0/ when analyzing a DEX, it's essential to look at efficiency metrics that provide an indication on how efficiently a DEX is able to generate volume & revenues on its TVL 📊🔍

feat. $UNI, $SUSHI, $JOE, $BOO, $QUICK

🧵 investor's guide on #DEX capital efficiency (0/30)⚖️👇

feat. $UNI, $SUSHI, $JOE, $BOO, $QUICK

🧵 investor's guide on #DEX capital efficiency (0/30)⚖️👇

1/ often people use the TVL (total value locked) metric in order to measure success of decentralized exchanges. However, this metric alone can be very misleading

2/ the goal of a #DEX is to generate volume and subsequently earn trading fees

a better DEX metric than TVL is hence capital efficiency or in different words, how well a DEX is able to maximize utilization of the available liquidity (get volume) & generate revenue on the pools

a better DEX metric than TVL is hence capital efficiency or in different words, how well a DEX is able to maximize utilization of the available liquidity (get volume) & generate revenue on the pools

3/ in this short analysis, we will divide total 365d revenue by TVL (avg. last 365d) in order to arrive at a simplified metric for DEX capital efficiency (revenue generated per liquidity unit)

2/ the focus will be on the following #DEX protocols:

- @Uniswap / $UNI

- @SushiSwap / $SUSHI

- @traderjoe_xyz / $JOE

- @SpookySwap / $BOO

- @QuickswapDEX / $QUICK

- @Clipper_DEX

- @Uniswap / $UNI

- @SushiSwap / $SUSHI

- @traderjoe_xyz / $JOE

- @SpookySwap / $BOO

- @QuickswapDEX / $QUICK

- @Clipper_DEX

3/ @Uniswap is the largest DEX by TVL and volume. Its total value locked amounts to currently $5.6bn

on average, #Uniswap TVL amounted to approx. $7bn during the past 365 days

source: @DefiLlama

on average, #Uniswap TVL amounted to approx. $7bn during the past 365 days

source: @DefiLlama

5/ consequently, #Uniswap's revenue/TVL ratio on an annual basis amounts to 0.17

6/ @SushiSwap's TVL amounts to $675m with an average of approximately $3bn over the past year

source: @DefiLlama

source: @DefiLlama

8/ this leaves us with a revenue/TVL ratio of 0.09 for $SUSHI

9/ $JOE is the largest DEX on #Avalanche measured by TVL and currently stands at $162m with an average TVL of approximately $850m during the past 365 days

source: @DefiLlama

source: @DefiLlama

11/ consequently, @traderjoe_xyz's ratio amounts to 0.3

12/ $BOO is the largest DEX on #Fantom with a TVL of $122m and an average of roughly $500m during the last 365 days

source: @DefiLlama

source: @DefiLlama

14/ @SpookySwap's revenue/TVL ratio hence stands at 0.27

15/ the largest DEX by TVL on #Polygon is @QuickswapDEX. Its TVL currently amounts to $275m with an average of approximately $500m during the past 365 days

