Have you ever wondered how much you need to save for your retirement? Ever wonder if you will make it or fall short?

Over 600+ clients have benefited from our Financial Planning engagement!

Here are FIVE ways financial planning can help you! (1/13)

#financialindependence

Over 600+ clients have benefited from our Financial Planning engagement!

Here are FIVE ways financial planning can help you! (1/13)

#financialindependence

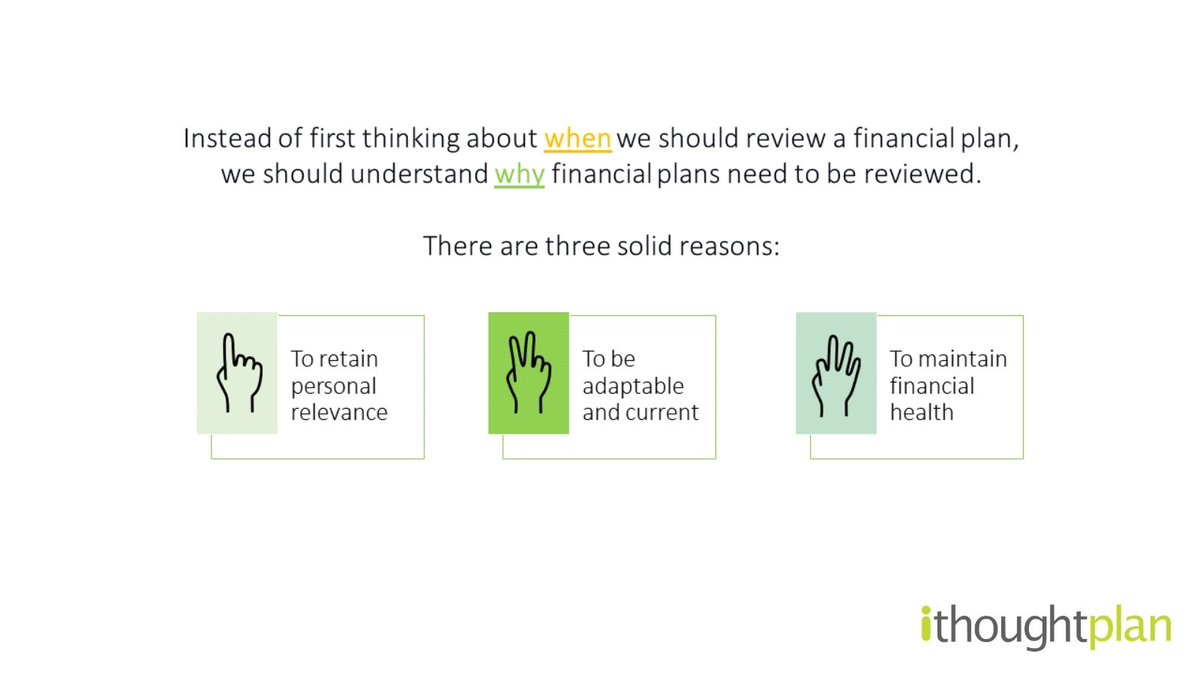

Before we begin, financial planning is a very personalised process. Every person's need is different. That is why we aim to craft tailor-made financial plans to meet each individual's needs. (2/13)

#financialplanning #personalfinance #savingstips

#financialplanning #personalfinance #savingstips

#1 Achieving Your Goals

Managing your finances in a way through which we can help you meet your goals is the crux of the planning process.

Proper planning can help you accomplish goals that you thought were far out of reach! (3/13)

#financialplanning #financialgoals

Managing your finances in a way through which we can help you meet your goals is the crux of the planning process.

Proper planning can help you accomplish goals that you thought were far out of reach! (3/13)

#financialplanning #financialgoals

The mark of a good financial plan is one where every aspect of your finances is optimised and works towards making your goals happen while keeping your priorities in mind.

Know that whatever your goal may be, it is not too far away when planned towards. (4/13)

#financialgoals

Know that whatever your goal may be, it is not too far away when planned towards. (4/13)

#financialgoals

#2 Proper Asset-allocation Decisions

An aggressive portfolio geared toward your short-term needs like paying for school fees or funding a vacation may lead to a failure in meeting that goal. (5/13)

#assetallocation #portfolio #financialgoals #debt #equity

An aggressive portfolio geared toward your short-term needs like paying for school fees or funding a vacation may lead to a failure in meeting that goal. (5/13)

#assetallocation #portfolio #financialgoals #debt #equity

A financial plan allows for a proper asset allocation strategy that works for you.

It enables you to make the right investment decisions that lead you towards achieving both your short-term and long-term goals without worry. (6/13)

#investmentplanning #investing #personalfinance

It enables you to make the right investment decisions that lead you towards achieving both your short-term and long-term goals without worry. (6/13)

#investmentplanning #investing #personalfinance

#3 Tax Planning

A quote that summarizes why one needs tax planning:

"You must pay taxes. But no law says you got to leave a tip." ~ Morgan Stanley.

Paying taxes is one thing. Overpaying is another. (7/13)

#taxplanning #taxexemption #deductions #taxtips

A quote that summarizes why one needs tax planning:

"You must pay taxes. But no law says you got to leave a tip." ~ Morgan Stanley.

