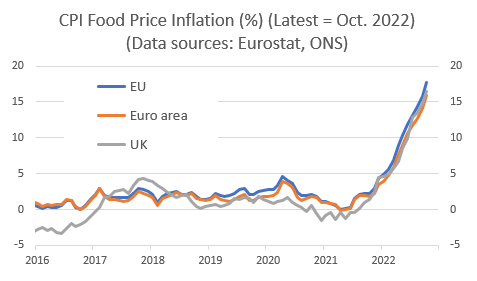

Seeing as this has come round again, here are two charts of what's actually happened to #food prices in the UK and EU over the last few years... 🤓

First, in levels 👇 (1/3)

#BrexitReality

First, in levels 👇 (1/3)

#BrexitReality

Second, annual #food #inflation rates 👇

(The differences, such as they are, can largely be explained by currency movements) (2/3)

(The differences, such as they are, can largely be explained by currency movements) (2/3)

And here are the links to the original data:

ec.europa.eu/eurostat/datab…

ons.gov.uk/economy/inflat…

(3/3)

ec.europa.eu/eurostat/datab…

ons.gov.uk/economy/inflat…

(3/3)

• • •

Missing some Tweet in this thread? You can try to

force a refresh