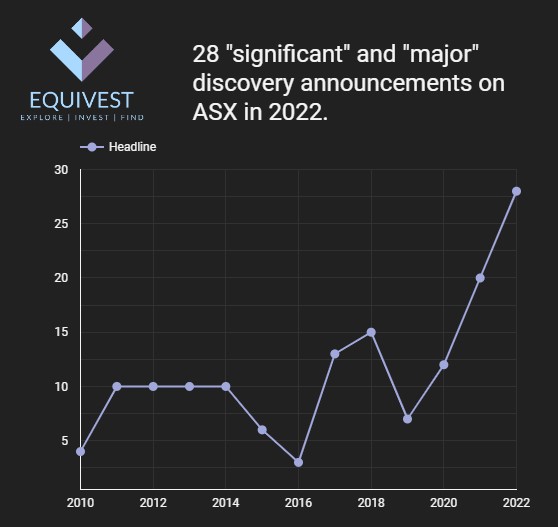

🧵The #nickel #exploration success rates by #ASX companies are better in 2022 than the commonly cited 1/1000.

We counted 53 exploration campaigns that focused on new exploration targets. No appraisal, resource drilling.

Of these, 70% were maiden exploration.

We counted 53 exploration campaigns that focused on new exploration targets. No appraisal, resource drilling.

Of these, 70% were maiden exploration.

2/5

30% of the companies drilled historical discoveries/mines. Not suprisingly these yielded no significant results.

Maiden exploration: 15 found no mineralisation, 13 only occurence, but we also had 1 discovery. Yet to be confirmed as significant.

30% of the companies drilled historical discoveries/mines. Not suprisingly these yielded no significant results.

Maiden exploration: 15 found no mineralisation, 13 only occurence, but we also had 1 discovery. Yet to be confirmed as significant.

3/5

From the 53 projects only 5 drilled in the favourable tectonic setting and had quality geochemical/geophysical anomaly support.

These are the targets we should be drilling more! Results are still pending from #S2R and $ADD in this group.

From the 53 projects only 5 drilled in the favourable tectonic setting and had quality geochemical/geophysical anomaly support.

These are the targets we should be drilling more! Results are still pending from #S2R and $ADD in this group.

4/5 Lessons learned:

1⃣ Despite capital flow into industry. We are drilling few quality targets per year.

2⃣ Applying simple set of geological principles eliminates 90% of the current targets.

3⃣ We need more quality maiden drill campaigns in the industry.

1⃣ Despite capital flow into industry. We are drilling few quality targets per year.

2⃣ Applying simple set of geological principles eliminates 90% of the current targets.

3⃣ We need more quality maiden drill campaigns in the industry.

5/5 Note: data used is imperfect and was extracted from press releases. I also asked the twitter followers to list nickel exploration projects that they followed last year to cross check.

If you know of agencies/individuals keeping stats pleae let me know🙏

If you know of agencies/individuals keeping stats pleae let me know🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh