To make exchange holdings easier to understand, below are both their relevant portfolios & associated explanatory statements.

- Binance

- Cryptocom

- OKX

- KuCoin

- Deribit

- Bitfinex

- Huobi

🧵👇

- Binance

- Cryptocom

- OKX

- KuCoin

- Deribit

- Bitfinex

- Huobi

🧵👇

2/ 📌 Assets/Net Worth shown is the value of the holdings in the wallet addresses provided by the exchanges, on blockchains that we support.

It is not meant to be an exhaustive or complete statement of the actual assets/reserves held by the exchange on behalf of its users.

It is not meant to be an exhaustive or complete statement of the actual assets/reserves held by the exchange on behalf of its users.

3/ @binance portfolio: nsn.ai/Binance-Portfo…

Current holdings: $64.3B (removed Binance Bridge pegged tokens, only include their original assets)

Chains:

#Bitcoin

#Ethereum

#Tron

#BNBChain

Binance statement:

binance.com/en/blog/commun…

Current holdings: $64.3B (removed Binance Bridge pegged tokens, only include their original assets)

Chains:

#Bitcoin

#Ethereum

#Tron

#BNBChain

Binance statement:

binance.com/en/blog/commun…

4/ @cryptocom portfolio: nsn.ai/Cryptocom-Port…

Current holdings: $2.36B

Chains:

#Bitcoin

#Ethereum

#Fantom

#Optimism

#Polygon

#BNBChain

#Avalanche

Cryptocom's statement:

crypto.com/company-news/t…

Current holdings: $2.36B

Chains:

#Bitcoin

#Ethereum

#Fantom

#Optimism

#Polygon

#BNBChain

#Avalanche

Cryptocom's statement:

crypto.com/company-news/t…

5/ @okx portfolio: nsn.ai/OKX-Portfolio

Current holdings: $5.84B

Chains:

#Bitcoin

#Ethereum

#Polygon

#Arbitrum

#TRON

#Avalanche

OKX's statement:

Current holdings: $5.84B

Chains:

#Bitcoin

#Ethereum

#Polygon

#Arbitrum

#TRON

#Avalanche

OKX's statement:

https://twitter.com/okx/status/1591370896169930754?s=20&t=wHcVBOvK3V4DKoC24mgJgA

6/ @kucoincom portfolio: nsn.ai/KuCoin-Portfol…

Current holdings: $2.65B

Chains:

#Bitcoin

#Ethereum

#TRON

#BNB

#Polygon

#Arbitrum

#Optimism

#Avalanche

KuCoin's statement:

kucoin.com/blog/transpare…

Current holdings: $2.65B

Chains:

#Bitcoin

#Ethereum

#TRON

#BNB

#Polygon

#Arbitrum

#Optimism

#Avalanche

KuCoin's statement:

kucoin.com/blog/transpare…

7/ @DeribitExchange portfolio: nsn.ai/Deribit-Portfo…

Current holdings: $1.46B

Chains:

#Bitcoin

#Ethereum

#Solana

Deribit's statement:

Current holdings: $1.46B

Chains:

#Bitcoin

#Ethereum

#Solana

Deribit's statement:

https://twitter.com/DeribitExchange/status/1591473425280811014?s=20&t=wHcVBOvK3V4DKoC24mgJgA

8/ @bitfinex portfolio: nsn.ai/Bitfinex-Portf…

Current holdings: $8.23B

Chains:

#bitcoin

#Ethereum

#Polygon

#TRON

#Solana

#Acala

#Avalanche

#Cosmos

#Fantom

#NEAR

#Terra

#TerraClassic

Bitfinex's statement:

Current holdings: $8.23B

Chains:

#bitcoin

#Ethereum

#Polygon

#TRON

#Solana

#Acala

#Avalanche

#Cosmos

#Fantom

#NEAR

#Terra

#TerraClassic

Bitfinex's statement:

https://twitter.com/bitfinex/status/1591370278680293378?s=20&t=DKZ1H_pawsvLMhs_baCfLA

9/ @HuobiGlobal portfolio: nsn.ai/Huobi-Portfolio

Current holdings: $3.31B

Chains:

#Bitcoin

#Ethereum

#Polygon

#TRON

#Solana

#Avalanche

#Cosmos

Huobi's statement: huobi.com/support/en-us/…

Current holdings: $3.31B

Chains:

