE CASE - HOW IS YETI USED TO CAPTURE VALUE

- Governance in the future

- To farm in other #DeFi protocols on #Avalanche such as @Platypusdefi, @CurveFinance, @traderjoe_xyz, etc

8. USE CASE - HOW IS YETI USED TO CAPTURE VALUE

- Governance in the future

- To farm in other #DeFi protocols on #Avalanche such as @Platypusdefi, @CurveFinance, @traderjoe_xyz, etc

... or farm in Stability Pools to receive $YETI rewards.

- To stake and get $veYETI, then $veYETI can be used to:

+ Increase rewards for liquidity providers of YUSD pools

+ Increase Stability Pool bonus

+ Reduce auto-compounding fees

+ Access future special farming strategies

- To stake and get $veYETI, then $veYETI can be used to:

+ Increase rewards for liquidity providers of YUSD pools

+ Increase Stability Pool bonus

+ Reduce auto-compounding fees

+ Access future special farming strategies

=> The $veYETI model is designed to incentivize users to accumulate and deposit $YETI through providing user benefits. When you cancel $YETI, you will lose your $veYETI balance, similar to $vePTP and $veJOE! 🤔

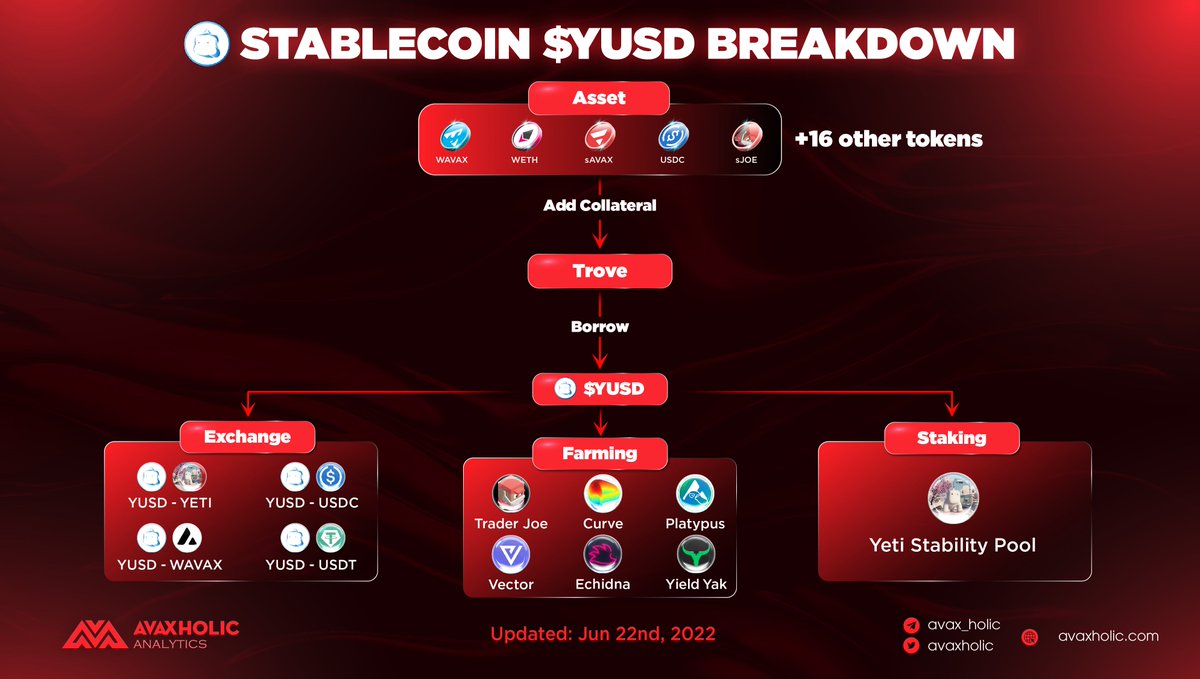

9. YETI FINANCE'S FINANCE STABLECOIN YUSD

9.1/ Collateral Ratio

Although the minimum collateral rate is 110%, the overall current mortgage rate of the protocol is in the 200% range.

=> Users mortgage $2000 AVAX but borrow only $1000 YUSD which helps the protocol avoid bad debt.

