$SUSHI "elected" a new chef!

You didn't think voting controversy only existed in the Trad world, did you??

Let's discuss the pathetic vote, the results, and what it could mean for @SushiSwap and on-chain governance moving forward

You didn't think voting controversy only existed in the Trad world, did you??

Let's discuss the pathetic vote, the results, and what it could mean for @SushiSwap and on-chain governance moving forward

Headline: Jared Grey, former CEO of DeFi platform Eons Finance, won with 83% of the votes. A landslide!

Reality: The vote was held in the depths of a bear market, and only ~2% of eligible voters actually voted. Democracy!

Reality: The vote was held in the depths of a bear market, and only ~2% of eligible voters actually voted. Democracy!

In that 2% that DID vote were FIVE whales that basically decided the whole thing (11M of the 13M votes).

And those whales? VC firms.

Specifically, @CumberlandSays and Golden Tree with a combined ~8.1M of the 13M votes.

@ViktorDefi

And those whales? VC firms.

Specifically, @CumberlandSays and Golden Tree with a combined ~8.1M of the 13M votes.

@ViktorDefi

So, to recap, a mature, (relatively) successful top 20 #DeFi project held a critical on-chain vote for the highest position that's maintained tons of controversy, headlines, & discussion since it launched...

and 2% voter turnout that really was a 5-person vote amongst VCs

@nlw

and 2% voter turnout that really was a 5-person vote amongst VCs

@nlw

So, what's done is done. Where does #Sushi go from here?

Well, first let's determine what Sushi is and what it's up against...

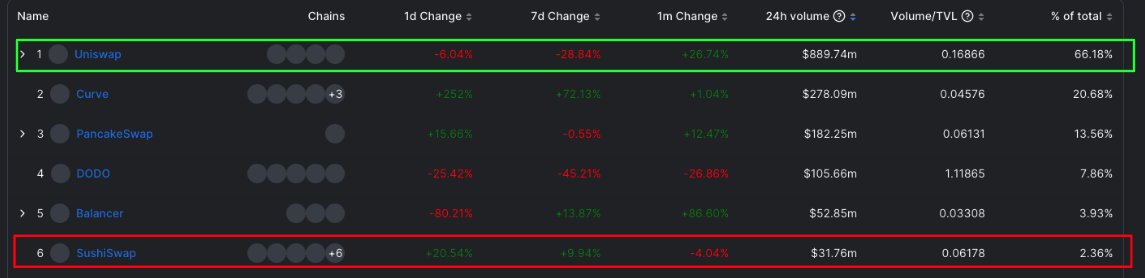

Like @Uniswap, SushiSwap is an AMM DEX.

Well, first let's determine what Sushi is and what it's up against...

Like @Uniswap, SushiSwap is an AMM DEX.

There is no order book for SushiSwap, and instead, the buying and selling of crypto is facilitated by smart contracts based on an algorithm and the liquidity pool depth. @thedefiedge

Sushi's main differentiator after forking UNI is its rewards being distributed in SUSHI tokens

Sushi's main differentiator after forking UNI is its rewards being distributed in SUSHI tokens

Liquidity providers on SushiSwap are rewarded with the protocol’s $SUSHI tokens which also act as a governance token for these token holders to participate in having a say in protocol changes.

As discussed, the governance part is debatable.

@eli5_defi

As discussed, the governance part is debatable.

@eli5_defi

SUSHI holders can also continue to earn rewards after they stop providing liquidity, unlike $UNI holders.

Users provide tokens through the liquidity pool and funds into this pool in token pairs, which provide the funds needed to complete swaps.

Users provide tokens through the liquidity pool and funds into this pool in token pairs, which provide the funds needed to complete swaps.

Like Uniswap, SushiSwap LPs are rewarded for providing liquidity via a percentage of swap revenue.

SushiSwap also offers a range of other DeFi services that are indicative of the SushiSwap team’s innovative outlook.

