🇺🇸 #Fed #Inflation | An update on CPI prospects ⚠

*Leading indicators suggest CPI YoY will normalize quickly in the coming months and, in absence of external shock, could ⬇ close to 3% in June 2023

*Therefore, Bloomberg consensus for 2023 CPI (+4%) should be revised ⬇ soon.

*Leading indicators suggest CPI YoY will normalize quickly in the coming months and, in absence of external shock, could ⬇ close to 3% in June 2023

*Therefore, Bloomberg consensus for 2023 CPI (+4%) should be revised ⬇ soon.

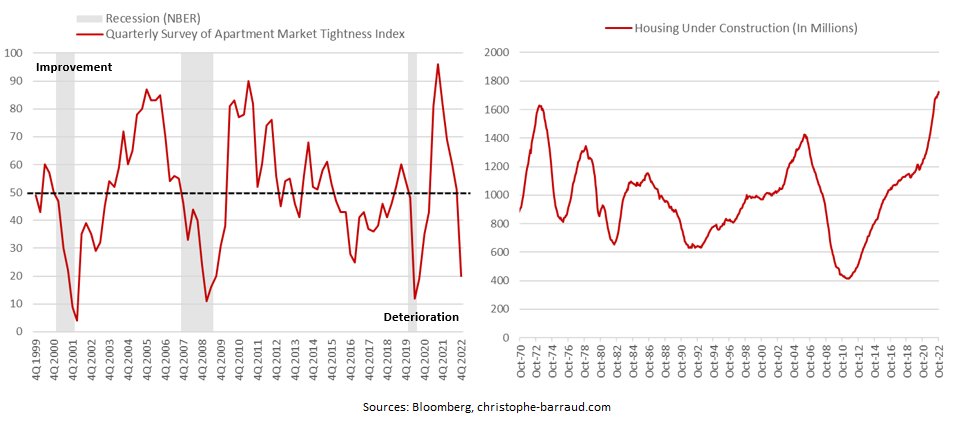

1- Market #rents will keep retracing in the coming months. Household formation and rental demand are slowing in response to macro conditions while #housing supply will gain traction, with a peak expected around 4Q23.

*The collision of these factors will probably result in a contraction of market #rents on a YoY basis at some point next year. In the past, the CPI’s measure of rents for homeowners has typically lagged other measures (9 to 12 months looks appropriate for this cycle).

2- Proxies also point to a downward normalization of food prices’ growth by the end of 2023.

*Agricultural commodity prices – which are usually leading CPI Food prices by 12 months – retraced over the past few months

*Note that fertilizer prices are also down ~50% from the peak

*Agricultural commodity prices – which are usually leading CPI Food prices by 12 months – retraced over the past few months

*Note that fertilizer prices are also down ~50% from the peak

3- Supply chain disruptions eased significantly.

*Several indexes point to a partial normalization at the global level and even a return close to normal in the U.S. (at least in #manufacturing sector).

*Several indexes point to a partial normalization at the global level and even a return close to normal in the U.S. (at least in #manufacturing sector).

4- Core good prices are expected to contract on a YoY basis at some point in 2023.

*In this context (easing supply disruptions), wholesalers of finished goods have faced an extremely large rebound in inventories due to weak real consumption and will implement discounts.

*In this context (easing supply disruptions), wholesalers of finished goods have faced an extremely large rebound in inventories due to weak real consumption and will implement discounts.

5- In addition, there are already signs that used cars and trucks’ prices could contract further on a YoY basis amid significant supply chain improvement for new vehicles.

6- Gasoline price is expected to contribute negatively in the coming months with a maximum base effect in June 2023.

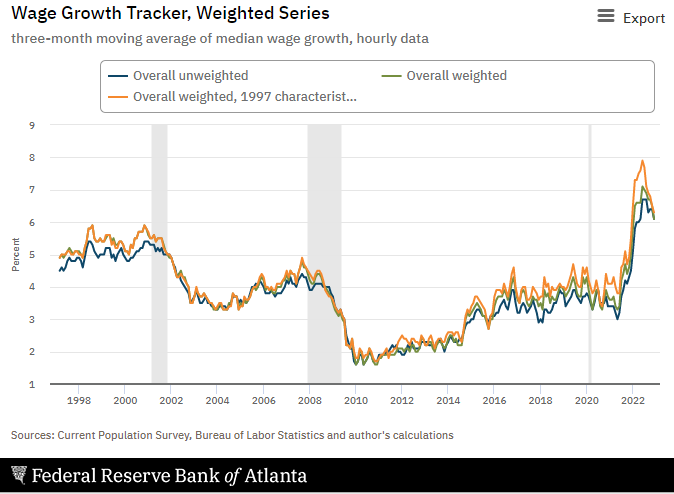

7- Lastly, there are also signs that CPI Services less rent of shelter could also normalize slowly on a YoY basis.

*Labour market momentum has weakened with wages already peaking.

*Labour market momentum has weakened with wages already peaking.

*I mean contraction of market #rents on a YoY basis at some point in 2023.

• • •

Missing some Tweet in this thread? You can try to

force a refresh