9.1/ Collateral Ratio

Although the minimum collateral rate is 110%, the overall current mortgage rate of the protocol is in the 200% range.

=> Users mortgage $2000 AVAX but borrow only $1000 YUSD which helps the protocol avoid bad debt.

9.2/ How YUSD keeps peg 1:1 USD

- When LUSD falls below $1:

The price of YUSD in trading market is below $1, but the value of YUSD is still $1 in @YetiFinance, which would encourage:

- When LUSD falls below $1:

The price of YUSD in trading market is below $1, but the value of YUSD is still $1 in @YetiFinance, which would encourage:

+ Users with debt positions in the protocol buy YUSD from the secondary market.

+ Then pay the delivery debt and earn the profit differently. 💹

+ Then pay the delivery debt and earn the profit differently. 💹

- When LUSD rises above $1:

The price of YUSD in the trading market is above $1. Since the price of YUSD is still $1 in @YetiFinance's system, users will have an opportunity to arbitrage by:

The price of YUSD in the trading market is above $1. Since the price of YUSD is still $1 in @YetiFinance's system, users will have an opportunity to arbitrage by:

- Loading collateral into @LiquityProtocol to borrow more $LUSD.

- Then selling them on the market to enjoy the price difference

- Then selling them on the market to enjoy the price difference

9.3/ Liquidity of YUSD

The liquidity pool on @CurveFinance shows that YUSD completely solves users' need to convert to $USDC or $USDT with a ratio of almost 1:1.

The liquidity pool on @CurveFinance shows that YUSD completely solves users' need to convert to $USDC or $USDT with a ratio of almost 1:1.

On @Platypusdefi, the amount of $USDC is 2⃣ as large as the amount of $YUSD, indicating that liquidity is always met.

#AVAX #Avalanche #Crypto #DeFi #StableCoin

#AVAX #Avalanche #Crypto #DeFi #StableCoin

11. CLOSE THOUGHTS

11.1/ Opportunity

The CDP project's development will be based on the expansion of demand and use cases for the protocol's #StableCoin. Therefore, the MC/Supply ratio is a method of valuing the project. 🧐

11.1/ Opportunity

The CDP project's development will be based on the expansion of demand and use cases for the protocol's #StableCoin. Therefore, the MC/Supply ratio is a method of valuing the project. 🧐

Yeti Finance is being valued much less when it has a ratio of only 1/6 of @MakerDAO & of 1/10 @LiquityProtocol.

TVL of @avalancheavax is in TOP 3, showing that the #DeFi cash flow here is more abundant than in other systems, farmers will be able to ...

TVL of @avalancheavax is in TOP 3, showing that the #DeFi cash flow here is more abundant than in other systems, farmers will be able to ...

... choose @YetiFinance as the place to help optimize the efficiency of their capital. From there, the protocol will gain a lot of profit. 🥰

12. CHALLENGE

- Highly dependent on the general #DeFi market:

12. CHALLENGE

- Highly dependent on the general #DeFi market:

When bear market:

Token price decreases -> Call Liquidation -> Users sell tokens, get #StableCoin to pay for the protocol -> Large selling force lowers prices -> Collateral value continues to decrease

=> The needle that hits the ball, everyone panics when the market fluctuates.

Token price decreases -> Call Liquidation -> Users sell tokens, get #StableCoin to pay for the protocol -> Large selling force lowers prices -> Collateral value continues to decrease

=> The needle that hits the ball, everyone panics when the market fluctuates.

- Currently, $YUSD is only available and used for farming in major protocols in the #Avalanche ecosystem. In order to expand its use, $YUSD in the future needs to be applied in more cases, specifically: 🤔

- Integrating into new chains with many users such as @BNBCHAIN, @solana, @ethereum,

- Increasing the number of trading pairs on the #DEX

- Being accepted by many protocols as collateral (Lending)

- Increasing the number of trading pairs on the #DEX

- Being accepted by many protocols as collateral (Lending)

Hope this thread could broaden your knowledge about this lending protocol @YetiFinance on Avalanche!

Like & RT if it's helpful and share your thoughts here 👉t.me/avaxholic_chat

Like & RT if it's helpful and share your thoughts here 👉t.me/avaxholic_chat

• • •

Missing some Tweet in this thread? You can try to

force a refresh