1/ #Kujira is the true successor to all that was good about the #Terra / #Luna / #UST ecosystem.

Forget Terra 2.0, look into Kujira. A thread. 🧵

@TeamKujira rebounded after the Terra collapse with its own chain, exchange, stablecoin & liquidation engine.

All in two months! 👇

Forget Terra 2.0, look into Kujira. A thread. 🧵

@TeamKujira rebounded after the Terra collapse with its own chain, exchange, stablecoin & liquidation engine.

All in two months! 👇

2/ The team started with a liquidation engine on top of Anchor, but after Terra collapsed, they shifted gears.

They deployed their own chain on Cosmos and started building. FAST.

Now, Kujira is about to make its latest move. 👇

They deployed their own chain on Cosmos and started building. FAST.

Now, Kujira is about to make its latest move. 👇

https://twitter.com/DU09BTC/status/1556645484621602823?s=20&t=G6uClLZzcdnXq_7Pprn-dg

3/ I present you their Cosmos native stablecoin: #USK.

This is the missing piece to bring the #Kuji ecosystem together.

The best part? All fees on Kujira network will go to Kuji stakers (see #13).

What about risks/competitors? 👇

This is the missing piece to bring the #Kuji ecosystem together.

The best part? All fees on Kujira network will go to Kuji stakers (see #13).

What about risks/competitors? 👇

4/ #USK is an over-collateralized stablecoin pegged to the USD and backed by ATOM and Kuji.

This is very much like #DAI and should work well. This is not UST where the same entity issued Luna + UST with no limit.

The only concern is growth and ATOM. Why? 👇

This is very much like #DAI and should work well. This is not UST where the same entity issued Luna + UST with no limit.

The only concern is growth and ATOM. Why? 👇

5/ #DAI cannot scale that fast as it is dependent on people minting DAI against collateral.

USK will face similar constraints.

ATOM?

ATOM has no cap on supply & inflates by 10% / year. In this regard, #Kujira is a better collateral to issue #USK.

Why can't USK scale fast? 👇

USK will face similar constraints.

ATOM?

ATOM has no cap on supply & inflates by 10% / year. In this regard, #Kujira is a better collateral to issue #USK.

Why can't USK scale fast? 👇

6/ #USK cannot scale beyond 60% of KUJI's market cap & users minting USK against ATOM will eventually be liquidated (due to dilution).

Good thing Kujira has a liquidation engine & can add more collateral types. 😅

More profits for Kuji stakers (see #13). 🚀

Competitors? 👇

Good thing Kujira has a liquidation engine & can add more collateral types. 😅

More profits for Kuji stakers (see #13). 🚀

Competitors? 👇

7/ When it comes to the Cosmos / ATOM ecosystem, Kujira is offering a complete package (see #1).

They could even leverage USK as one of the dominant stablecoins on Cosmos.

That will help with scaling.

But, why choose USK or Kuji in the first place?

They could even leverage USK as one of the dominant stablecoins on Cosmos.

That will help with scaling.

But, why choose USK or Kuji in the first place?

8/ The Kujira chain + Fin exchange has very competitive fees (0.15% / 0.075%). 🚀

Plus it integrates perfectly with other Cosmos chains. However, there is a problem.

Growth outside Cosmos is unlikely & adding more collateral types increases risks for #USK holders.

More 👇

Plus it integrates perfectly with other Cosmos chains. However, there is a problem.

Growth outside Cosmos is unlikely & adding more collateral types increases risks for #USK holders.

More 👇

9/ Kujira is not very decentralized & there are alternatives on #Ethereum

With 75 validators of which the first 4 hold 33% of the voting power, this is a bit concerning (pic)

Plus, if ETH fixes its high fees after going PoS, Kujira will face stiff competition.

For example 👇

With 75 validators of which the first 4 hold 33% of the voting power, this is a bit concerning (pic)

Plus, if ETH fixes its high fees after going PoS, Kujira will face stiff competition.

