West Bromwich Albion’s 2020/21 accounts covered a season when they finished 19th in the Premier League, leading to relegation to the Championship. Coach Slaven Bilic replaced by Sam Allardyce in December 2020, subsequently succeeded by Valerien Ismael, then Steve Bruce #WBA

#WBA swung from £23m pre-tax loss to a small £0.1m profit, as revenue almost doubled from £54m to £107m following promotion to the Premier League, though profit on player sales fell £25m to £4m and operating expenses rose £4m (4%) in the top flight.

Main driver of #WBA £53m revenue increase was broadcasting, up £56m from £41m to £97m, due to the more lucrative Premier League TV deal, though commercial also grew £2m (21%) to £10m. This offset the COVID driven reduction in gate receipts, down £4.8m (98%) to just £74k.

#WBA wages rose £10m (15%) from £67m (including hefty promotion bonus) to £77m, while player amortisation rose £5m (26%) to £25m. However, there was no repeat of prior year £6m player impairment, while other expenses were down £5m (38%), due to lower costs of staging games BCD.

#WBA were one of only five Premier League clubs to report a pre-tax profit in 2020/21, though two of those suffered relegation. #WWFC £145m boosted by £127m loan write-off. A full year of COVID meant some very large losses elsewhere, e.g. #CFC £156m, #AFC £127m and #EFC £121m.

As a technical aside, the #WBA 2020/21 accounts only covered 11 months, as the previous 2019/20 accounts were extended by a month to match the longer season, so included a 13-month period. Revenue was not significantly impacted, but this meant one month fewer expenses.

#WBA 2020/21 COVID losses added up to £13.2m, mainly broadcasters’ rebate £8.4m and match day £7.5m, partly offset by £2.5m insurance. Including the £2.3m shortfall in 2019/20 means a total adverse impact of £15.5m in the past two years.

#WBA profit from player sales fell £25m from £29m to £4m, mainly Oliver Burke to #SUFC and Jonathan Leko to #BCFC. One of the smallest player trading results in the Premier League, miles below the likes of #MCFC £69m, #WWFC £61m and #LCFC £44m.

Before last season’s small surplus #WBA had posted three consecutive losses, amounting to £37m. However, traditionally West Brom have been quite prudent financially, making money every season from 2010 to 2017. Indeed, they had the seventh highest profits in PL in last 10 years.

Like many other clubs, #WBA have become increasingly reliant on player sales with £63m profit in the last 5 years compared to only £27m in the preceding 5-year period, though still on low side for PL. Sold players for £19m after these accounts, mainly Matheus Pereira to Al Hilal.

#WBA operating loss (i.e. excluding player sales and interest) narrowed from £53m to just £4m, which was the third best result in the Premier League, only surpassed by #SUFC and #LUFC. Some clubs posted huge losses: #CFC £159m, #EFC £118m, #FFC £94m and #AFC £91m.

Despite the growth following promotion, #WBA revenue was still £31m (22%) lower than the Premier League high of £138m in 2017, largely due to less central TV distributions, though there were also falls in gate receipts £7m and commercial £2m (mainly because of COVID).

In fact, #WBA £107m revenue was comfortably the lowest in the Premier League, a fair way below Burnley and #SUFC £115m and less than a fifth of #MCFC £570m. However, this season’s rankings are distorted by different amounts of revenue deferred from 2019/20 accounts.

As the 2019/20 season was extended, many clubs deferred revenue into 2020/21 for games played after the accounting close. However, as #WBA moved their year-end to 31st July, they deferred no money, while clubs with a May year-end benefited significantly, e.g. #WWFC £43m.

#WBA broadcasting income shot up from £41m to £97m, though increase was smaller than other promoted clubs, as prior year included parachute payment. Lowest in the top flight, as others benefited from revenue deferrals from 2019/20, while WBA rebate was only booked in 2020/21.

As #WBA were relegated after just one season in the Premier League, they only get two years of parachutes (instead of the full three years). Details not published for 2020/21, but in 2019/20 a relegated club received £42m in year one and £34m in year two.

#WBA gate receipts fell £4.8m (98%) to just £74k, as all home games were played behind closed doors (except one with restricted capacity). Season tickets either refunded or rolled over to be used against future purchases. Even at its highest, much lower than most other PL clubs.

#WBA average attendance of 24,053 in 2019/20 (for games played with fans) would have placed them firmly in the bottom half of the Premier League, though crowds held up pretty well after relegation to the Championship.

