4 RICO not suave

#JPMorgan traders

go on trial today🧵

Wait?!

US DoJ claims PM mkts 'were' criminal

JPMorgan still dominates US precious metals derivative mkt share

This topic is way deeper than mere greed

- bloom.bg/3Pf2W97 -

2 Bloomberg reporters tagged below

#JPMorgan traders

go on trial today🧵

Wait?!

US DoJ claims PM mkts 'were' criminal

JPMorgan still dominates US precious metals derivative mkt share

This topic is way deeper than mere greed

- bloom.bg/3Pf2W97 -

2 Bloomberg reporters tagged below

https://twitter.com/jameshenryand/status/1418289207131451400

IRONIC TIMING:

💣former London gold trader

precious metals mkt makers increasingly use unsecured derivatives to subvert mkt forces, now decades running:

reaction.life/dont-forget-th…

"Once investors swallowed this stupefying pill it was easy to sell them gold that simply didn’t exist."

💣former London gold trader

precious metals mkt makers increasingly use unsecured derivatives to subvert mkt forces, now decades running:

reaction.life/dont-forget-th…

"Once investors swallowed this stupefying pill it was easy to sell them gold that simply didn’t exist."

JPMorgan

paid a paltry $920 million fine

for the US Department of Justice's 8 yr RICO precious metals rigging indictment 2008-2016

US Office of the Comptroller of the fiat Currency

often known by the acronym OCC just acknowledged Q1 22 that +90% of PM derivatives = JPMorgan/Citi

paid a paltry $920 million fine

for the US Department of Justice's 8 yr RICO precious metals rigging indictment 2008-2016

US Office of the Comptroller of the fiat Currency

often known by the acronym OCC just acknowledged Q1 22 that +90% of PM derivatives = JPMorgan/Citi

Waterfall price declines like 2 obvious ones below represent handfuls of billions in profits in mere weeks of time, for those concentrated on the short side, likely then churning long in the bounce from the fall they exacerbate

2011 Silver

& related COMEX $SI price chart below

2011 Silver

& related COMEX $SI price chart below

'body that runs the London gold market'

called

London Bullion Market Association (LBMA)

Two co-heads of JPMorgan's RICO precious metals desk were 'esteemed' LBMA board members

Nowak now on trial,

Sid Tipples still working in seemingly lawless London

called

London Bullion Market Association (LBMA)

Two co-heads of JPMorgan's RICO precious metals desk were 'esteemed' LBMA board members

Nowak now on trial,

Sid Tipples still working in seemingly lawless London

https://twitter.com/jameshenryand/status/1175120534457212929

GOLD & PRECIOUS METALs

price rigs⬇️⬆️aren't just short term

cyclical driven by greedy conspiring traders

Often deeper long-term secular by design, govt decree, even international coordination

coming Bullion Shortage

is COMEX/London's future public trial

price rigs⬇️⬆️aren't just short term

cyclical driven by greedy conspiring traders

Often deeper long-term secular by design, govt decree, even international coordination

coming Bullion Shortage

is COMEX/London's future public trial

Globally greedy smaller fry PM traders

are often so disconnected & stupid

they leave mkt rig evidence in writing

Rare they nor supervisors end up in prison

Unsecured bank shareholders typically only take the hit in fines, bad press, & lawsuit settlements

are often so disconnected & stupid

they leave mkt rig evidence in writing

Rare they nor supervisors end up in prison

Unsecured bank shareholders typically only take the hit in fines, bad press, & lawsuit settlements

#Silver is a tiny mkt JPMorgan is still alleged to often throw around for profits

People often forget,

outsized leverage to create phony mkt signals cuts both ways. Wall climbing price rises often follow mkt hammerings (e.g., think -oil 2020 to ahead)

People often forget,

outsized leverage to create phony mkt signals cuts both ways. Wall climbing price rises often follow mkt hammerings (e.g., think -oil 2020 to ahead)

for NOW🧵end

I'll follow this 4 trader JPMorgan RICO trial

as I have from the start of the indictment

Whatever justice actually gets served, there's a whole lot more coming as financial mkts & confidence inevitably devolve via corrupt seeds allowed sown

I'll follow this 4 trader JPMorgan RICO trial

as I have from the start of the indictment

Whatever justice actually gets served, there's a whole lot more coming as financial mkts & confidence inevitably devolve via corrupt seeds allowed sown

Today FRIDAY

jurors basically got read

a cursory RICO act on alleged precious metals price rigging 2008-2016 via #JPMorgan's PM desk

--

bloomberg.com/news/articles/…

jurors basically got read

a cursory RICO act on alleged precious metals price rigging 2008-2016 via #JPMorgan's PM desk

--

bloomberg.com/news/articles/…

No Paywall on Today's JP Morgan RICO Trial Start

https://twitter.com/WallStreetSilv/status/1545581250693320705

DYK?

