1- 75% of the $FTM current supply is locked, with the remaining 25% unlocked, indicating that whales and holders believe in the FTM token. #Fantom

2- As of today $FTM is down more than 90% from its previous all-time high of $3.3, and its market cap has dropped from $7.6 bn to less than $600 mn,

3- #Fantom Treasury holds approximately 18% of $FTM token supply.

@FantomFDN

read my previous article

cryptoavanza.com/fantom-up-25-i…

@FantomFDN

read my previous article

cryptoavanza.com/fantom-up-25-i…

4- On October 22, when the $FTM price was $0.19, it was on its way to recovering from the low range-bound movement price of $FTM toward $3.1, which is approximately 60% up,

5- but on November 2, when #Coindesk revealed the Alameda balance sheet and @cz_binance tweeted about the #FTX exchange, $FTM dropped dramatically and reached a new all-time low of $0.16.

@fantom_daily

@fantom_daily

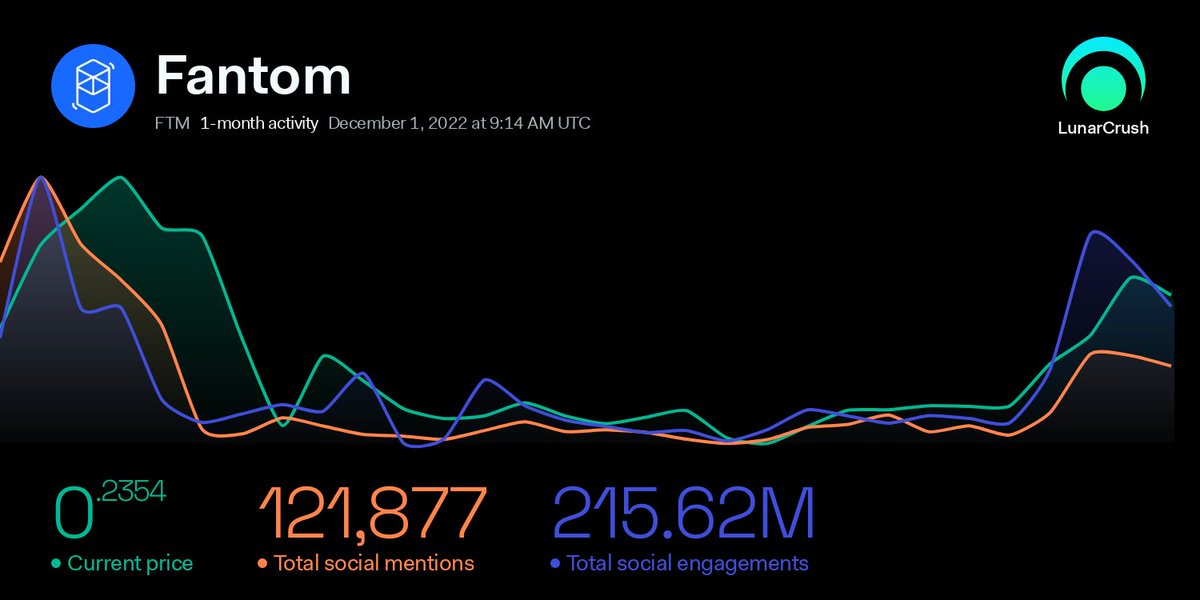

6- $ftm holders have seen a 28.44% increase in the last 30 days. However, cruisers (short-term holders), who earlier dominated $FTM addresses, saw an 18.18% decline and a 389.01% rise in traders.

7- Addresses by time-held data for $FTM showed a healthy rise in holders and traders over the 30-day window.

8- Short-term holders indicate that they bought the dip of $FTM and DCA into it, then sold tokens and booked profit when the price surged. Hodlers still accumulating their holding which means they trust fantom.

9- So Why did Trader’s volume jump around 4,000% because the social volume of $FTM increased also @AndreCronjeTech article create more social engagement which is the way retail entered into it.

10- For the majority of traders in FOMO, you can see the monthly volume is a surge above the price trend line, however, long-term holders and whales keep accumulating $FTM tokens.

11- Fantom’s total value locked (TVL) is suffering even more than its token price. As per Defillama, the total value of $FTM is worth $455 million in USD, which is down from $8.07 billion.