#WBA commercial income rose £1.8m (21%) to £10.1m, thanks to higher sponsorship. However, a fair bit lower than £15.3m peak in 2018, due to COVID and only 11 months. Smallest in the top flight, just below Burnley. For more context, over a quarter of billion less than #MCFC £272m.

#WBA shirt sponsor Ideal Boilers has extended its deal by 3 years to June 2024, though this was reportedly the lowest in the Premier League in 2020/21 at just £3m. Puma have a multi-year deal as the club’s kit supplier.

#WBA did not report anything in other operating income, though this is where most clubs included £2.5m business interruption insurance claim for COVID losses. Highest amount booked here was #CFC £12.6m, mainly due to unexplained recharges.

#WBA wages up £10m (15%) from £67m to £77m, though growth restricted as prior year included large promotion bonus. It’s also a bit misleading, as accounting period changing from 13 months to 11 months. On a like-for-like basis, the increase would be £22m (36%) from £62m to £84m.

#WBA £67m wage bill was the second smallest in the Premier League, only ahead of #SUFC £57m. While the club could be commended for its tight cost control, the flip side is that low wages made relegation more likely (though survival would have triggered a bonus payment).

#WBA wages to turnover ratio fell from 124% in the Championship to 72% in the Premier League. This was mid-table, though I calculate it would have been 78% if adjusted for the 11 months’ accounts, which would have been one of the highest in the top flight.

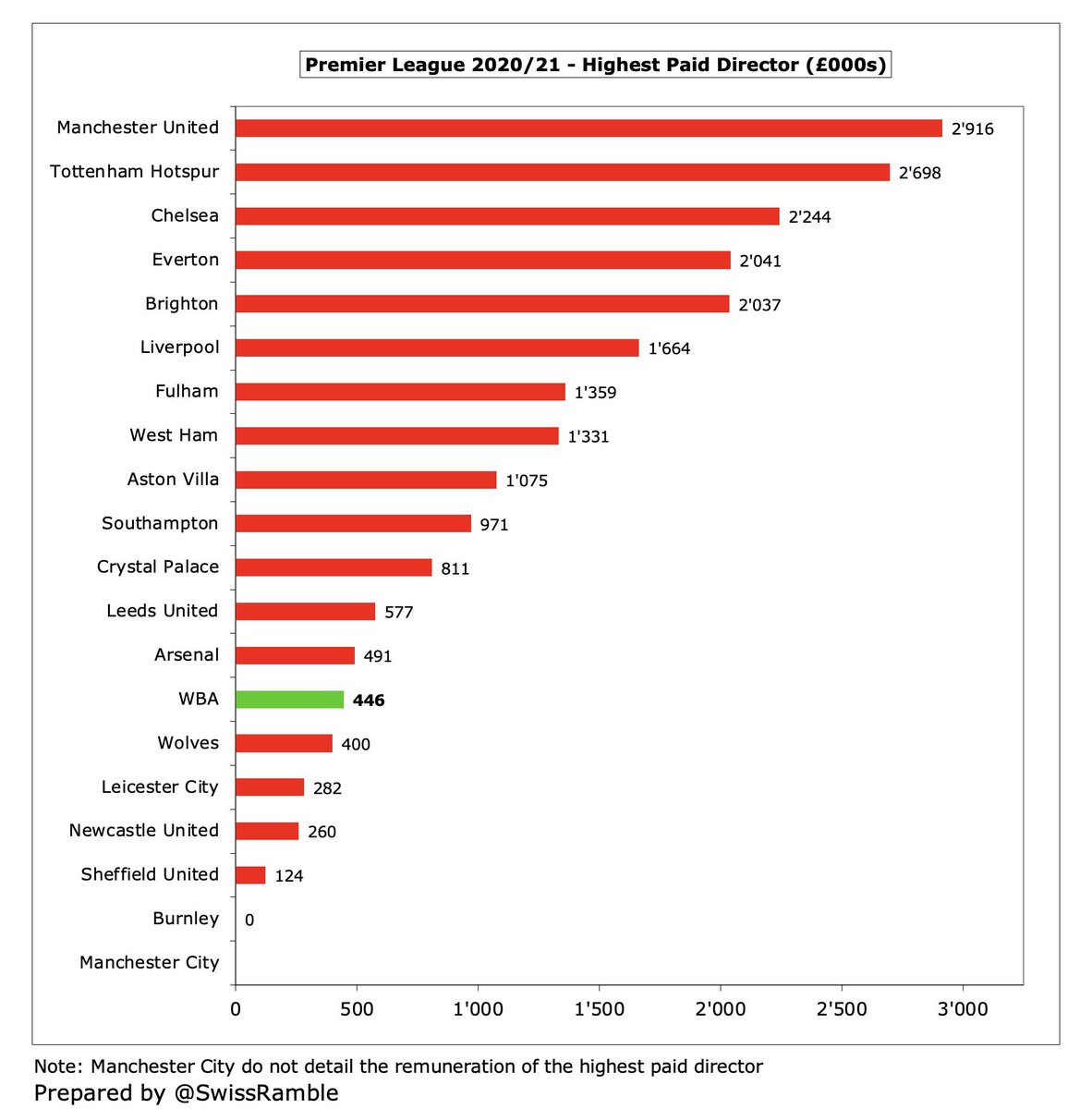

The amount received by #WBA highest paid director doubled from £223k to £446k, though still significantly lower than the £2m paid in 2016. Also very much on the low side in the Premier League, far below the likes of Ed Woodward at #MUFC £2.9m and Daniel Levy at #THFC £2.7m.

#WBA player amortisation, the annual charge to write-off transfer fees over a player’s contract, rose £5m (26%) from £20m to £25m, though still second lowest in Premier League (partly due to only 11 months). No repeat of prior year £6m impairment (write-down of player values).