There were 2

Co-Head's of #JPMorgan's

alleged RICO precious metals rig 2008-16

--

Both were 'esteemed' #LBMA Board members

#MichaelNowak now on trial in USA

#SidTipples resigned early'18, not indicted,

still works City of London commodity mkts👍

sdbullion.com/blog/jp-morgan…

There were 2

Co-Head's of #JPMorgan's

alleged RICO precious metals rig 2008-16

--

Both were 'esteemed' #LBMA Board members

#MichaelNowak now on trial in USA

#SidTipples resigned early'18, not indicted,

still works City of London commodity mkts👍

sdbullion.com/blog/jp-morgan…

Spoof traders & past tense, how it gets framed

nypost.com/2022/07/08/ex-…

The truth is current PM dominance by JPMorgan is more profitable than past paltry fines or ongoing bad press: nasdaq.com/articles/exclu…

nypost.com/2022/07/08/ex-…

The truth is current PM dominance by JPMorgan is more profitable than past paltry fines or ongoing bad press: nasdaq.com/articles/exclu…

VIDEO LOOKBACK

JPMorgan's 21st Century dominance in PM Mkts

After #BearsSterns bank failed in early 2008 GFC,

#JPMorgan inherited its bankrupt PM Desk & also reportedly hired many of their spoof-skilled PM traders

disgraceful^^

#CFTC admittances follow^^

JPMorgan's 21st Century dominance in PM Mkts

After #BearsSterns bank failed in early 2008 GFC,

#JPMorgan inherited its bankrupt PM Desk & also reportedly hired many of their spoof-skilled PM traders

