The Game of Investing 🧵

[an introductory thread for normies -like me]

[an introductory thread for normies -like me]

Markets are hard to quantify & #investing isn't exactly a science because there are no exact formulas to tell you what's the right thing to do

That's why #investors need to build a framework that speaks to them and a personalized investing style to apply in the process... 1/12

That's why #investors need to build a framework that speaks to them and a personalized investing style to apply in the process... 1/12

The eternal struggle: #Markets are constantly changing and are filled with contradictory information/indicators.

Also, markets don't care about you!

Understand that what matters today will change at some point without any notice & it'll undoubtedly affect your portfolio... 2/12

Also, markets don't care about you!

Understand that what matters today will change at some point without any notice & it'll undoubtedly affect your portfolio... 2/12

Here's where #riskmanagement becomes essential.

The market is indifferent to all because it has NO feelings. As in life, don't take this too personally and use your emotions to feed you insights:

- Focus on returns, not on being right

- Avoid emotional choices at all cost

3/12

The market is indifferent to all because it has NO feelings. As in life, don't take this too personally and use your emotions to feed you insights:

- Focus on returns, not on being right

- Avoid emotional choices at all cost

3/12

YOUR GAME:

Self-awareness is key. Understand who you are and what you want. Every person has unique circumstances and needs an investing plan that fits their lifestyle and investing goals.

Define:

- Time horizon

- Asset classes

- Markets

- Instruments

- Risk Tolerance

4/12

Self-awareness is key. Understand who you are and what you want. Every person has unique circumstances and needs an investing plan that fits their lifestyle and investing goals.

Define:

- Time horizon

- Asset classes

- Markets

- Instruments

- Risk Tolerance

4/12

Something that needs more emphasis nowadays:

Mental fitness is imperative to handle your investments like a boss!

Physical health is also key. They feed off each other

You can't neglect any of these. Doing so will likely result in poor investing choices sooner or later... 5/12

Mental fitness is imperative to handle your investments like a boss!

Physical health is also key. They feed off each other

You can't neglect any of these. Doing so will likely result in poor investing choices sooner or later... 5/12

IDEA GENERATION:

Sources constantly change

If you want to become a better investor, take ownership of your ideas & constantly scrutinize them if they originated from other sources.

Leverage social media to develop new ideas and meet like-minded, growth-oriented people... 6/12

Sources constantly change

If you want to become a better investor, take ownership of your ideas & constantly scrutinize them if they originated from other sources.

Leverage social media to develop new ideas and meet like-minded, growth-oriented people... 6/12

