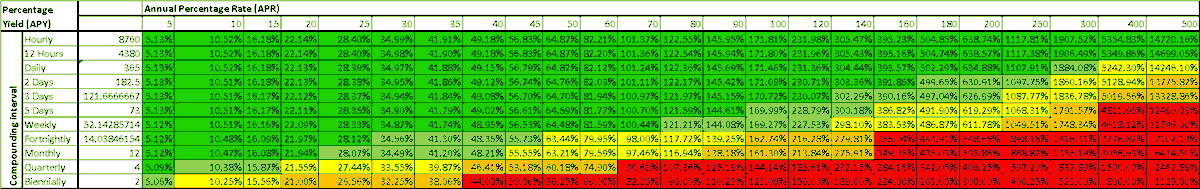

Here's how the top 10 #OsmosisZone pools stack up after factoring in inflation, fees, APRs & incentives.

Green = better than staking

Red = worse than staking

Read on for a link to my spreadsheet and explanation/notes.

#CosmosEcosystem #DeFi #DYOR #Osmosis #Yield

Green = better than staking

Red = worse than staking

Read on for a link to my spreadsheet and explanation/notes.

#CosmosEcosystem #DeFi #DYOR #Osmosis #Yield

Observations:

-Staking $OSMO is still bad. Stride MEV won't make much of a difference ($2k a day extra income split between all stakers is less than 0.1% extra)

-Pooling $EVMOS, $ATOM and $JUNO worse than staking.

-Pooling $STARS, $CRO or any AXL tokens good. USDC/OSMO pool great

-Staking $OSMO is still bad. Stride MEV won't make much of a difference ($2k a day extra income split between all stakers is less than 0.1% extra)

-Pooling $EVMOS, $ATOM and $JUNO worse than staking.

-Pooling $STARS, $CRO or any AXL tokens good. USDC/OSMO pool great

Why is this different to Dexmos / APRs? Because it accounts for inflation. (as well as pool fees, external rewards etc). Basically, if you have 10% APR, but inflation is more than 10%, you're losing money. As you can see, not accounting for inflation gives very different returns.

This is how the spreadsheet works. The instructions are on the right, simply fill in the yellow boxes.

docs.google.com/spreadsheets/d…

docs.google.com/spreadsheets/d…

Notes:

1) I assumed USD stablecoin inflation to be 8.3% in line with USD actual inflation

2) I couldn't figure out how ATOM/stATOM or other stride pools would work so I've left them out.

3) I used 40% for JUNO APR even though it's currently more like 28%

1) I assumed USD stablecoin inflation to be 8.3% in line with USD actual inflation

2) I couldn't figure out how ATOM/stATOM or other stride pools would work so I've left them out.

3) I used 40% for JUNO APR even though it's currently more like 28%

If this post made you think about how to invest your money in DeFi, my job is done!

As always, follow for more content and like/RT so that I can continue educating other awesome #CosmosEcosystem people!

As always, follow for more content and like/RT so that I can continue educating other awesome #CosmosEcosystem people!

• • •

Missing some Tweet in this thread? You can try to

force a refresh