Paying taxes is one thing. Overpaying is another. (7/13)

#taxplanning #taxexemption #deductions #taxtips

Through appropriate tax planning, we aim to optimise your after-tax income in a way that is more tax efficient.

In simple words, more money after taxes = more money in your hand. (8/13)

#taxplanning #personalfinance #MorganHousel

In simple words, more money after taxes = more money in your hand. (8/13)

#taxplanning #personalfinance #MorganHousel

#4 Debt Management

Properly managing your EMI outflow and paying off high-interest debt will save you a lot of mental stress and free up extra cash to invest towards your goals. (9/13)

#debtmanagement #financialfreedom

Properly managing your EMI outflow and paying off high-interest debt will save you a lot of mental stress and free up extra cash to invest towards your goals. (9/13)

#debtmanagement #financialfreedom

Buying certain assets on loan can also help you save on taxes and allows you to invest the excess cash towards investments that pay a better return in the long run. (10/13)

#investmentplanning #taxsaving #assets #longterminvesting

#investmentplanning #taxsaving #assets #longterminvesting

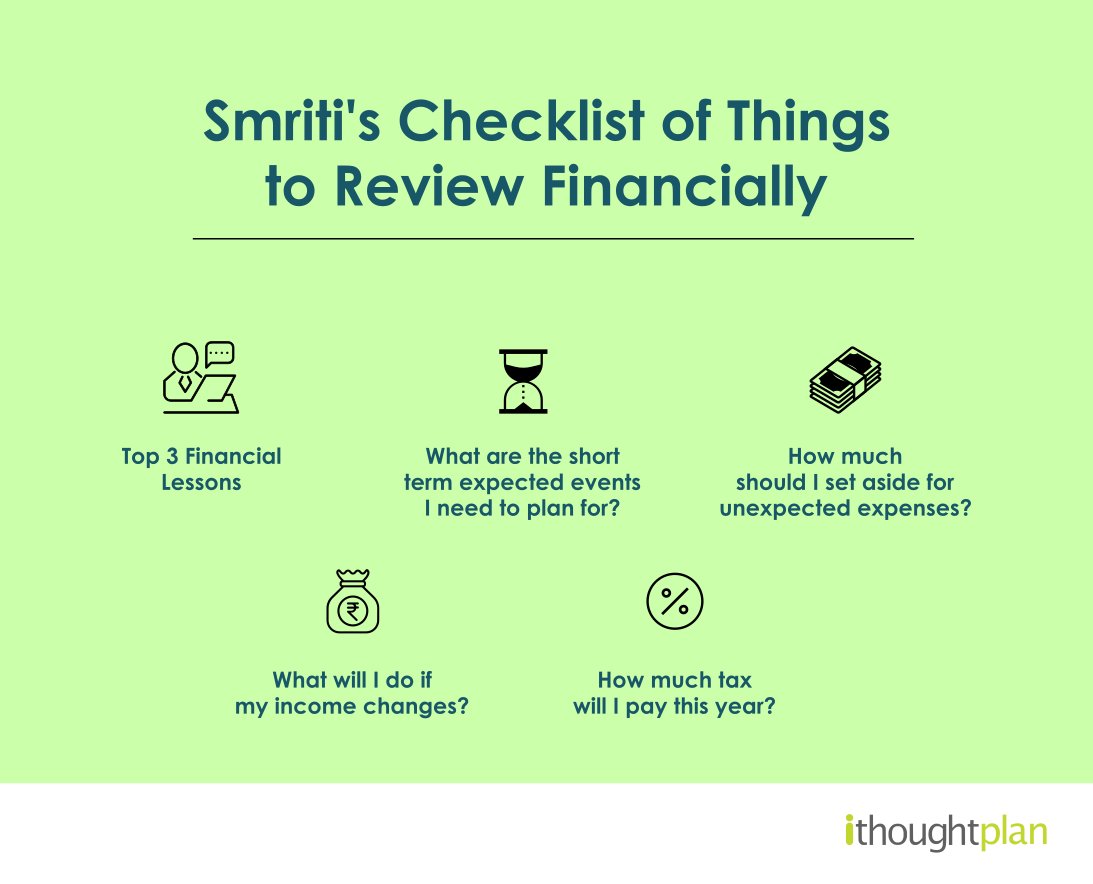

#5 Portfolio Review

Let's say you have an existing portfolio of assets but aren't sure whether to hold or sell them.

Through a comprehensive review of your #portfolio with the help of our in-house team of experts, we can guide you to better align your portfolio. (11/13)

Let's say you have an existing portfolio of assets but aren't sure whether to hold or sell them.

Through a comprehensive review of your #portfolio with the help of our in-house team of experts, we can guide you to better align your portfolio. (11/13)

Holistic financial planning can help you save a lot of time and money.

We can help you plan for your future, letting you focus your attention on more important things in your life. (12/13)

#financialplanning

We can help you plan for your future, letting you focus your attention on more important things in your life. (12/13)

#financialplanning

If you find this thread useful, retweet the first tweet that helps us to reach more people like you. (13/13)

#financialplanning #financialgoals #financialfreedom #personalfinance

#financialplanning #financialgoals #financialfreedom #personalfinance

• • •

Missing some Tweet in this thread? You can try to

force a refresh