🐻♉️↗️↘️↔️⚠️🚩🔺🔻🧮 💰

1/7 🧵

Global Macro Review 08/14/2022

A big decline in $CPI to +8.5% y/y, ➕ the July services #PMI ↗️ ➕ #NFP ↗️, kept the 🔥 burning on risk assets - enough to lure the ♉️

Is this a new ♉️ market or the end of the 🐻 rally?

Let’s dig into the 🧮!

1/7 🧵

Global Macro Review 08/14/2022

A big decline in $CPI to +8.5% y/y, ➕ the July services #PMI ↗️ ➕ #NFP ↗️, kept the 🔥 burning on risk assets - enough to lure the ♉️

Is this a new ♉️ market or the end of the 🐻 rally?

Let’s dig into the 🧮!

2/7

Equity volatility ↘️ across market and 🐻 Trend (T)

$VX 19.53 -1.62 bps

$VXN 25.18 -1.95 bps

$RVX 24.23 -1.07 bps

$VSTOXX 21.21 -1.64 bps

$VXEEM 19.45 -2.41 bps

Chart: $VXEEM lending support to $EEM 🆕 ♉️

Equity volatility ↘️ across market and 🐻 Trend (T)

$VX 19.53 -1.62 bps

$VXN 25.18 -1.95 bps

$RVX 24.23 -1.07 bps

$VSTOXX 21.21 -1.64 bps

$VXEEM 19.45 -2.41 bps

Chart: $VXEEM lending support to $EEM 🆕 ♉️

3/7

US equity indices 🚀

$SPX +3.25% (w) +6.35% (T) 🆕 ♉️

$COMPQ +3.1% (w) +10.55% (T)

$IWM +5.0% (w) +12.5% (T)

Chart: $IWM - small caps have retraced nearly 50% of the 6-mo decline

US equity indices 🚀

$SPX +3.25% (w) +6.35% (T) 🆕 ♉️

$COMPQ +3.1% (w) +10.55% (T)

$IWM +5.0% (w) +12.5% (T)

Chart: $IWM - small caps have retraced nearly 50% of the 6-mo decline

3a/7

In US sectors, energy, materials, and financials led the way ↗️

$XLE +7.4% (w) -2.85% (T)

$XLF +5.55% (w) +6.05% (T) 🆕 ♉️

$XLB +5.2% (w) -1.65% (T)

$XLRE +4.15% (w) +5.7% (T) 🆕 ♉️

Chart: $XLF is +17.5% from the June lows and ♉️ (T)

In US sectors, energy, materials, and financials led the way ↗️

$XLE +7.4% (w) -2.85% (T)

$XLF +5.55% (w) +6.05% (T) 🆕 ♉️

$XLB +5.2% (w) -1.65% (T)

$XLRE +4.15% (w) +5.7% (T) 🆕 ♉️

Chart: $XLF is +17.5% from the June lows and ♉️ (T)

3b/7

International indices also ↗️

$DAX +1.65% (w) -1.65% (T)

$SSEC +1.55% (w) +6.25% (T)

$KOSPI +1.5% (w) -2.95% (T)

$NIKK +1.3% (w) +8.0% (T)

$CAC +1.25% (w) +3.0% (T)

$HSI -0.15% (w) +1.4% (T)

Chart: $NIKK +6.55% over trade (t) = 1-mo duration

International indices also ↗️

$DAX +1.65% (w) -1.65% (T)

$SSEC +1.55% (w) +6.25% (T)

$KOSPI +1.5% (w) -2.95% (T)

$NIKK +1.3% (w) +8.0% (T)

$CAC +1.25% (w) +3.0% (T)

$HSI -0.15% (w) +1.4% (T)

Chart: $NIKK +6.55% over trade (t) = 1-mo duration

3c/7

Natural resource country ETFs led ↗️

$EWZ +7.55% (w) +0.3% (T)

$EWW +7.3% (w) -0.8% (T)

$EWC +4.25% (w) +0.95% (T)

$EWP -4.05% (w) -1.10% (T)

Chart: $IDX back to ♉️ +3.4% (T)

Natural resource country ETFs led ↗️

$EWZ +7.55% (w) +0.3% (T)

$EWW +7.3% (w) -0.8% (T)

$EWC +4.25% (w) +0.95% (T)

$EWP -4.05% (w) -1.10% (T)

Chart: $IDX back to ♉️ +3.4% (T)

