Oct #CPI came in way better than consensus estimates and even better than I projected.

This is only the 2nd beat on the headline and 3rd on the core #CPI this yr.

Does that mean the #CPI has really started to come down and the #Fed can #pivot?

🧵

1/18

This is only the 2nd beat on the headline and 3rd on the core #CPI this yr.

Does that mean the #CPI has really started to come down and the #Fed can #pivot?

🧵

1/18

https://twitter.com/MBjegovic/status/1590088955160297472?s=20&t=dOLfZ7hPtmsoQ25vC-ZvBQ

In the details this was a good report. MoM unadjusted:

1) Food +0.7%, same as Sep

2) Energy +1.0% vs -2.6% in Sep due to higher gas prices (+3.1% vs -5.6% in Sep), while #electricity and #natgas went down (-1.3% and -4.0% respectively vs +0.8% and +2.6% respectively in Sep)

2/18

1) Food +0.7%, same as Sep

2) Energy +1.0% vs -2.6% in Sep due to higher gas prices (+3.1% vs -5.6% in Sep), while #electricity and #natgas went down (-1.3% and -4.0% respectively vs +0.8% and +2.6% respectively in Sep)

2/18

3) Apparel unexpectedly went down by -0.6% vs +2.2% in Sep

4) New vehicles edged up to +0.5% vs +0.4% in Sep

5) Used vehicles and trucks -2.3%, slower than in Sep (-4.2%)

6) Medical care commodities -0.02% vs -0.09% in Sep

7) Alcoholic beverages +0.8% vs +0.1% in Sep

3/18

4) New vehicles edged up to +0.5% vs +0.4% in Sep

5) Used vehicles and trucks -2.3%, slower than in Sep (-4.2%)

6) Medical care commodities -0.02% vs -0.09% in Sep

7) Alcoholic beverages +0.8% vs +0.1% in Sep

3/18

8) Tobacco +0.3% vs +0.2% in Sep

9) Shelter +0.66% vs +0.68% in Sep

10) Medical services tumbled by -0.5% vs 0.7 in Sep

11) Transportation services +1.2% vs +1.7% in Sep due to easing Motor vehicle maintenance and repair #inflation (+0.7% vs +1.9% in Sep)

4/18

9) Shelter +0.66% vs +0.68% in Sep

10) Medical services tumbled by -0.5% vs 0.7 in Sep

11) Transportation services +1.2% vs +1.7% in Sep due to easing Motor vehicle maintenance and repair #inflation (+0.7% vs +1.9% in Sep)

4/18

Shelter is the most important component making 32.6% of the headline #CPI and 41.7% of the core.

Unadjusted MoM increase in shelter is lower than in Sep and the same as in Aug.

It is only 1.5 bps above 0.6%

But rent #inflation is even less benign:

5/18

Unadjusted MoM increase in shelter is lower than in Sep and the same as in Aug.

It is only 1.5 bps above 0.6%

But rent #inflation is even less benign:

https://twitter.com/MBjegovic/status/1582900236435206145?s=20&t=HGfAXslUm28e2fZHj9AqcQ

5/18

If we swap the #CPI shelter component with the Apartment List Rent Index, core #CPI is DOWN -0.43% in Oct.

Some (like @LHSummers) have been arguing that rents usually fall in this time of the yr so it would be necessary to seasonally adjust them.

6/18

Some (like @LHSummers) have been arguing that rents usually fall in this time of the yr so it would be necessary to seasonally adjust them.

6/18

But even after seasonal adjustments, decline in rents is clearly visible.

Read more about this in the following thread:

7/18

Read more about this in the following thread:

https://twitter.com/MBjegovic/status/1587510489579495426?s=20&t=II08qUc8hYHo4yOSviU2eA

7/18

Unadjusted, 3M moving average for the headline #CPI is only 0.20%.

Although up from 0.06% in Sep this is still a pretty low number.

When annualized it gives only 2.4% which is below the #Fed's 2% #inflation target.

Yes, you read that right.

Explanation follows.

8/18

Although up from 0.06% in Sep this is still a pretty low number.

When annualized it gives only 2.4% which is below the #Fed's 2% #inflation target.

Yes, you read that right.

Explanation follows.

8/18

Namely the LT (since 1913) average #CPI is 3.3% YoY.

Although it often gets mistaken, the #Fed is not targeting 2% #CPI but 2% core #PCE which is consistent with the LT #CPI average.

Now the obvious Q is what does the #Fed do with such a number?

9/18

Although it often gets mistaken, the #Fed is not targeting 2% #CPI but 2% core #PCE which is consistent with the LT #CPI average.

Now the obvious Q is what does the #Fed do with such a number?

9/18

In the last 4 months I've made numerous analyses explaining how and why the #Fed should #pivot bc the #economy warrants it.

But, as we learnt along the way, what the #Fed should do and what it actually does are 2 completely different things.

10/18

But, as we learnt along the way, what the #Fed should do and what it actually does are 2 completely different things.

10/18

So they opted to hike aggressively in a disinflationary environment.