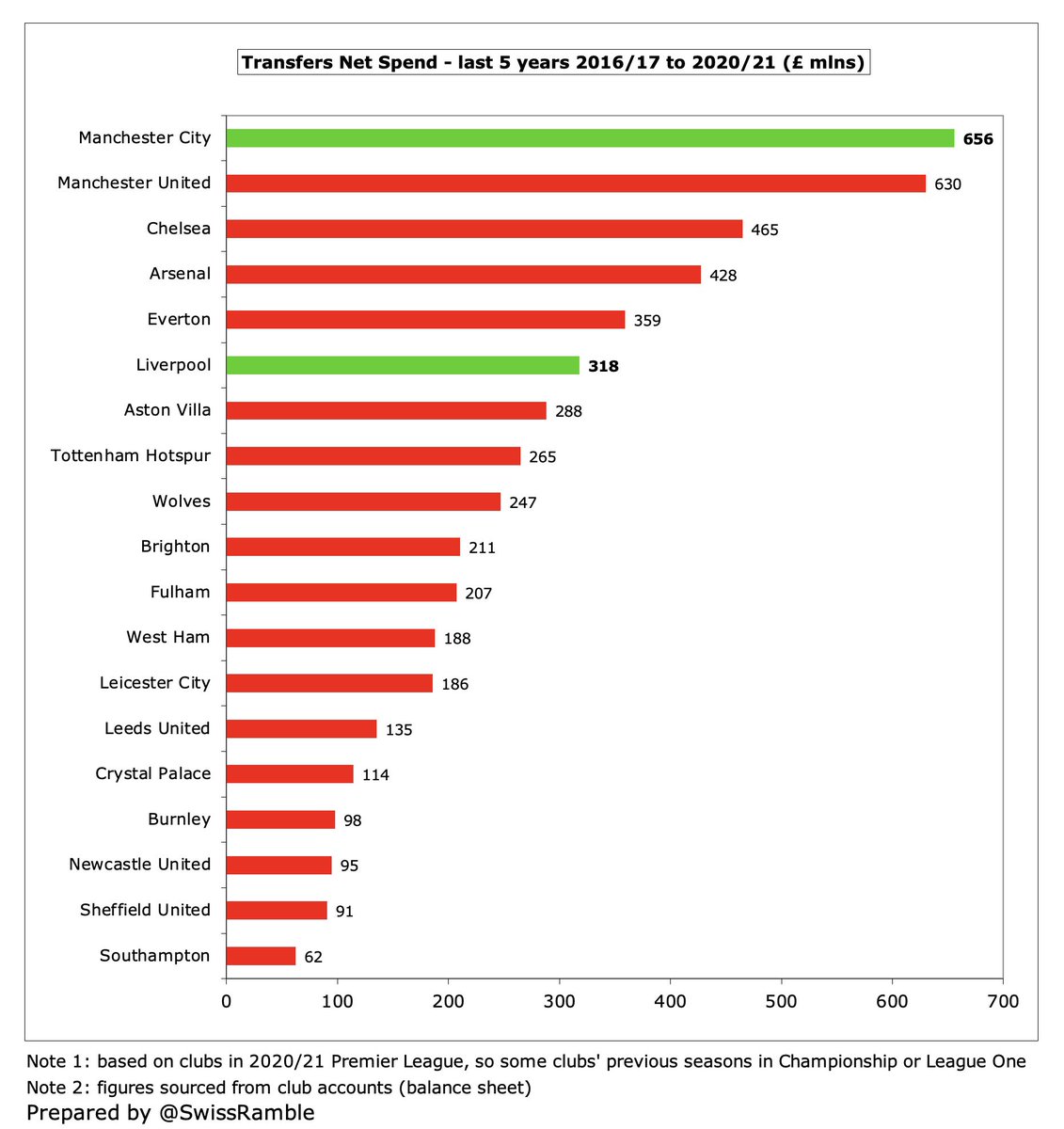

#WBA spent £40m on player purchases, mainly Karlan Grant from #HTAFC, Grady Diangana from #WHUFC and Matheus Pereira from Sporting. Among the lowest spenders in the Premier League, way below the likes of #CFC £221m, #MCFC £194m and #LFC £136m in 2020/21.

Although #WBA maintained gross transfer spend in their two years in the Championship, high player disposals meant that they had net sales in this period. Following promotion to the Premier League, they returned to £35m net spend.

However, #WBA have spent very little since relegation, as many players have arrived on free transfers or loans. In fact, of the teams playing in the 2020/21 Premier League, West Brom had the third lowest gross spend in the last 5 years, only above Burnley and #SUFC.

#WBA gross debt in the football club decreased from £24m to £19m, all owed to the owners (unsecured, no fixed repayment date) with no external debt. The club’s holding company, West Bromwich Albion Holdings Limited, has zero financial debt.

#WBA £19m gross debt was one the lowest in the Premier League, far below the likes of #CFC £1.5 bln (Abramovich funding), #THFC £854m (stadium), #MUFC £530m (Glazers’ leveraged buy-out), #EFC £379m and #BHAFC £374m.

Loans provided by #WBA owners are interest-free, which gives them a slight competitive advantage against many other clubs who have to pay interest on their loans. Some had very high charges in 2020/21, e.g. #AFC £34m (mainly debt refinancing break fee), #MUFC £21m and #THFC £18m.

