1/14 I've been deeply following @synthetix_io lately, and fundamentals + financials figures are touching the sky. So if you invested in it, here is a simple guide for #DeFi Noobs about #staking $SNX on @synthetix_io platform 🧵👇

And read it carefully!

And read it carefully!

2/14 First, staking is done on #L2 #Optimism #blockchain

staking.synthetix.io

Current APR is 57,21%.

Rewards are in $sUSD - #StableCoin & $SNX. Tokens MUST be claimed every week before the end of each epoch (Wed. at 09:00 UTC) -> Otherwise, rewards go back to the pool.

staking.synthetix.io

Current APR is 57,21%.

Rewards are in $sUSD - #StableCoin & $SNX. Tokens MUST be claimed every week before the end of each epoch (Wed. at 09:00 UTC) -> Otherwise, rewards go back to the pool.

3/14 $SNX rewards do not go directly into your #web3 wallet, instead, claimed $SNX are escrowed on this webpage staking.synthetix.io/escrow, and you can get them back in 12 months from the claim date. In the mean time, you can stake them, and increase your staked amount of $SNX

4/14 When you Stake $SNX, you mint $sUSD. Take this as if you were borrowing $sUSD with $SNX as a collateral, and with the same risk of "Liquidation". In order to unstaked your $SNX, you need to redeem $sUSD. But, now things get a bit more complex.

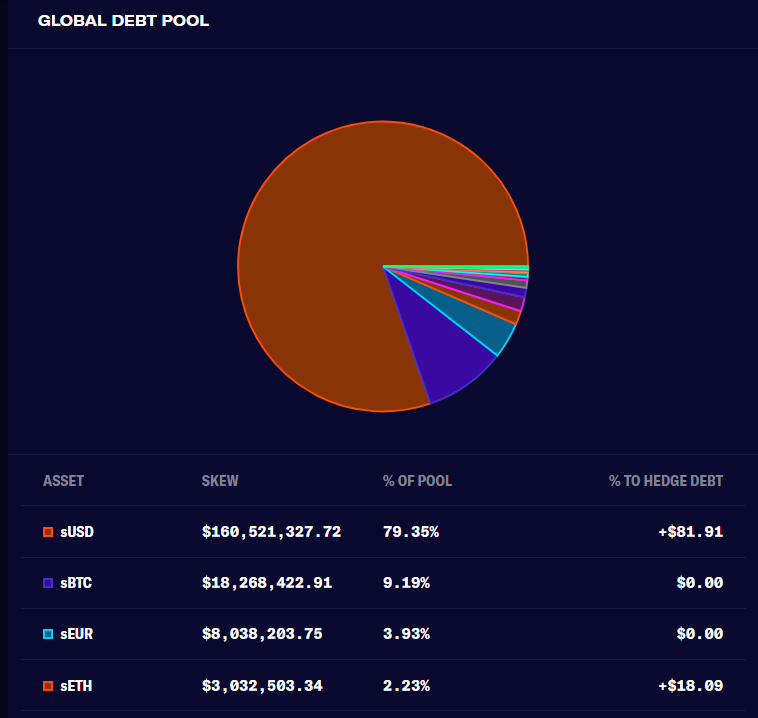

5/14 Your debt is not your "borrowed", aka minted, $sUSD, but it's a share of the global debt of the protocol. The debt pool represents the total value of all Synthetic Assets in the system. Here is a today extract. Very interesting the rise of $sEUR holdings.

6/14 Your #collateral ratio, called C-RATIO, MUST be >= to 400% (value may change depending on Gov. Vote) to receive rewards. If your C-RATIO < 400%, you won't receive your weekly reward. So How your C-RATIO can be impacted?

7/14 You need to maintain C-RATIO to 400%. C-RATIO = Staked $SNX / Your share of Debt Pool. Variables here are:

1) If $SNX price goes ⬇️, C-RATIO ⬇️

2) If Dept pool goes ⬆️, C-RATIO ⬇️

1) If $SNX price goes ⬇️, C-RATIO ⬇️

2) If Dept pool goes ⬆️, C-RATIO ⬇️

8/14 If your C-RATIO < 150%, you must recover the set C-RATIO in 12h, otherwise you will be LIQUIDATED. Your $SNX position + a max of 30% penalty will be used to pay your debt, leaving a min of 20% of your staked position. blog.synthetix.io/new-liquidatio…

How can you managed your C-RATIO?

How can you managed your C-RATIO?

9/14 For 1): If $SNX price goes down, you need to stake more $SNX, or redeem a part of your $sUSD to maintain your C-RATIO. On that page, staking.synthetix.io/staking/burn, @synthetix_io has a one click button to define the right $sUSD amount to get your C-RATIO back to normal.

10/14 For 2): If the dept pool varies, you may see your Debt getting bigger or smaller than your minted $sUSD. Here is a table showing your debt if the #Crypto market goes +20% ⬆️ or -20% ⬇️. The worst case: you end up seeing your debt increasing by +3.3%.

11/14 But you can "HEDGE" your position. It's a financial mechanism to avoid being exposed to market volatily in that case, Debt volatily. Just click the "Hedge Button" thanks to @dHedgeOrg protocol.

https://twitter.com/synthetix_io/status/1552677344736854021?t=LHPQXl6FE8yZtcq7WwDJlQ&s=09

12/14 The only counterpart is that your $sUSD is swapped into a $dSNX token, making it impossible for you to farm $sUSD. Today on @VelodromeFi , you can get on stable pool up to 16.54% per year.

But just to remind you that $ETH made x2 in 45days. So select your strategy wisely!

But just to remind you that $ETH made x2 in 45days. So select your strategy wisely!

13/14 In order to continue easing User Experience, @gelatonetwork & @synthetix_io partnered to automatically claim your weekly reward🔥🔥 & manage burning yoru $sUSD to recover your C-RATIO 🫡🫡

https://twitter.com/synthetix_io/status/1539249780630511616?s=20&t=CIchZQh4ZygHq8D_alcEmQ

14/14 Finally, they are many tutorials on @YouTube , don't hesitate to check. However, i recommend the video from @gabrielhaines, precise, short, up to date.

If you like this thread, please Preach the Word by retweeting the 1st post:

https://twitter.com/Subli_Defi/status/1553868917927452674?s=20&t=yaKe6-BTUmDh7l-HcJmVeg

Just toggaing you guys as i know you are mastering this protocol and maybe provides additional advice for DEFI begginers, or even the advanced ones 😎

@DeFi_Dad

@rektdiomedes

@SalomonCrypto

@DAdvisoor

@DefiMoon

@BarryFried1

@Dynamo_Patrick

@intocryptoast

@kaiynne

@DeFi_Dad

@rektdiomedes

@SalomonCrypto

@DAdvisoor

@DefiMoon

@BarryFried1

@Dynamo_Patrick

@intocryptoast

@kaiynne

@TheDeFinvestor

@phtevenstrong

@MattLosquadro

@DefiantNews

@CurveCap

@SmallCapScience

@dcfgod

@crypto_condom

@Cryptoyieldinfo

@Route2FI

@phtevenstrong

@MattLosquadro

@DefiantNews

@CurveCap

@SmallCapScience

@dcfgod

@crypto_condom

@Cryptoyieldinfo

@Route2FI

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh