🚨 New paper 🚨

Green #hydrogen and derived #efuels are critical for #climate #mitigation, but when will they be available at scale?

In a new Nature Energy study, we look at a key bottleneck: the market ramp-up of #electrolysis capacity.

Summary 🧵⬇️

nature.com/articles/s4156…

Green #hydrogen and derived #efuels are critical for #climate #mitigation, but when will they be available at scale?

In a new Nature Energy study, we look at a key bottleneck: the market ramp-up of #electrolysis capacity.

Summary 🧵⬇️

nature.com/articles/s4156…

2/ #GreenHydrogen, produced from renewable electricity via electrolysis, is vital for the #EnergyTransition. In the #EnergyCrisis hydrogen is also considered an option to limit Europe's fossil fuel imports.

However, scaling up supply is a huge challenge!

However, scaling up supply is a huge challenge!

3/ There's a lot of momentum in electrolysis project announcements. This is also much needed because global capacity needs to grow a staggering 6,000-8,000-fold from 2021-2050 to meet #NetZero scenarios. Yet, most projects still lack an FID, making them uncertain.

4/ The market ramp-up of electrolysis can therefore be characterised by three uncertainties:

1️⃣ How many projects will materialise in the short term?

2️⃣ What growth rates are feasible in the mid- to long-term?

3️⃣ How quickly will demand for green hydrogen expand?

1️⃣ How many projects will materialise in the short term?

2️⃣ What growth rates are feasible in the mid- to long-term?

3️⃣ How quickly will demand for green hydrogen expand?

5/ To answer these questions, we build a probabilistic technology diffusion model, which we parameterise with electrolysis project data, growth from technology analogues, and policy targets and scenario results. We explore and aggregate ten thousand pathways (MC simulation).

6/ Three key insights emerge:

1️⃣ Even if electrolysis capacity grows as fast as #wind and #solar power, green hydrogen remains scarce for at least 1-2 decades and likely supplies <1% of final energy until 2030 in the EU and 2035 globally.

👉 Short-term scarcity

1️⃣ Even if electrolysis capacity grows as fast as #wind and #solar power, green hydrogen remains scarce for at least 1-2 decades and likely supplies <1% of final energy until 2030 in the EU and 2035 globally.

👉 Short-term scarcity

7/ Specifically, reaching the recently raised #REPowerEU target of 10 Mt domestic production of renewable hydrogen by 2030 (~100 GW electrolysis capacity) requires growth rates that are unprecedented for energy technologies.

8/

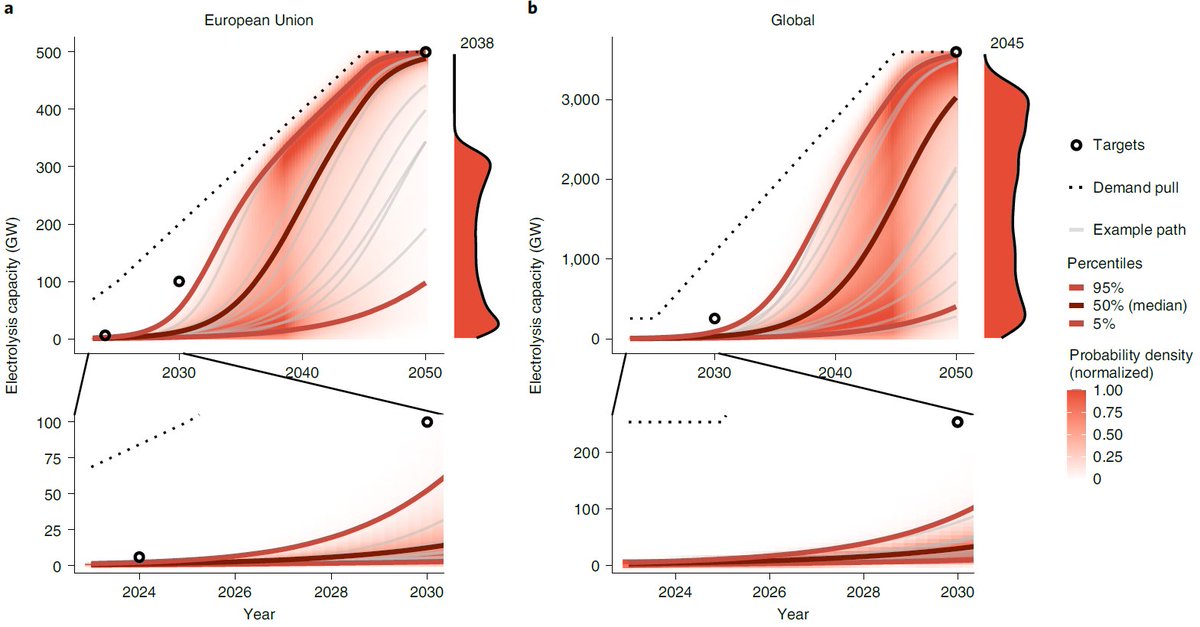

2️⃣ A breakthrough to high electrolysis capacity is possible, but timing and magnitude are uncertain. In the EU, the breakthrough occurs ~2038, globally ~2045. By then, feasible capacities under wind/solar-like growth span a very wide range.

👉 Long-term uncertainty

2️⃣ A breakthrough to high electrolysis capacity is possible, but timing and magnitude are uncertain. In the EU, the breakthrough occurs ~2038, globally ~2045. By then, feasible capacities under wind/solar-like growth span a very wide range.

👉 Long-term uncertainty

9/

3️⃣ There's a pronounced bimodal distribution (two local maxima) near the breakthrough point, further increasing uncertainty.

👉 Bad for risk management

Short-term scarcity and long-term uncertainty pose challenges for policymakers, system planners, and industry.

3️⃣ There's a pronounced bimodal distribution (two local maxima) near the breakthrough point, further increasing uncertainty.

👉 Bad for risk management

Short-term scarcity and long-term uncertainty pose challenges for policymakers, system planners, and industry.

10/ Sounds disappointing?

We also explore what might be possible for #GreenHydrogen under emergency deployment. Unconventionally high growth rates (technologies in panel a) mitigate short-term scarcity and long-term uncertainty, keeping the 2030 #REPowerEU target in reach.

We also explore what might be possible for #GreenHydrogen under emergency deployment. Unconventionally high growth rates (technologies in panel a) mitigate short-term scarcity and long-term uncertainty, keeping the 2030 #REPowerEU target in reach.

11/ What's needed to realise such unconventionally high growth rates for green hydrogen?

Special dedication, coordination and funding! Policies need to secure business cases through co-financing or direct investments along the whole H2 value chain. Also, CO2 pricing, of course!

Special dedication, coordination and funding! Policies need to secure business cases through co-financing or direct investments along the whole H2 value chain. Also, CO2 pricing, of course!

12/ Unconventional growth rates accelerate the breakthrough to ~2030, reducing short-term scarcity and securing long-term availability. However, even then, reaching the @IEA #NZE scenario of 850 GW global capacity by 2030 remains unlikely (panel e).

13/ Summing up, under wind/solar-like growth #GreenHydrogen supply suffers from short-term scarcity and long-term uncertainty. Both are two sides of the same coin and could be resolved together by policies that kick-start rapid Gigawatt-scale electrolysis deployment.

14/ Even though #GreenHydrogen is critical for #ClimateChange mitigation, it's no panacea and policy makers should be aware that there remains a risk of overestimating its potential. Reducing emissions requires an accelerated roll-out of all crucial #ZeroCarbon technologies.

15/ Please do approach us for questions, feedback and remarks.

Thanks a lot to all co-authors @FalkoUeckerdt, @GregNemet, @mhjnstrl, @GunnarLuderer, as well as funding agencies @AriadneProjekt and @umweltstiftung.

#EnergyTwitter #ClimateCrisis

Thanks a lot to all co-authors @FalkoUeckerdt, @GregNemet, @mhjnstrl, @GunnarLuderer, as well as funding agencies @AriadneProjekt and @umweltstiftung.

#EnergyTwitter #ClimateCrisis

Also, here's the free view-only link to our paper:

rdcu.be/cVdvI

rdcu.be/cVdvI

• • •

Missing some Tweet in this thread? You can try to

force a refresh