There have been lots of talks around easing rent #inflation and how lagging the Shelter #CPI really is.

Its 12M (or longer) lag makes it difficult to use in assessing current/future #inflation.

So what can the #Fed do?

Let's take a look at some other measures.

A thread.

1/14

Its 12M (or longer) lag makes it difficult to use in assessing current/future #inflation.

So what can the #Fed do?

Let's take a look at some other measures.

A thread.

1/14

Lots of recent comments by the #Fed have been about "sticky" and "high" #inflation.

But #inflation is neither sticky nor high as evidenced by the headline #CPI in the last 3M (unadjusted).

2/14

But #inflation is neither sticky nor high as evidenced by the headline #CPI in the last 3M (unadjusted).

2/14

https://twitter.com/MBjegovic/status/1580562847305584646?s=20&t=5LI-G9wD6Wf3_FXbJwm-1A

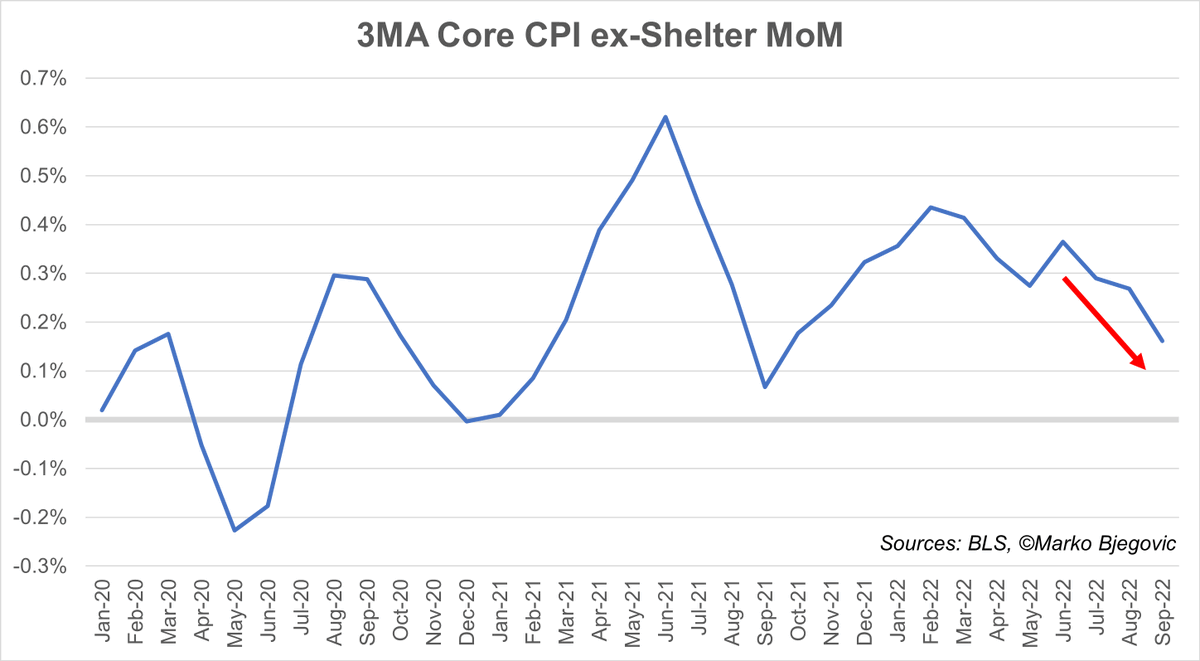

Then the #Fed tries to spin it by saying core #inflation is "sticky" and "high".

If we exclude the shelter component (unadjusted), core #CPI is quite low and in a downtrend.

Now obvious Q is what if it reverses its course just like it did in 2021 and heads up again?

3/14

If we exclude the shelter component (unadjusted), core #CPI is quite low and in a downtrend.

Now obvious Q is what if it reverses its course just like it did in 2021 and heads up again?

3/14

I don't think that will happen for 2 reasons:

1) Last yr Covid still played significant role in many ppl's lives and full reopening of the #economy (ppl travelling around) didn't come until late 2021/early 2022.

This yr worries about Covid are almost non-existent.

4/14

1) Last yr Covid still played significant role in many ppl's lives and full reopening of the #economy (ppl travelling around) didn't come until late 2021/early 2022.