disgraceful^^

#CFTC admittances follow^^

21st Century CYNICS

on alleged mkt riggings

or on failed prosecutions in this

golden age of fraud as a business model

they've been proven sage,

inferring the Rule of Law is pretty much

only for small fry, multinational banks are exempt

RIP Rob Kirby

on alleged mkt riggings

or on failed prosecutions in this

golden age of fraud as a business model

they've been proven sage,

inferring the Rule of Law is pretty much

only for small fry, multinational banks are exempt

RIP Rob Kirby

Price Rigging Precious Metals Markets

was an open London USA conspiracy

From 1960s London Gold Pool price fix rig fail

to closed

1974 US Treasury cable from London (h/t #Wikileaks)

price of gold -1/2'd from $200 to $100 oz not long after

was an open London USA conspiracy

From 1960s London Gold Pool price fix rig fail

to closed

1974 US Treasury cable from London (h/t #Wikileaks)

price of gold -1/2'd from $200 to $100 oz not long after

https://twitter.com/jameshenryand/status/816065891741921281💯% mkt rig facts

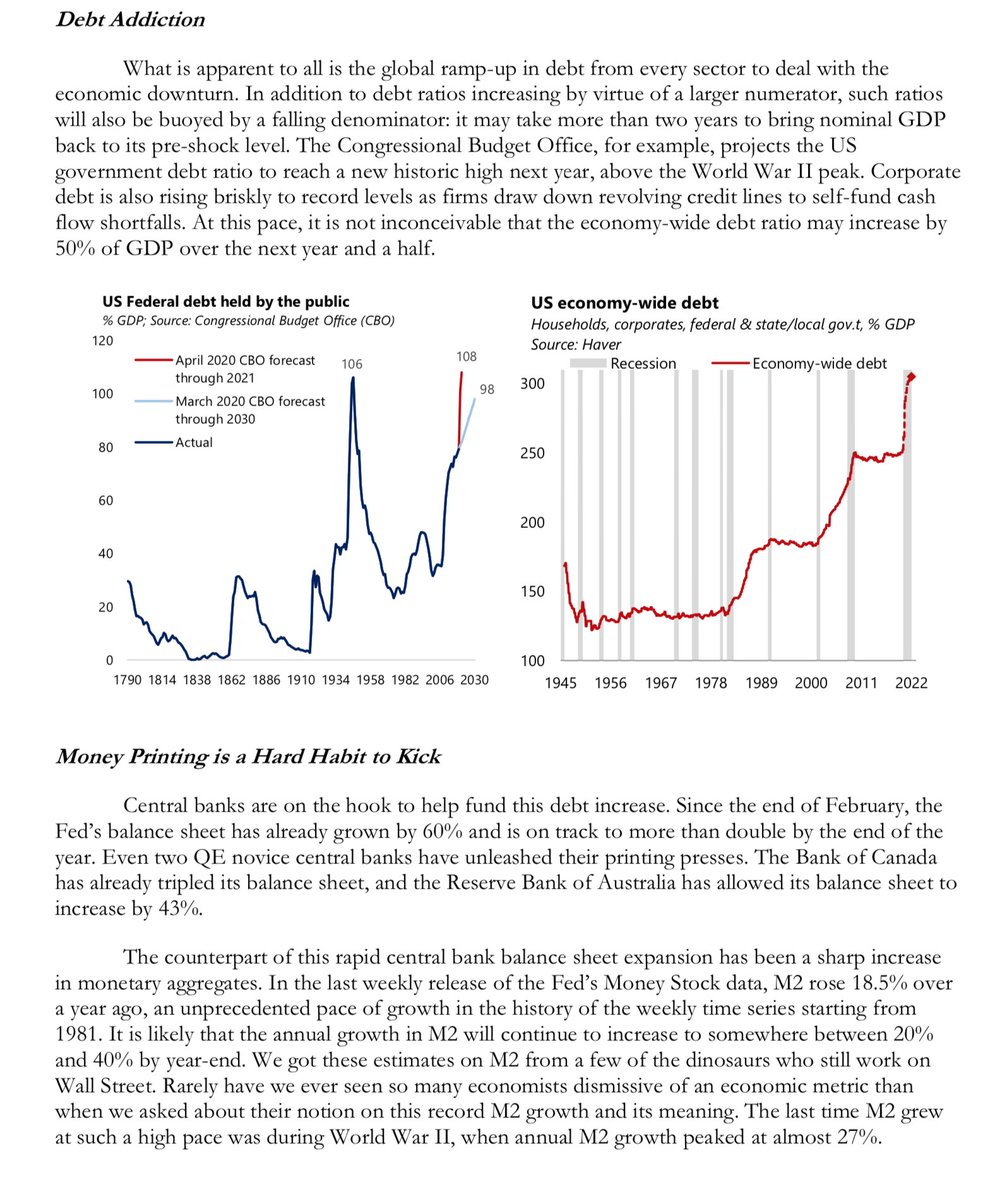

Paul Volker

before he died literally

called #Gold: 'The Enemy' in headlines

You'd have to be a child, an arrogant fool, or in some form on the take to claim PM price perceptions aren't of gov't import, especially after blowing out global fiat currency supply levels post Aug-2019

before he died literally

called #Gold: 'The Enemy' in headlines

You'd have to be a child, an arrogant fool, or in some form on the take to claim PM price perceptions aren't of gov't import, especially after blowing out global fiat currency supply levels post Aug-2019

RUSSIA & CHINA's

OFFICIAL GOLD RESERVEs reported have been coordinated mirrors of one another this 21st Century

If we really wanted to keep 'em growing closer last few decades, we failed as they've divested into major Gold players in more multipolar world

OFFICIAL GOLD RESERVEs reported have been coordinated mirrors of one another this 21st Century

If we really wanted to keep 'em growing closer last few decades, we failed as they've divested into major Gold players in more multipolar world

Most retail precious metals bulls simply

leave derivative leverage to professional traders

Instead, they simply stack #Bullion for the long haul

--

Precious Metals Spoofing Trials

Show Too Much Deceit In Play For 'Little Guy'

investing.com/analysis/preci…

leave derivative leverage to professional traders

Instead, they simply stack #Bullion for the long haul

--

Precious Metals Spoofing Trials

Show Too Much Deceit In Play For 'Little Guy'

investing.com/analysis/preci…

LOOKBACK to

March 2, 2011, with

silver spot price near $35 oz, ∞QE∞ just starting

archive.nytimes.com/opinionator.bl… #Silver $Silver

March 2, 2011, with

silver spot price near $35 oz, ∞QE∞ just starting

archive.nytimes.com/opinionator.bl… #Silver $Silver

“I wanted to drive the price where I wanted it to go” by creating a false indication of demand alleged JPMorgan Precious Metals derivative trader John Edmonds.

50,000+ spoofs over nearly a decade of time

Sweet mkts @CFTC

--

50,000+ spoofs over nearly a decade of time

Sweet mkts @CFTC

--

https://twitter.com/Edspencive/status/1546974019035054080

@CFTC Breaking laws be damned apparently...

