Buying the Dip will no longer work?

A big recession is coming?

According to @BlackRock's latest report, 2023 will require a whole new approach to investing in #stocks and #crypto

#BlackRock released their 2023 investment playbook, and I read it all so you don’t have to👇

1/n🧵

A big recession is coming?

According to @BlackRock's latest report, 2023 will require a whole new approach to investing in #stocks and #crypto

#BlackRock released their 2023 investment playbook, and I read it all so you don’t have to👇

1/n🧵

@BlackRock 2/n

In this thread we are going to cover the following interesting claims by #BlackRock:

- A new #investment playbook is needed for this new volatile market state

- “Old Playbook” strats like “buying the dip” may no longer work

In this thread we are going to cover the following interesting claims by #BlackRock:

- A new #investment playbook is needed for this new volatile market state

- “Old Playbook” strats like “buying the dip” may no longer work

3/n

- Central Banks are deliberately slowing down the markets

- Recession is all but certain

- And many more interesting #stock strategies than we can apply on #crypto

For reference, the full outlook is here: blackrock.com/corporate/lite…

- Central Banks are deliberately slowing down the markets

- Recession is all but certain

- And many more interesting #stock strategies than we can apply on #crypto

For reference, the full outlook is here: blackrock.com/corporate/lite…

4/n

According to #BlackRock: “The Great Moderation, the four-decade period of largely stable activity

and inflation, is behind us”

They claim a recession is coming and a new #stocks and #investment playbook is needed!

According to #BlackRock: “The Great Moderation, the four-decade period of largely stable activity

and inflation, is behind us”

They claim a recession is coming and a new #stocks and #investment playbook is needed!

5/n

Why do we need a new investment strategy? According to @blackrock :

- Central banks are tightening policy to tame #inflation

- bond yields are rising

- There is an ongoing pressure on risk assets

Why do we need a new investment strategy? According to @blackrock :

- Central banks are tightening policy to tame #inflation

- bond yields are rising

- There is an ongoing pressure on risk assets

6/n

#BlackRock talks about 3 main investment themes:

1. Is the economic damage fully reflected in the market prices

2. Rethinking government bonds

3. Persistent Inflation

Let’s break down those themes, that are affecting #crypto, #stocks and #bonds:

#BlackRock talks about 3 main investment themes:

1. Is the economic damage fully reflected in the market prices

2. Rethinking government bonds

3. Persistent Inflation

Let’s break down those themes, that are affecting #crypto, #stocks and #bonds:

7/n

Damage reflection in the market

@Investingcom, @YahooFinance and @business are constantly showing us the "blood in the streets" like #WarrenBuffett loves to say

BR claims recession is sure to come because the central banks have already started fighting the inflation.

Damage reflection in the market

@Investingcom, @YahooFinance and @business are constantly showing us the "blood in the streets" like #WarrenBuffett loves to say

BR claims recession is sure to come because the central banks have already started fighting the inflation.

8/n

Damage reflection in the market

CBs won’t try to rescue industries when growth slows down, like many investors came to expect, but rather deliberately bring this slowdown.

Damage reflection in the market

CBs won’t try to rescue industries when growth slows down, like many investors came to expect, but rather deliberately bring this slowdown.

9/n

Thinking about buying the dip of stocks like $AAPL $AMZN?

Maybe the dips of $BTC or $ETH?

Unlike the old playbook of “buying the dip”,which made sense because the policy was used to drive growth, a new playbook that continuously reassesses the damage CBs are making is needed

Thinking about buying the dip of stocks like $AAPL $AMZN?

Maybe the dips of $BTC or $ETH?

Unlike the old playbook of “buying the dip”,which made sense because the policy was used to drive growth, a new playbook that continuously reassesses the damage CBs are making is needed

10/n

Rethinking #bonds

In the old playbook, @BlackRock claims long-term government bonds were part of the package as they historically shielded portfolios from recession.

However this might not be the case anymore..

Rethinking #bonds

In the old playbook, @BlackRock claims long-term government bonds were part of the package as they historically shielded portfolios from recession.

However this might not be the case anymore..

11/n

Rethinking Bonds

#bonds have proven they can go down at the same time as #stocks. (And #crypto, as a side note @Overdose_AI)

Why?

Because CBs are unlikely to reduce rates in recessions they engineered to bring down #inflation.

Rethinking Bonds

#bonds have proven they can go down at the same time as #stocks. (And #crypto, as a side note @Overdose_AI)

Why?

Because CBs are unlikely to reduce rates in recessions they engineered to bring down #inflation.

12/n

Rethinking Bonds

As a result, #BlackRock remains underweight on long term govt bonds, and may strategically favor short-term bonds and high-grade credit

Rethinking Bonds

As a result, #BlackRock remains underweight on long term govt bonds, and may strategically favor short-term bonds and high-grade credit

13/n

Higher baseline Inflation

Old playbook says that #recession makes #inflation go lower than 2-3% target and causes looser monetary policies.

This is once again, not the case, according to @blackrock.

Higher baseline Inflation

Old playbook says that #recession makes #inflation go lower than 2-3% target and causes looser monetary policies.

This is once again, not the case, according to @blackrock.

14/n

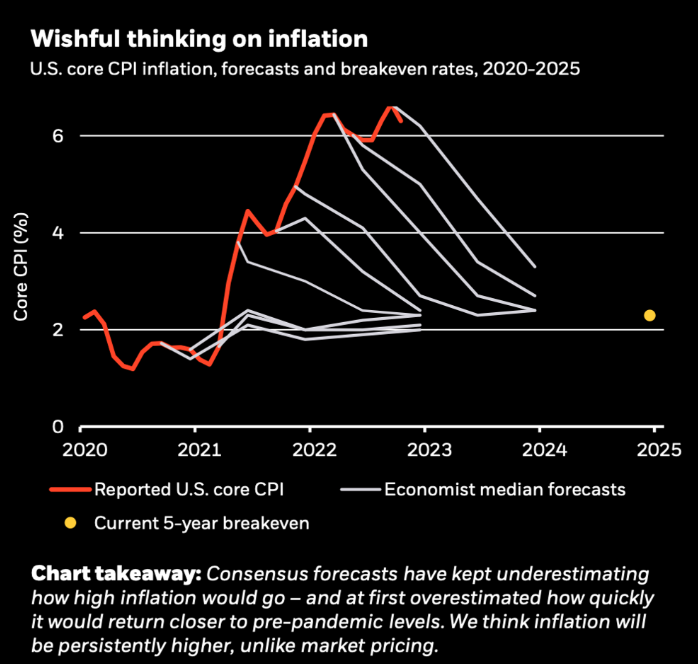

Higher baseline #Inflation

#BlackRock sees persistent inflation, i.e longer period inflation that will persist above the 2-3% target, as not priced in by the market yet.

This persistent inflation is caused by 3 main drivers:

Higher baseline #Inflation

#BlackRock sees persistent inflation, i.e longer period inflation that will persist above the 2-3% target, as not priced in by the market yet.

This persistent inflation is caused by 3 main drivers:

15/n

-COVID-related supply disruptions

-Aging populations

-Geopolitical fragmentation (Russia - Ukraine, China - Taiwan etc)

-Lower-carbon world

According to the chart above, #BlackRock claims that current market, according to the old playbook, are under-appreciating inflation

-COVID-related supply disruptions

-Aging populations

-Geopolitical fragmentation (Russia - Ukraine, China - Taiwan etc)

-Lower-carbon world

According to the chart above, #BlackRock claims that current market, according to the old playbook, are under-appreciating inflation

16/n

Higher baseline Inflation

This is why Blackrock currently has maximum-overweight for inflation-linked real assets like #bonds.

Higher baseline Inflation

This is why Blackrock currently has maximum-overweight for inflation-linked real assets like #bonds.

17/n

Summary

In summation, @BlackRock claims that a new economic era is upon us - one that may require ditching the old, simple, #playbook and require a more complex approach involving mixing assets and constant rebalancing and reassessment of risks.

Summary

In summation, @BlackRock claims that a new economic era is upon us - one that may require ditching the old, simple, #playbook and require a more complex approach involving mixing assets and constant rebalancing and reassessment of risks.

18/n Summary

This new world order is mainly driven by shaky geopolitical state (”The most fraught since WW2”), an aging workforce that contributes less to the economy and the migration to low-carbon, #CleanEnergy .

This new world order is mainly driven by shaky geopolitical state (”The most fraught since WW2”), an aging workforce that contributes less to the economy and the migration to low-carbon, #CleanEnergy .

19/n

Follow me for more 🧪

For more great content about #Crypto and useful threads like this, make sure to follow me on Twitter @Overdose_AI and on my great free of charge TG channel:

t.me/overdose_gems_…

Follow me for more 🧪

For more great content about #Crypto and useful threads like this, make sure to follow me on Twitter @Overdose_AI and on my great free of charge TG channel:

t.me/overdose_gems_…

20/n

DISCLAIMER:

Everything in this thread is not endorsed by #BlackRock in anyway, and is a subjective summary by us, based on my understanding of their document.

It is also not a financial advice in any way, I encourage everyone to read the full doc

Educational purposes only

DISCLAIMER:

Everything in this thread is not endorsed by #BlackRock in anyway, and is a subjective summary by us, based on my understanding of their document.

It is also not a financial advice in any way, I encourage everyone to read the full doc

Educational purposes only

21/n

The outlook goes into more detail on all of the above points and a few other ones and is definitely a recommended read if you want to better understand what are the main drivers of the macro economy in 2023-2024

blackrock.com/corporate/lite…

The outlook goes into more detail on all of the above points and a few other ones and is definitely a recommended read if you want to better understand what are the main drivers of the macro economy in 2023-2024

blackrock.com/corporate/lite…

• • •

Missing some Tweet in this thread? You can try to

force a refresh