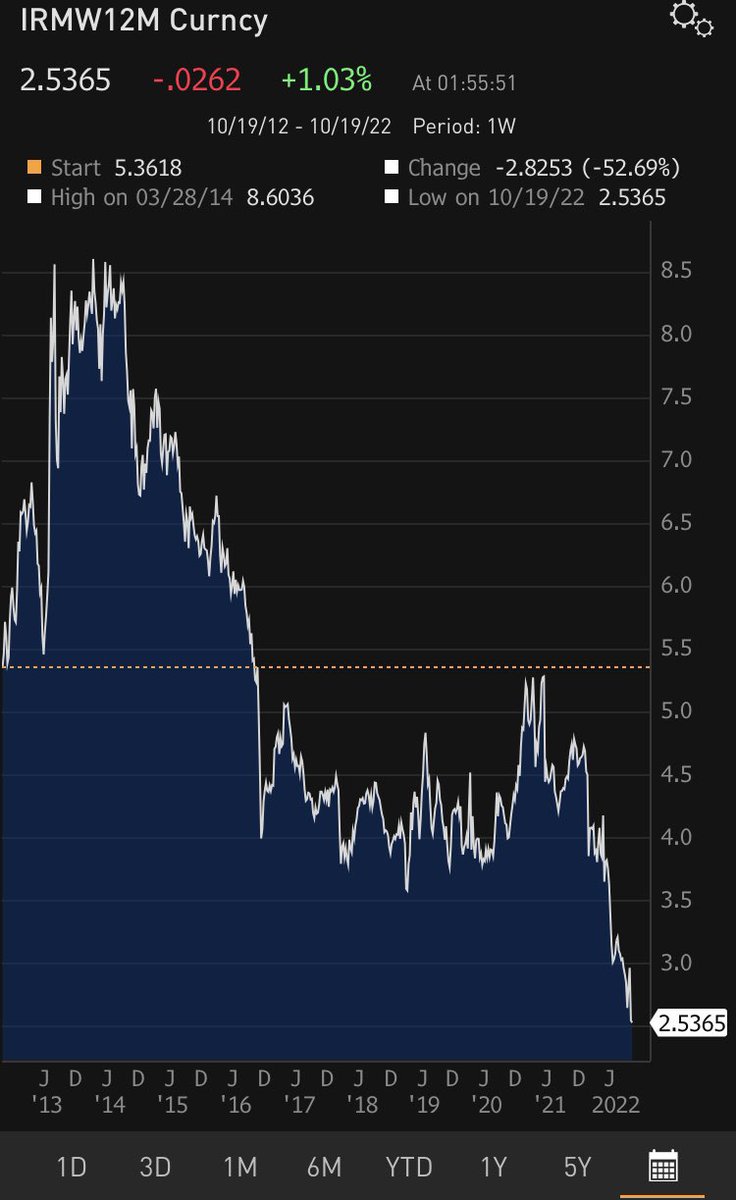

#EU #NATURALGAS: #OUTRAGEOUS Forecast …. Can #NaturalGas in the Europe Spot Market #CRASH TO #ZERO !!

Here is the thing, There are more than 35 LNG-laden vessels drifting off Spain & around the Mediterranean, with at least 8 vessels anchored off Bay of Cadiz. Why ?

Here is the thing, There are more than 35 LNG-laden vessels drifting off Spain & around the Mediterranean, with at least 8 vessels anchored off Bay of Cadiz. Why ?

Europe's lack of "regasification" capacity since all these years they were depending on pipelines and not LNG which is liquid cooled. HOW BAD? “declaration of exceptional operational situation", Spain's national gas grid operator Enagas said it may have to reject unloads of LNG

Floating storage levels in LNG shipping is at all time high levels with slightly more than 2.5million tonnes tied up in floating storage. These guys are speculators holding cargo as well.