SushiSwap also offers a range of other DeFi services that are indicative of the SushiSwap team’s innovative outlook.

While Uniswap focuses on being a #DEX, SushiSwap is more focused on more products, such as Shoya, its planned #NFT marketplace, and BentoBox, a token locker for dApps.

As well as listing on numerous alt chains although pool creation has declined this year

@Delphi_Digital

As well as listing on numerous alt chains although pool creation has declined this year

@Delphi_Digital

While Uniswap is a more widely used exchange and maintains a much higher TVL as of September 2022, SushiSwap has been more innovative with experimenting with new features since its launch.

SushiSwap also offered a different incentive system for liquidity providers.

@DefiLlama

SushiSwap also offered a different incentive system for liquidity providers.

@DefiLlama

@DefiLlama On Uniswap, 0.3% of a pool’s liquidity is shared equally among LPs.

On SushiSwap, 0.25% of the pool’s trading fees go to LPs in a ratio, and an additional 0.05% is converted into SUSHI and spread to token holders.

UNI is experimenting with its own "fee switch"

On SushiSwap, 0.25% of the pool’s trading fees go to LPs in a ratio, and an additional 0.05% is converted into SUSHI and spread to token holders.

UNI is experimenting with its own "fee switch"

https://twitter.com/mt_1466/status/1572231399243157511

Uniswap’s liquidity mining program to incentivize liquidity providers is also no longer active at this time, while that of SushiSwap continues to be online.

Uniswap v3 offers concentrated liquidity to allow users to form larger swaps, while SushiSwap does not offer this feature.

Uniswap v3 offers concentrated liquidity to allow users to form larger swaps, while SushiSwap does not offer this feature.

Finally, Uniswap does not offer any extra rewards to new tokens on its platform, while SushiSwap offers what’s called the “Onsen Program.” This is a liquidity provision strategy for new tokens.

SUSHI Tokenomics

SushiSwap added an incentive structure to its ecosystem with its own governance token, SUSHI.

During the initial days of the protocol, this made the DEX popular for token holders who wanted to have a say in changes to the protocol.

These days...

SushiSwap added an incentive structure to its ecosystem with its own governance token, SUSHI.

During the initial days of the protocol, this made the DEX popular for token holders who wanted to have a say in changes to the protocol.

These days...

While SUSHI initially had an infinite supply, a proposal that suggested capping the supply at 250M SUSHI was adopted by the community.

The current expected date for this supply cap to be reached is November 2023.

@MessariCrypto

The current expected date for this supply cap to be reached is November 2023.

@MessariCrypto

For the first 100,000 blocks following the SUSHI distribution launch, SushiSwap minted 1,000 SUSHI tokens per block to the stakers of each supported pool.

This was all happening during Sushi’s liquidity drain from Uniswap.

This was all happening during Sushi’s liquidity drain from Uniswap.

After the 100,000th block, rewards of SUSHI dropped to 100 SUSHI per block. Rewards are set to decrease until the max supply cap of SUSHI is reached. 10% of all emissions go to the SushiSwap multi-sig development fund.

SUSHI can be staked in return for xSUSHI, which receives voting rights as well as fees, including 0.05% on swaps. 2/3rd of SUSHI earned via staking in xSUSHI pools is time-locked for six months.

When a user withdraws their SUSHI, they receive back whatever fees they earned during the time they were holding xSUSHI. The SUSHI token can also be staked across various platforms and used as collateral across other Ethereum DeFi platforms such as on Aave.

That's a wrap!

If you enjoyed this thread:

1. Follow me @mt_1466 for more of these

2. RT the tweet below to share this thread with your audience

If you enjoyed this thread:

1. Follow me @mt_1466 for more of these

2. RT the tweet below to share this thread with your audience

https://twitter.com/913017695880253440/status/1577669230660620289

• • •

Missing some Tweet in this thread? You can try to

force a refresh