So many are talking about #diesel & #gas shortages. Just a couple of facts from the latest @EIAgov This Week in Petroleum report.

1. US diesel stocks are below the 5 year average. Typically for this time we are between 120 to 140 million barrels of diesel.

We are at 110M...

1. US diesel stocks are below the 5 year average. Typically for this time we are between 120 to 140 million barrels of diesel.

We are at 110M...

2. In terms of days of supplies, last year we were sitting at 30 days of supplies, today we are at 25 days....

3. In terms of production of #diesel, we are above last year's 4.6 million barrels per day; currently producing 5 million barrels of day.

Okay, if production is up and supplies are down, what is the cause?

Are we driving more?

No, diesel use is down in the US.

Then what?

Okay, if production is up and supplies are down, what is the cause?

Are we driving more?

No, diesel use is down in the US.

Then what?

4. The answer is #diesel exports!

Due to sanctions against Russia by Europe and other countries, one of the largest sources of diesel is no longer available; meaning the cost for diesel in Europe 🔼.

According to @eia, current exports are 1.3M bbls a day; over last year's 0.9M.

Due to sanctions against Russia by Europe and other countries, one of the largest sources of diesel is no longer available; meaning the cost for diesel in Europe 🔼.

According to @eia, current exports are 1.3M bbls a day; over last year's 0.9M.

5. The solution to this is not waiving the #JonesAct to have foreign tankers haul #diesel and #gas from the Gulf coast to the NE because there is no guarantee that those stocks don't get shipped to Europe.

Most diesel and gas to Europe is shipped out of NY due to distance.

Most diesel and gas to Europe is shipped out of NY due to distance.

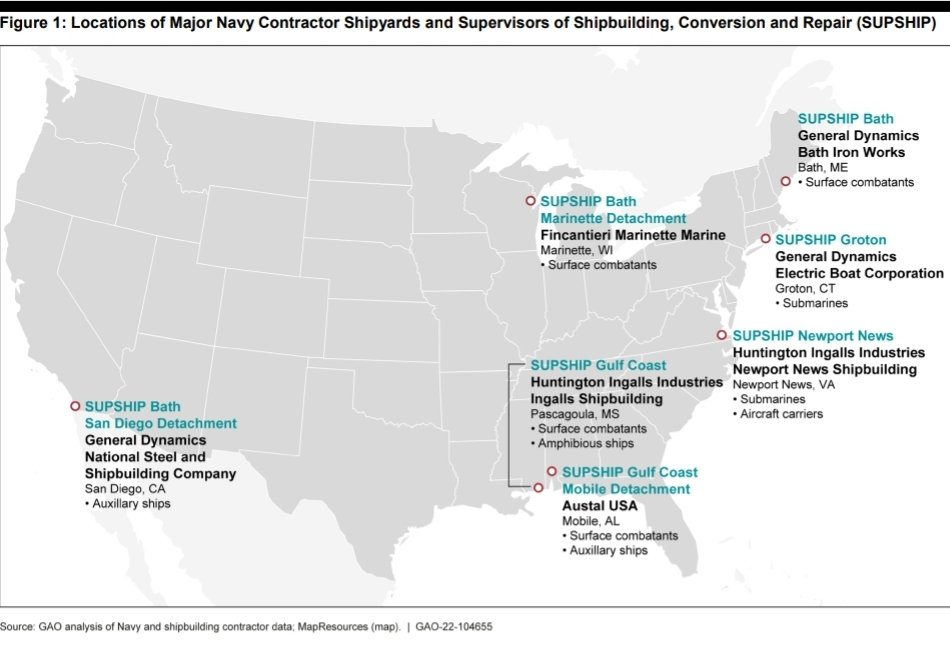

6. Dedicated #JonesAct tankers ensures that there is dedicated tankers to service between US ports.

@SecDef @SecretaryPete @SecMayorkas @SecGranholm should be advocating and leading the reform of the #JonesAct to offset costs to ship US & a building program for new tonnage.

@SecDef @SecretaryPete @SecMayorkas @SecGranholm should be advocating and leading the reform of the #JonesAct to offset costs to ship US & a building program for new tonnage.

What the Ship (Ep56)

1⃣ Updates: #Hamburg, #Rivers, #LNG & #Globalization

2⃣ #Russia Oil

3⃣ #Gas & #Diesel Shortages in the US & the #JonesAct

4⃣ #Container Rates, Volumes, & Number of Ships

5⃣ West Coast & @PortofLA

via @YouTube

1⃣ Updates: #Hamburg, #Rivers, #LNG & #Globalization

2⃣ #Russia Oil

3⃣ #Gas & #Diesel Shortages in the US & the #JonesAct

4⃣ #Container Rates, Volumes, & Number of Ships

5⃣ West Coast & @PortofLA

via @YouTube

• • •

Missing some Tweet in this thread? You can try to

force a refresh