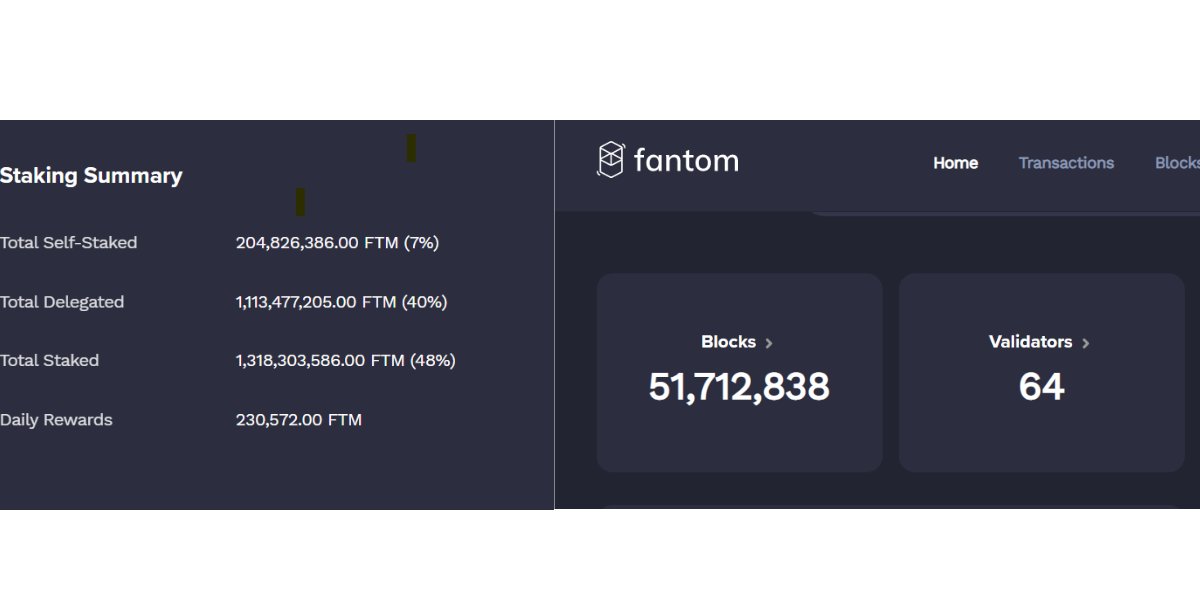

12- Furthermore, as per #Fantom network explorer, the total network delegated staking is 1.31 billion FTM which is around 40% of the total supply validating the network to earn rewards and 8% of the $FTM supply on self-staking.

13- Total number of validators is 64. On November 28, @AndreCronjeTech published a blog in which he claimed $Ftm runs 9 validators, which means 14% of network validation is done by #Fantom, and the remaining others are whales and institutions.

cryptoavanza.com/fantom-on-chai…

cryptoavanza.com/fantom-on-chai…

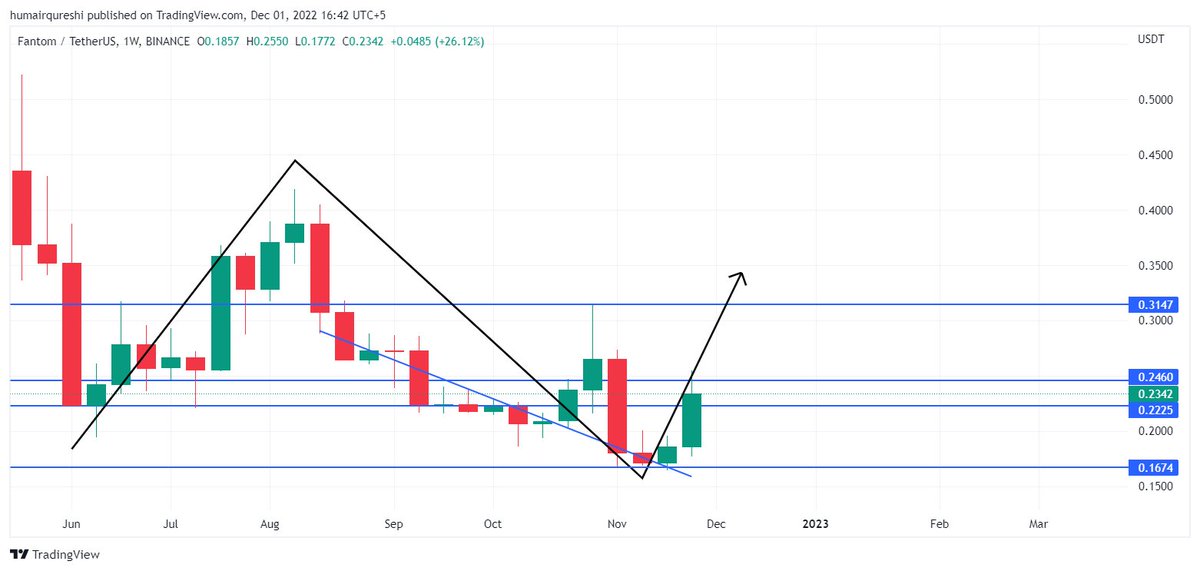

14- On June 13, the #FTMUSDT downtrend market structure was converted back into an uptrend structure, but again the market structure broke in August, and we are still in a downtrend in the weekly timeframe.

$ftm

$ftm

15- Looking at the bigger picture, I believe $FTM will move toward the $0.34 resistance level because the market structure always moves in a higher high and lower low style.

16- 40% of the $FTM token supply is locked in network validation, which is a good sign. Recently, there have been too many bad events that seriously affected the overall crypto market, so my advice is to learn crypto rather than trade it

learn real crypto cryptoavanza.com

learn real crypto cryptoavanza.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh