What can we learn from $HUR $PANR $RECO. Geologists musings and personal opinions.

Best read with a glass of new years eve drink of your choice.

#oil #exploration

🧵👇

Best read with a glass of new years eve drink of your choice.

#oil #exploration

🧵👇

2/24 CHAPTER 1: "Story of geologists greed for discovery."

I first heard about $HUR fractured basement prospect as a student at Aberdeen Univ. I went to an evening lecture where geologist, Rob Trice HUR CEO was laughed by industry for his idea of oil in the basement rocks.

I first heard about $HUR fractured basement prospect as a student at Aberdeen Univ. I went to an evening lecture where geologist, Rob Trice HUR CEO was laughed by industry for his idea of oil in the basement rocks.

4/24 The story did not end well. The field went into the production and seriously disappointed. There were many technical signs to park this discovery early.

Geologists that are in love with their prospects tend to ignore them. #FOMO

Geologists that are in love with their prospects tend to ignore them. #FOMO

5/24 I was working in Norway and followed the developments and rumors closely. Company I worked for tried to replicate Hurricane success. As portfolio manager I spend a lot of time making sure we did not drill "Hurricane-look-alike" prospects. This was before Hurricane fall.

6/24 There were many technical signs to worry about: number one being low oil saturation and only 2 day test in reservoir type that is notorously difficult to produce. Company also did not focus on technical risks and tried to hide them from public eye.

7/24 Geologists fall in love with their ideas. People get angry or depressed when their projects do not get drilled.

Staying unbiased ⚖️and critical 🧐is key to succesful treasure hunt, but requires practice.

Staying unbiased ⚖️and critical 🧐is key to succesful treasure hunt, but requires practice.

8/24 Combine this with CEO of HUR being laughed at in public by industry. Proving them wrong, making tones of money. Human nature will prevent many from seeing what is wrong with the asset and admiting to disappointment.

PS. Not disimilar from falling in love with your stocks.

PS. Not disimilar from falling in love with your stocks.

9/24 Personal opinion based on outside view: I think we saw something similar happen to $RECO. With geologist having difficult to admit that their model failed after first hole and pushing through despite disappointing results.

10/24 Geos involved had good track record and initial exploration concept was a good, high risk, frontier exploration model (until disproved by drilling). $IVZ is drilling similar exploration concept now and has proven deep 3km+ basin vs $RECO hitting metamorphic basement at 1km.

11/24 Game of exploration. Models fail all the time.

I made significant profit on $RECO, but key was to get out fast when the model fell apart on the first drill results.

Staying unbiased and critical.

Data vs Greed.

I made significant profit on $RECO, but key was to get out fast when the model fell apart on the first drill results.

Staying unbiased and critical.

Data vs Greed.

12/24 CHAPTER 2 "Project is verified by Baker/Schluberger/Haliburton etc. therefore it is good."

All three companies had that narrative in common. The narrative was spinned by retail, but management did nothing to dispell it and in some cases used it to back the project.

All three companies had that narrative in common. The narrative was spinned by retail, but management did nothing to dispell it and in some cases used it to back the project.

13/24 There is a difference between:

Schlumberger providing a report saying porosity is 8% vs

Schlumberger saying it is a good porosity.

PS It is a terrible porosity.

Schlumberger providing a report saying porosity is 8% vs

Schlumberger saying it is a good porosity.

PS It is a terrible porosity.

14/24 None of the press releases, video interview etc. had service companies backing the results as being "good". They only provided the data and Operator had their own commentary.

Somehow they were now saying the project was good 🤯.

Somehow they were now saying the project was good 🤯.

15/24 As an investor the key is to separate the difference between numbers provided by external party and operator commentary. Stay unbiased and critical. Control FOMO.