For example 👇

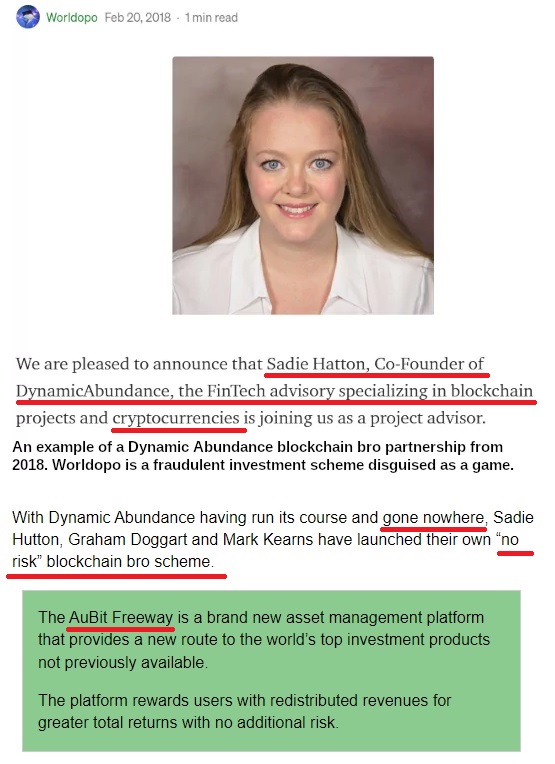

10/ @LiquityProtocol has #LUSD & #LQTY + you can participate in ETH liquidations via the stability pool.

It's like Kujira, just that it is native to ETH, the best #DeFI chain.

While LUSD lacks an exchange as Kujira has, they have #Curve, #Uniswap, etc.

My assessment? 👇

It's like Kujira, just that it is native to ETH, the best #DeFI chain.

While LUSD lacks an exchange as Kujira has, they have #Curve, #Uniswap, etc.

My assessment? 👇

11/ #Kujira & #USK will do great on Cosmos and likely will eat up that market share.

Going beyond that, however, will likely be difficult as they will face stiff competition.🙄

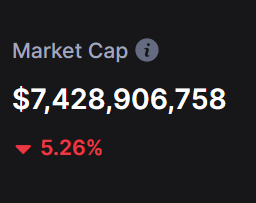

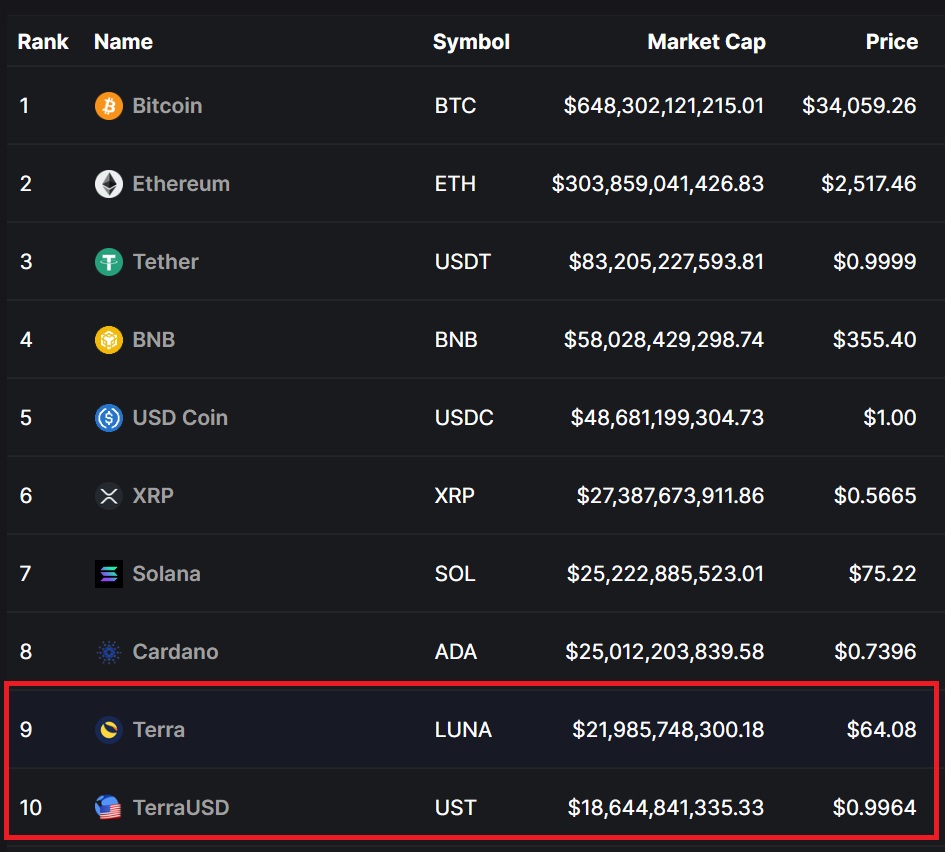

But that is fine. Just don't expect to see them reach the top 10 on CoinMarketCap (see pic).