This yr worries about Covid are almost non-existent.

4/14

2) Last yr the #Fed was still doing the #QE.

This yr we've had a contraction of the #Fed's B/S.

As a result money supply contracted by the largest amount on record (data going back to 1959).

Ex-Shelter core CPI (unadjusted) in Sep is only 0.14% or 1.7% annualized < 2%.

5/14

This yr we've had a contraction of the #Fed's B/S.

As a result money supply contracted by the largest amount on record (data going back to 1959).

Ex-Shelter core CPI (unadjusted) in Sep is only 0.14% or 1.7% annualized < 2%.

5/14

There is no doubt rent #inflation is easing.

Some measures like Apartment List National Rent Index even show a decline in rents in Sep:

6/14

Some measures like Apartment List National Rent Index even show a decline in rents in Sep:

6/14

https://twitter.com/MBjegovic/status/1577446184263860224?s=20&t=5LI-G9wD6Wf3_FXbJwm-1A

If we swap Shelter component of the #CPI with Zillow Observed Rent Index, we get a more benign core #CPI of 0.25% in Sep vs 0.43% with standard Shelter component.

Core #CPI with ZORI in Sep is only 3% annualized.

Note both core CPIs are unadjusted.

7/14

Core #CPI with ZORI in Sep is only 3% annualized.

Note both core CPIs are unadjusted.

7/14

#CPI with ZORI rose faster than the regular #CPI in 2021 and is now falling faster to reflect the rent #inflation downtrend.

This suggests that if the #Fed had relied upon ZORI, instead of Shelter back in 2021, they wouldn't have missed the #inflation surge.

8/14

This suggests that if the #Fed had relied upon ZORI, instead of Shelter back in 2021, they wouldn't have missed the #inflation surge.

8/14

Now ZORI is pointing to the #disinflation showing there is in fact no "sticky" or "high" headline nor core #inflation like the #Fed has tried to argue.

There is one more thing that worries the #Fed, and that's the difference between the new and continuing rents.

9/14

There is one more thing that worries the #Fed, and that's the difference between the new and continuing rents.

9/14

@NickTimiraos (the #Fed "whisperer") argued the other day that rents on continued leases are outpacing rents on new leases as evidenced by a $GS analysis.

But $GS made the analysis (and conclusions) based on the BLS (extremely lagging) rent data.

10/14

But $GS made the analysis (and conclusions) based on the BLS (extremely lagging) rent data.

10/14

https://twitter.com/NickTimiraos/status/1582397479303385089?s=20&t=0W2PEm5N7dxgxrlRXEen2w

In order to avoid the lagging effect of the BLS rent data, it would be much better and precise to use other measures.

Just like the #Fed would've been better off if they swapped #CPI Shelter with ZORI when #inflation was going up, the same is true now on its way down.

11/14

Just like the #Fed would've been better off if they swapped #CPI Shelter with ZORI when #inflation was going up, the same is true now on its way down.

11/14

If the #Fed really remains stubborn and insists on the extremely lagging Shelter #CPI component as opposed to other measures, they will create serious disruptions.

With continued aggressive hiking sth will break much sooner than the Shelter #CPI comes back down.

12/14

With continued aggressive hiking sth will break much sooner than the Shelter #CPI comes back down.

12/14

These threads take a lot of time and effort to write.

If you like the content, please love and retweet to help me spread the message.

13/14

If you like the content, please love and retweet to help me spread the message.

13/14

The #Fed now has all the reasons to #pivot:

1) 3MA #CPI unadjusted is only +0.06%, lower than in Mar 2020 when they started the latest #QE

2) Ex-Shelter core CPI (unadjusted) in Sep is only 0.14% or 1.7% annualized < 2%

3) Core #CPI with ZORI (unadjusted) is 3% annualized

14/14

1) 3MA #CPI unadjusted is only +0.06%, lower than in Mar 2020 when they started the latest #QE

2) Ex-Shelter core CPI (unadjusted) in Sep is only 0.14% or 1.7% annualized < 2%

3) Core #CPI with ZORI (unadjusted) is 3% annualized

14/14

• • •

Missing some Tweet in this thread? You can try to

force a refresh