An ithought endeavour that aims at creating Holistic Financial Plans for Individuals, small and medium Enterprises and Trusts.

How to get URL link on X (Twitter) App

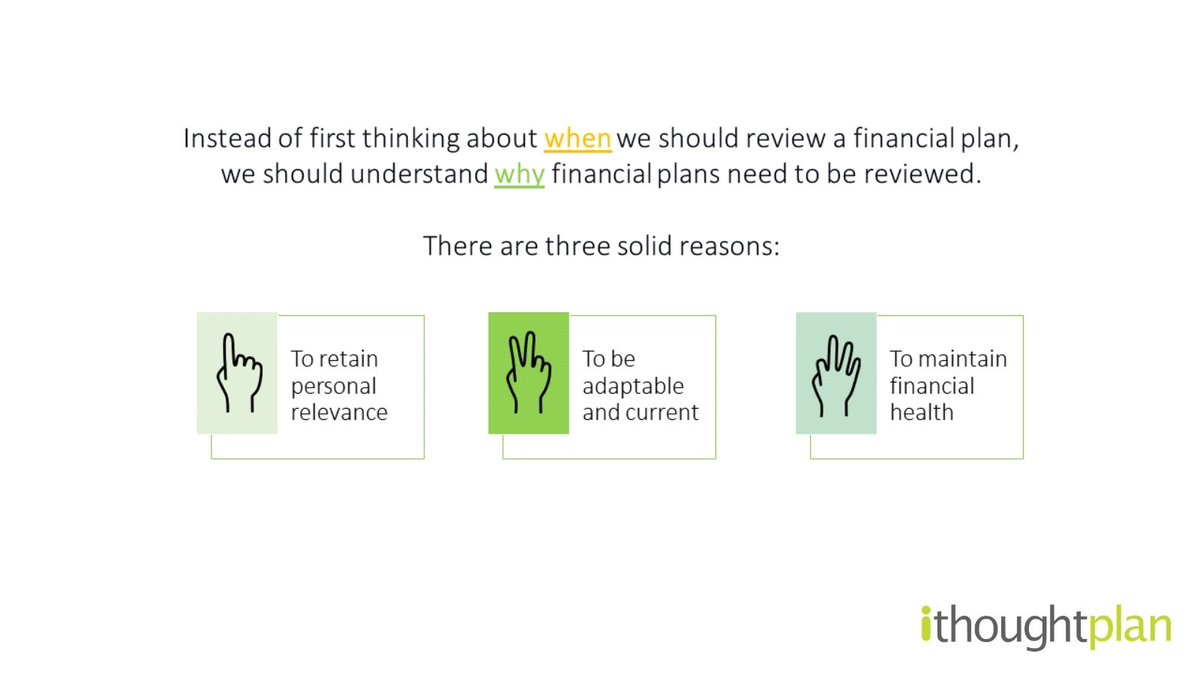

3 solid reasons to review your #financialplan in 2021. Are you confident that your financial plan is still relevant and adaptable? Are you in the best of #financial health?

3 solid reasons to review your #financialplan in 2021. Are you confident that your financial plan is still relevant and adaptable? Are you in the best of #financial health?