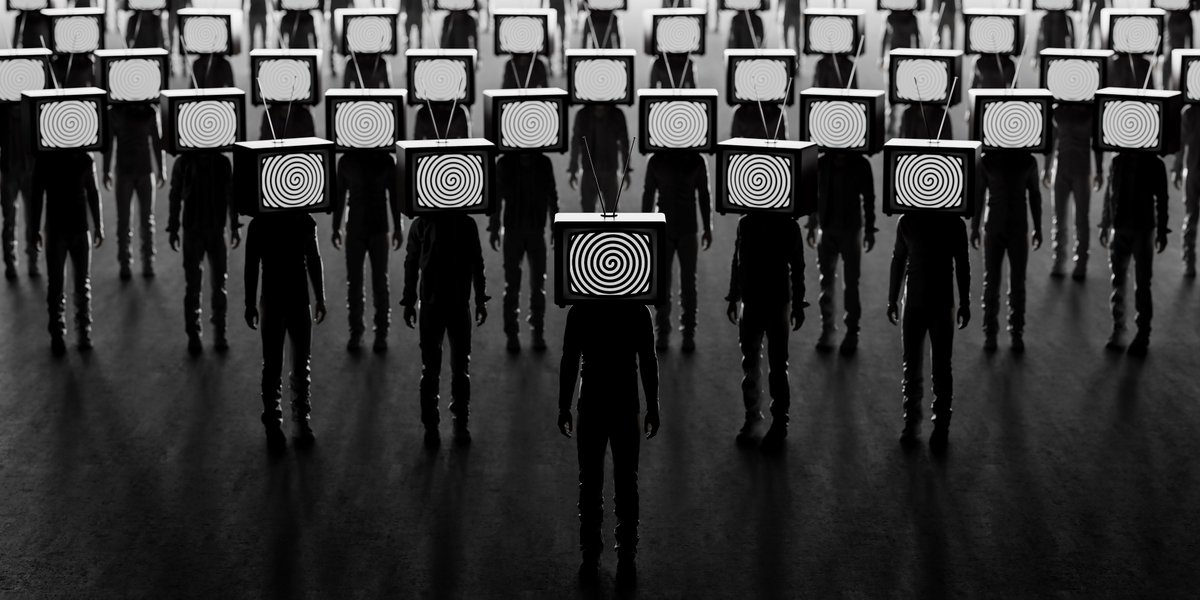

Don't rely on traditional media. It's a lagging indicator most of the time

Most information is noise and has an agenda

There's always more of it & you'll find yourself in an endless loop

Be specific about what you need to know to make a certain investment and go for it... 7/12

Most information is noise and has an agenda

There's always more of it & you'll find yourself in an endless loop

Be specific about what you need to know to make a certain investment and go for it... 7/12

Ask yourself:

Who's saying that & what's their incentive?

What type of investor are they?

What's their time horizon & does it align with mine?

How's this idea structured & does it fit their portfolio?

Do I have similar exposures already?

Does it fit in my portfolio & life? 8/12

Who's saying that & what's their incentive?

What type of investor are they?

What's their time horizon & does it align with mine?

How's this idea structured & does it fit their portfolio?

Do I have similar exposures already?

Does it fit in my portfolio & life? 8/12

Many investments need a catalyst to make them move in your direction:

- The housing bubble and how it collapsed an over-levered financial system

- Oil oversupply in 2014 with a rising dollar and its dire effects - Full thread about it here 👇

9/12

- The housing bubble and how it collapsed an over-levered financial system

- Oil oversupply in 2014 with a rising dollar and its dire effects - Full thread about it here 👇

https://twitter.com/PaulGrra/status/1548430769298608135?s=20&t=Lq0Tdj_tZ1t6tHi1-djXBA

9/12

Something being cheap or expensive is not a catalyst.

You need a spark that makes your thesis a reality, that changes the perception in the markets and reverses direction

ie. uranium bull thesis started moving recently after 2020's pandemic... 10/12

You need a spark that makes your thesis a reality, that changes the perception in the markets and reverses direction

ie. uranium bull thesis started moving recently after 2020's pandemic... 10/12

So, what will be that spark to your idea?

In .@AshBennington's fashion, we have to see it from a 50,000 ft view, big picture.

Conversely, if you're riding a profitable trend, beware of catalysts that could reverse your thesis.

You have to know when your idea is wrong... 11/12

In .@AshBennington's fashion, we have to see it from a 50,000 ft view, big picture.

Conversely, if you're riding a profitable trend, beware of catalysts that could reverse your thesis.

You have to know when your idea is wrong... 11/12

In that sense, never forget that all your #investing decisions are related to macro. No matter if it's #crypto, #realestate or any other asset class.

.@RaoulGMI elaborates on this... 👇 12/12

.@RaoulGMI elaborates on this... 👇 12/12

Thank you for reading! If you liked this thread please RT the first tweet ⬆️

All credit to the Real Investing Course by .@RealVision! It's on a massive discount until August 7 rvtv.io/3QnKXxU

Follow me @PaulGrra b/c I’ll keep sharing as I keep learning

All credit to the Real Investing Course by .@RealVision! It's on a massive discount until August 7 rvtv.io/3QnKXxU

Follow me @PaulGrra b/c I’ll keep sharing as I keep learning

• • •

Missing some Tweet in this thread? You can try to

force a refresh