1/3 If you think the entity that has been moving this wall of #BTC bid liquidity around the order book for the last 5 weeks is trying to help #Bitcoin moon, you are wrong.

The strategy seems clear...

The strategy seems clear...

2/3 Yesterday they moved the buy wall to just above the trend line. Today they moved it just above the 21DMA

They are using technical levels to raise the floor of local support. At some point it may get filled, but based on past behavior it's likely to move again or get rugged.

They are using technical levels to raise the floor of local support. At some point it may get filled, but based on past behavior it's likely to move again or get rugged.

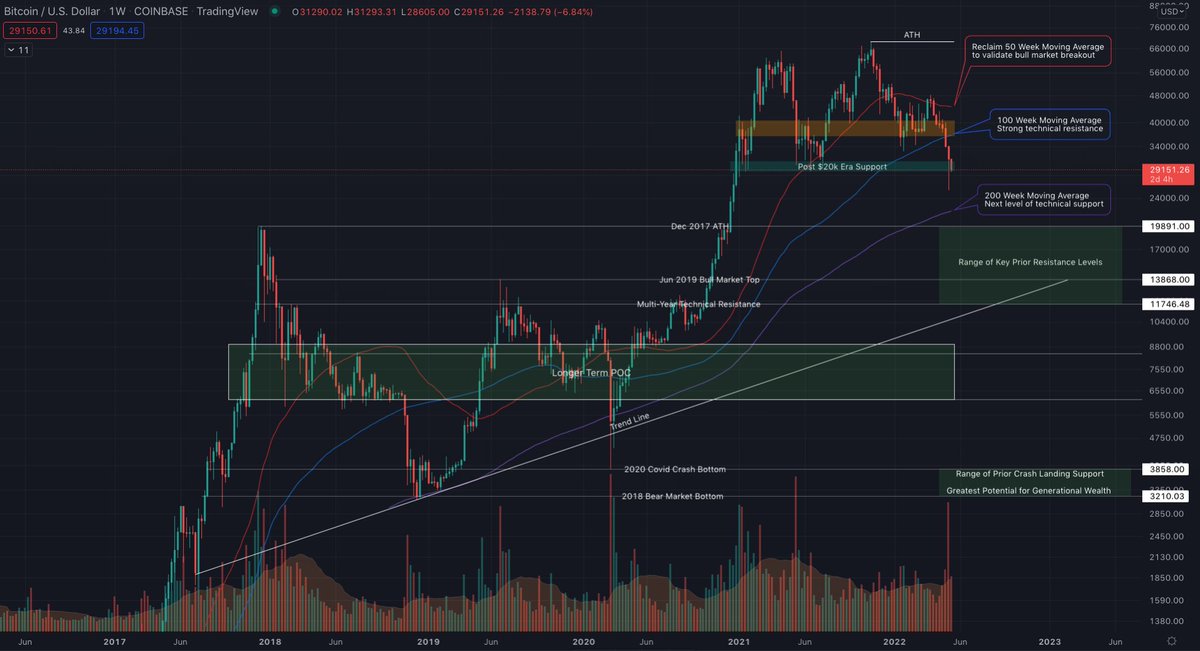

3/3 They are attempting to create what looks like a bull market breakout. We already have 2 rejections so if they get it, it's a bonus.

IMO, the goal was to raise the distribution range and drop ask liquidity on to bull market maxis. #MissionAccomplished #WhalishDivergence

IMO, the goal was to raise the distribution range and drop ask liquidity on to bull market maxis. #MissionAccomplished #WhalishDivergence

• • •

Missing some Tweet in this thread? You can try to

force a refresh