#Bitcoin

#Ethereum

#Polygon

#TRON

#Solana

#Avalanche

#Cosmos

Huobi's statement: huobi.com/support/en-us/…

10/ @Bybit_Official portfolio: nsn.ai/Bybit-Portfolio

Current holdings: $1.89B

Chains:

#Bitcoin

#Ethereum

#Polygon

#TRON

#Solana

#Arbitrum

#Avalanche

#Fantom

#Ripple

#Aurora

#Moonbeam

#Moonriver

#Optimism

@benbybit' statement:

Current holdings: $1.89B

Chains:

#Bitcoin

#Ethereum

#Polygon

#TRON

#Solana

#Arbitrum

#Avalanche

#Fantom

#Ripple

#Aurora

#Moonbeam

#Moonriver

#Optimism

@benbybit' statement:

https://twitter.com/benbybit/status/1592797790518018048?s=20&t=5lhtCXa8wtnwPSpkUgKY0Q

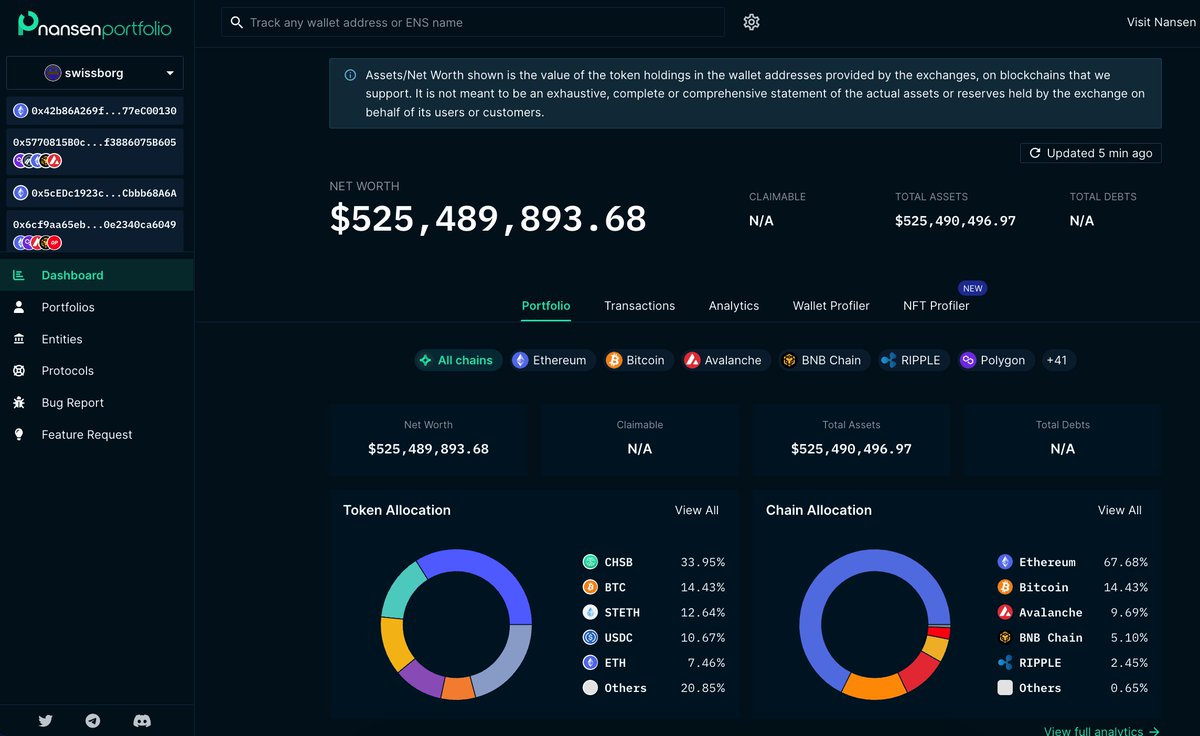

11/ @swissborg portfolio: nsn.ai/SwissBorg-Port…

Current holdings: $525.5M

Chains:

#Bitcoin

#Ethereum

#Polygon

#BNBChain

#Solana

#Arbitrum

#Avalanche

#Cardano

#Ripple

#Near

#Optimism

SwissBorg's statement: swissborg.com/blog/in-swissb…

Current holdings: $525.5M

Chains:

#Bitcoin

#Ethereum

#Polygon

#BNBChain

#Solana

#Arbitrum

#Avalanche

#Cardano

#Ripple

#Near

#Optimism

SwissBorg's statement: swissborg.com/blog/in-swissb…

• • •

Missing some Tweet in this thread? You can try to

force a refresh