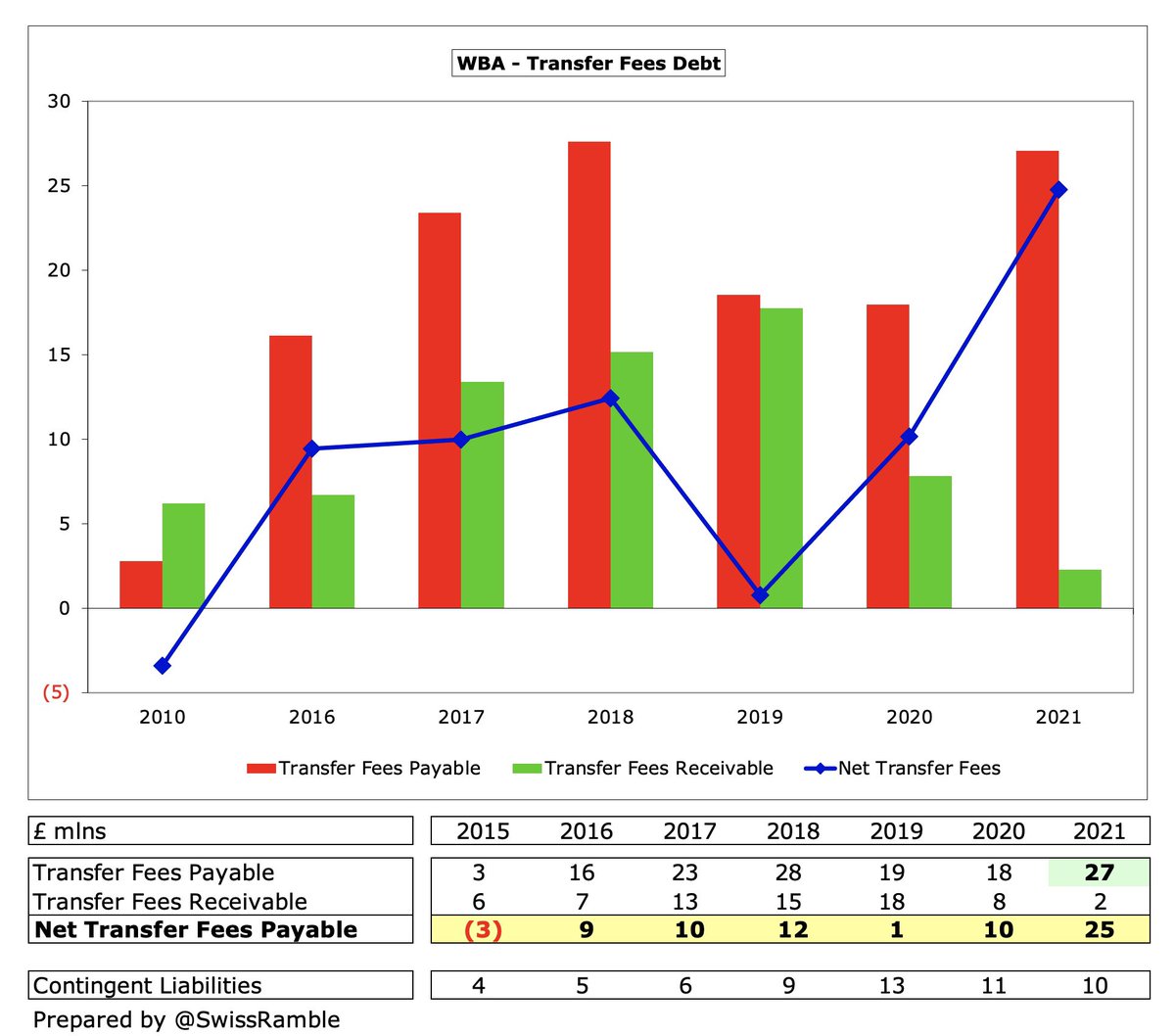

#WBA transfer debt for outstanding stage payments rose from £18m to £27m, but the amounts owed by other clubs fell from £8m to £2m, so net payable up from £10m to £25m. This was again on the low side for the Premier League, e.g. #THFC owe £170m.

#WBA £4m operating loss became £14m positive cash flow (after adjusting for non-cash movements), but they then spent net £21m on players (purchases £31m, sales £10m) and £5m on repaying owner loans. Hardly anything went on infrastructure and interest.

As a result, #WBA cash balance decreased by £12m to £3m, one of the lowest in the Premier League. The relatively high prior year balance was partly due to receiving the first tranche of Premier League TV money in July 2020, so included in extended accounts.

In the last 9 years #WBA have been largely self-sustaining, generating an impressive £137m from operations, supplemented by £17m of owner loans. Of this, £101m was spent on players (net), £27m on an inter-company dividend in 2016, £12m tax and £10m capex.

Only £17m owner funding has been provided to #WBA in the last 10 years, which was one of the lowest in the Premier League. Over that period some other clubs received substantially more from their owners, e.g. #MCFC £684m, #CFC £516m, #AVFC £506m, #FFC £453m and #EFC £448m.

In fact, #WBA actually loaned £5m (£4.95m plus £50k interest) to Wisdom Smart Corporation Ltd, a related party to controlling shareholder Guochuan Lai, as the COVID pandemic saw his “international business suffer”, which is hardly comforting to Baggies’ fans.

#WBA supporters will be particularly concerned, given that the original repayment date of 15 September 2021 was missed, since rescheduled to 31 December 2022. Even though Lai has confirmed he will repay the loan in full, this transaction took money from the club’s playing budget.

In addition, West Bromwich Albion Holdings Ltd borrowed £2m from Warmfront Holdings Ltd and lent the proceeds to a related party (presumably Lai) at 0.3% monthly interest with repayment due on 31 March 2022.There is a potential dividend pay-out to settle the £7m outstanding.

This is not the first time that #WBA have effectively acted as a bank, as £3.7m was loaned to former owner Jeremy Peace via the holding company in 2014 with the debt passed to Lai following the sale of the club. Including interest, the amount owed is probably nearer £5m now.

Some shareholders have suggested that Peace used the money from the loan to buy more shares in #WBA before the sale of the club in 2016, though this claim has been denied by the former chairman. Either way, Lai would now appear to owe the club around £12m in total.

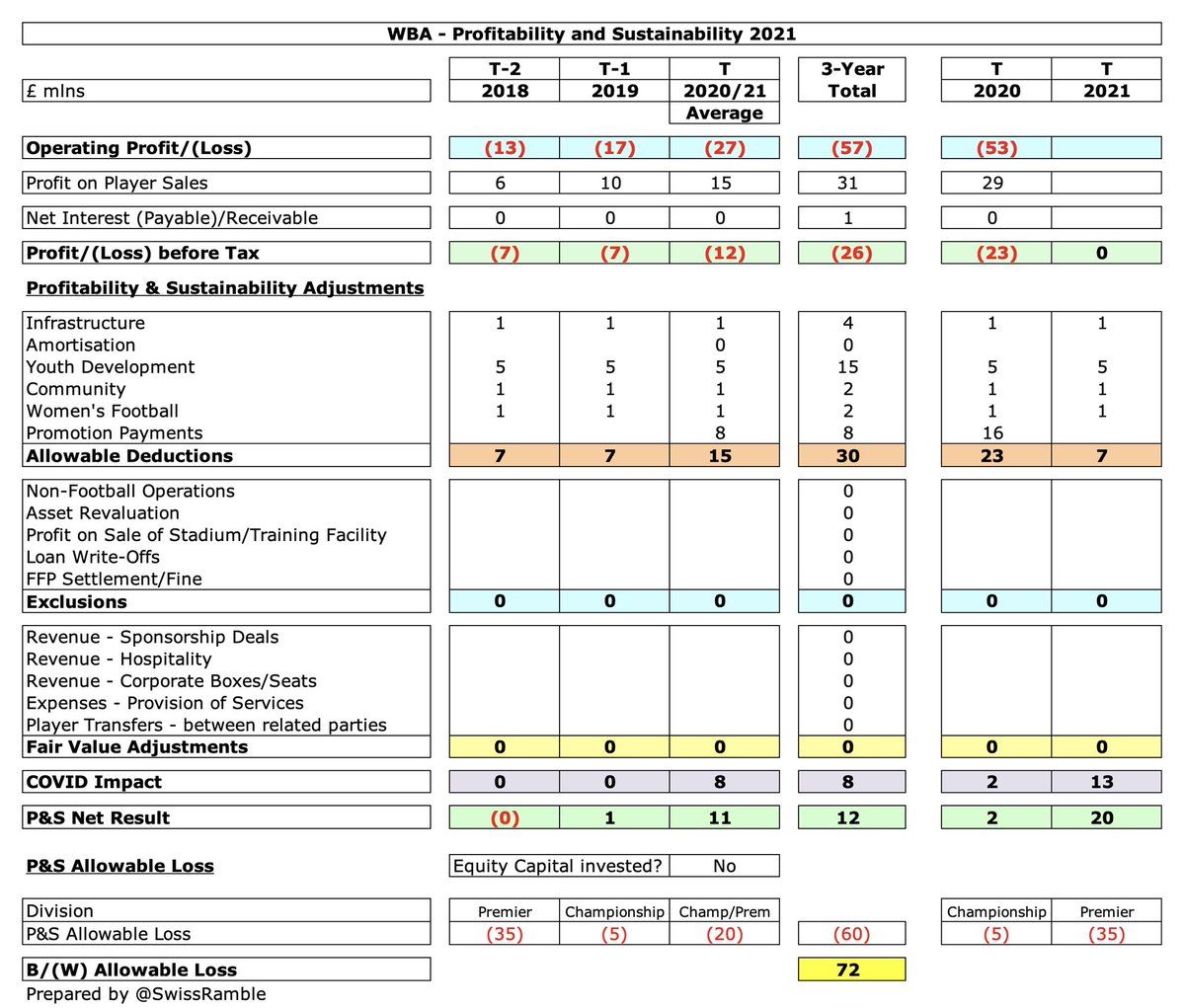

#WBA don’t have any issues with FFP, as they are within the allowable loss for the three-year monitoring period, even before allowable exclusions for academy, community & infrastructure, promotion bonus and COVID impact.

This analysis is based on West Bromwich Albion Football Club Ltd, though #WBA have many companies in their rather complex structure. Revenue and wages for the ultimate parent company, West Bromwich Albion Holdings Ltd, are the same with only minor differences in profit.

#WBA said they “maintained a solid financial position”, which is true, though the loans to the owner do leave a bad taste in the mouth. Lai is “confident” that the club will be able to compete for promotion from the Championship this coming season, but fans may not be so sure.

• • •

Missing some Tweet in this thread? You can try to

force a refresh