They chose to disregard all other indicators and focus on the extremely lagging #CPI burdened by the shelter component that lags 12M+ behind the real rent #inflation.

11/18

They chose to disregard all other indicators and focus on the extremely lagging #CPI burdened by the shelter component that lags 12M+ behind the real rent #inflation.

11/18

For months other rent data has been showing that #inflation has eased or even went negative MoM like Apartment List Rent Estimates show.

But shelter #CPI component can remain elevated for quite a while due to its extremely lagging nature.

12/18

But shelter #CPI component can remain elevated for quite a while due to its extremely lagging nature.

12/18

As I've showed, unadjusted shelter component eased a bit in Oct compared to Sep but seasonally adjusted shelter actually went up by 0.8% MoM which is 0.1 pp higher than in Sep.

Shelter component could end up dragging the #CPI for months to come.

13/18

Shelter component could end up dragging the #CPI for months to come.

13/18

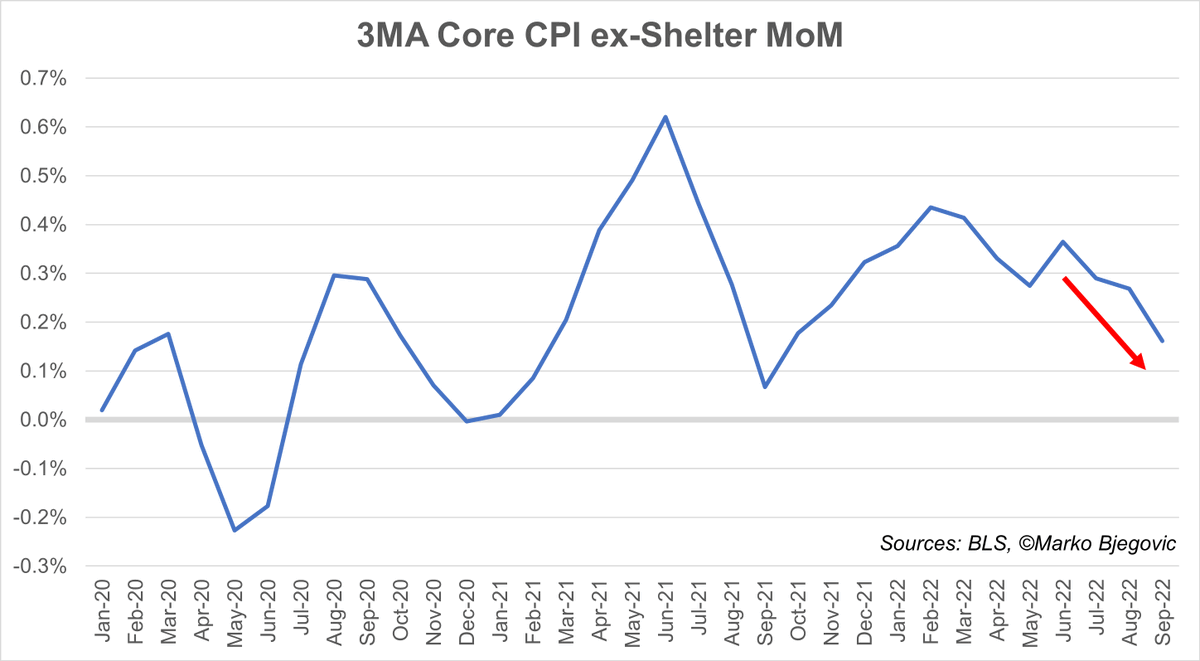

The fact that the #CPI came in cooler even when the shelter component is hotter on an adjusted basis tells a lot about other core components and actually negates any services (core) #inflation "stickiness".

But will that be enough for the #Fed to #pivot?

14/18

But will that be enough for the #Fed to #pivot?

14/18

Some #Fed officials like Chicago #Fed Evans have openly called for lower hikes.

Let me say that back in the summer when I was calling for the #Fed to #pivot I actually meant for the #Fed to pause in Sep.

15/18

Let me say that back in the summer when I was calling for the #Fed to #pivot I actually meant for the #Fed to pause in Sep.

15/18

Since they hiked additional 150 bps and are at least planning to hike more, now the #economy actually warrants a full #pivot to cutting rates.

But again, this is what they should do and not necessarily what they will do.

So what the #Fed might do in Dec and beyond?

16/18

But again, this is what they should do and not necessarily what they will do.

So what the #Fed might do in Dec and beyond?

16/18

These threads take a lot of time and effort to write.

If you like the content, please love and retweet to help me spread the message.

17/18

If you like the content, please love and retweet to help me spread the message.

17/18

Oct #CPI practically seals the 50 vs 75 in Dec debate.

The #Fed will get one more #CPI (Nov) before their decision in Dec.

If it, again, comes in better than expected, I think we'll see 25 in Dec and then a pause.

18/18

The #Fed will get one more #CPI (Nov) before their decision in Dec.

If it, again, comes in better than expected, I think we'll see 25 in Dec and then a pause.

18/18

• • •

Missing some Tweet in this thread? You can try to

force a refresh