4/7

The $CRB 👁🗨 at the deceleration in #CPI and promptly tacked on +4.45%

Chart: $CRB is -4.9% over (T) duration 🐻

The $CRB 👁🗨 at the deceleration in #CPI and promptly tacked on +4.45%

Chart: $CRB is -4.9% over (T) duration 🐻

4a/7

GOLD and Metals ↗️

$GOLD +1.35% (w) +0.4% (T) 🆕 neutral

$SILVER +4.35% (w) -1.45% (T)

$COPPER +3.4% (w) -12.0% (T)

$PLAT +3.75% (w) +3.15% (T)

Chart: $PLAT is +15.6% (t) and 🆕 ♉️

GOLD and Metals ↗️

$GOLD +1.35% (w) +0.4% (T) 🆕 neutral

$SILVER +4.35% (w) -1.45% (T)

$COPPER +3.4% (w) -12.0% (T)

$PLAT +3.75% (w) +3.15% (T)

Chart: $PLAT is +15.6% (t) and 🆕 ♉️

4b/7

Hydrocarbons joined the ♉️ 🎉 ↗️

$WTIC +3.45% (w) -6.9% (T)

$BRENT +3.55% (w) -12.05% (T)

$GASO +6.9% (w) -26.45% (T)

$NATGAS +8.75% (w) +14.5% (T) 🆕 ♉️

Chart: $GASO deeply oversold with overhead @ ~ 2.90

Hydrocarbons joined the ♉️ 🎉 ↗️

$WTIC +3.45% (w) -6.9% (T)

$BRENT +3.55% (w) -12.05% (T)

$GASO +6.9% (w) -26.45% (T)

$NATGAS +8.75% (w) +14.5% (T) 🆕 ♉️

Chart: $GASO deeply oversold with overhead @ ~ 2.90

4c/7

Grains with a ↗️ week

$CORN +5.3% (w) -17.8% (T)

$SUGAR +3.9% (w) -3.15% (T)

$WHEAT +3.9% (w) -31.55% (T)

$SOYB +3.25% (w) -11.7% (T)

Chart: $COFFEE ☕️ +8.35% (w) +6.0% (T) 🔥 ♉️

Grains with a ↗️ week

$CORN +5.3% (w) -17.8% (T)

$SUGAR +3.9% (w) -3.15% (T)

$WHEAT +3.9% (w) -31.55% (T)

$SOYB +3.25% (w) -11.7% (T)

Chart: $COFFEE ☕️ +8.35% (w) +6.0% (T) 🔥 ♉️

5/7

UST yields ↗️ slightly on the week with 10/2s to -40.8 bps ↔️ but 30/5s to +14.9 BPS 🔺