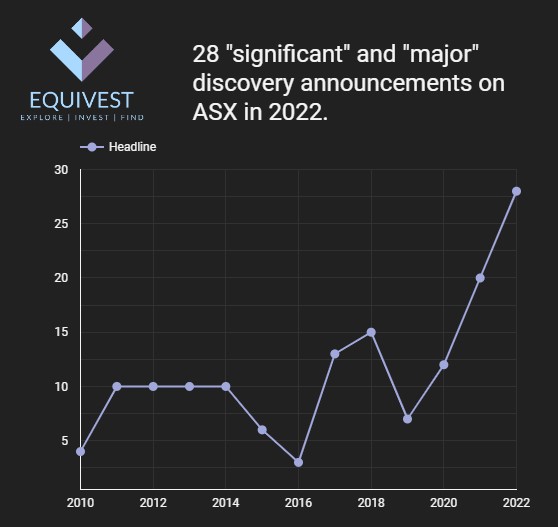

16/24 CHAPTER 3 "Billion barrels discoveries in recent years have one thing in common - they are in bad reservoirs."

And this ⬇️ can happen...not literally, but I will explain.

And this ⬇️ can happen...not literally, but I will explain.

17/24 Succesful exploration is not that easy! So what is wrong with all these bad reservoirs?

What do we know:

$HUR - fractured basement (gneisses)

$RECO - fractured basement (metamorphosed carbonates)

$PANR - tight sand unconventional reservoir

What do we know:

$HUR - fractured basement (gneisses)

$RECO - fractured basement (metamorphosed carbonates)

$PANR - tight sand unconventional reservoir

18/24 They all have different peculiarities - I teach more about it my course. But a key is:

"When reservoir is poor the downhole tools have low confidence on measurment accuracy."

E.g. what looks like 50% oil saturation could be 30% oil saturation. Oops.

"When reservoir is poor the downhole tools have low confidence on measurment accuracy."

E.g. what looks like 50% oil saturation could be 30% oil saturation. Oops.

19/24 All three of these projects had low oil saturations across large (or all) parts of hydrocarbon column.

But 40-60% oil saturation looks great!

No..

40-60% of oil is not recovered from most of reservoir unless you do EOR, fracking etc. = COSTS + DIFFICULT = LOW VALUATION

But 40-60% oil saturation looks great!

No..

40-60% of oil is not recovered from most of reservoir unless you do EOR, fracking etc. = COSTS + DIFFICULT = LOW VALUATION

20/24 There is also risk that the saturation is lower. Remember our tool measurment accuracy. Double oops. These are difficult, risky projects.

21/24 CHAPTER 4: Low porosity sand brights up on seismic. What could it be? $PANR special.

There is one thing that makes low porosity sand bright up on the seismic at few kms depth. Gas.

Oil does not bright up on seismic when porosites are low.

There is one thing that makes low porosity sand bright up on the seismic at few kms depth. Gas.

Oil does not bright up on seismic when porosites are low.

22/24 RECAP

1. Geologists have the same FOMO as investors. It prevents them from seeing pitfalls.

2. Project verified by Baker etc. - separate data provided by service company from Operator interpretations.

3. Giant discovery can disappear overnight if the reservoir is poor.

1. Geologists have the same FOMO as investors. It prevents them from seeing pitfalls.

2. Project verified by Baker etc. - separate data provided by service company from Operator interpretations.

3. Giant discovery can disappear overnight if the reservoir is poor.

23/24 I do not own stocks in any of the companies. Not investment advice - just end of the year geologist musings.

Note: I refrained and continue to refrain from commenting on the pump, management etc. so please keep trolling to yourself.

Note: I refrained and continue to refrain from commenting on the pump, management etc. so please keep trolling to yourself.

24/24 Please share the knowledge and retweet the first post. This one has correct tickers.

Have a great New Year Eve celebration! Time to kick off the party here on the CET time.

Have a great New Year Eve celebration! Time to kick off the party here on the CET time.

• • •

Missing some Tweet in this thread? You can try to

force a refresh