"Our job was to do whatever it takes to make money."

-John Edmonds, former JPMorgan PM trader

"Our job was to do whatever it takes to make money."

-John Edmonds, former JPMorgan PM trader

@CFTC Paul Tudor Jones' firm

gets dragged into this former

JPMorgan RICO precious metals spoof trading trial

bloomberg.com/news/articles/…

PTJ has warned how crazy commodity valuations might get later this decade as hot money momentum floods in

gets dragged into this former

JPMorgan RICO precious metals spoof trading trial

bloomberg.com/news/articles/…

PTJ has warned how crazy commodity valuations might get later this decade as hot money momentum floods in

https://twitter.com/jameshenryand/status/1404867445962297344

@CFTC @ptj_official so for example:

900 futures contracts X 100 oz equivalent gold

thus every +/-$10 oz move by Gold

is nearly +/-$1 million to profit or loss

daily

2012 #Gold Prices below

nice ramps late Jan into late Feb '12:

sdbullion.com/gold-prices-20…

PTJ trading 1986:

900 futures contracts X 100 oz equivalent gold

thus every +/-$10 oz move by Gold

is nearly +/-$1 million to profit or loss

daily

2012 #Gold Prices below

nice ramps late Jan into late Feb '12:

sdbullion.com/gold-prices-20…

PTJ trading 1986:

When does @mtaibbi dare

try to take on this precious metals price rig saga?

Not merely from Bear Sterns fail to JPMorgan RICO desk & recent OCC gold derivative ramp not-FX disclosure

Maybe give Chris Powell from GATA

a few phone calls Matt:

try to take on this precious metals price rig saga?

Not merely from Bear Sterns fail to JPMorgan RICO desk & recent OCC gold derivative ramp not-FX disclosure

Maybe give Chris Powell from GATA

a few phone calls Matt:

https://twitter.com/jameshenryand/status/1261717412866555904

JPMorgan #RICO spoof trial

is but a glimpse inside a corrupt price discovery system for #Silver #Gold yr to yr, decade after decade

Indicted on trial Michael Nowak

& his trader underlings

But🇺🇸mkt rigging price data is systemic

more crime than mere🤡trader bonus greed involved

is but a glimpse inside a corrupt price discovery system for #Silver #Gold yr to yr, decade after decade

Indicted on trial Michael Nowak

& his trader underlings

But🇺🇸mkt rigging price data is systemic

more crime than mere🤡trader bonus greed involved

More Important than 4 former JPMorgan precious metals price rigging trial is damning 2010-2022 #silver #gold price data

#COMEX has left smoking guns

all over $GC & $SI mkts

via systematic value suppressing trading hour data we go through here:

#COMEX has left smoking guns

all over $GC & $SI mkts

via systematic value suppressing trading hour data we go through here:

After early 2008 $Silver helped bankrupt Bear Sterns’ desk

Many former Bear Sterns traders ended up at JPMorgan’s RICO precious metals derivatives desk

Many former Bear Sterns traders ended up at JPMorgan’s RICO precious metals derivatives desk

https://twitter.com/Edspencive/status/1549098329811861504

$Gold fell -$500 oz or -30% on yr

spoof scares by July 2013 bounce must’ve been effective after $GC longs got waterfall decline raped so often

+100 spoofs a day by admitted #Gold price rig Gregg👍🏽

Meanwhile crime assisted

#China who took mass

western ETF Gold Bullion🇨🇳🫠cheap

spoof scares by July 2013 bounce must’ve been effective after $GC longs got waterfall decline raped so often

+100 spoofs a day by admitted #Gold price rig Gregg👍🏽

Meanwhile crime assisted

#China who took mass

western ETF Gold Bullion🇨🇳🫠cheap

https://twitter.com/goldseek/status/1549296820035125248

Daddy

"worked at #JPMorgan for decades and was a senior executive"

... in🤡🌎🌍🌏Precious Metals price discovery:

straitstimes.com/business/banki…

re: #RICO #JPMorgan #Spoof #Trial #Gold #Silver $Gold $Silver #Platinum #Palladium $GC $GC_f $SI

"worked at #JPMorgan for decades and was a senior executive"

... in🤡🌎🌍🌏Precious Metals price discovery:

straitstimes.com/business/banki…

re: #RICO #JPMorgan #Spoof #Trial #Gold #Silver $Gold $Silver #Platinum #Palladium $GC $GC_f $SI

• • •

Missing some Tweet in this thread? You can try to

force a refresh