Why? 👇

Going beyond that, however, will likely be difficult as they will face stiff competition.🙄

But that is fine. Just don't expect to see them reach the top 10 on CoinMarketCap (see pic).

Why? 👇

12/ #Terra / #Luna / #UST reached such levels due to flawed mechanics that were not sustainable.

Terra used ponzi-tokenomics.

#Kujira & #USK are none of that. They will grow organically. 💪

Sustainable returns = Kujira (#RealYield)

Final remarks 👇

Terra used ponzi-tokenomics.

#Kujira & #USK are none of that. They will grow organically. 💪

Sustainable returns = Kujira (#RealYield)

Final remarks 👇

https://twitter.com/DU09BTC/status/1504862614572179456?s=20&t=iN-bP99ebz2A17rfFO6ANQ

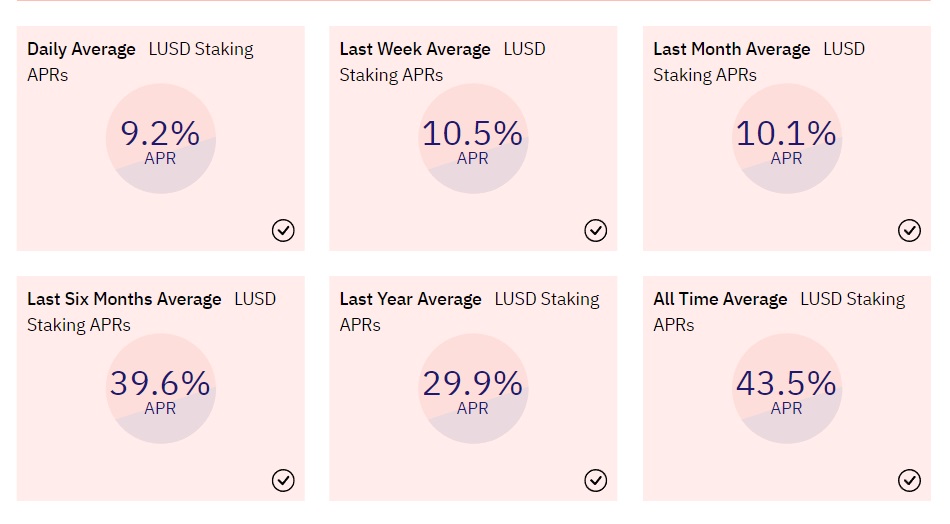

13/ I expect the APR for Kuji stakers to increase over time, as well as Kuji's price (see pic and #1 pic).

If the ecosystem grows, this is inevitable. Getting in early will give you a nice return.

Some important resources for further study next. 👇

If the ecosystem grows, this is inevitable. Getting in early will give you a nice return.

Some important resources for further study next. 👇

14/ See below & next tweet:

✅ Main site with all links: kujira.app

✅ Check their docs: docs.kujira.app/introduction/w…

✅ Buy Kuji on FIN: fin.kujira.app/trade/kujira14…

✅ Stake Kuji: blue.kujira.app

💎All ecosystem fees on Kujira go to Kuji stakers!

Lastly 👇

✅ Main site with all links: kujira.app

✅ Check their docs: docs.kujira.app/introduction/w…

✅ Buy Kuji on FIN: fin.kujira.app/trade/kujira14…

✅ Stake Kuji: blue.kujira.app

💎All ecosystem fees on Kujira go to Kuji stakers!

Lastly 👇

15/ If you liked this thread, #retweet the first post to get more of this content in the future!😍

Stay in touch + follow @DU09BTC:

✅ Twitter (best of)

✅ Discord

✅ YouTube

✅ TradingView

✅ Newsletter

✅ Patrons

My best content is one click away. 👇

linktr.ee/duonine

Stay in touch + follow @DU09BTC:

✅ Twitter (best of)

✅ Discord

✅ YouTube

✅ TradingView

✅ Newsletter

✅ Patrons

My best content is one click away. 👇

linktr.ee/duonine

• • •

Missing some Tweet in this thread? You can try to

force a refresh