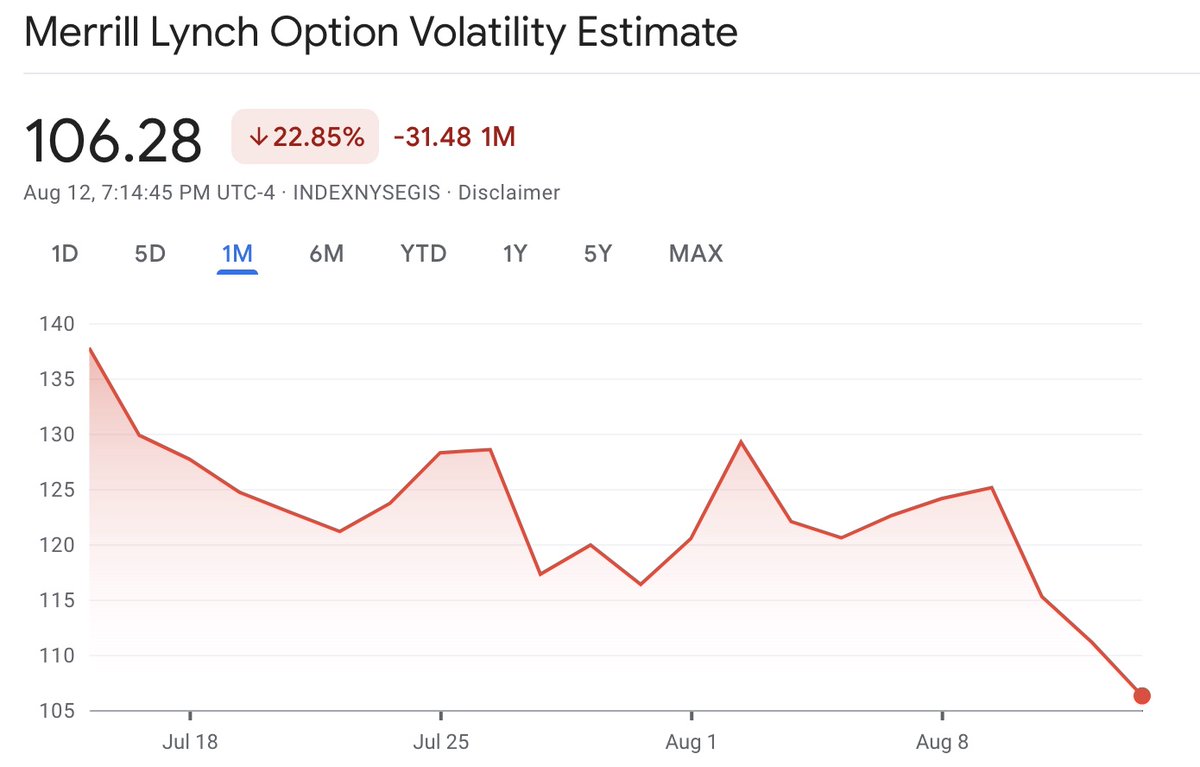

MOVE 106.28 - 16.30 points 🐻

Chart: MOVE - a decline in treasury bond vol could be supportive for bond proxies going forward

UST yields ↗️ slightly on the week with 10/2s to -40.8 bps ↔️ but 30/5s to +14.9 BPS 🔺

MOVE 106.28 - 16.30 points 🐻

Chart: MOVE - a decline in treasury bond vol could be supportive for bond proxies going forward

5a/7

Convertibles and high yield ↗️ and part of the #riskon move

$CWB +2.35% (w) +6.1% (T) 🆕 ♉️

$HYG +1.15% (w) +2.75% (T) 🆕 ♉️

$LQD +1.10% (w) +2.35% (T)

$BND +0.4% (w) +0.45% (T)

$TIP +0.3% (w) -2.7% (T)

$TLT -0.8% (w) -0.35% (T)

Chart: $HYG +9.1% off lows 🩳🔥

Convertibles and high yield ↗️ and part of the #riskon move

$CWB +2.35% (w) +6.1% (T) 🆕 ♉️

$HYG +1.15% (w) +2.75% (T) 🆕 ♉️

$LQD +1.10% (w) +2.35% (T)

$BND +0.4% (w) +0.45% (T)

$TIP +0.3% (w) -2.7% (T)

$TLT -0.8% (w) -0.35% (T)

Chart: $HYG +9.1% off lows 🩳🔥

6/7

The $USD took 🥵 from all #FX

$UUP -0.88% (w) +1.0% (T)

$FXA +3.05% (w) +2.8% (T) 🆕 ♉️

$FXB +0.57% (w) -0.9% (T)

$FXC +1.4% (w) +1.25% (T) 🆕 ♉️

$FXE +0.8% (w) -1.6% (T)

$FXF +2.1% (w) +6.25% (T)

$FXY +1.2% (w) -3.2% (T)

Chart: $UUP -2.1% (t) at risk of reversing trend

The $USD took 🥵 from all #FX

$UUP -0.88% (w) +1.0% (T)

$FXA +3.05% (w) +2.8% (T) 🆕 ♉️

$FXB +0.57% (w) -0.9% (T)

$FXC +1.4% (w) +1.25% (T) 🆕 ♉️

$FXE +0.8% (w) -1.6% (T)

$FXF +2.1% (w) +6.25% (T)

$FXY +1.2% (w) -3.2% (T)

Chart: $UUP -2.1% (t) at risk of reversing trend

7/7

All aboard the ♉️ 🚂⁉️

The market has eased financial conditions considerably; 🩳 have covered, and $USD ↘️

Perfect 🐻 🍩 or new ♉️?

🤷🏻♂️ but #BTD in ♉️ Trends and #STR in 🐻 Trends continues to be my MO

👁🗨 on $USD and have a super profitable 💰 week!

All aboard the ♉️ 🚂⁉️

The market has eased financial conditions considerably; 🩳 have covered, and $USD ↘️

Perfect 🐻 🍩 or new ♉️?

🤷🏻♂️ but #BTD in ♉️ Trends and #STR in 🐻 Trends continues to be my MO

👁🗨 on $USD and have a super profitable 💰 week!

• • •

Missing some Tweet in this thread? You can try to

force a refresh