#INFLATION IN India does not Exist @nsitharaman

Prices of most #Huble & #affordable #snacks available in #Mumbai—vada pav, bhaji pav and samosa pav—have increased by Rs 2 to 5 in view of the hike in rates of edible oils & commercial cylinders ...2nd time in 2022 #Shrinkflation

Prices of most #Huble & #affordable #snacks available in #Mumbai—vada pav, bhaji pav and samosa pav—have increased by Rs 2 to 5 in view of the hike in rates of edible oils & commercial cylinders ...2nd time in 2022 #Shrinkflation

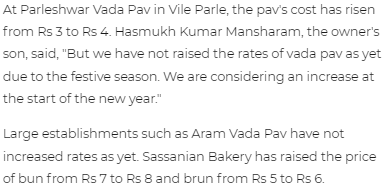

Lets start with the Article from #APRIL2022... The rate of oil has suddenly increased by Rs 800-Rs 900 and the price of gas has also increased. Earlier, we used to pay Rs 1,600 for gas and now it stands at Rs 2,300. Green chilly too has become expensive.

Earlier we used to sell each vada pav for Rs 20 but we have now increased it to Rs 22. Similarly, we are selling samosa pav for Rs 23 as opposed to earlier Rs 20, and bhaji pav for Rs 22, up from Rs 20

Now with 2nd Nov 2022 Article on #Inflation and #Shrinkflation of the famous #Pav in the #Vada. The cost of the humble pav has now gone up to Rs 5 apiece from Rs 3.50-4 in 2021... Bakeries and suppliers have raised rates by 50 paise to a rupee as recently as october.

#Shrinkflation of the Pav .. they are becoming smaller and lighter

If you recall, I did a thread on how the famous #AlooTikki Burger by @McDonalds #India has hiked its prices by almost 40% since Pre-covid....

• • •

Missing some Tweet in this thread? You can try to

force a refresh