1/7🧐So what's new on @0xconcentrator over this Sunny Month of August. You could read my previous update here below. Quick summary and financial figures in the below 🧵 Things are moving up!🧐

https://twitter.com/Subli_Defi/status/1555140368596967427?s=20&t=GUtrJsqJ5Uy4m9nX2IPWug

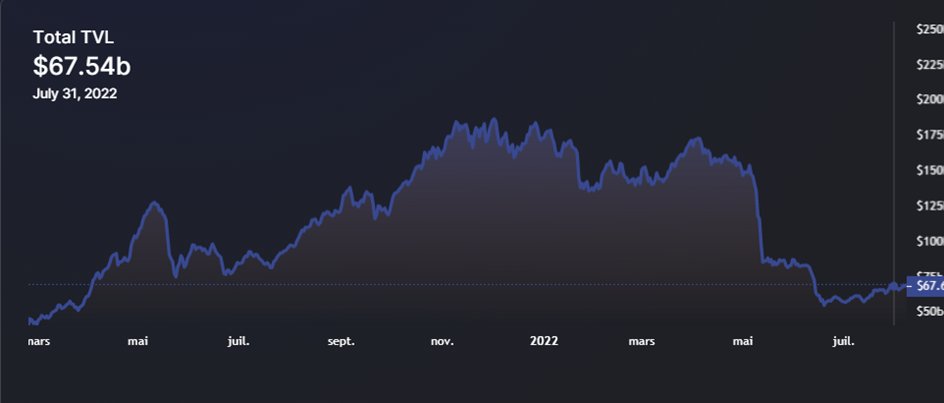

2/7 TVL decreased to around 89m$, from 105m$ at beg. of August. Since the market and especially $CRV crashed by -30%, it's actually a pretty confident and positive figure. 4,7m $cvxCRV are now deposited on the protocol.

3/7 Farmed $CTR during the #IFO achieved the 1st cap of 1/3 of the emission during this offering period, cumulating 930k $CTR. According to my Maths, end of the IFO is still planned to mid-November. So 2,5 months from now.

4/7 The Locking page has been opened and you can already see the 1,5m $CTR allocated to @aladdindao already locked. In addition, 26k $CTR has been locked. First voting will be to vote for the contributors for 1/3 of their $CTR allocation.

5/7 New token has been added as part of the Yield Optimizer Strategy of @0xconcentrator . You will soon be able to auto-compound $FXS with this new yield bearing asset $aFXS.

https://twitter.com/0xconcentrator/status/1562478939821740034?s=20&t=GUtrJsqJ5Uy4m9nX2IPWug

6/7 And when you know that TVL on @fraxfinance is about 1.35b$, that should drive more TVL back to @0xconcentrator, so more fees, so more revenues for $CTR lockers.

7/7 Finally, There is a question that is often asked on the Discord: Where can I Buy $aCRV:

-Liquidity is available on @Polygon

-Will be soon available on Optimism

-For Arbitrum: the team is waiting for Curve V2 Factory pools to be live!!

-Liquidity is available on @Polygon

-Will be soon available on Optimism

-For Arbitrum: the team is waiting for Curve V2 Factory pools to be live!!

8/7 END of this summary for this month. Time will be interesting in the coming months, so let's see how the game is played by big players. If you like this summary, please retweet the 1st post:

https://twitter.com/Subli_Defi/status/1564283949836341248?s=20&t=Z8P5L6W_klHAOaruUFgXhg

• • •

Missing some Tweet in this thread? You can try to

force a refresh