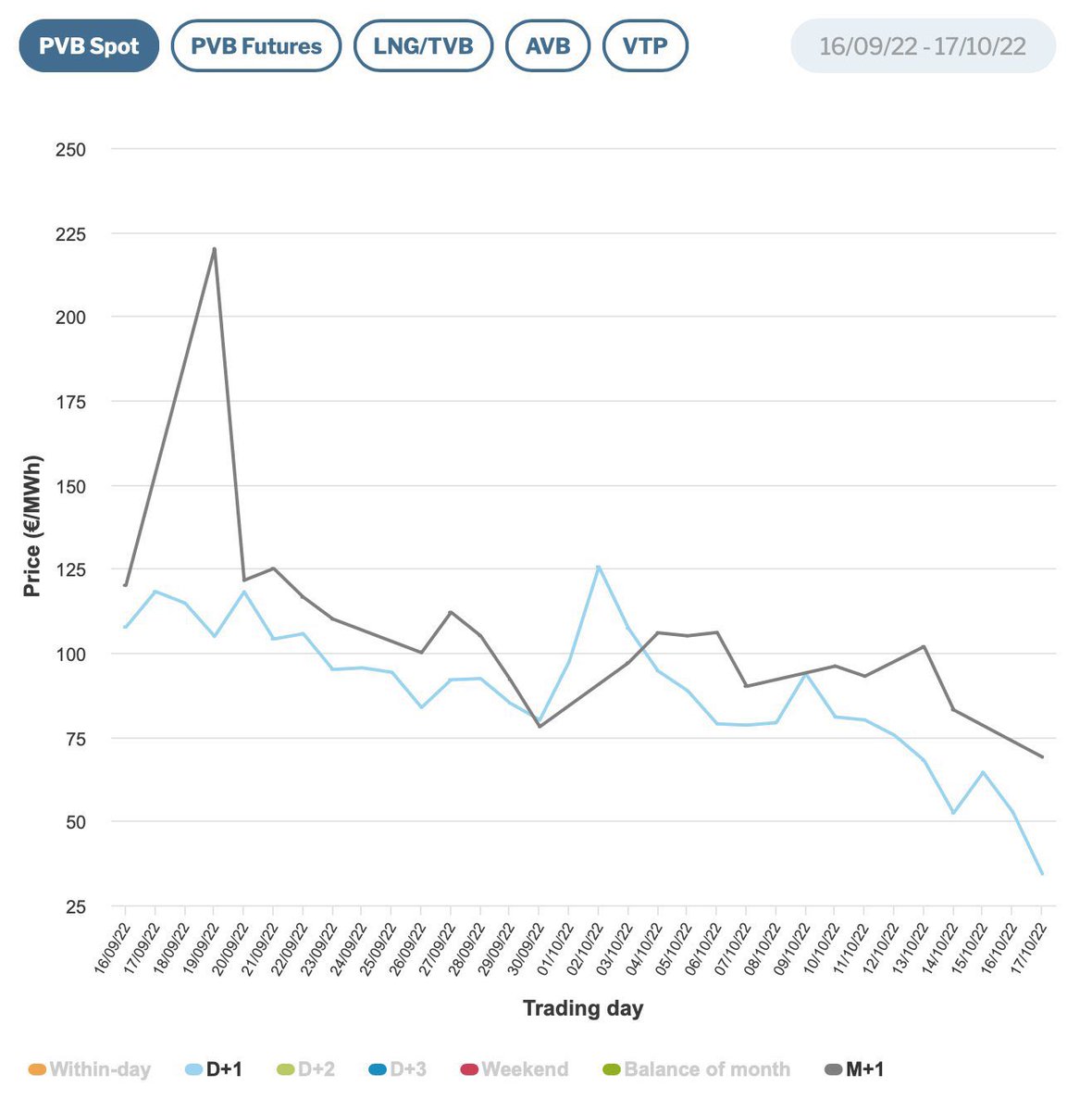

However..While Day Head Power has fallen, but Month Ahead has crashed to <30…

However..While Day Head Power has fallen, but Month Ahead has crashed to <30…

So with storage virtually full, who is bid the front end futures? If you notice back end is in contango.

Also one logistical problem is how will Gas collected in Spain which has REGAS capacities be sent to Germany to be used ?

So Every Possibility of fall to ZERO! #RETWEET

Also one logistical problem is how will Gas collected in Spain which has REGAS capacities be sent to Germany to be used ?

So Every Possibility of fall to ZERO! #RETWEET

• • •

Missing some Tweet in this thread? You can try to

force a refresh