source: @DefiLlama

source: @DefiLlama

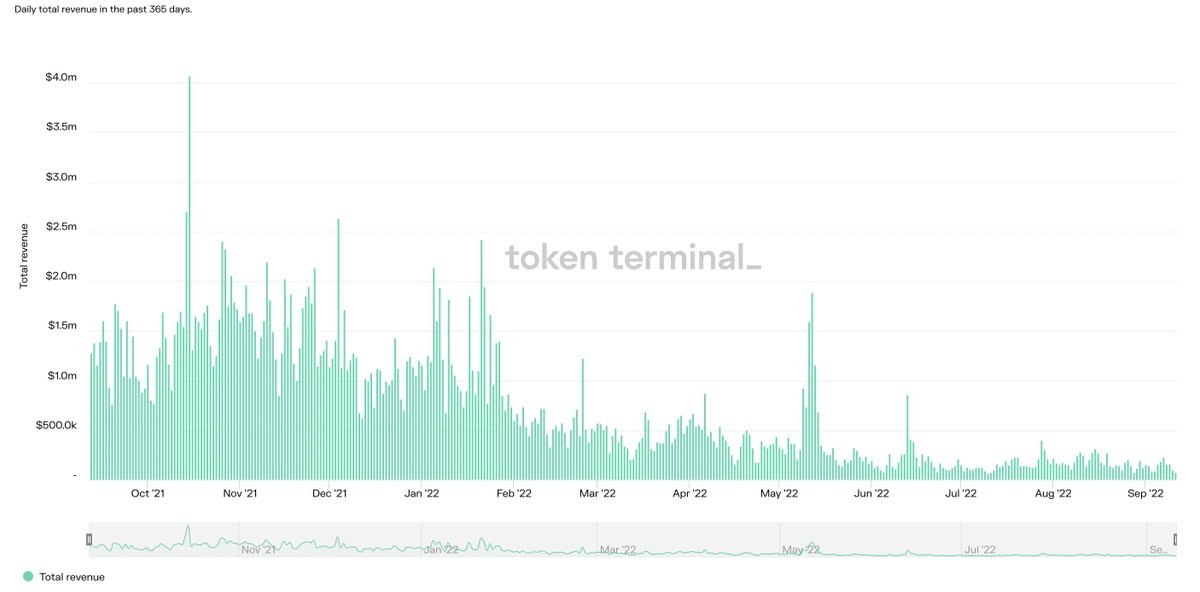

16/ during the same time period $QUICK has generated a total of $60m in revenue

source: @tokenterminal

source: @tokenterminal

17/ this means a revenue/TVL ratio of 0.12 for $QUICK

18/ finally, @Clipper_DEX, a DEX that operates on a couple of EVM-compatible L1s & L2s (incl. $OP), has a TVL of $10.7m with an average of roughly $17m in the past year

source: @DefiLlama

source: @DefiLlama

19/ @Clipper_DEX has also generated a total of $895k in revenue in the past 90 days and 2m in the past 365 days

source: @tokenterminal

source: @tokenterminal

20/ that leaves us with a revenue/TVL ratio of 0.11

21/ in conclusion, we have the following ratios:

1) @traderjoe_xyz: 0.3

2) @SpookySwap: 0.27

3) @Uniswap: 0.17

4) @QuickswapDEX: 0.12

5) @Clipper_DEX: 0.11

6) @SushiSwap: 0.09

1) @traderjoe_xyz: 0.3

2) @SpookySwap: 0.27

3) @Uniswap: 0.17

4) @QuickswapDEX: 0.12

5) @Clipper_DEX: 0.11

6) @SushiSwap: 0.09

22/ we need to keep in mind though, that this calculation is highly simplified and only meant to provide an indication

23/ the approach could be modified and from a LP perspective it would probably make more sense to make the calculation based on supply-side revenue rather than total revenue, while token holders likely primarily care about protocol revenue (value that accrues to the protocol)

24/ but since we're talking about a metric for the success of a #DEX we look how much users are willing to pay to use the protocols and hence consider the total fee revenue that is generated, without differentiating between protocol & supply-side revenue

25/ while the approach is very simplified and a more comprehensive analysis that also includes the cost the protocol incurs (token emissions), etc. is necessary to make investment decisions...

26/ ...the ratio does provide investors with an indication on how much revenue per unit of #TVL the protocols are able to generate or how much users are willing to pay per unit of TVL

27/ an interesting insight for LPs since in relative terms there is more revenue being generated per liquidity unit (not considering liquidity mining programs) if the ratio is higher

28/ similarly for investors, because revenue is a function of volume, a higher ratio shows that liquidity (TVL) is concentrated in pools generating volume & hence revenue (which is a measure for operational efficiency of a protocol). Consequently, a high ratio is desirable as...

29/ ...unproductive liquidity that doesn't generate volume & fees is not desirable for LPs (don't earn fees) and the protocol (potentially incurs cost through incentives but earns no revenue) alike

30/ the analysis could also be more granular if TVL/revenue were disaggregated to account for different ratios across chains (e.g. for $SUSHI), which could make sense from an LP perspective. However, for the purpose of this short protocol-level analysis it's not necessary

thanks for reading if you made it until the end! If you liked this thread, please support me by following & sharing the first post of the thread 🥰✨

• • •

Missing some Tweet in this thread? You can try to

force a refresh