Here is my DYOR analysis on @RebusChain which may help you make decisions about what to do with your #airdrop, or if you want to stake/buy/sell $REBUS

[...]

#CosmosEcosystem #Airdrop #DYOR

[...]

#CosmosEcosystem #Airdrop #DYOR

Rebus is a chain built on Cosmos SDK and using Tendermint consensus (like everything else in the Cosmos Ecosystem). It's aimed at bringing TradFi banks and investors into Crypto. Let's start with a few assumptions on which Rebus success is based.

[...]

[...]

Assumption 1: Crypto will grow substantially. This is fair, as crypto MC is 5% of S&P500 MC and 10% of gold MC. $BTC in itself is about 5% of gold MC.

I agree with this assumption - however, chains that have growth potential without total crypto MC growing are better.

[...]

I agree with this assumption - however, chains that have growth potential without total crypto MC growing are better.

[...]

Assumption 2: It'll grow through TradFi investments driven by banking. Banks don't sell products themselves, they make revenue from rebates on product sales. As such, Rebus will aim to create products for banks to sell such as

[...]

[...]

Structured Derivatives, Asset management, Indexes, ETFs etc.

This assumption means that we will first have to see regulation enacted to allow banks to participate in crypto, which is not quite there yet. A good sign will be once we see super funds etc buying into crypto.

[...]

This assumption means that we will first have to see regulation enacted to allow banks to participate in crypto, which is not quite there yet. A good sign will be once we see super funds etc buying into crypto.

[...]

Assumption 3: The #CosmosEcosystem will continue to thrive. (I agree)

Assumption 4: Rebus can move liquidity from $ETH to Cosmos. (I agree now that $ETH holders have been exposed to PoS)

[...]

Assumption 4: Rebus can move liquidity from $ETH to Cosmos. (I agree now that $ETH holders have been exposed to PoS)

[...]

Moving on to Rebus partners. The Tech partners listed on their website are just bells and whistles. Literally every Cosmos/Tendermint chain is partnered with these.

[...]

[...]

Smartlabs = art/blockchain links to track ownership and authenticity

Smartivative = TradFi portfolio management

Farming Tales = P2E game

Dropmint -= NFT minting, airdrop, management.

These are all small, and none mention their partnership with Rebus from what I could see.

[...]

Smartivative = TradFi portfolio management

Farming Tales = P2E game

Dropmint -= NFT minting, airdrop, management.

These are all small, and none mention their partnership with Rebus from what I could see.

[...]

I assess Rebus will just subcontract their "platform partners" services to banks and act as a middle man in some capacity.

[...]

[...]

Roadmap. The main thing missing from their roadmap in the foreseeable future is... their main product. When are Rebus actually planning to sell products to banks? I think it's because there's still too many external factors that need to line up first.

[...]

[...]

Tokenomics time! Quick math, initial distro:

68 mil tokens airdropped

25 mil tradeable

175mil tokens distributed to team/partners/presale etc.

Roughly, these will be released at 5mil/month over 33 months.

[...]

68 mil tokens airdropped

25 mil tradeable

175mil tokens distributed to team/partners/presale etc.

Roughly, these will be released at 5mil/month over 33 months.

[...]

The good news is, that's not much sell pressure in comparison to the circulating tokens. The price shouldn't dump like $AKT and other VC-heavy coins did upon unlocks.

[...]

[...]

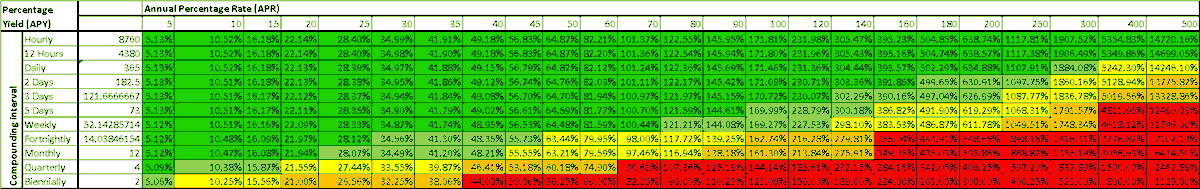

Staking rewards for the first year are 100mil $REBUS. I assess the APR will start off ridiculously high (stake on 01 Oct if you hold Rebus) and settle towards the 200% range (assuming 50% staked). This means the value of any unstaked coins will go down a lot.

[...]

[...]

I couldn't see any details if the groups with locked tokens could stake them before they unlock - if so, this will drop the APR a lot and, in effect, bleed value from non-staked holders and redistribute it to partners/devs/presale token holders. Bad if true.

[...]

[...]

The #airdrop was for $ATOM, $EVMOS and $OSMO holders, with the max amount received being 2,250 $REBUS.

[...]

[...]

Price action:

Considering there is no working product and a lot of assumptions for $REBUS, I personally don't have a lot of confidence in their product. The high APR may drive people to buy early, so I'd expect the price to spike initially and then drop for a long time until[...]

Considering there is no working product and a lot of assumptions for $REBUS, I personally don't have a lot of confidence in their product. The high APR may drive people to buy early, so I'd expect the price to spike initially and then drop for a long time until[...]

Regulations pass that allow banks and financial institutions to invest in crypto, and consumers gain confidence during the next bull. Overall, if you're banking on #Crypto and #ComsosEcosystem doing well, I think there's many other projects that are more likely to succeed.

[...]

[...]

Comparing this project to others in the Cosmos Ecosystem, I would not value it more than $UMEE (24 mil) $CRE (33 mil) or CMDX (11 mil), giving the tokens an initial fair price of about 20-30c.

Additionally, I know for a fact that Rebus is paying #CosmosEcosystem influencers to market their chain (I declined), however they seemed to have an ethical approach, which is a positive. DYOR, don't get sucked into hype and become someone's exit liquidity.

[...]

[...]

I hope you've enjoyed reading my assessments, whether you agree or not. If you got this far, please consider liking/retweeting the first post and following for more.

If you want to tip my work, you could delegate to my #NomicBTC node "Cosmos Dive Bar"

If you want to tip my work, you could delegate to my #NomicBTC node "Cosmos Dive Bar"

https://twitter.com/Cosmodiver/status/1573094509915033602?s=20&t=vCVqjeNjx7W9oNJH2PIZEg

• • •

Missing some Tweet in this thread? You can try to

force a refresh